The travel industry has seen its fair share of challenges over the past two years. As the wider situation begins to stabilize, will we see travel trends bounce back to pre-COVID levels? We took a closer look at Q1 2022 foot traffic data for hotels, airports, and major convention centers to find out.

Hotels Making a Gradual Recovery

Travel agents are predicting that domestic tourism may return to pre-pandemic levels in 2022, as people finally get to take those trips they’d been putting off. We took a look at data to see if those predictions are reflected in the foot traffic.

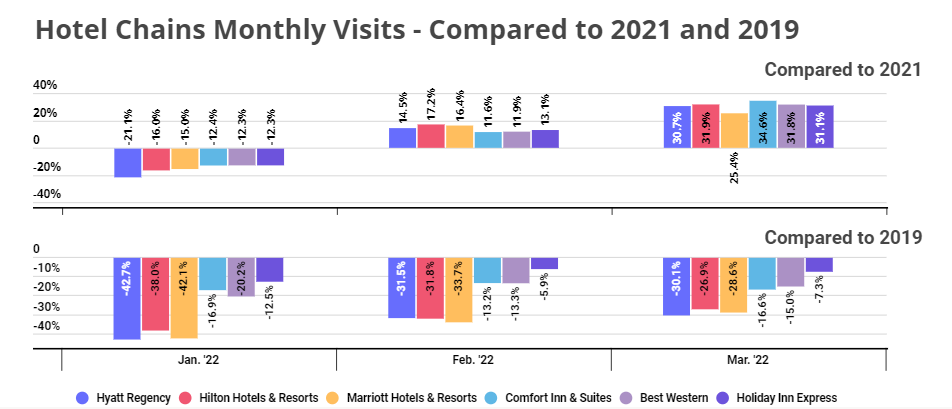

Hotels showed a strong recovery for the second half of 2021, but the recovery appears to have stalled somewhat in Q1. This may be due to a variety of factors, including the harsh COVID wave that canceled many plans, inflation causing people to tighten their budgets, and the fact that these months are typically quieter months for travel.

On a year-over-year (YoY) basis, however, monthly visits to hotels are higher than they were at this time last year. A slight downturn at the beginning of January, possibly related to the abovementioned factors, was quickly reversed as the numbers began to climb upward in February and March 2022. And while these numbers are still significantly below 2019 levels, it’s important to note just how intensely the travel sector was affected by the pandemic, and how impressive the recovery really is. With all indicators pointing to a robust year of travel in 2022, and as attitudes toward the pandemic increasingly turn to acceptance, we can hope to see visit shares trending upward.

Airports Continuing to Bounce Back

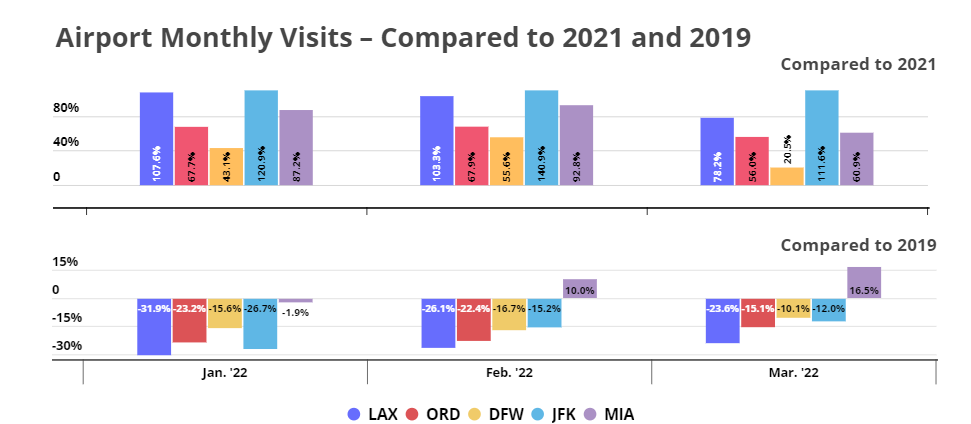

A closer look at travel trends overall shows just how many challenges the industry has withstood over the past two and a half years. Prior to COVID, the share of passengers opting for air travel had been on a consistent increase since 2010 as more and more low-cost carriers began to enter the market; 2019 saw roughly 812 million domestic travelers within the US. But with the onset of the pandemic, that number fell by 59% to 336 million in 2020.

Air travel recovered somewhat in 2021, but it still has a ways to go before reaching pre-pandemic levels. And Q1 2022 added to the challenge. As Omicron swept through the world, it also had a new side effect: airport staffing crises and unprecedented numbers of canceled flights, which may help account for dips in foot traffic levels relative to both Q1 2021 and Q1 2019. Despite the obstacles, airports have once again shown their resilience as they continue to edge closer to 2019 levels.

Of the five major transportation hubs we examined, one, Miami International Airport, is performing above 2019 levels, a hugely impressive feat given just how intensely Omicron battered the aviation industry. But given Florida’s warm weather and minimal COVID restrictions, perhaps it’s not a surprising one. And despite canceled flights and inclement weather, the YoY and Yo3Y visit gaps for the other four airports analyzed narrowed significantly between February and March, with visits to Dallas Fort Worth (DFW), Chicago O’hare, (ORD), JFK, and LAX only 10.1%, 15.1%, 12.0%, and 23.6% lower, respectively, than they were in March 2019.

Business Travel Still Catching Up

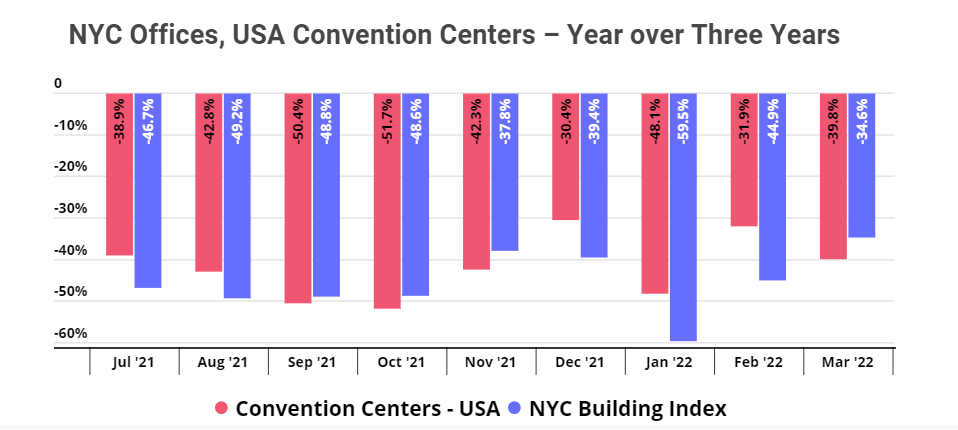

Business travel typically makes up around 25% of overall travelers within the United States, so we took a look at roughly 40 large convention centers, including the Javits Center, Las Vegas Convention Center, and others, to see how the category was faring. While as expected, visits took a hit during the pandemic, it also seems that foot traffic is taking longer to recover than other aspects of the travel industry, taking a marked downturn from June 2021 onward.

The persistence of hybrid conferences is likely slowing down the convention center recovery just like the persistence of hybrid work is keeping office foot traffic well below 2019 levels. Time will tell whether conventions centers will soon be packed once more or whether the transition to virtual conferences over the pandemic has caused some longer term changes in the sector. Either way, for now, it seems that leisure travel reigns supreme.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.