About the Mall Index: The Index analyzes data from more than 100 top-tier indoor malls, 100 open-air lifestyle centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai uses anonymized location information from a panel of 30 million devices and processes the data using industry-leading AI and machine learning capabilities to make estimations about overall visits to specific locations.

Visits Remain Stable Amid More Challenging Comparisons and a More Challenging Context

Looking at Mall Index visits between April and May showed a clear pattern of expanded visit gaps for all three segments. And while this is certainly not ideal, it does also demand context.

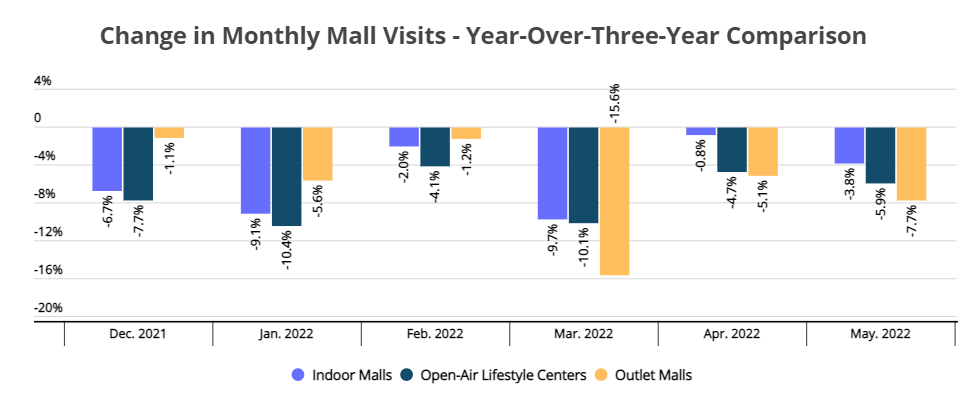

The comparison for malls, outlet malls, and open-air lifestyle centers in May compares to a much more significant peak than in March or April. So while elements like inflation and gas prices are likely playing a role here, the relatively minimal increase in the visit gap indicates that this role has been far more muted than might have been otherwise expected.

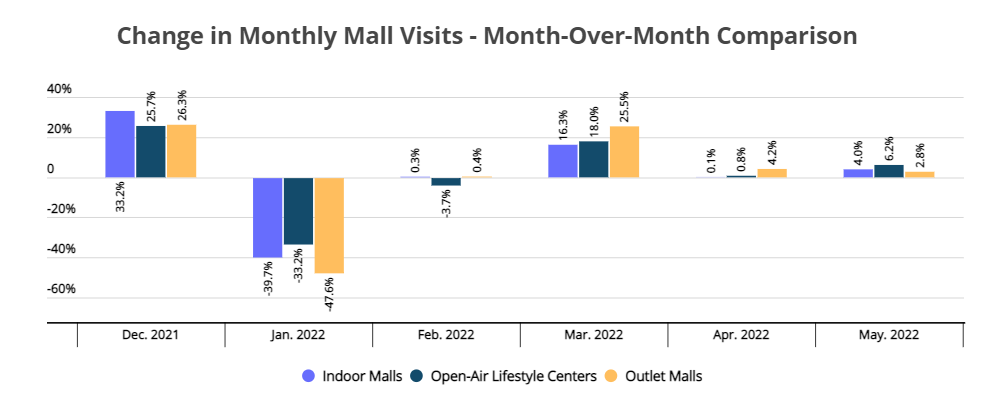

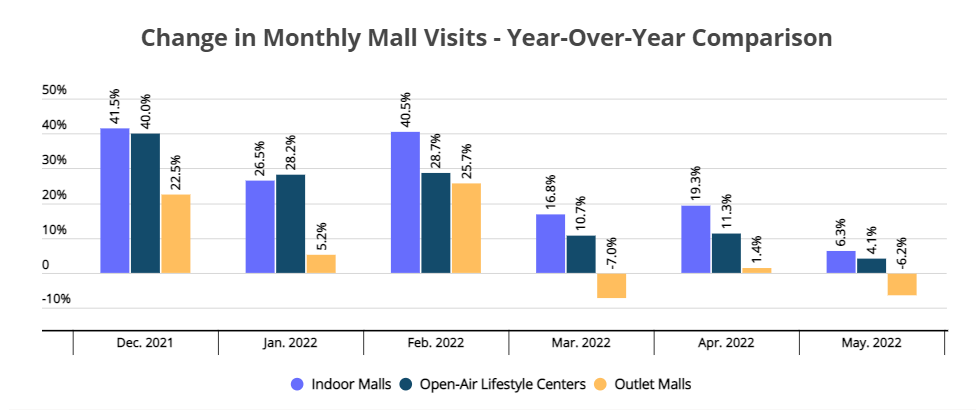

Instead of declining, mall visits have actually been on a steady increase since a major jump between February and March. In May, Indoor Mall visits increased by 4.0% compared to April, while open-air lifestyle centers and outlet malls saw MoM increases of 6.2% and 2.8% respectively. For context, indoor malls, open-air lifestyle centers and outlet malls had increases of 7.2%, 5.7% and 7.6% between April and May in 2019. So essentially, we appear to be seeing a sector that is absolutely rebounding, but simply not at the same pace as a result of significant economic headwinds. And the relative strength being seen through limited declines is actually a testament to the unique demand that malls are still able to drive – even during a difficult period.

This perspective lends an added effect to the year-over-year growth seen in May. While the more limited nature of the growth is a sign of the challenging environment, the growth itself is significant as it shows the unique resilience of consumer demand for the mall experience. The outlet mall experience here also stands out as the lengthier trip that many of these locations demand has become a serious impediment in a period marked by the unique effects of rising gas prices. This further indicates that as these economic headwinds dissipate, top tier indoor malls, open-air lifestyle centers and outlet malls could be uniquely well positioned.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.