Would you take it if someone offered you $3b for something you started building two years ago?

Literally everyone on the planet would likely accept that offer—everyone except Evan Spiegel, co-founder of Snapchat, who infamously turned down Mark Zuckerberg’s offer to buy his then-two-year-old app for a whopping $3b.

Almost a decade later, it’s clear that Spiegel knew what he had and that $3b was just a drop—no, a penny—in the bucket.

Snap Inc.’s (Snapchat’s parent company) current market cap is closing in on $50b and Spiegel is worth more than $6b.

How did Snapchat get there?

You guessed it.

Advertising.

Virtually all of the company’s $4.1b in revenue comes from ads.

Seriously.

Ninety-nine percent of Snap’s revenue comes from companies buying ads—and they did a lot of that in 2021.

Last year, advertisers spent 16% more than they did in 2020 as those from 580 companies promoted over 1.4k brands on the platform.

Of the companies that advertised on Snapchat in 2021, 63% didn’t do so in 2020.

That said, 32% of the companies that advertised in 2020 returned last year.

But that’s the past.

What about now?

How are advertisers spending so far in 2022?

Let’s find out.

How Advertisers Spent on Snapchat in Q1 2022

To help you better understand how advertisers are thinking about Snapchat in 2022, we pulled data from 190 companies (396 brands) that bought ads on the platform during the first quarter of the year.

Of these brands and advertisers, 46% and 27% (184 and 52) of them didn’t buy ads on Snapchat in 2020 or 2021.

It’s impossible to know precisely why this is the case, but it may have something to do with Snapchat’s maturity.

While Snapchat’s far from new, it’s still relatively early in its maturity curve compared to other digital ecosystems like Facebook and Google.

This may have been enough to keep some advertisers away until now, especially those with smaller budgets that restrict their ability to experiment.

For other advertisers, Snapchat’s impressive growth last year may have finally wooed them.

According to Snapchat’s February 2022 financial results, Daily Active Users (DAUs) increased by 20% year-over-year to 319mm.

That said, 47% of the companies we looked at had bought Snapchat ads before, indicating the stickiness of the platform’s ad products and the impact they can have.

Snapchat advertising to the moon

Of the companies that advertised during Q1, 5% (nine) of them increased their spending by more than 1000% YoY.

The most well known of these companies was Samsung, which increased its spending to promote its Galaxy phones.

This significant increase comes on the heels of a year in which Samsung already increased spending by 62x from the year prior.

UVNV, the company that owns Mint Mobile (yes, the one owned by Ryan Reynolds), is spending big, too.

So far in 2022, UVNV has spent 87% of what it did last year—an impressive development considering it increased its spending by 43x in 2021.

Finally, after a busy 2021 that saw it increase its Snapchat ad buys 14x YoY, Johnson & Johnson Services poured more dollars than ever into Snapchat to promote its brands, Stelara, Tremfya, and Zyrtec Allergy during the first quarter of the year.

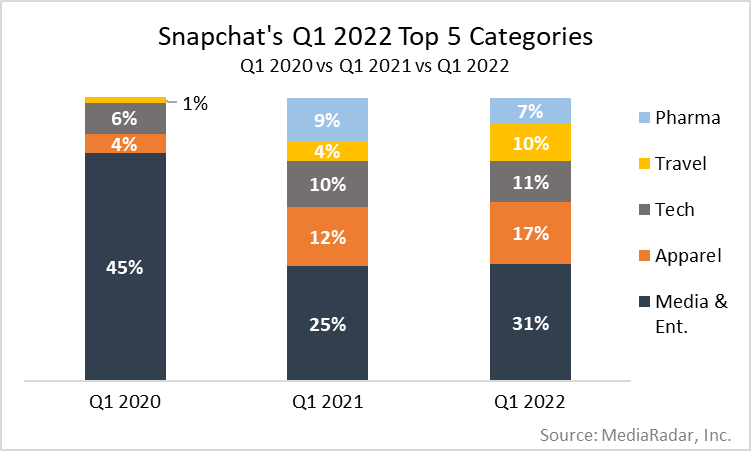

Q1 2022 Snapchat Top 5 Categories

Snapchat’s Q1 2022 Top 5 Categories

We looked at a few brands that increased their spending in big ways this year, but let’s take a step back and look at Snapchat’s top 5 categories—after all, they accounted for 75% of the ad buys in Q1.

The big spending from Amazon helped offset QoQ decreases by other names like Paramount (down 19% QoQ) and Warner-Elektra-Atlantic (down 86% QoQ).

Kering (Balenciaga and Gucci) and VF (Vans and Timberland) led this charge, increasing their buys by 116% and 308%, respectively.

Propelling the Travel category into the top 5 for the first time were Carnival, Royal Caribbean, the State of New Hampshire and Southwest Airlines, which makes sense as the world tries to make up for two lost years of travel.

While Samsung was down 66% in Q1 compared to last year, Apple (beats Earbuds, iPhone and iPad) helped offset this with an increase by almost 1,000% QoQ.

Helping to keep it there was Novartis, which increased its spending on Snapchat by more than 100x QoQ as it promoted Kesimpta (used to treat certain forms of multiple sclerosis (MS) in adults).

What to Expect from Snapchat Moving Forward

Snapchat’s had an impressive run and has identified ways to attract brands to its platform despite a seemingly endless list of alternatives.

That said, it’s certainly not resting on its laurels. Snapchat continues to up its advertising game to keep new advertisers coming in the door and existing ones inside its walls.

A good example of this came earlier this year when it launched Catalog-powered Shopping Lenses, which give brands real-time results on SKU-level AR product engagement.

Another improvement came when Snapchat rolled out multi-format delivery of ad creatives, allowing advertisers to use a single ad set across multiple ad formats and for Snapchat to optimize delivery.

Said another way, advertisers can batch their Snapchat campaigns under the same roof and Snapchat’s ad technology will optimize them together rather than doing so in siloes. The result is better performance and efficiency.

When you look at what Snapchat’s doing from an advertising standpoint and combine that with its proven ability to carve out market share, especially with the highly influential Gen Z, there’s no question what the future holds for Snapchat: a lot more ad revenue.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.