Our quarterly indexes track foot traffic patterns for major retail and retail-adjacent sectors, including grocery, superstores, home improvement, fitness, and dining. Below is a taste of our findings. For the full report, visit our Q1 2022 quarterly indexes.

A Regression to the Norm for Home Improvement in Q1 2022

The home improvement sector has reached wild heights since spring 2020, but recent foot traffic data indicates that the heightened demand of the past two years started to taper off. We dove into Q1 2022 home improvement patterns to find out where the sector stands as we move into the third pandemic year.

Home Improvement Still Ahead of Pre-Pandemic Performance

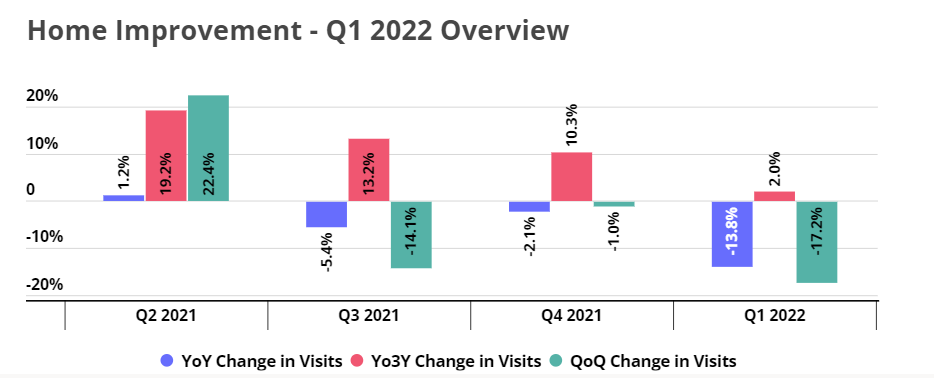

Foot traffic to home improvement retailers was up by 2.0% in Q1 2022 compared to Q1 2019. Although this year-over-three-year (Yo3Y) visit increase may not be as impressive as some of the visit records of the past two years. Visits were still higher than they were in 2019 – even after three straight quarters of QoQ drops – which speaks to the sector’s ongoing strength.

Some of the Yo3Y increase in visits is due to consumers remaining engaged with hobbies taken on during the pandemic. According to a survey we conducted in March 2022, 35% of respondents have taken on DIY and home improvement projects over the past two years. And some of the visits came from contractors who upped the frequency of their visits following the revamped loyalty programs of many of these home improvement retailers. So while the growth may have somewhat slowed down, the category still appeals to diverse customer segments who may well bring foot traffic back up in Q2.

It is important to remember that winter is typically one of the slower seasons for the home improvement sector and that this past quarter has brought its fair share of retail obstacles, from the Omicron wave early on to the more recent rising gas prices and inflation. So the fact that the home improvement category succeeded in holding on to its Yo3Y visit growth in the face of these challenges is a testament to the sector’s improved position since the onset of COVID.

As the warmer weather sets in and gas prices hopefully return to lower levels, contractors and DIY customers will likely return to their favorite home improvement retailers and drive visit growth once again.

Some Retailers Experience Long-Term Boost

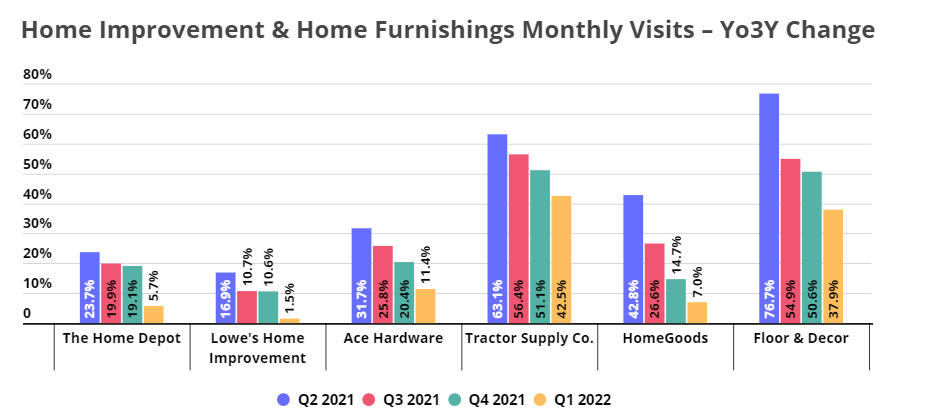

Although many home improvement retailers have seen their visits slowly move closer to 2019 levels, the quarterly comparisons to Q1 2019 show that several home improvement and home furnishing brands have successfully transformed the short-term craze into long-term gains. On the home improvement side, Ace Hardware and Tractor Supply Co. saw their Q1 visits increase by double-digits compared to Q1 2019, despite the overall slowdown in the sector. And on the home furnishing side, Floor & Decor’s Yo3Y foot traffic jumped by 37.9% in Q1 – an indication that the heightened demand for home-focused retail created by the pandemic is still having an impact on retailers’ offline traffic numbers.

As hybrid work becomes the norm, many people will continue to spend more time in their homes when compared to pre-pandemic times – which means increased wear and tear and heightened demand for home furnishings. While the home improvement sector may not break its pandemic visit records this year, the boost in foot traffic to leading home improvement and home furnishing retailers shows that the many players in the sector have succeeded in transforming the short-term opportunity presented by the pandemic into long-term strength.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.