About the Mall Index: The Index analyzes data from more than 100 top-tier indoor malls, 100 open-air lifestyle centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai uses anonymized location information from a panel of 30 million devices and processes the data using industry-leading AI and machine learning capabilities to make estimations about overall visits to specific locations.

The wider retail landscape has been significantly impacted by the combination of inflation and high gas prices with visits taking a significant hit. We dove into the Placer.ai Mall Index to see how visits were faring ahead of a key summer season.

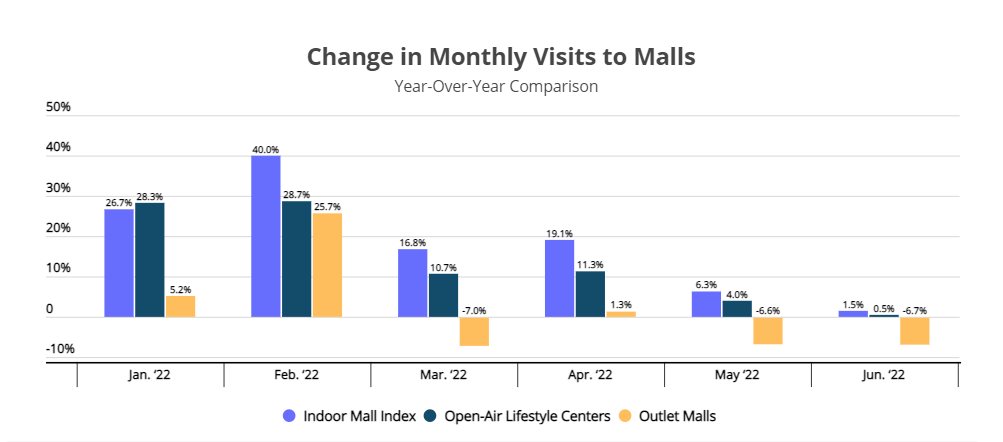

Year-over-Year Strength Diminishing

Visits for indoor malls continued to outperform the equivalent month from 2021, but the overall strength did wane. Visits were up 1.5% for indoor malls, and 0.5% for open-air lifestyle centers. And while this growth is important, the comparison is limited as overall mall visits were still in the early stages of the post-COVID recovery in June of 2021.

For June, outlet malls saw a decline of 6.7% year over year (YoY), in line with the same gap seen in May. And the decline for outlet malls is especially important as it indicates the unique impact that high gas prices are having on visits. While outlet malls would normally thrive when consumers are looking to save money as a result of inflation, the distance needed to travel to many outlet malls is limiting performance.

Visit Gaps Expanding

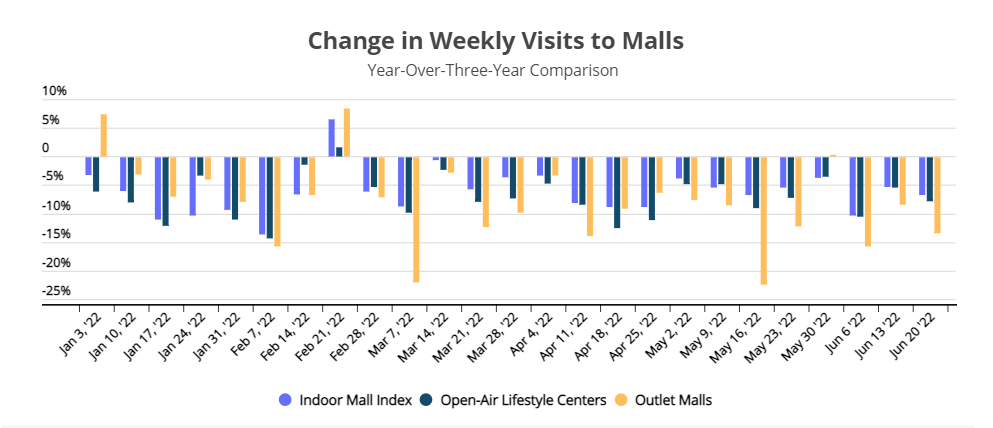

This perspective comes into sharper view when looking at visits compared to the same period pre-pandemic. From this perspective, visits to indoor malls were down 9.5%, open-air lifestyle visits down 9.4% and outlet malls down 14.3%. The expanding declines speak to the cumulative impact that inflation and gas prices are having on consumer visits. Critically, this does not necessarily mean a decline in purchasing as it could simply be driving a more efficient shopping experience where visitors look to accomplish more with each visit – a return of mission-driven shopping.

Context and Recovery

And while the situation is certainly challenging, there were also positive trends as the month concluded. After seeing visits hit their lowest point the week beginning June 6th from a year-over-three-year (Yo3Y) perspective, traffic has been steadily improving. Visits beginning the week of June 20th and June 27th were down just 5.3% and 6.8% for indoor malls, and 5.4% and 7.9% for open-air lifestyle centers respectively, bringing them in line with April and May numbers. This positive trend is critical heading into a very important July and August back to school season.

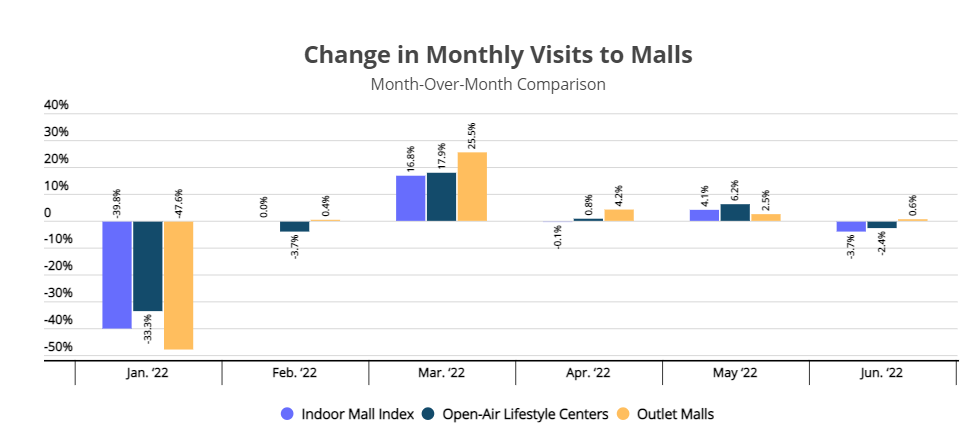

The challenges also require context to properly understand how strong top tier malls are truly performing. While indoor malls and open-air lifestyle centers saw declines of 3.7% and 2.4% respectively month-over-month (MoM), equivalent declines for even high performing segments like superstores, apparel, and grocery were down 5.8%, 3.7% and 6.1% respectively MoM. These declines speak to the wider impacts being felt across the retail landscape and make the relative performances from top tier malls look fairly impressive, especially considering the non-essential nature of these visits.

The result is a powerful indication that demand is clearly there, though it is being limited by the wider economic headwinds impacting the space.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.