With summer almost upon us, we took a look at foot traffic trends associated with a classic American activity – spending time in nature. We dove into visits to 20 national and state parks as well as foot traffic to a rising star in the recreational equipment space, Sierra, to see what its strength can tell us about the demand for leisure time in the great outdoors.

Sierra’s Continued Market Dominance

With the recent rise in costs of consumer goods and services, people may be turning to outdoor activities as a cost-friendly leisure option. Sierra, an off-price camping and outdoor recreation retailer owned by TJX Companies (which also owns T.J. Maxx, Marshalls, HomeSense and HomeGoods), has been benefiting from the growing interest in both outdoor activities and consumer demand for low-cost alternatives.

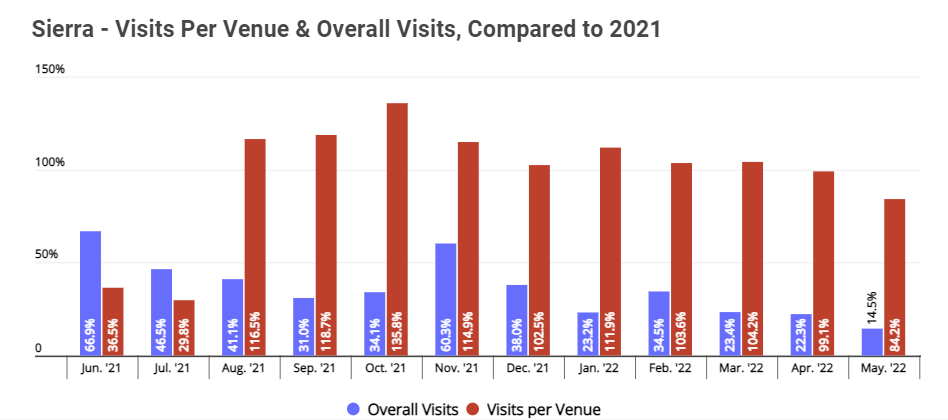

Despite the challenges currently facing many retailers, year-over-three-year (Yo3Y) visit numbers indicate that Sierra is continuing its growth, with visits in April and May 2022 up 105.4% and 99.7%, respectively, when compared to the same months in 2019.

Some of the foot traffic increase can be attributed to Sierra’s rapidly expanding store fleet. The brand went from 27 stores at the end of fiscal 2018 to 59 at the end of fiscal 2021, and since more stores usually translate into more foot traffic, this foot increase is to be expected. But in Sierra’s case, Yo3Y visits per venue are also up. This shows the strength of the concept, as Sierra executed a significant store expansion during a pandemic, kept its foot traffic positive throughout one of the most challenging periods for brick-and-mortar stores, and are continuing to pull customers into each individual location.

Sierra Still has Significant Room for Growth

When looking at visits compared to previous years, overall visits are still up, and visits per venue have skyrocketed – year over year (YoY) visits in May 2022 were up 14.5% overall and up 84.2% on a visits per venue basis. This means that Sierra’s physical expansion is successfully filling an existing demand for low-cost outdoor gear and that the retailer still has significant room to grow.

This sustained, impressive growth is also a testament to the high consumer demand for off-price outdoor equipment. Generally speaking, the off-price model – where items are sold at a significant discount – is still relatively uncommon in the recreational sector, allowing Sierra to dominate the market.

But competition may be starting to heat up – Dick’s Sporting Goods recently launched two discount athletic gear brands – Going, Going, Gone! and Dick’s Warehouse Sale. With these new concepts, as well as its Public Lands brand, Sierra may soon find themselves sharing the off-price and camping gear market with another major player.

National Parks Doing Well

The rise of Sierra goes hand in hand with the heightened demand for outdoor activities. Camping has long been a popular American pastime, and COVID restrictions only increased interest in visiting state and national parks. Many national and state parks received a serious boost in foot traffic during the pandemic. The combination of affordable entry fees, outdoor (and therefore, socially-distant) options, and accessibility – each state in the country boasts several beautiful parks – made national parks an excellent vacation destination.

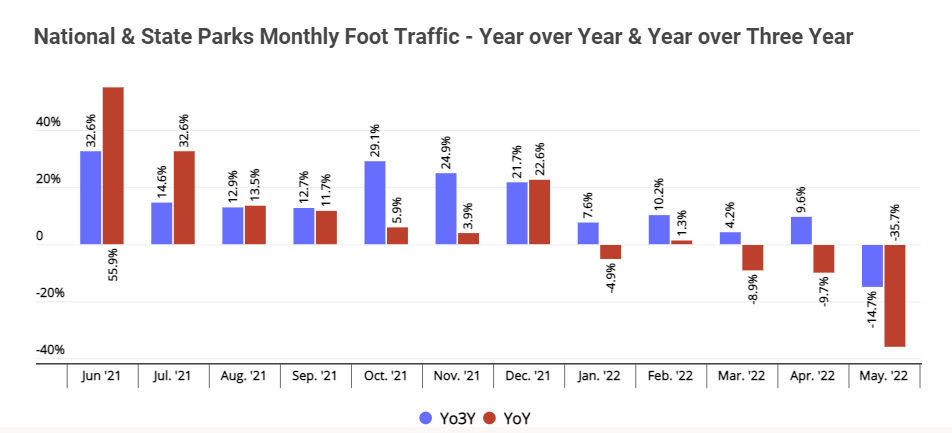

Year-over-year visits were down in the new year, but this may be due to the unusually high visits of early 2021. Visits to national parks tend to be lower in the winter months, but winter 2021 likely received an artificial boost in park foot traffic from visitors looking for a COVID-friendly activity.

And despite the drop in YoY visits, Yo3Y foot traffic has remained consistently strong, with April 2022 visits up 9.6% relative to April 2019. The strong Yo3Y numbers indicate that the interest in outdoor activities was not just a fad – instead, it looks like COVID led to a long-term increase in interest in the outdoors, which may also be one of the factors driving Sierra’s success. And while foot traffic did fall in May 2022, the drop is likely due to exceptionally low Memorial Day visits rather than to waning demand for nature-based activities.

May Gas Price Challenges

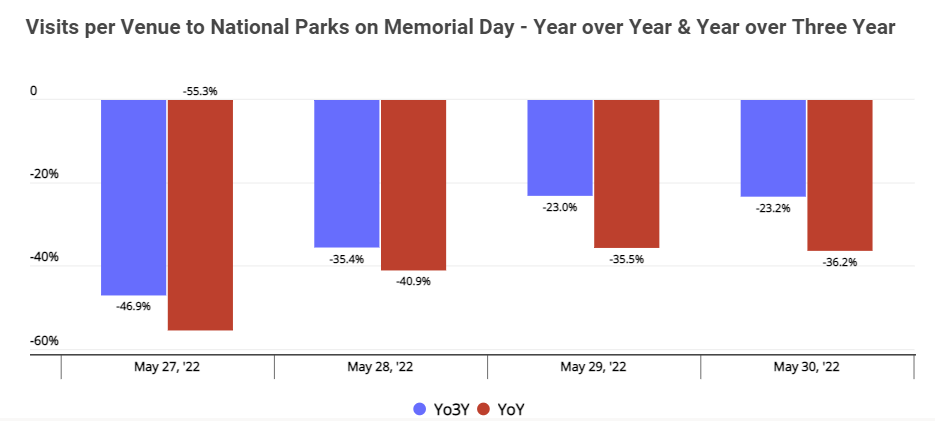

May 2022 visits took a tumble relative to previous months, seeing visits per venue dip into the negative – reaching -14.7% Yo3Y – for the first time in 12 months. But, context here is key. Memorial Day, which falls the last weekend of May, usually provides a significant visit boost to state and national parks. But this year’s high gas prices seems to have kept Memorial Day visits lower than anticipated – the Monday of Memorial Day weekend saw a 23.2% and 36.2% dip in Yo3Y and YoY visits per venue, respectively. Since most of the national and state parks are only accessible by car, concerns over high gas prices likely kept vacationers and cost-conscious consumers closer to home, choosing to spend their gas budget on local attractions instead.

But, May’s lower visits might be just a small blip on the overall increase in park visits, with the US Secretary of Commerce announcing a four-step plan to boost tourism to national parks, and as attitudes towards rising gas prices shift toward acceptance,

As national parks continue to grow in popularity, and as consumers continue to seek lower-cost options where possible, both national parks and off-price outdoor retailers can expect to see continued growth.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.