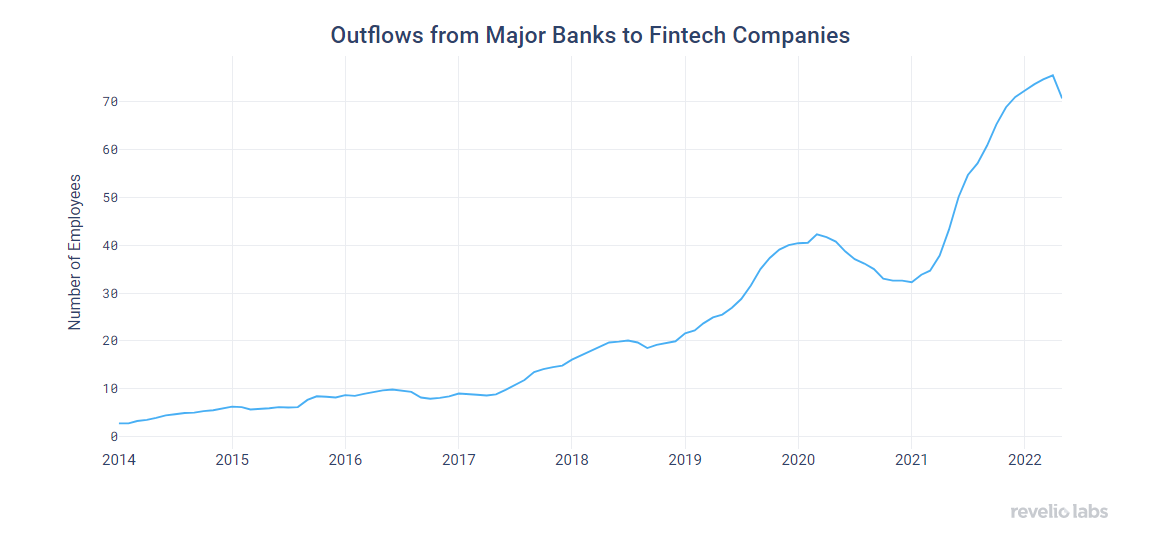

Fintech companies like Coinbase, Robinhood and Revolut have been snatching talent from Wall Street for years, but recently, this trend has hit a record high. In a collaboration with Bloomberg this week, we look at the talent flows from major banks to fintech companies over the last few years to understand what is driving this trend.

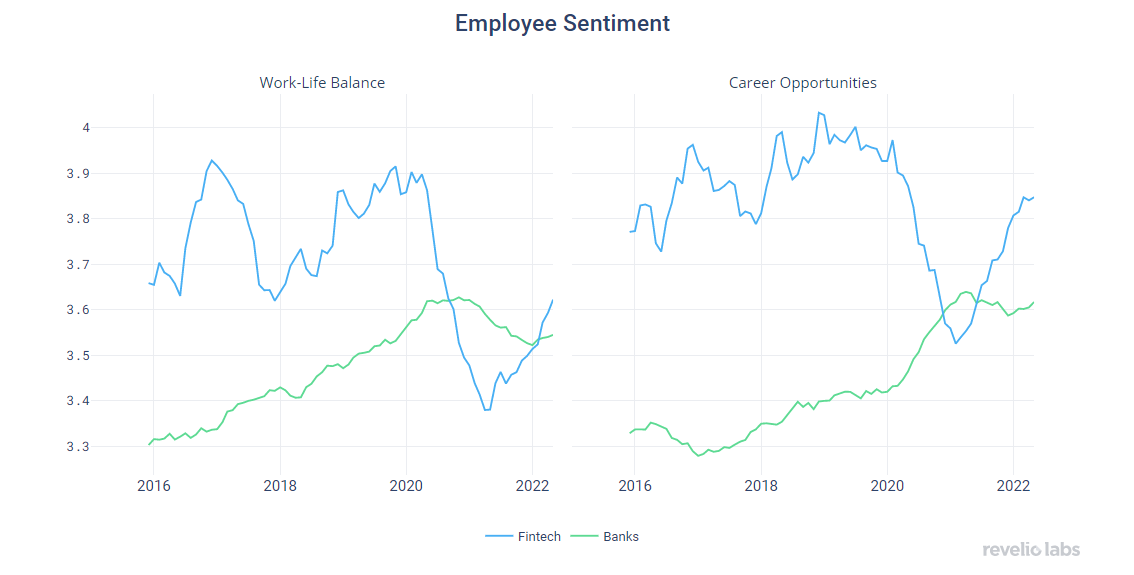

Inflows to Fintech from Wall Street accelerated sharply in 2021, after dipping at the onset of the pandemic. This trend is in line with the recent record numbers of transitions during the great reshuffling, where employees typically searched for new jobs with better working conditions. Tech companies also tend to offer better work life balance than Wall Street, as we have shown in the past.

Having said that, work-life balance and career outlooks at Fintech companies actually took a major hit at the start of the pandemic. This recent change to work-life balance may have been driven by a struggle to adopt remote work at the onset of the pandemic. A more cynical view could be that the influx of Wall Street bankers would have created a more aggressive work-life culture.

The most recent slowdown of Wall Street talent inflows to Fintech, however, may be more related to Fintech’s current economic outlook and to the fact that employees tend to transition less during uncertain times. Coinbase introduced a hiring freeze only this week.

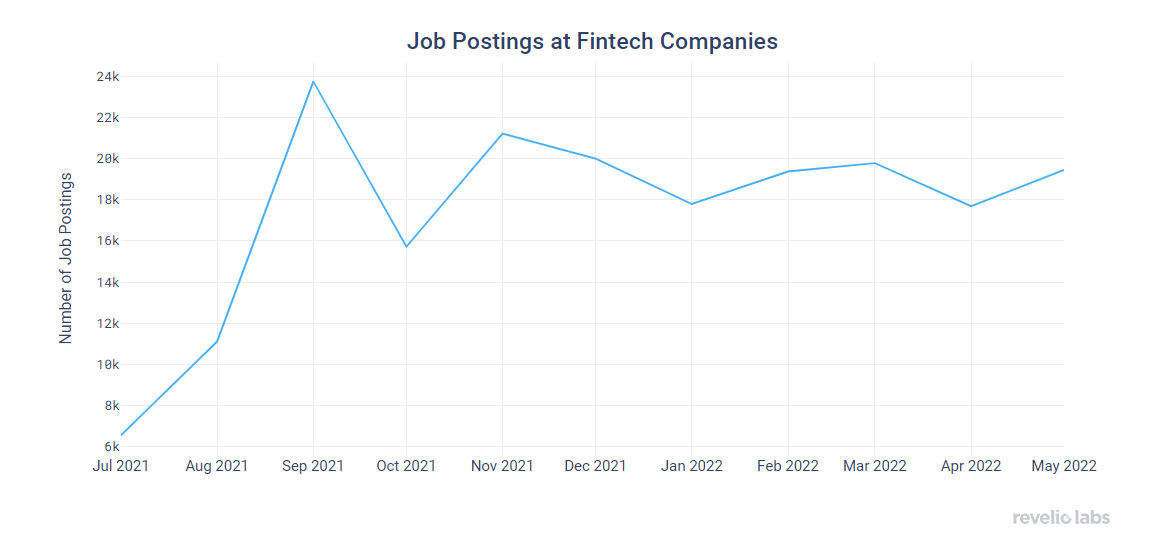

But it is worth pointing out that Fintech overall is not slowing down their hiring efforts just yet, as May job postings at major Fintechs was in line with the past months.

Key Takeaways:

To learn more about the data behind this article and what Revelio Labs has to offer, visit https://www.reveliolabs.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.