About the Placer.ai Mall Indexes: These Indexes analyze data from more than 100 top-tier indoor malls, 100 open-air lifestyle centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai uses anonymized location information from a panel of 30 million devices and processes the data using industry-leading AI and machine learning capabilities to make estimations about overall visits to specific locations.

A confluence of factors, including ongoing economic headwinds and a challenging comparison to a uniquely strong 2021 Back to School shopping period, positioned shopping centers for a challenging summer season.

But September created an opportunity for a significant step forward, with signs that some of the economic headwinds were dissipating and further help from a comparison to a month heavily limited by 2021’s Delta variant.

So how did malls perform?

Steps Forward, But Still Seeing Visit Gaps

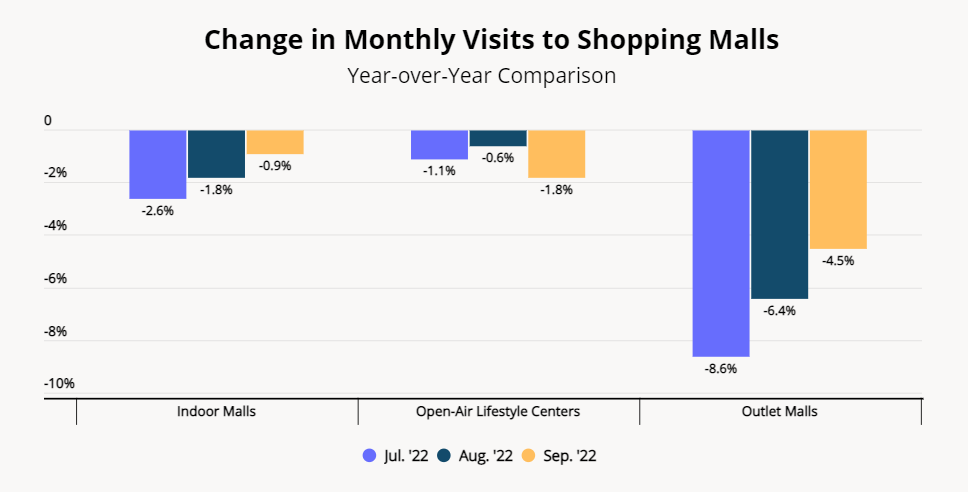

Looking at September 2022’s foot traffic year-over-year (YoY) shows that the visit gap for indoor malls decreased to just 0.9%, while outlet malls visits hit their strongest mark since April with visits down just 4.5%. Open-air lifestyle centers did see a minor increase in their visit gap with visits down 1.8% in September. This is a very positive step for shopping centers across the board and shows the resiliency of the segment as the impact of wider economic headwinds continues to dissipate.

The timing of this visit recovery is also critical as it comes ahead of a holiday shopping season that could put brick-and-mortar retail in a particularly advantageous position. Issues with excess inventory could push more products to retailers with a strong brick-and-mortar orientation such as the off-price segment, and could drive some brands to offer the types of major discounts that privilege stores for distribution. The excess inventory could also add more incentive for retailers to extend the holiday season earlier into October to help move more products off shelves.

Comparisons to 2019 Highlight Current Challenges – and Opportunities

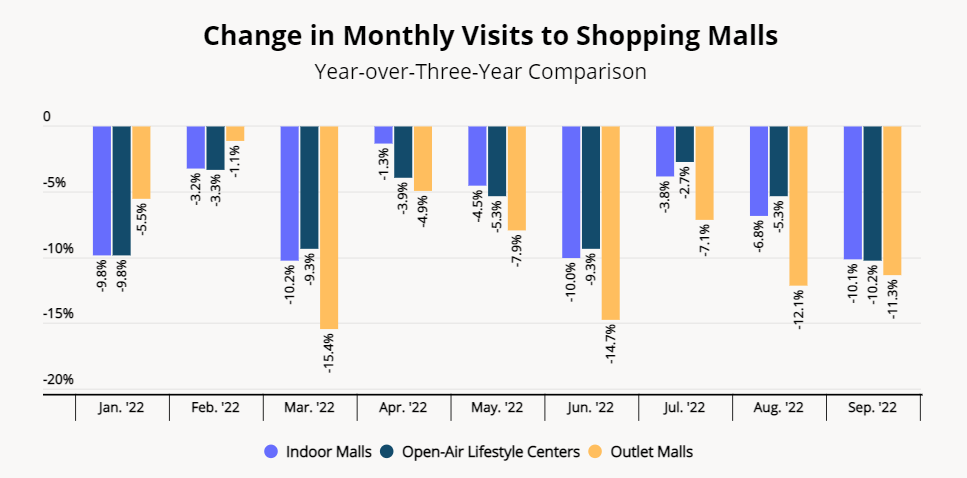

Yet, while these mall numbers do mark an important sign of relative strength, it is also important to remember that many malls are still seeing visits lag behind pre-pandemic levels. While YoY visits saw improvements between August and September, a year-over-three-year (Yo3Y) perspective shows a more challenging environment. Here, the more advantageous comparison to a COVID affected September in 2021 is replaced with a ‘normal’ September from 2019. Critically though, shopping patterns have also shifted with visits coming with more intent and driving larger basket sizes. Nonetheless, the comparison shows that there is still more room for growth with malls in the coming months.

Weekly Visit Trends Provide Optimism

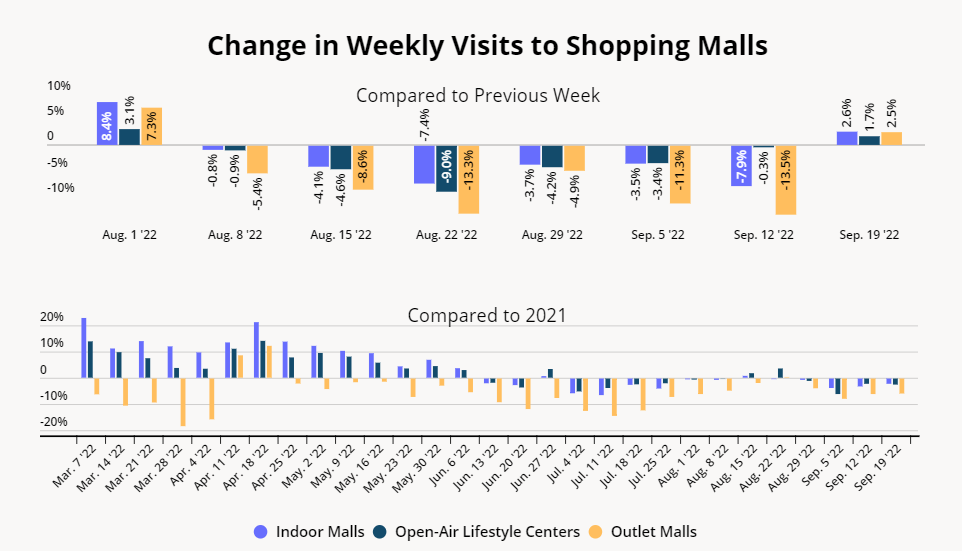

And there are signs that the coming weeks could provide this needed rise in visits. Looking at weekly visits week-over-week (WoW) showed increases of 2.6%, 2.5% and 1.7% more Indoor Malls, Open-Air Lifestyle Centers, and Outlet Malls, respectively, for the week beginning September 19th – the first period of WoW growth since the beginning of August. The timing here is crucial as it indicates that the shopping patterns seen last year with lifts in early holiday shopping could be repeating again in 2022.

Should visits continue to recover alongside these added draws, brick-and-mortar visits could see a strong push as the height of the holiday shopping season nears.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.