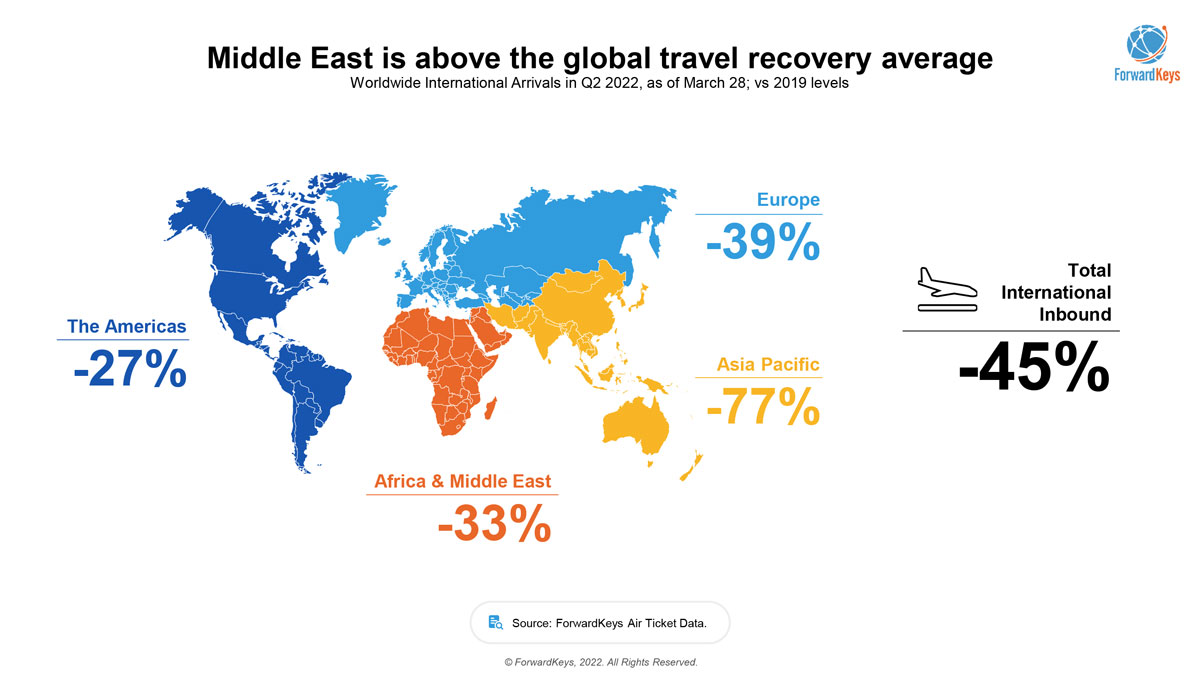

As there is much talk about travel recovery around the world, first with the Americas leading in 2021 and again in 2022, the travel data experts at ForwardKeys are noticing the first taste of recovery in Africa and the Middle East.

International arrivals to Africa and the Middle East in Q2 of 2022 are at -33% compared to 2019 levels, above the total international outbound average of -45% and just behind the leading recovery region, the Americas (-27%). Last year this figure was at -64%, so this is a marked improvement.

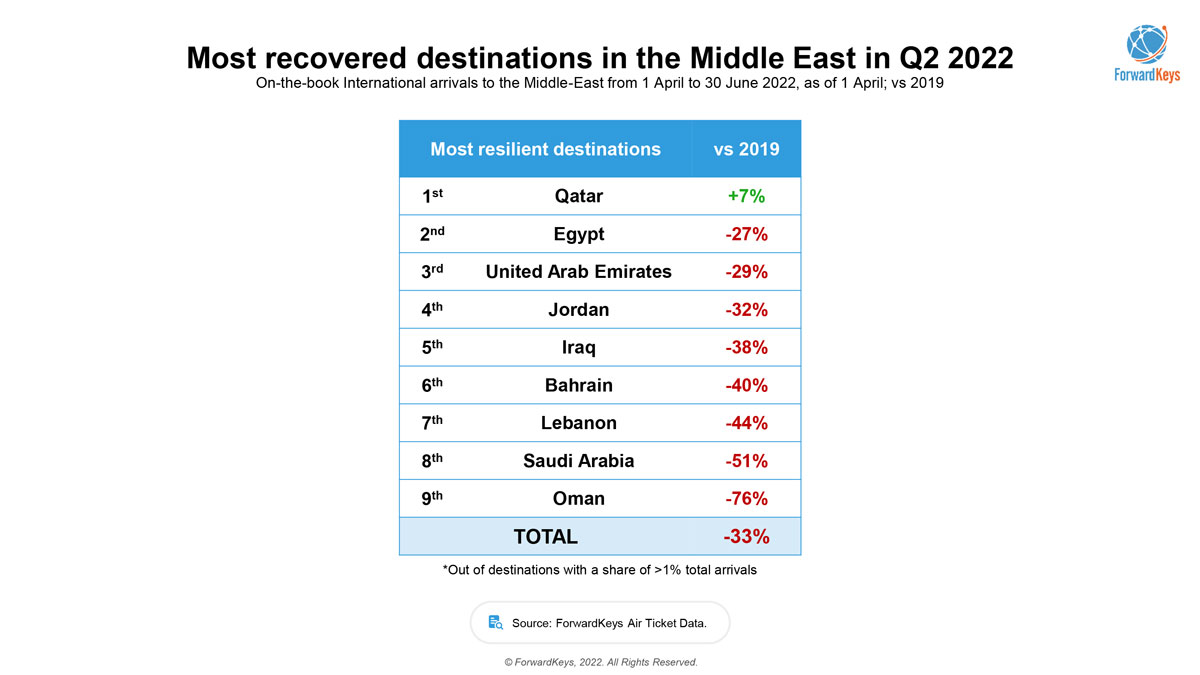

Most Recovered Destination in the Middle East: Qatar

Looking at the issued tickets for international arrivals in the Middle East in Q2 this year, it’s Qatar which is the soaring falcon demonstrating a 7% increase compared to pre-pandemic levels. Neck to neck in 2nd and 3rd position are Egypt and the UAE. Both performed better against the total average of -33% for the region.

The largest origin market for the Middle East is the UK with shares of 12.8%, and whilst compared with 2019 it is performing well, at just -6% behind, it’s the US that is leading the recovery with a +15% increase compared with 2019 and shares just slightly smaller at 11.3%. Could this be a new business opportunity for hoteliers, airlines, and tour operators?

“Looking specifically at Qatar, we see a +76% increase for arrivals from the UK, compared with 2019, and remarkably we see a +105% increase of arrivals from the US to Qatar compared with 2019. Considering all the challenges the tourism sector has faced recently, this is an encouraging feat for Qatar ahead of the FIFA World Cup in November,” says Olivier Ponti, VP of Insights at ForwardKeys.

Luxury Travel and Top Airports in the Middle East

The other encouraging news for the region is that Premium cabin shares have increased by +4.3% since 2019. Indeed, it’s the premium cabin classes that are leading the recovery, down by just -14% versus pre-pandemic levels. Economy class tickets are at -37% versus 2019 levels!

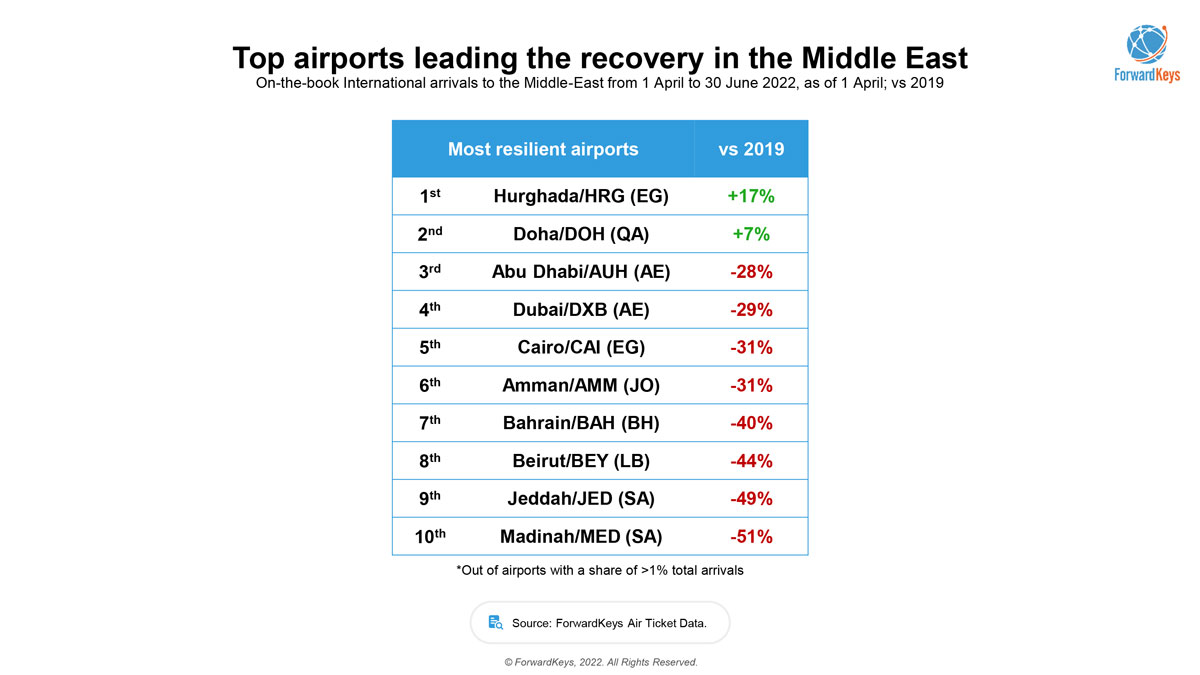

Which airports are buzzing again, you wonder? In the number one position for international arrivals from April – to June is the gem of Egypt’s Red Sea – Hurghada. The appeal of the sun and sea means that Hurghada is showing a 17% increase in pre-pandemic levels.

Another destination that is not only seeing an increase in arrivals to its nation but also its main airport – Doha.

“This trend was aided by Doha maintaining most air services during the pandemic and Qatar Airways adding more routes from their Doha hub,” says Africa Market Expert, Shingai George.

Adding more fuel to the fire of this controversial ranking is that Abu Dhabi airport is also ahead of the much famous DXB airport.

“All of this can change in the blink of an eye as we’ve seen last-minute bookings become the norm and bookings soar overnight when travel restrictions are eased. But we are seeing consumer confidence for long-haul flights is up again, with the Americans really kick-starting travel revival around the world now,” adds George.

To learn more about the data behind this article and what ForwardKeys has to offer, visit http://forwardkeys.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.