Robust top-line hotel performance indicators for the four weeks ending 11 June point to a clean transition between a rock-solid recovery during the spring to summer’s traditionally leisure-heavy travel period. With domestic leisure travel expected to remain strong, along with a recent lifting of international travel restrictions, STR expects a record-breaking summer season with numerous U.S. hotel markets to surpass 2019 comparables.

Largely on the strength of average daily rate (ADR), 142 of 165 (86%) STR-defined U.S. markets posted a four-week index in revenue per available room (RevPAR) that was above the matched 2019 period. Further, all but four U.S. markets recently had nominal (non-inflation adjusted) average rates that exceeded 2019 levels. Almost 100 U.S. markets reported average rates that were 15% or higher than 2019 levels. In contrast, 43 markets showed four-week average occupancy that matched or exceeded 2019 levels. Two-thirds of those 123 markets that fell short on occupancy, however, missed their 2019 period marks by a relatively narrow margin of five percentage points or less.

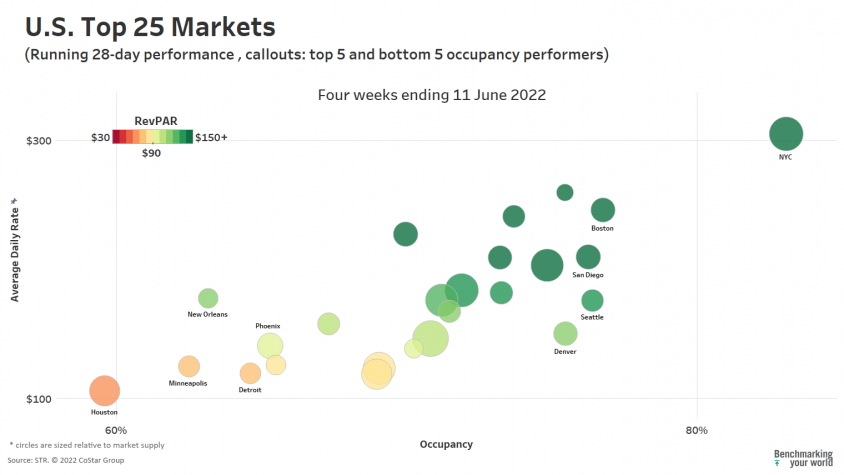

The Top 25 Markets have recently shown a more blended recovery in both occupancy and ADR over recent weeks. New York City led all U.S. markets in average occupancy for the period at 83.1%—a jump of 6.6 percentage points since our May update. The next markets on the Top 25 occupancy leaderboard were well below that level, including Boston (76.8%, a 6.7pp monthly gain), and Seattle (76.4%, up 7.7pp). Room pricing power increased because of those markets’ occupancy gains. NYC’s monthly ADR increased US$25 month over month to US$305, which was a 15% increase over 2019 ADR levels. Boston’s ADR rose US$32 to US$246, while Seattle saw a 15% ADR increase to US$176. On the lower end of larger markets, there was an expected seasonal transition with several warm climate destinations, such as Houston, New Orleans and Phoenix, moving into a slower seasonal RevPAR pattern.

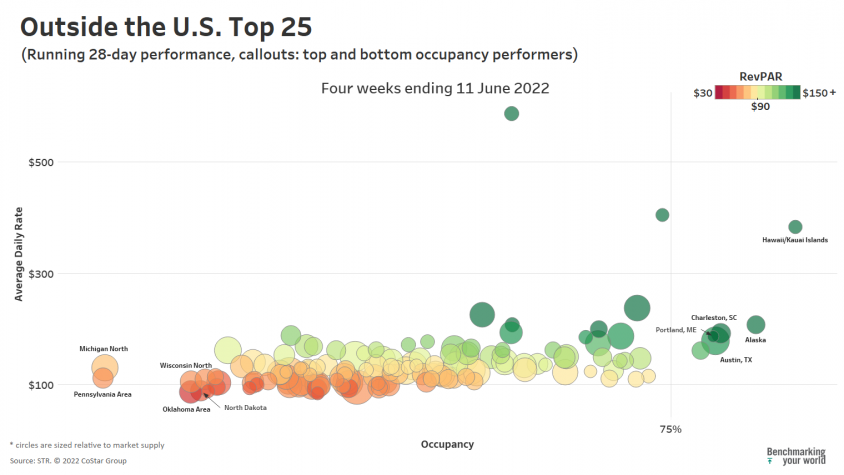

Outside of the largest markets, the top occupancy for the four-week period consisted largely of leisure-oriented destinations. Hawaii/Kauai Islands had the nation’s second highest occupancy (79.6%) followed by the Alaska market filling 78.1% of its rooms. Both Hawaii’s and Alaska’s seasonal occupancy levels are generally in the vicinity of 2019’s “normal” period performance. The key recent performance differentiator is how ADR has been significantly higher in both markets than 2019—US$383 or a 54% average premium for Hawaii/Kauai Islands and an 18% ADR premium for Alaska at US$208. Likewise, ADRs in Charleston (+24%), Austin (+24%), and Portland, Maine (+32%) have risen significantly above 2019 levels with leader markets filling a similar percentage of rooms.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.