With Q1 2022 behind us, we dove into foot traffic data to find out how CVS, Walgreens, and Rite Aid were performing.

CVS and Walgreens Still Seeing Increased Visits

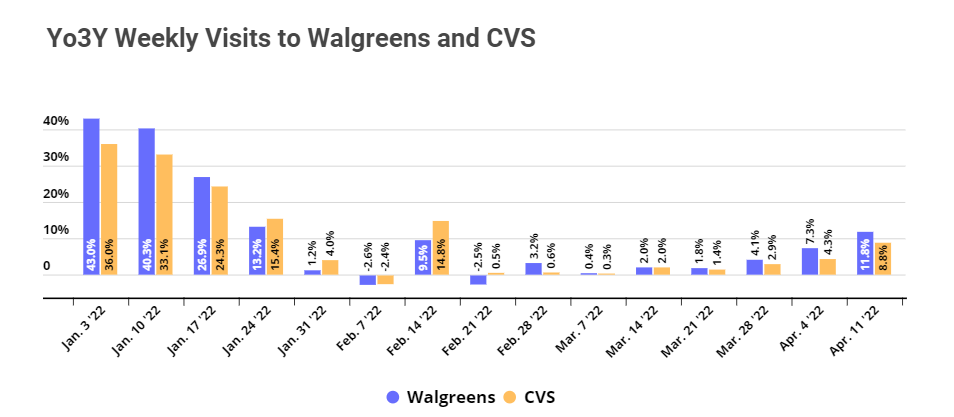

Walgreens and CVS both saw big successes during 2021, and foot traffic to both brands is still ahead of where it was pre-pandemic; visits the week of April 11th were up 11.8% and 8.8% for Walgreens and CVS, respectively, compared to the equivalent week in 2019. Still, there does appear to be a dip in visits since the beginning of 2022, which could be due to waning numbers of COVID and reduced demand for tests and vaccines.

Walgreens kept busy during 2021 with new leadership, technological acquisitions, and an expanded healthcare division. Its large-scale alliance with VillageMD makes it the first national pharmacy chain to offer full-service primary care practices with physicians and pharmacists co-located at its stores all under one roof.

In November 2021, CVS announced that starting in spring 2022, it will close about 900 stores across the nation over the course of the next three years. This marks the closure of roughly 10% of the brand’s retail locations. The store closures have been announced to take place during spring 2022 and some closures are already underway. CVS’ decision to downsize reflects its ongoing focus on its omnichannel strategy and an emphasis on in-location services. We previously wrote about how cannibalization influences the choice to close certain store locations and maximize rightsizing efforts.

Revamped Efforts at Walgreens and CVS To Boost Customer Loyalty Paying Off

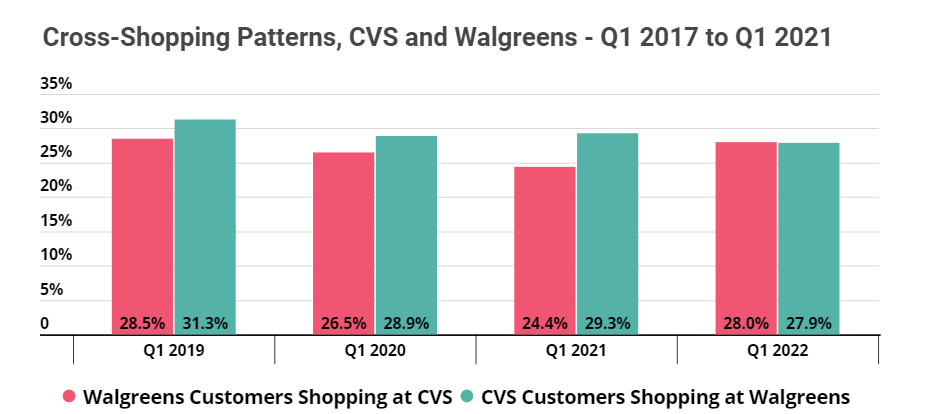

Last year, Walgreens and CVS both took steps to bolster customer loyalty by offering its customers access to a personalized, omnichannel healthcare experience. As we’ve written about previously, customers are more likely to be loyal to their healthcare provider than to their local pharmacy, so the brands’ transition to focus on the needs of customers as patients is a significant factor in driving growth and bolstering customer loyalty.

So far, while cross-shopping from Walgreens to CVS and from CVS to Walgreens is slightly lower than it was pre-pandemic, neither brand has yet to make significant inroads in convincing its customers not to shop at competing pharmacy chains. But it’s clear that fostering customer loyalty is at the core of both CVS’ and Walgreens’ current growth strategy, so these efforts will undoubtedly raise the bar for the pharmacy sector as a whole going forward.

Rite Aid’s Overall Traffic Is Down, but Visits Per Venue Are Up

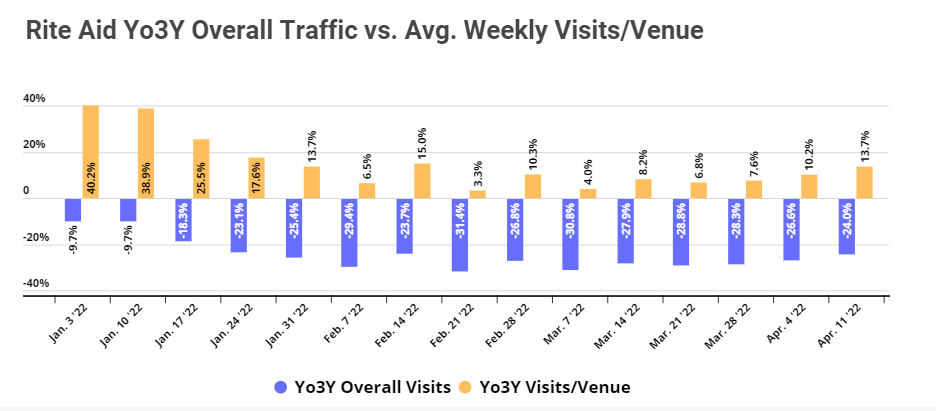

Unlike CVS and Walgreens, Rite Aid saw decreased foot traffic in 2021 – perhaps due to the fact that Rite Aid branches are located primarily in areas more affected by COVID, with more than half the stores in California, New York, and Pennsylvania. As a result, the company announced in December 2021 plans to close over 60 stores in the following months, and recently announced plans for an additional 145 store closures.

Already, it looks like Rite Aid’s store fleet consolidation is having an impact on foot traffic performance. Since the beginning of the year, Rite Aid’s Yo3Y visits per venue metrics have been positive, even as the brand’s overall visit numbers lag behind pre-pandemic levels. In March 2022, its average weekly visits per venue were up by 7.2% compared to March 2019.

Rite Aid’s efforts to rightsize its operations are accompanied by ongoing efforts to boost its in-store product offering with brand partnerships, such as Rite Aid’s recent collaboration with Beyond Meat. Although the brand’s overall visits are currently down in numbers, the fact that visits per venue are up goes to show that Rite Aid is ultimately on the right strategic path.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.