As inflation continues to strain consumer budgets and retail sales, Labor Day Weekend presented a chance to grab last-minute back-to-school and early-bird holiday deals. Though shoppers remained budget-conscious, there are strong indications that these concerns are beginning to subside. We dove into the foot traffic data across multiple retail categories to take a closer look at the shift in discretionary spending ushered in by Labor Day 2022.

Big Box Retailers

The big box retail category was heavily impacted by inflation in recent months as consumers seemed to put off home improvement projects and purchasing big-ticket items in favor of essentials. But strong foot traffic to these chains during Labor Day signaled a resurgence in discretionary spending.

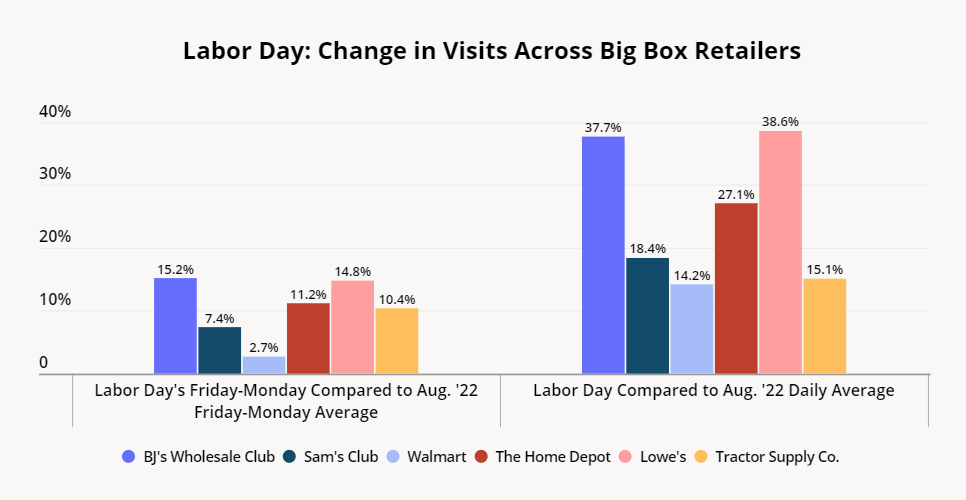

The big box retailers we analyzed experienced significant Labor Day foot traffic gains. Visits during Labor Day Weekend 2022 (Fri-Mon) grew compared to Friday-Monday averages in August 2022 for all of the chains we analyzed – BJ’s Wholesale Club (+15.2%), Sam’s Club (+7.4%), Walmart (+2.7%), The Home Depot (+11.2%), Lowe’s Home Improvement (+14.8%), and Tractor Supply Co. (+10.4%).

On Labor Day itself (Monday), visits to the big box chains surpassed daily averages for August 2022. Labor Day’s one-day visit growth for BJ’s (+37.7%), Sam’s Club (+18.4%), Walmart (+14.2%), Home Depot (+27.1%), Lowe’s (+38.6%) and Tractor Supply (+15.1%), demonstrated just how pivotal Labor Day was in terms of driving visits.

Department Stores

The department store category also experienced tremendous foot traffic growth over Labor Day Weekend. Renewed discretionary spending combined with back-to-school and holiday shopping likely drove visits to this sector. Many back-to-school shoppers waited for Labor Day sales to make their purchases, and because consumers could be anticipating holiday-season price hikes, a growing number looked to get in gift-buying early.

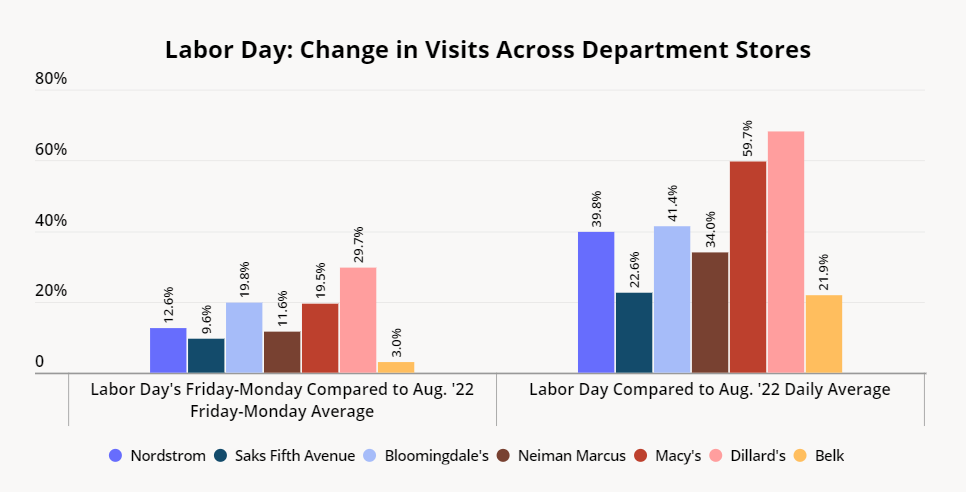

Visit data shows that foot traffic on Labor Day weekend (Fri-Mon) grew compared to August 2022’s Friday-Monday average for the department stores analyzed – Nordstrom (+12.6%), Saks Fifth Avenue (+9.6%), Bloomingdale’s (+19.8%), Neiman Marcus (+11.6%), Macy’s (+19.5%), Dillard’s (+29.7%), and Belk (+3.0%).

In comparison to daily averages in August 2022, Labor Day (Monday) visits were up for Nordstrom (+39.8%), Saks Fifth Avenue (+22.6%), Bloomingdale’s (+41.4%), Neiman Marcus (+34.0%), Macy’s (+59.7%), Dillard’s (+68.2%), and Belk (+21.9%). Whether consumers were shopping back to school, or with the holidays in mind, the department store category had monumental success over Labor Day 2022.

Off-Price Retailers

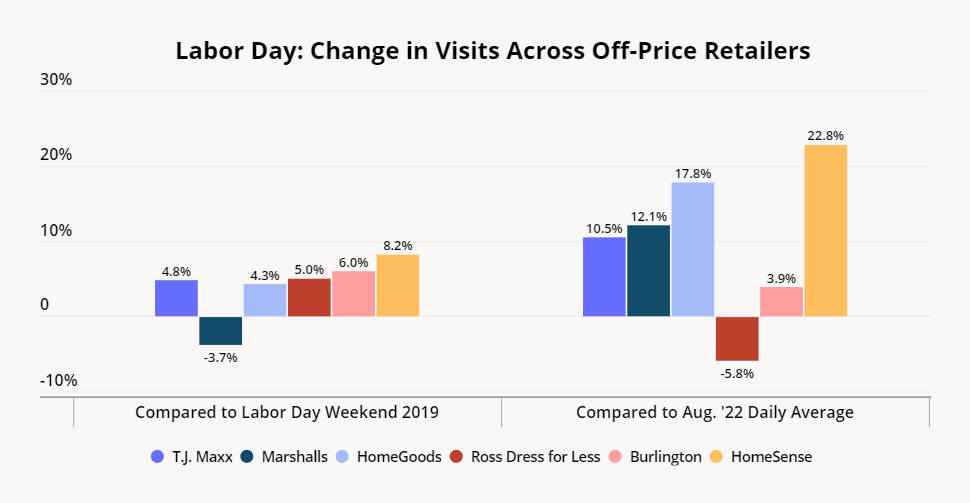

The success of off-price retail is a topic we’ve been following closely, and location analytics shows the value-driven consumer trend continued into Labor Day. A majority of the off-price chains analyzed had visit growth that surpassed Labor Day Weekend (Saturday-Monday) foot traffic in 2019 as well as average daily visits in August 2022.

HomeSense led the pack with noteworthy Yo3Y Labor Day Weekend (Sat-Mon) visit growth and daily visit growth compared to August 2022’s average. Visits to the retailer were up 8.2% for the weekend as a whole, and up 22.8% for daily visits on Labor Day.

Though Marshalls visits were down 3.7% Yo3Y over the Labor Day Weekend, its one-day Labor Day 2022 visit growth was up 12.1% compared to average daily visits in August 2022. So while Labor Day Weekend foot traffic was slightly down for the chain Yo3Y, Labor Day 2022 outperformed the daily visit average of the previous month.

Specialty Retailers

Foot traffic data for specialty retailers over Labor Day provides insight into both back-to-school shopping and discretionary spending trends. Labor Day ushered in a resurgence in discretionary spending demonstrated by visit data for top electronics, sporting goods, and beauty retailers – all categories hit hard by inflation.

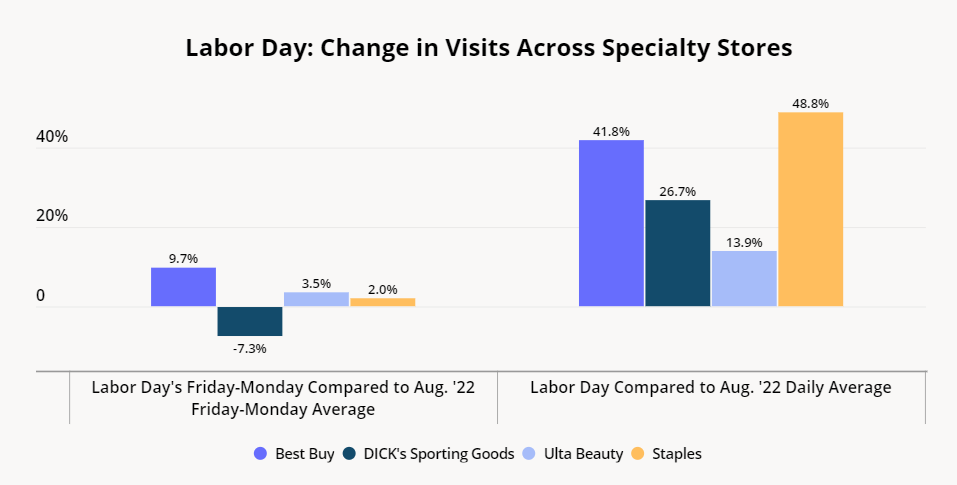

Best Buy’s Labor Day Weekend (Fri-Mon) foot traffic in 2022 exceeded August 2022’s Friday-Monday visits by 9.7%. Labor Day 2022 (Monday) saw visits increase for Best Buy by 41.8% compared to average daily visits in August 2022. Ulta Beauty’s Labor Day Weekend (Fri-Mon) visits were up 3.5% from August 2022’s Friday-Monday average and the brand’s Labor Day (Monday) visits increased 13.9% compared to average daily visits in August.

Though DICK’s Sporting Goods’ Labor Day Weekend 2022 (Fri-Mon) foot traffic was down 7.3% compared to August 2022’s Friday-Monday average, this visit gap has more to do with strong weekend performance throughout August than a subpar Labor Day 2022. This is demonstrated by DICK’s Labor Day (Monday) visit growth (26.7%) compared to the chain’s August 2022 average daily visits – an average that takes into account both weekdays and weekends.

Visits to Staples on Labor Day (Monday) grew 48.8% compared to August 2022’s average daily visits, and the 2022 Labor Day Weekend (Fri-Mon) saw a 2.0% visit increase compared to the Friday-Monday average in August. Staples’ visits show just how instrumental Labor Day was for driving last-minute back-to-school purchases.

Labor Day 2022 Recap

The foot traffic data for multiple retail categories reveals that Labor Day Weekend was a powerful catalyst for rising retail trends – notably, waning inflationary concerns and the resurgence of discretionary spending.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.