In July 2022, the grocery industry reportedly experienced the biggest year-over-year price hikes since the 1970s, affected by factors such as inflation and ongoing supply chain issues. So how has consumer spending at specific supermarket chains fared against this backdrop? Using consumer transaction data, we analyzed how U.S. consumer spending at major grocery store companies—including Ahold Delhaize; Albertsons Companies, Inc (NYSE: ACI); Aldi; H-E-B; The Kroger Company (NYSE: KR); Publix; and Trader Joe’s—changed between July 2021 and July 2022. Our data reveals that average transaction values increased the most year-over-year at H-E-B and The Kroger Company, but Ahold Delhaize saw the most growth in year-over-year sales.

H-E-B and Kroger (NYSE: KR) saw the most growth in average transaction values year-over-year

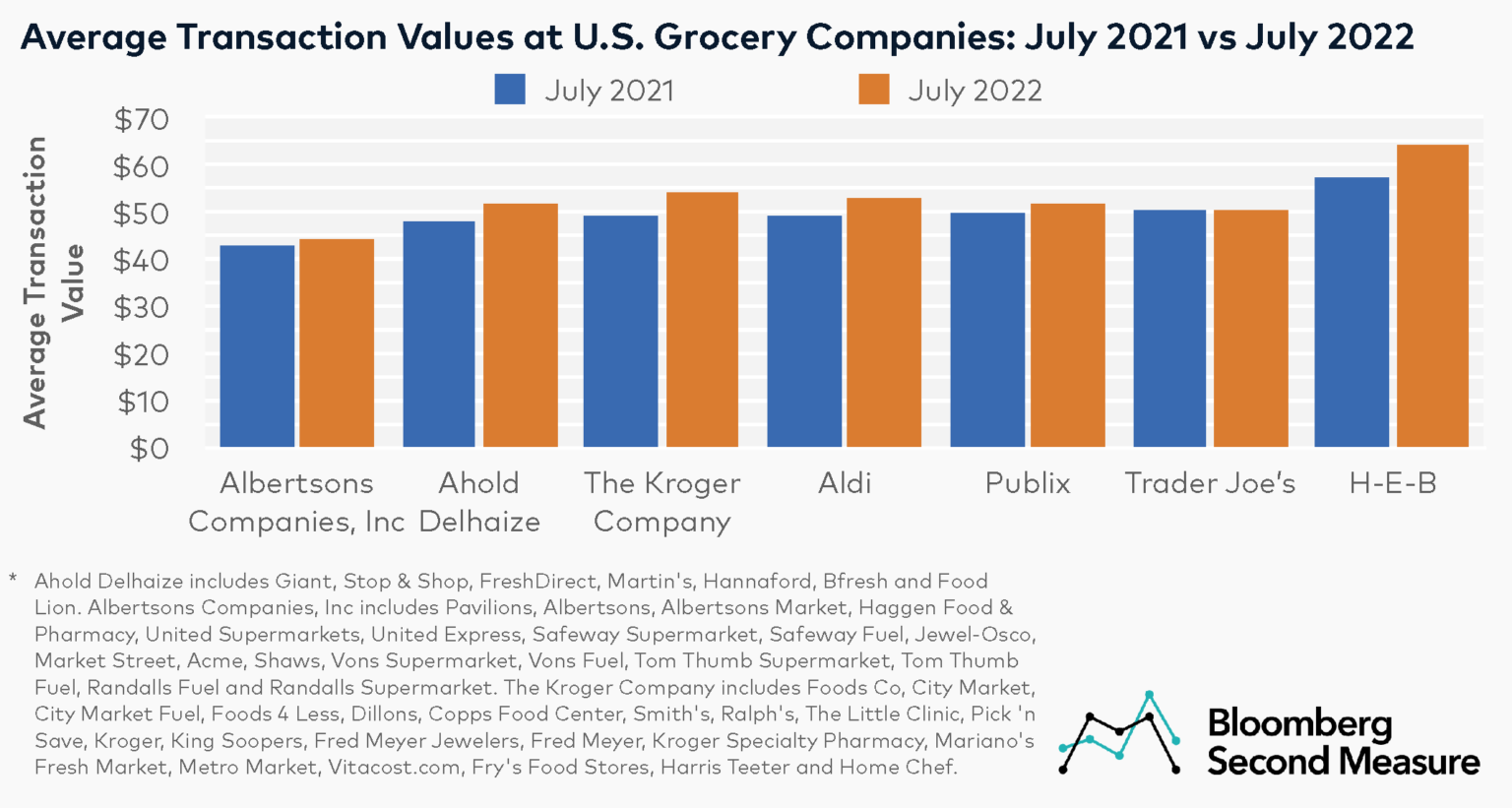

Most of the grocery companies in our analysis experienced year-over-year growth in average transaction values in July 2022. Between July 2021 and July 2022, the average transaction value at H-E-B grew 12 percent, the largest increase among the companies. The average transaction value also increased 10 percent year-over-year at The Kroger Company (which includes City Market Fuel, Foods Co, Smith’s, Copps Food Center, Dillons, Foods 4 Less, City Market, Kroger Specialty Pharmacy, Pick ‘n Save, The Little Clinic, Fred Meyer Jewelers, King Soopers, Mariano’s Fresh Market, Metro Market, Ralph’s, Kroger, Fred Meyer, Vitacost.com, Fry’s Food Stores, Harris Teeter, and Home Chef).

In the same time frame, average transaction values grew 8 percent at Aldi, 7 percent at Ahold Delhaize (which includes Giant, Stop & Shop, FreshDirect, Martin’s, Hannaford, Bfresh, and Food Lion), 4 percent at Albertsons Companies, Inc (which includes Pavilions, Haggen Food & Pharmacy, Albertsons, Safeway Supermarket, Tom Thumb Fuel, Safeway Fuel, Star Market, Acme, Albertsons Market, Shaws, Vons Supermarket, Market Street, Vons Fuel, United Supermarkets, United Express, Jewel-Osco, Tom Thumb Supermarket, Randalls Fuel, and Randalls Supermarket), and 3 percent at Publix. Trader Joe’s was the only grocery company in our analysis that did not experience an increase in average transaction value, instead remaining consistent year-over-year.

In July 2022, shoppers at H-E-B spent $64 on average, the highest average transaction value in our analysis. By contrast, customers at Albertsons Companies, Inc spent $44 on average per visit, the lowest among these grocery competitors. Some of the factors that might influence average transaction values include the type of subsidiaries that are owned by each grocery giant. For example, in addition to their grocery stores, some of the companies like The Kroger Company and Albertsons Companies, Inc have fuel, pharmacy, and convenience store offerings.

The geographic distribution of each grocery company may also partially account for the variety in average transaction values. For example, H-E-B only operates in Texas and Publix is primarily located in southeastern states, while Albertsons Companies, Inc and The Kroger Company have broader representation across regions in the U.S.

U.S. consumer spending data shows that Ahold Delhaize, Aldi, and H-E-B saw the biggest year-over-year increases in sales in July 2022

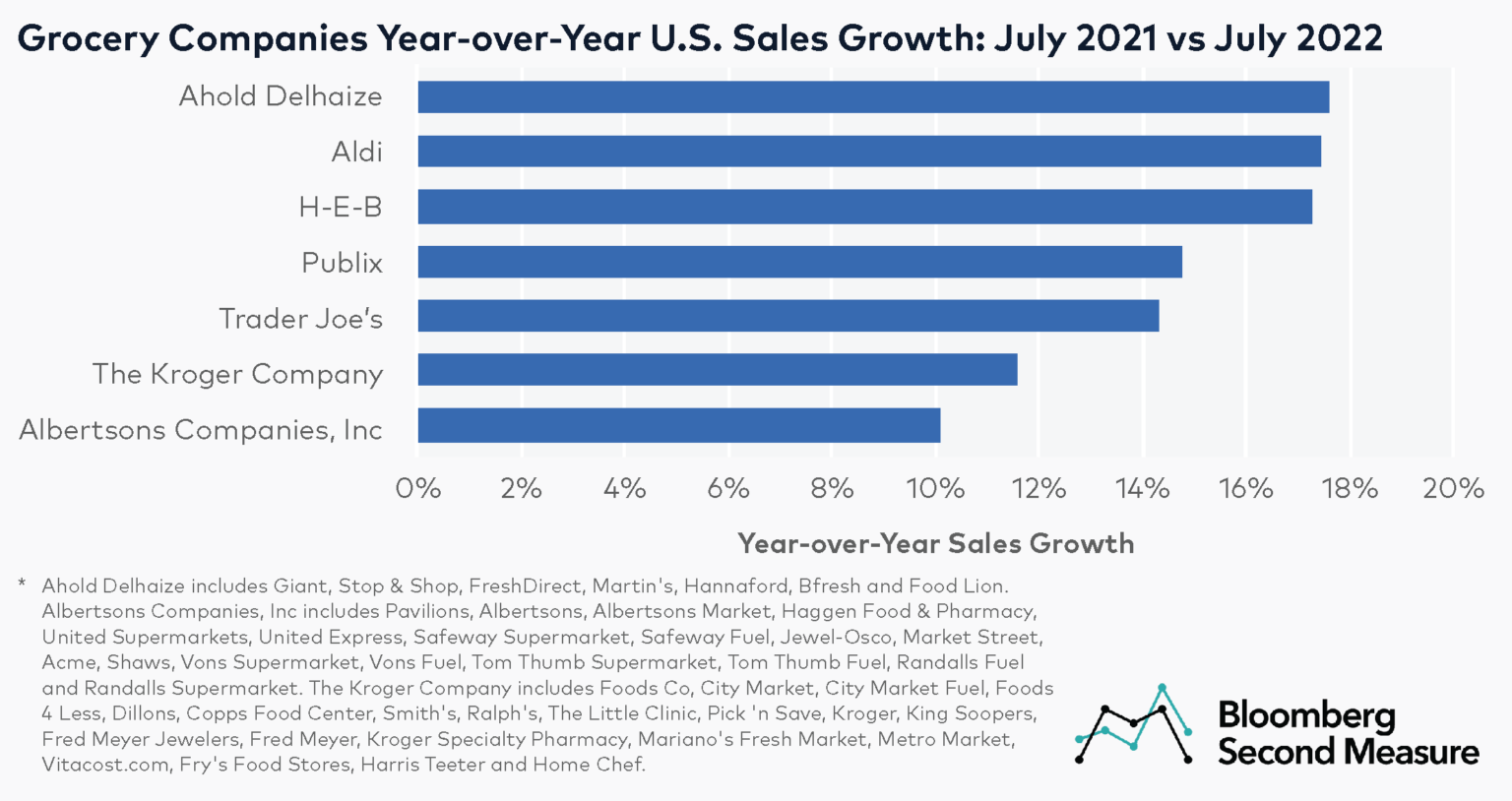

U.S. consumer spending data further shows that all companies in our analysis saw their total U.S. sales increase between July 2021 and July 2022. U.S. sales at Ahold Delhaize grew 18 percent year-over-year, followed by Aldi and H-E-B with increases of 17 percent each.

During the same time period, U.S. sales grew 15 percent at Publix, 14 percent at Trader Joe’s, and 12 percent at The Kroger Company. Albertsons and its subsidiaries experienced a 10 percent sales increase during this time period. Albertsons’ CEO has publicly credited the pandemic—and specifically, the widespread adoption of remote work—with driving at-home eating habits and grocery shopping.

How are grocers and consumers adapting to inflation and rising food prices?

The grocery industry is experimenting with new ways to engage with customers in the current inflationary environment. Grocers like Albertsons and Ahold Delhaize are offering prepared meals to combat inflation and drive customer loyalty, while Kroger recently rolled out its Boost membership program, which offers free delivery for online orders and reward points for fuel purchases, nationwide.

Looking at other grocery industry trends, some consumers are reportedly pivoting to private-label brands at the grocery store or trading down by buying more affordable alternatives to expensive items. Discount stores are also reportedly experiencing increased consumer demand, especially for groceries and household items.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.