About the Office Building Indexes: These indexes analyze foot traffic data from nearly 250 office buildings (53 in San Francisco, 72 in Manhattan, 50 in Boston, and 65 in Chicago). They only include commercial office buildings and commercial office buildings on the first floor (like an office building that might include a national coffee chain on the ground floor). They do NOT include mixed-use buildings that are both residential and commercial.

We took a look at office foot traffic trends since the start of the pandemic with a special focus on the first half of 2022 to see what visit patterns could tell us about the workplace recovery.

Year Over Year Seeing Growth

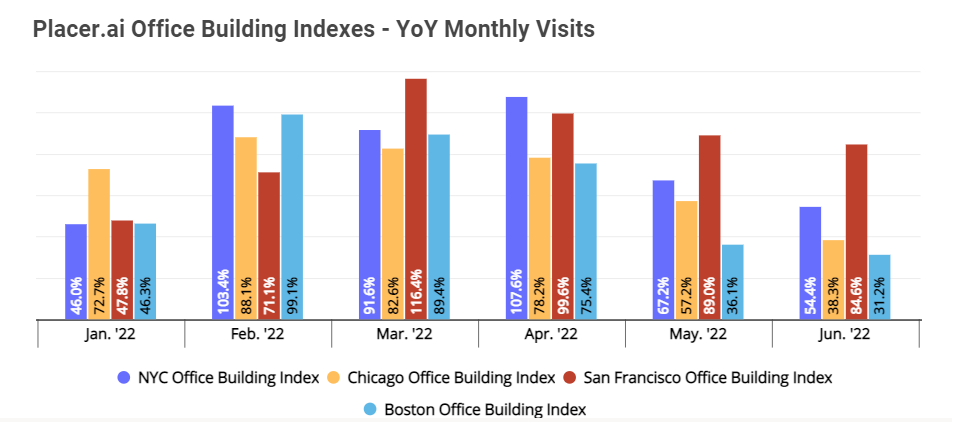

The first half (H1) of 2022 showed strong year-over-year (YoY) growth for office foot traffic. New York City, Chicago, San Francisco, and Boston all showed sustained growth in monthly office visits compared to the equivalent months last year.

And although the growth in YoY visits appears to be leveling out, this is likely more a reflection of the increase in office foot traffic throughout the first half of 2021 than of any real downward trend. So while June 2022’s YoY numbers took a dip relative to the colder winter months, the fact that YoY visits were up 54.4%, 38.3%, 84.6%, and 31.2% in New York City, Chicago, San Francisco, and Boston, respectively, indicates that the office return is still underway.

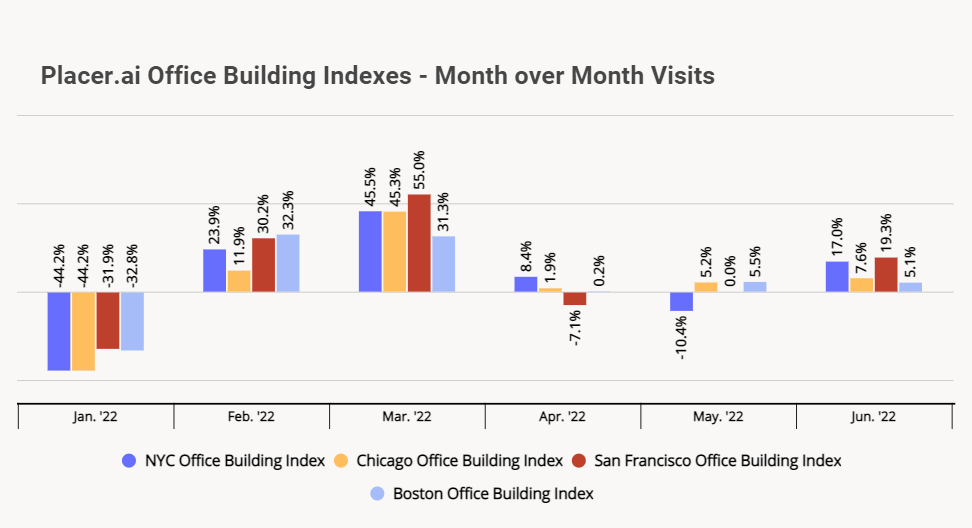

Monthly Visits Pulling Forward

Month-over-month (MoM) foot traffic data for the first half of 2022 reflects some of the challenges of the year so far – while still indicating that offices are nevertheless continuing their comeback. January saw the Omicron surge, which brought office foot traffic down as people stayed at home. MoM visits picked up again in February and March but stalled somewhat in April and May as the rise in gas prices created yet another obstacle for many would-be commuters. But these dips quickly righted themselves, reaffirming the ongoing pull for offices even in these uniquely challenging circumstances.

Now, gas prices have begun to trend downward, and COVID restrictions are fading into the background. As the year continues and the unpredictability caused by both a COVID surge and the unique confluence of inflation and skyrocketing fuel costs begin to level out, we are seeing the workplace foot traffic recovery picking up once again.

In June, MoM office foot traffic in New York City, Chicago, San Francisco, and Boston increased by 17.0%, 7.6%, 19.3%, and 5.1%, respectively. Workers who are choosing to go into the offices seem to have made space in their budgets and accepted higher gas prices.

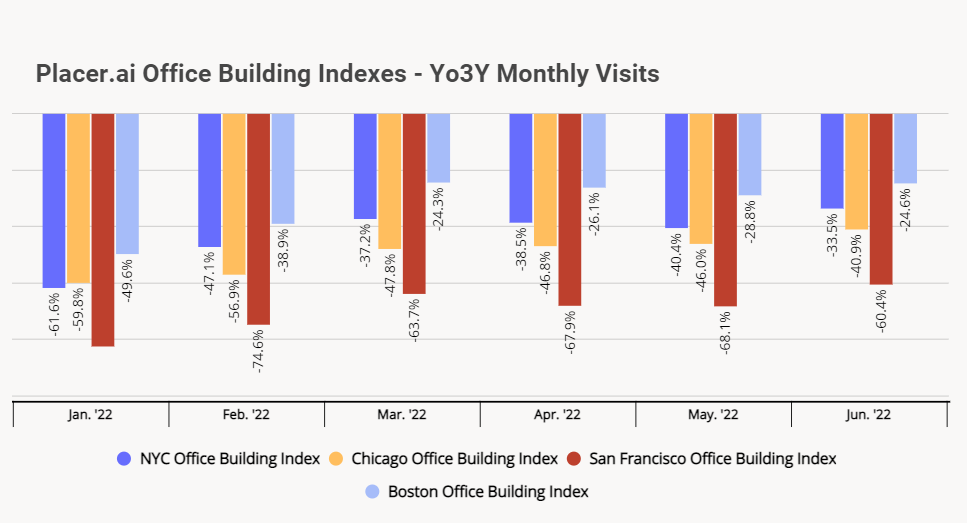

Office Foot Traffic Still Significantly Lower than Pre-Pandemic

Foot traffic to offices, while showing strong upward trajectories, may never look the way it did pre-pandemic, as attitudes toward coming into work have shifted dramatically over the past few years. While many workers have returned to the office – a recent survey showed that 11% of workers are fully remote, down from 22% in April 2021 – that does not mean that 89% of workers are back in the office. As of May 2022, only 65% of workers surveyed said they were back in the office full time.

The year-over-three-year (Yo3Y) foot traffic seems to align with these numbers. Monthly foot traffic to office buildings in New York City, Chicago, San Francisco, and Boston is still lagging behind foot traffic in the equivalent months in 2019.

Still, that doesn’t mean that there is no recovery. The foot traffic comparisons have been narrowing considerably, with the June 2022 Yo3Y office visit gap to New York City, Chicago, San Francisco, and Boston down to 33.5%, 40.9%, 60.4%, and 24.6%, respectively. And while San Francisco has seen larger visit gaps than the other cities we looked at, this may simply be due to the overall population changes seen in San Francisco since the beginning of the pandemic. The city saw its population shrink by 3.1% between January 2019 and April 2022, leaving its offices with fewer feet available to boost foot traffic.

As the pandemic eases, returning to the office continues to be a fraught topic. Companies are still grappling with whether to mandate a full-time return, or go all-in on hybrid work. Employees are finding that the benefits of working from home far outweigh those of coming into the office, and after two years of flexibility, employers will need to find a way to entice their employees to come back full time. While numbers are trending upward, and visit gaps are narrowing consistently, whether these trends will continue or level out remains to be determined.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.