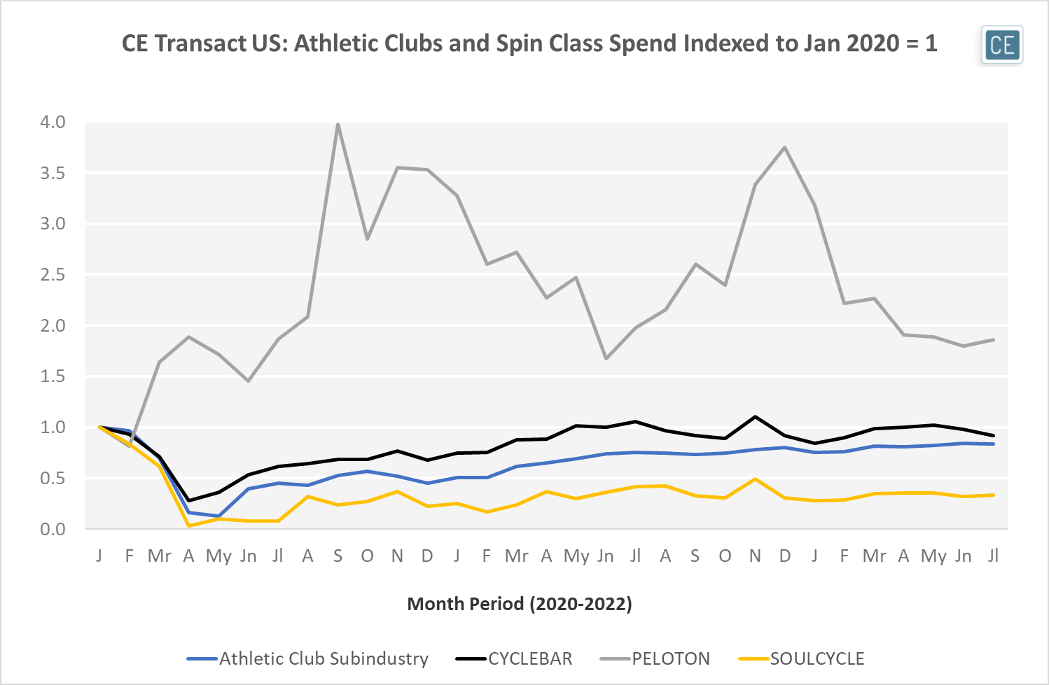

Heading into 2020, cycling studios and spin classes were gaining speed. As studios closed, at-home cycling brands kept the trend in focus. But troubles at Peloton earlier this year followed by a recent announcement from Soul Cycle that it was closing a quarter of its studios seem to indicate that the workouts have gone off course. In today’s Insight Flash, we examine how spin classes have fared versus overall athletic clubs in our CE Transact data, then deep dive into specific trends for Peloton class attendance using our CE Web data, followed by tracking the markets where SoulCycle is closing from our CE Transact data.

Athletic Clubs have been among the slowest subindustries to recover from closures during the COVID-19 pandemic. In January 2022, usually a strong month due to New Year’s resolutions, spend was still only 75% of pre-pandemic levels in January 2020. Although spend continues to inch up, even as recently as July spend was still less than 85% of where it had been. Peloton’s at-home workouts were able to capitalize on lockdowns with a large jump in spend in Spring 2020, but spending levels have receded since a holiday sales peak. Although Xponential’s CycleBar with its growing franchisee base has recovered to about 90% of pre-pandemic spend, SoulCycle spend is only 1/3 of January 2020 levels.

Subindustry Trends

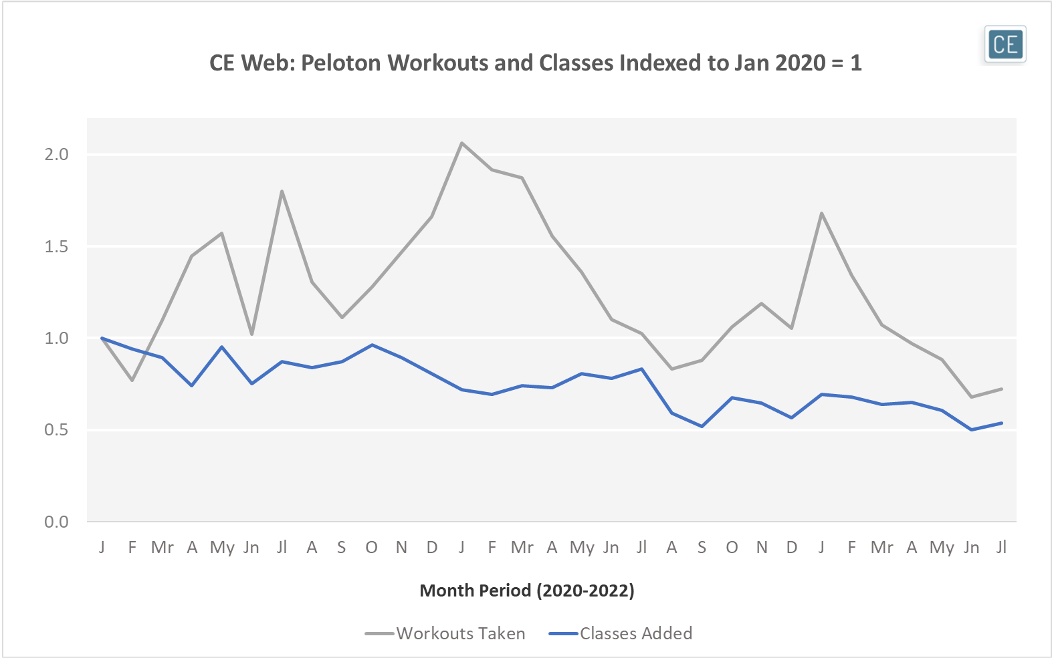

Amid recent layoffs and cost-cutting, Peloton has decreased the number of live classes offered. Our CE Webscrape data shows that in July 2022, the company added half as many classes as it had in January 2020. Whether this is the cause or result of dwindling demand is unclear, but tracked live workouts taken were only 72% of January 2020 levels.

Peloton Workouts

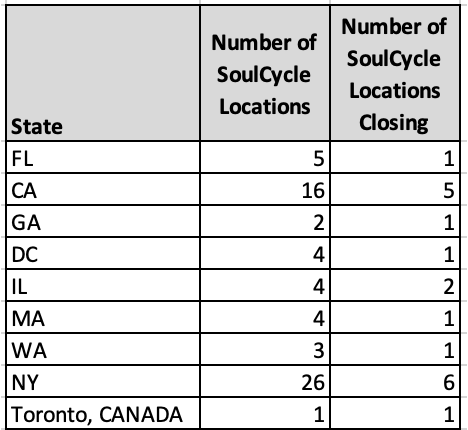

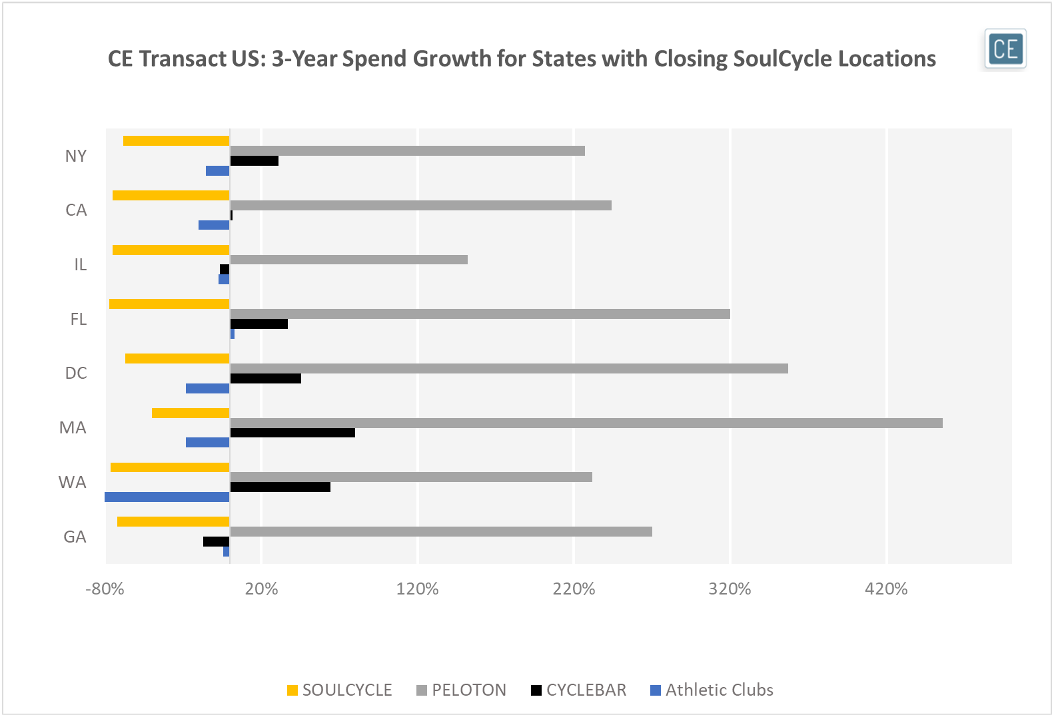

Over the last three months, SoulCycle spend in the states closing locations has been down significantly versus three years ago. Florida, Washington, California, and Illinois have all seen spend decline by more than 75%. The other states with closing locations have seen spend at least cut in half. And while some of this may be due to broader at-home workout trends, the decline is substantially higher than the decline in Athletic Club spend overall in those states.

SoulCycle Spend Change by Geography

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.