Our latest white paper dives into the biggest retail, dining, and fitness trends of the first half (H1) of 2022. The data indicates that while H1 2022 took brick-and-mortar businesses – and the economy as a whole – on a wild ride, the extent of the challenges may be overblown. And while some categories will bear more of the brunt of the current economic downturn than others, the situation is also creating opportunities for brands who can cater to customers’ current value orientation.

Inflation and Gas Prices: The Aftermath

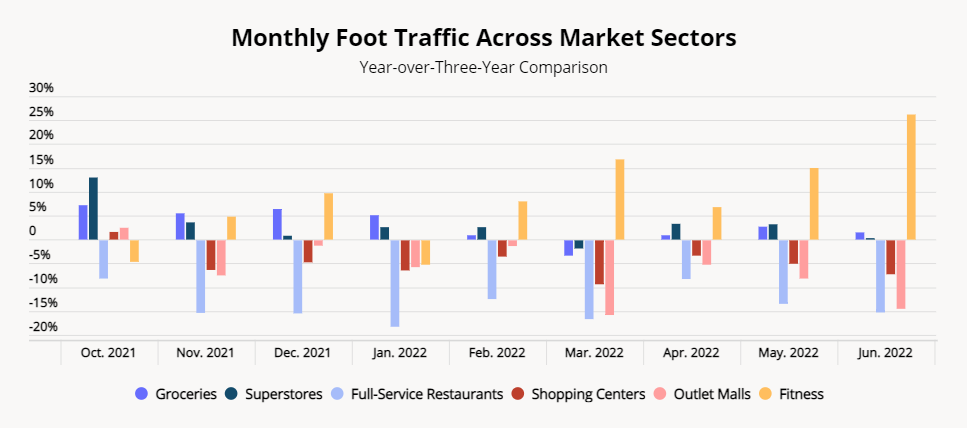

It is increasingly clear that the rise of both inflation and gas prices are having a marked effect on retail. And although these two trends are usually mentioned together, inflation and high gas prices are impacting the retail space in different ways.

Inflation is likely to have a greater impact on spending patterns and may be driving trading down behavior. This could give a short-term boost to value oriented retailers such as dollar stores, value grocers like Lidl and Aldi, and even off-price apparel. The rise in prices leading to tighter budgets may also impact discretionary spending – something we’re already seeing with restaurant foot traffic trends.

Unlike inflation, rising gas prices fundamentally impact the visit itself – how far consumers are willing to drive, how often they shop, and how many stops they will make in a given shopping trip. The increase in gas prices can push more mission-driven shopping which privileges superstores, wholesale clubs, and other retailers that enable consumers to stock up and consolidate shopping trips. Another effect of the high cost at the pump could be a greater orientation to the local option – and the increasing visit gaps in outlet malls could be an indicator of this trend.

As of now, inflation is likely to remain elevated going into the second half of 2022. Learning to grapple with these issues and finding ways to attract consumers despite the challenges will be critical to success in H2.

Not Just Challenges

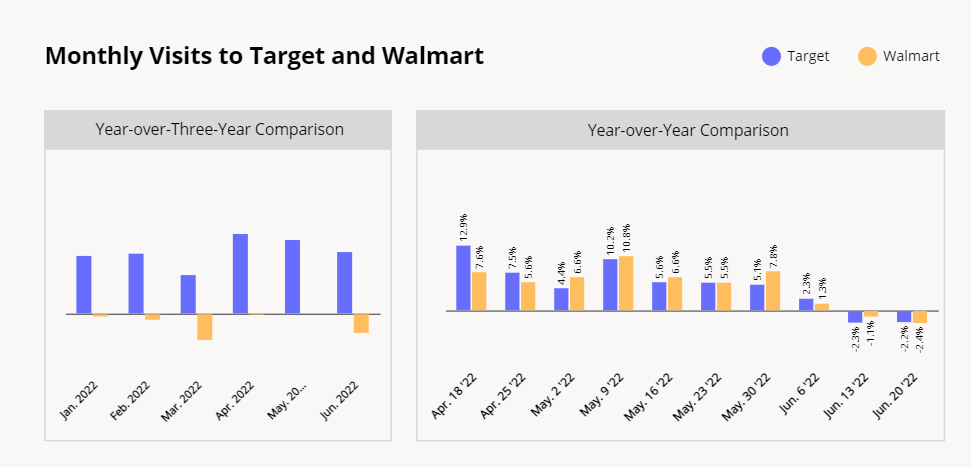

While inflation and high gas prices are undoubtedly adding a speed bump to the recovery journey of many brick-and-mortar retailers, the current economic climate is also creating opportunities – and some categories can capitalize on this moment.

The ongoing strength of grocery and QSR could be attributed in part to a customer’s’ need to be more cost-conscious. Movie theaters have the option of positioning themselves as recession-friendly entertainment options. BevAlc retailers can help consumers make their favorite fancy cocktails at home. And, as mentioned above, superstores and big-box retailers that “offer it all” like Target and Walmart could also be major beneficiaries of the latest market trends.

As opposed to pessimistic predictions that are centered heavily around the stock market and companies that are being negatively affected – there are clearly retailers that will benefit in both the long and short term from current trends.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.