Wholesale clubs like Costco Wholesale, BJ’s Wholesale Club, and Sam’s Club were some of the big winners of the pandemic’s shift to mission-driven shopping, and that strength carried throughout 2021. Early 2022 data indicated that the category was undergoing a mild correction following the record-breaking foot traffic numbers of the previous year. But comparisons to pre-pandemic metrics showed wholesale remaining strong despite the rise in inflation and gas prices. Now, as retail visitors continue tightening their budgets in the face of high consumer prices, we checked in to understand how the economic headwinds are impacting the three wholesale giants.

Visits Normalize Following Unusually Strong 2021

The pandemic strengthened many brick-and-mortar retail giants. The widespread closures of non-essential businesses in the spring of 2020 directed consumers to stores such as Costco, BJ’s, and Sam’s Club that not only remained open but also carried a wide assortment of groceries, appliances, apparel, and other products. Consumers looking for a one-stop-shop to minimize COVID exposure led to surges in membership sign ups, which drove significantly heightened visits.

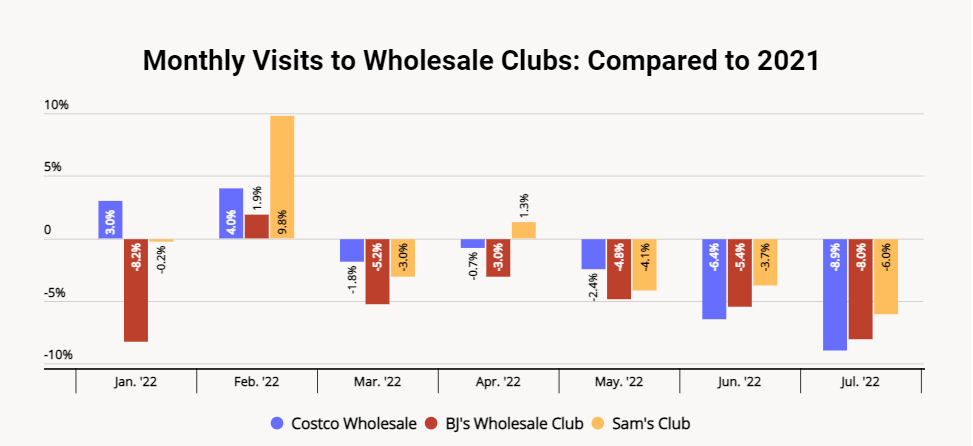

Now, year-over-year (YoY) monthly visit numbers indicate that foot traffic to the category is normalizing following the unusually high 2021 visit levels. For the past three months, monthly visits to all three wholesale clubs remained below 2021 levels, with July 2022 foot traffic to Costco, BJ’s, and Sam’s Club seeing a 8.9%, 8.0%, and 6.0% decrease, respectively, when compared to July 2021.

Pre-Pandemic Comparisons Reveal Category’s True Strength

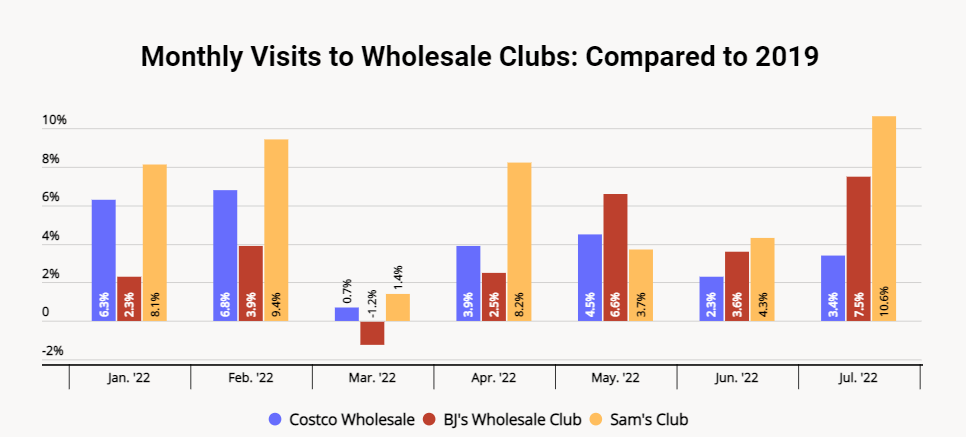

Although the YoY visit numbers seem to show a downturn in foot traffic, year-over-three-year (Yo3Y) numbers showcase just how much the category has grown over the past two years. With the exception of March 2022, when the initial fuel hike shock likely led consumers to temporarily avoid longer shopping trips, all three wholesale retailers saw their 2022 monthly visits increase significantly when compared to 2019. In July 2022 – visits exceeded July 2019 by 3.4%, 7.5%, and 10.5% for Costco, BJ’s, and Sam’s Club, respectively.

The pandemic-driven increase in wholesale club membership sign-ups is likely playing a critical role in maintaining these retailers’ strength. Consumers who may have been deterred from committing to the annual membership fee before 2020 and decided to take the plunge over COVID are retaining their membership even now that the wider retail landscape has opened back up.

Inflation’s Impact on Wholesale Visits

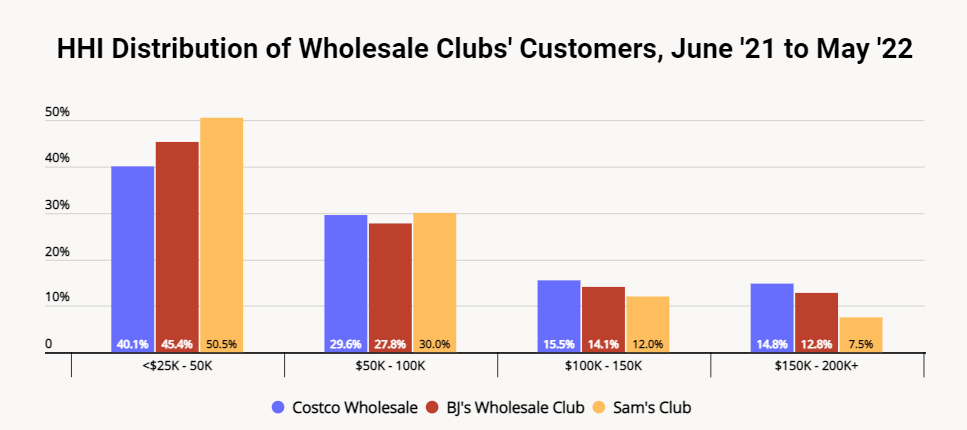

While all three wholesale leaders have seen strong visit trends in recent months, the Yo3Y and YoY foot traffic charts above show Sam’s Club consistently outpacing the other two brands in terms of Yo3Y foot traffic increase. And while there could be many reasons driving Sam’s Club’s success – including the brand’s periodic limited-time offers of $8 membership – one important factor could be the brand’s unique consumer base.

Using census data and to analyze the income distribution in the three brand’s True Trade Area (TTA, or the area where 70% of the brand’s consumers reside) reveals that over 50% of Sam’s Club’s consumers belong to households where the annual income is under $50K, compared to 45.4% for BJ’s Wholesale Club and 40.1% for Costco Wholesale. On the other end of the spectrum,14.8% of Costco consumers belong to households where the annual income is over $150K, compared to 12.8% for BJ’s and 7.5% for Sam’s Club. This could mean that inflation is having the greatest impact on Sam’s Club members, and so these consumers are more likely to go out of their way to look for ways to stretch their budgets – including increasing trips to the local wholesale club.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.