About the Mall Index: The Index analyzes data from more than 100 top-tier indoor malls, 100 open-air lifestyle centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai uses anonymized location information from a panel of 30 million devices and processes the data using industry-leading AI and machine learning capabilities to make estimations about overall visits to specific locations.

While the early months of the pandemic were defined by retail restrictions for top performing malls and retail centers, 2021 and early 2022 need to be understood with the wider context of volatility engulfing the space. Visits saw a strong return in the summer, before the Delta variant cut off the growth. Then October saw a boost before November and December were affected by supply chain challenges, inflation and the onset of Omicron.

January was up next, getting hit by Omicron’s true peak before the sector started recovering only to have this recovery offset – at least initially – by rising gas prices. So to unpack the progress, we dove into our Mall Index.

Omicron’s Impact and March’s Recovery

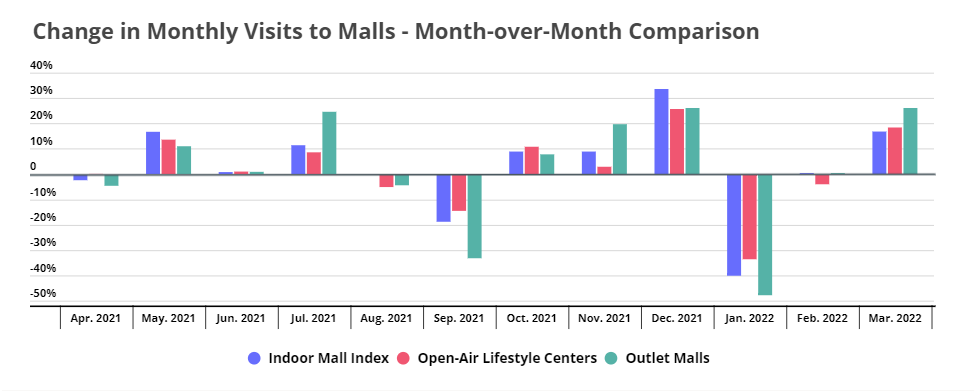

While it is overly simplistic to look only at month-over-month metrics, they do provide an important view at the wider trend impacting visits. January’s steep decline from December was driven by a combination of Omicron and the natural ebb and flow of retail seasonality following the holiday season. While February did see a comeback, the lack of days in the month saw that recovery muted before malls enjoyed a stronger performance in March. Top performing indoor malls saw a 16.8% MoM jump from February to March, while open-air lifestyle centers and outlet centers saw improvements of 18.4% and 26.1% respectively.

Comparing to Previous Years

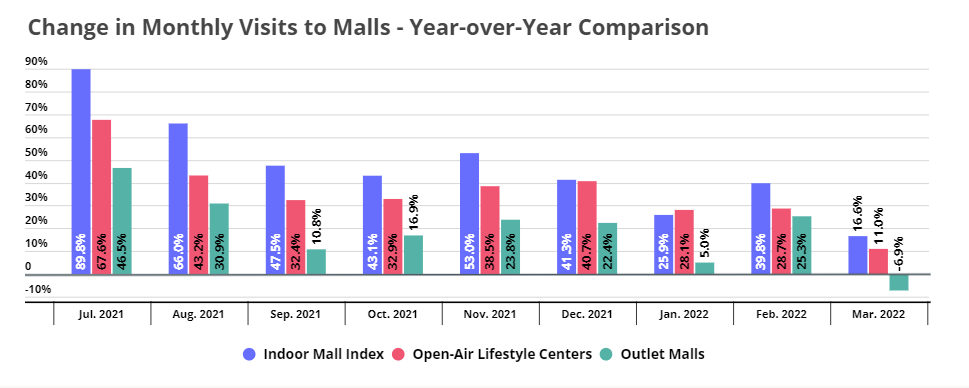

Yet, to properly account for seasonality, context from previous years is necessary. Looking at visits compared to the year prior shows a significant uptick in the first months of 2022 – though lower than the heights hit in late 2021. Critically, much of the strength centers around the comparison to a COVID-affected Q1. In this case, the lessening visit growth indicates the challenges faced including continued COVID, continued inflation, and rising gas prices among other issues. However, the progress is still important, especially considering just how significant the impact of Omicron was in January and the wave of obstacles faced in March. March especially faced a fairer comparison than we’ve seen from the year-over-year lens since the pandemic began.

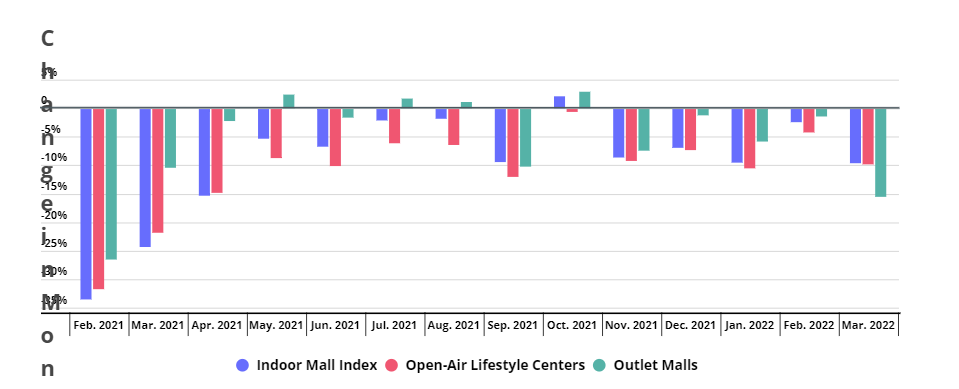

But the most accurate metric for contextualizing the recovery in early 2022 comes from a year-over-three-year comparison. In this view, January saw an expected decline prior to a February recovery that led into another dip in March. Visits in March were down 9.5% for indoor malls, 9.7% for open-air lifestyle centers and 15.4% for outlet centers.

As discussed above, much of this March slide centers around the powerful combination of rising gas prices alongside the other challenges that brick and mortar retail has been coping with since late 2021. And the rise in gas prices is especially significant for malls of all types because it fundamentally disrupts the decision-making process. If the destination is too far – as many regional powerhouse centers are for at least part of their core audience – then visits can be impacted.

Weekly Visits View – Malls Again Showing Resilience

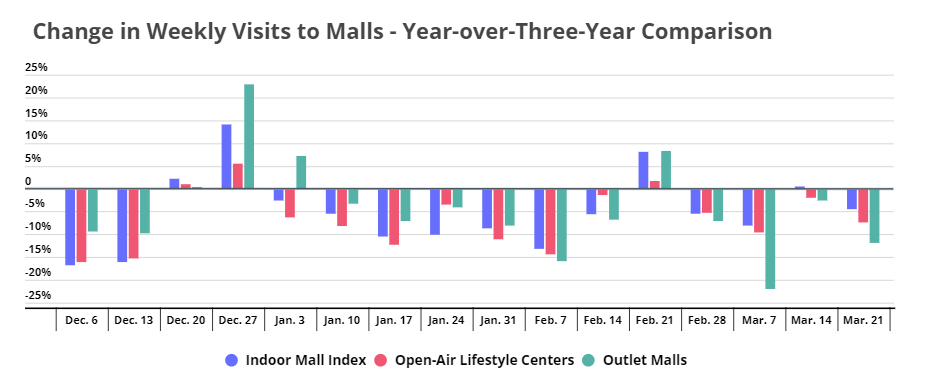

However, in the latest testament to the seemingly endless resilience of top tier malls, weekly visits compared to 2019 show yet another recovery. While rising gas prices clearly played a role in sending visits plunging in early March, by the weeks beginning March 14th and 21st, the situation had already stabilized. In fact, the week beginning March 14th actually saw visits up 0.5% for indoor malls compared to the equivalent week in 2019. That same week, visits to open-air lifestyle centers and outlet malls were down just 1.8% and 2.4% respectively.

The return to pre-pandemic levels shows that top tier centers continue to have a pull that brings in core audiences for a wider experience centered around their powerful combination of retail, dining and entertainment. The latest rebound shows that these formats have a built in a draw that continues to create excitement and interest. This is only augmented by shifts taking place within malls to create more urgency and differentiation from a tenant mix perspective.

Should the wider COVID recovery continue and the impact of some of retail’s newer challenges begin to dissipate, the next quarter could see a sharp rise in mall traffic and engagement.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.