The coffee space performed very well in 2021, with foot traffic back to pre-pandemic levels for much of 2021. In recent months, however, the Omicron surge, rising prices, and ongoing economic uncertainty has put a dent in the sector’s fairytale recovery. We dove into recent visit data for Starbucks, Dutch Bros., and Dunkin’ to understand where the coffee category stands today.

Dunkin’ and Starbucks Omicron Recovery

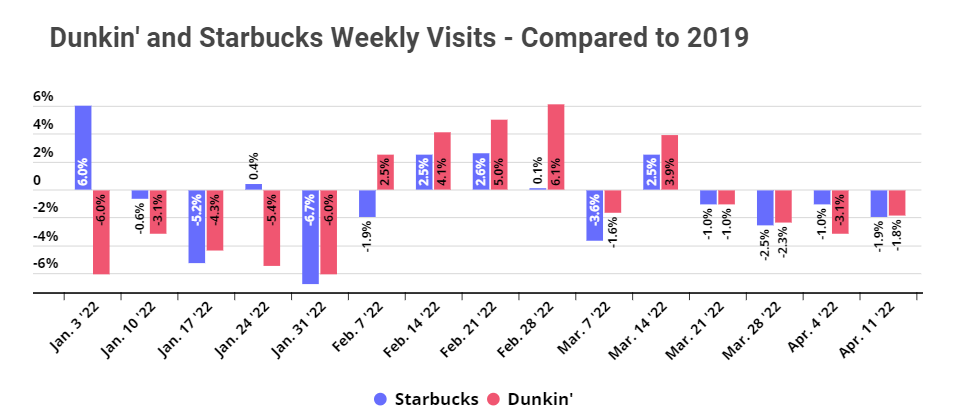

Starbucks and Dunkin’ visits essentially recovered in the second half of 2021, before dropping again in early 2022 as a result of Omicron. Then, just as the recovery began picking up steam again, inflation and rising prices brought foot traffic back down to slightly below 2019 levels. During the week of April 11th, Starbucks and Dunkin’ visits were 1.9% and 1.8% lower, respectively, than visits during the equivalent week in 2019.

Still, pulling in foot traffic within a percentage point or two of pre-pandemic performance is quite a feat in the current economic climate. Due to the high inflation rates and rising gas prices, many consumers are now spending more on essentials, which means that their budget is tighter – even if their spending habits have not changed.

As a result, a CNBC|Momentive poll found that more than 50% of adults have already cut back on dining out – making Dunkin’ and Starbucks’ Yo3Y foot traffic data particularly impressive. At the same time, the drive to save money on dining out may also be what’s pulling the coffee sector up, as consumers who are saving money on dining costs may be treating themselves to a cup of coffee as a cheaper alternative to their regular purchased full meals.

Starbucks Community Stores

In its simplest form, a coffee shop gives people their morning caffeine fix, but it can also provide so much more than that. Diving into Starbucks community stores can quantify the boost coffee shops can receive by also serving as community hubs. These stores are dedicated spaces with the stated goal of serving their communities by emphasizing local hiring, partnering with farmers and artists in the area, and extending disability inclusion and access. The concept was first introduced in 2015 as a way for Starbucks to enter lower-income neighborhoods, and has grown and expanded over time to reflect each location’s unique needs.

The Starbucks community store in Dallas, Texas has seen consistent growth in foot traffic since its opening in 2018 – including maintaining this performance throughout the pandemic. This growth is particularly impressive in context. Analyzing the change in Starbucks visits against the same December 2018 baseline for the community store, the nearby locations’ average, the Dallas DMA, and Texas as a whole shows that Starbucks foot traffic is down in all the control groups – even as the Dallas community store thrives.

The relative strength of this store shows just how much value a business can get out of focusing on the local level. Prioritizing collaborations with local businesses, providing employment opportunities, and consciously cultivating community engagement does not just benefit the locals, it also sets the coffee shop up for business success.

Dutch Bros. Visits Still Far Ahead of Pre-Pandemic Levels

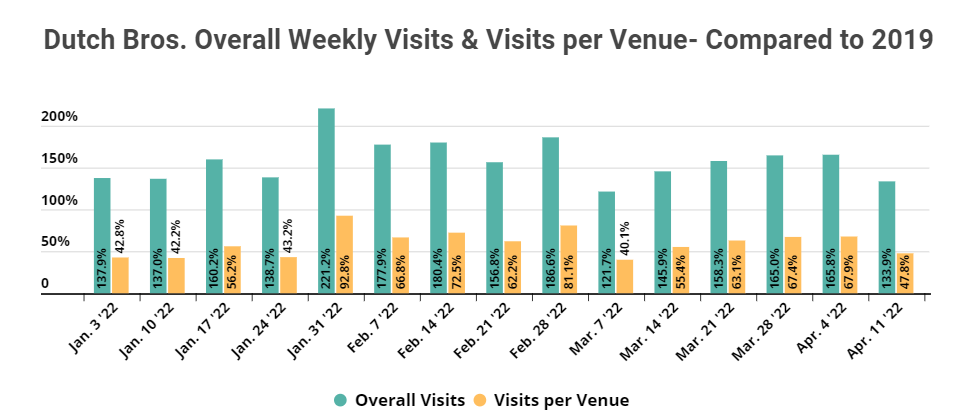

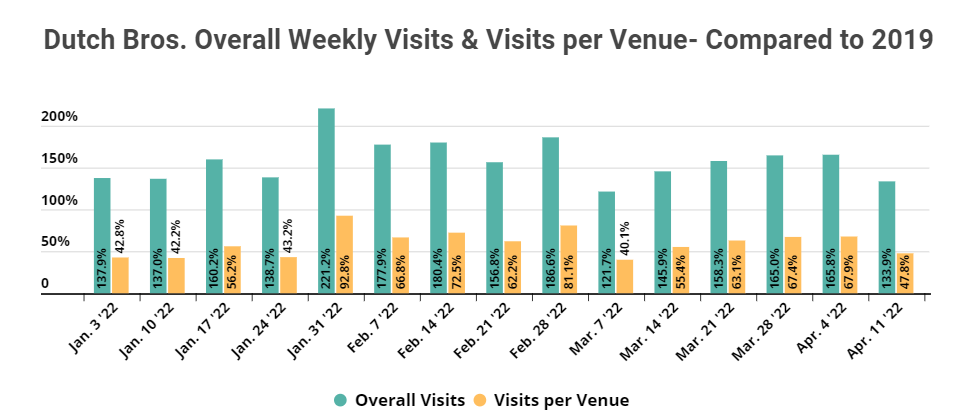

Dutch Bros. Coffee was one of our Top Ten Retail Brands to Watch in 2022, and Q1 data confirms that the Oregon-based company deserved its spot on the list. Since January 2022, overall visits stayed far ahead of pre-pandemic levels – which makes sense given Dutch Bros.’ aggressive expansion over the past two years. But visits per venue have also been up in a big way – for the week of April 11th, overall visits were up by 133.9% and visits per venue were up by 47.8% compared to the equivalent week in 2019. These numbers indicate that the current store fleet is still not sufficient to meet the full demand for Dutch Bros. Coffee.

Dutch Bros. Growth Slowing Slightly Compared to 2021

The brand’s foot traffic is also growing when compared to 2021, albeit at a slightly more subdued rate. Overall visits and visits per venue were higher almost every week this year compared to the equivalent week last year, even though growth remained in the single digits for much of March and April. Yet, the fact that Dutch Bros. managed to see a 9.2% and 4.2% increase in visits per venue for the weeks of April 4th and April 11th, respectively, shows just how strong the brand still is and how much growth potential it has once the current economic situation stabilizes.

Whether it’s the famously friendly service or festively colored drinks, a visit to Dutch Bros. may feel like welcome respite during these uncertain times. As inflation rates continue to rise, there is every reason to think that foot traffic will remain on its growth path, and the brand will continue serving up cheer in the form of good coffee and candy colored iced drinks.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.