According to recent reports, Starbucks is looking to sell its UK business. Although sales have recovered somewhat with offices reopening, does lower loyalty in the UK versus the US pose a problem? In today’s Insight Flash, we compare trends in the US versus UK, loyalty metrics, and cross-shop to dig into the company’s performance across geographies.

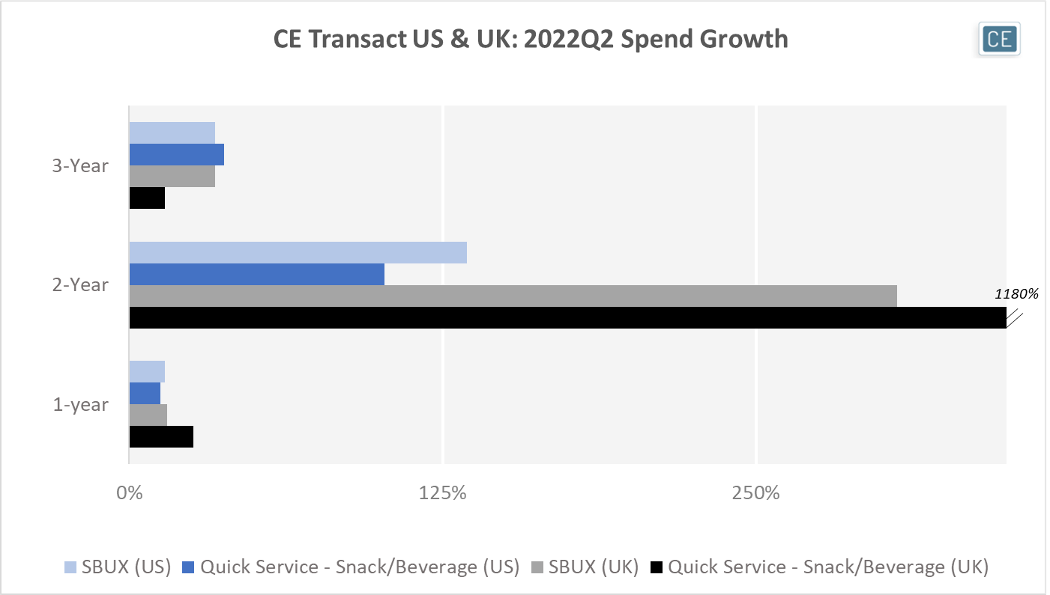

Looking at spend versus pre-pandemic levels, Starbucks UK growth is very similar to US growth. On a three-year basis, UK spend grew 34.4% versus 34.1% in the US. Even year-over-year the patterns are similar, with spend growing 15.0% for Starbucks in the UK and 14.1% for Starbucks in the US. However, Starbucks is underperforming the broader subindustry year-over-year in the UK as it laps a stronger recovery at the beginning of vaccine rollouts.

Spend Growth

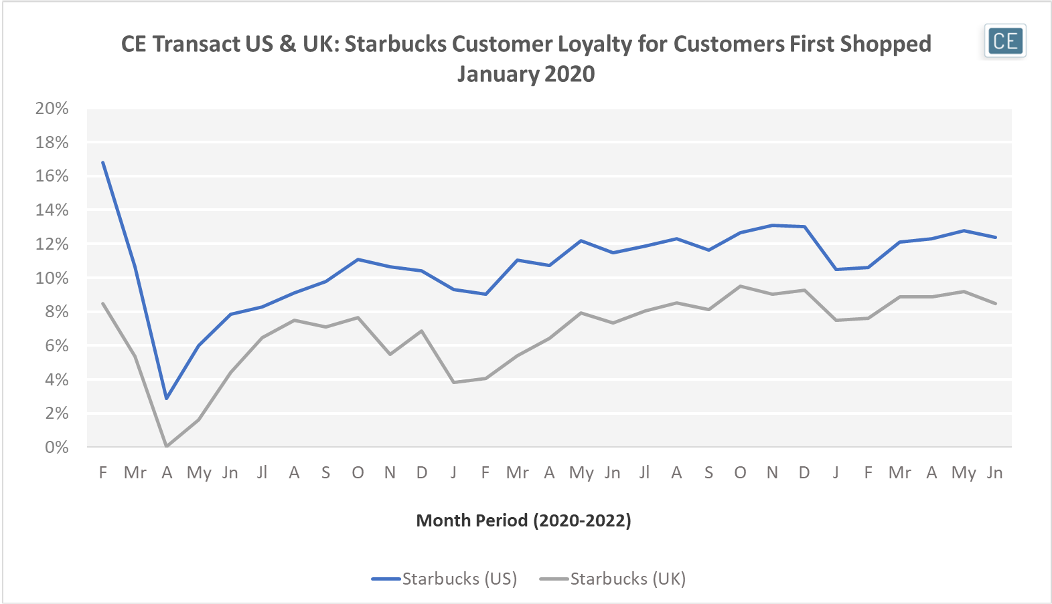

However, Starbucks may have more trouble getting customers in the UK to keep coming back. Even though the US is a more mature market, among customers who made their first Starbucks transaction in our cohort history in January 2020, only 8% came back the next month in the UK, versus twice as high a rate of 17% returning in the US. In June, 12% of those customers were still transacting at Starbucks in the US versus only 8% in the UK.

Loyalty

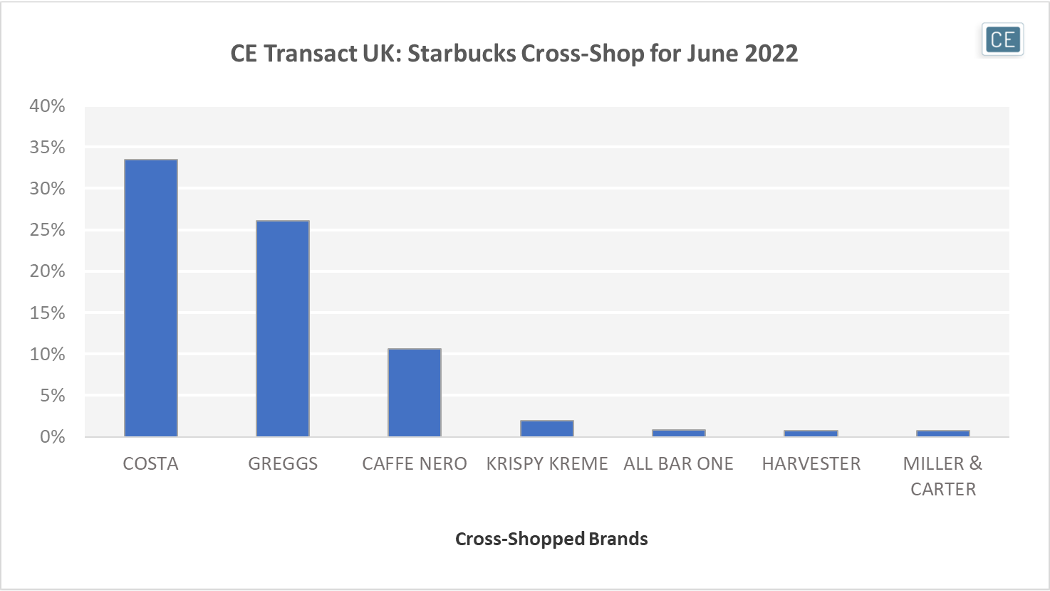

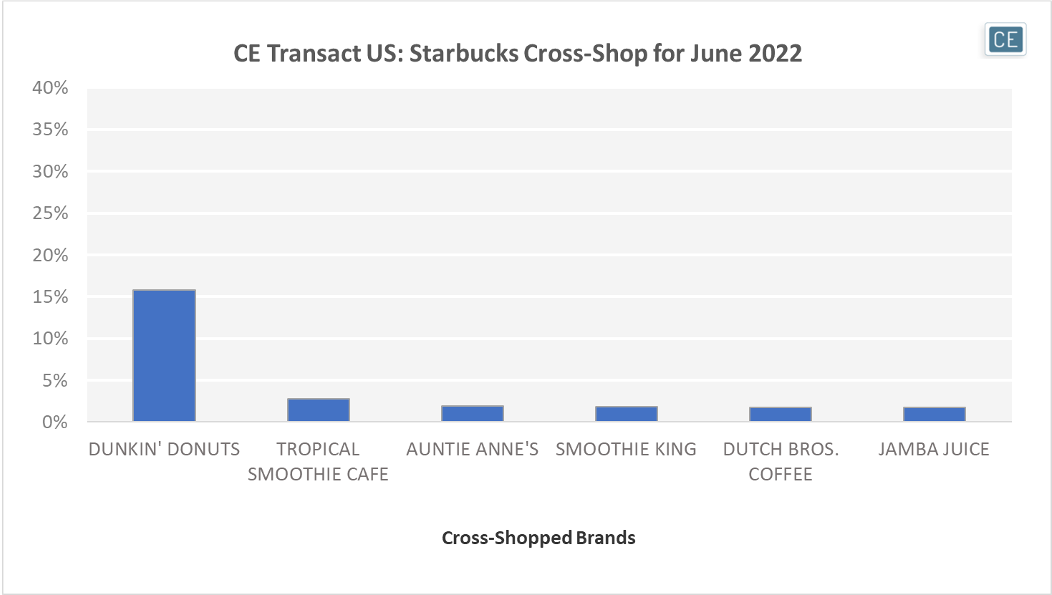

Some of the pressure on Starbucks in the UK may be coming from more potent competitive threats. Of UK guests who stopped in at Starbucks in June 2022, over a third also made a purchase at Costa and over a quarter chose a snack from Greggs. In contrast, in the US Starbucks’s closest subindustry competitor was Dunkin’ Donuts, but only 16% of Starbucks shoppers also bought an item there.

Cross-Shop

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.