Although summer is not even over, many skiers are already looking forward to slope season. In today’s Insight Flash, we look at Epic Annual Pass sales for MTN over the last three years to show how our data can be used to interpret the upcoming surge in spend. We look at the overall seasonality in higher tickets, spend by customers traveling in from different regions, and how often annual passholders skied last year.

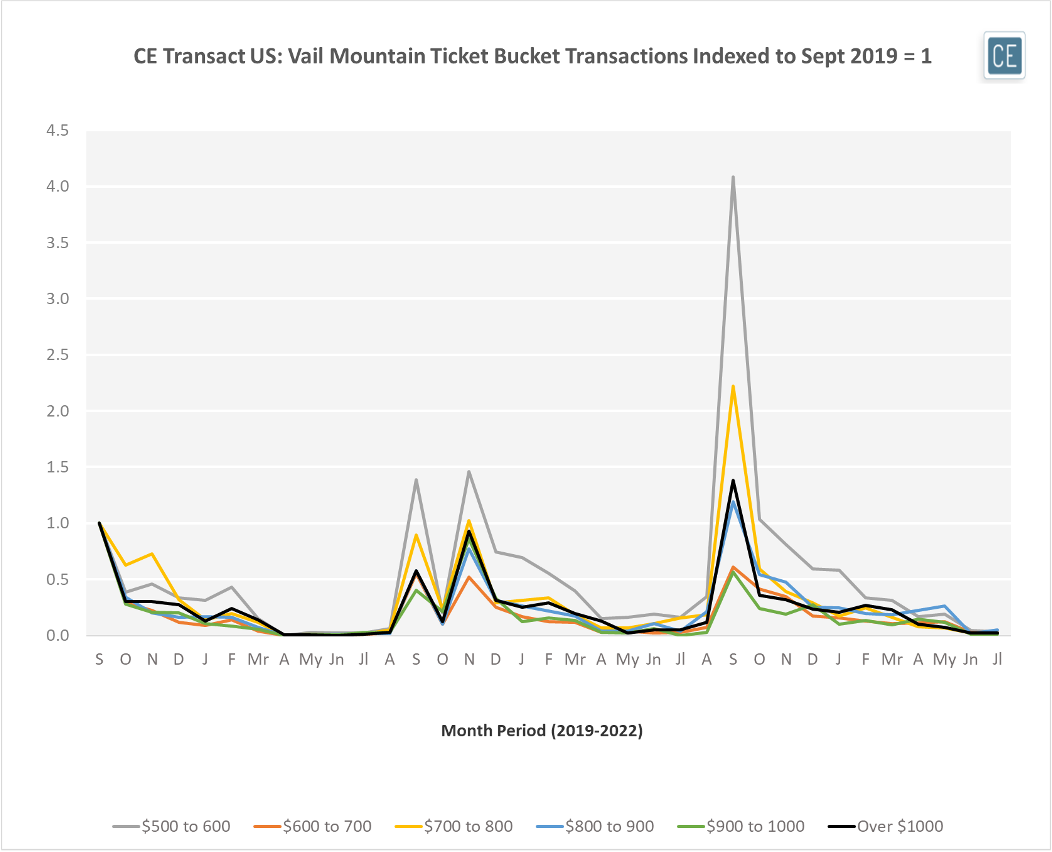

Among the price ranges that apply to annual passes, the biggest jump in spend tends to be in September just before prices go up for the season. 2021 showed a large rise in September transactions versus 2019, likely due to pent up demand. Overall transactions over $500 at Vail Mountain (where annual pass spend shows up in our data), were up over 1.5x from two years prior.

Monthly Transactions by Ticket Bucket

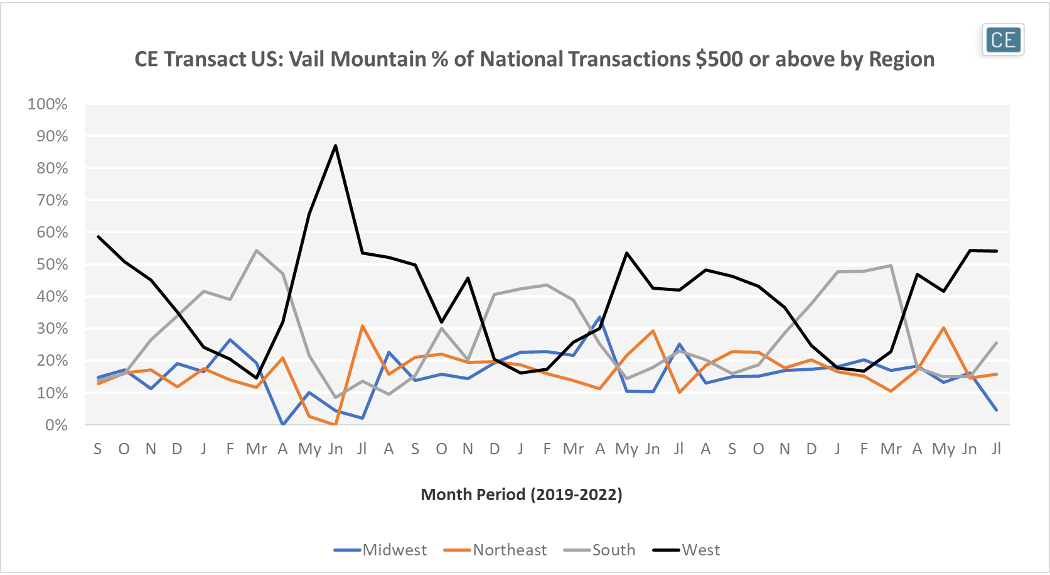

Using transactions over $500 as a proxy for annual pass sales, the majority of earlier buyers during the summer months are locals from the West Coast. Southerners are more likely to make higher spend purchases closer to the ski season itself, with the highest percentage of over $500 transactions in January – March of the last three years. The larger ticket price for these customers may also be a function of longer stays since they are traveling further.

Geographic Breakdown

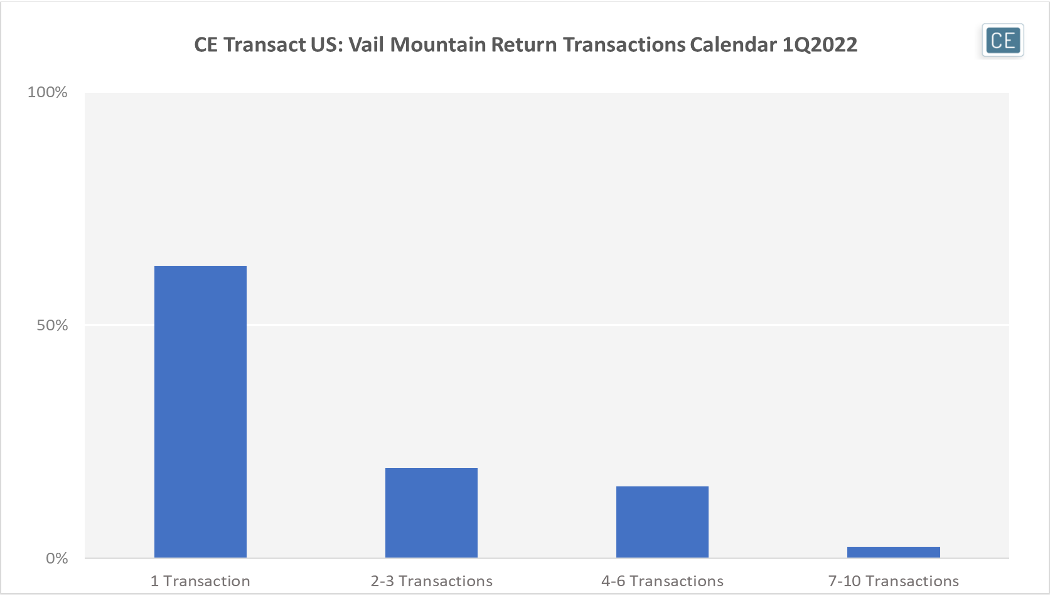

Among those buying annual passes, many come in for the day or stay at non-Vail Mountain owned accommodations. Of those who could be inferred to have purchased an annual pass in summer 2021, about two-thirds only made one other Vail Mountain transaction in January through March of 2022. About one-fifth made two or three transactions, with only about fifteen percent making between four and six transactions.

Repeat Trips

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.