Our latest white paper looks at six brands that are leading their category and continuing to attract visitors amidst ongoing inflation and tightening consumer budgets. Below is a taste of our findings. For the full report, read the white paper here.

Overall Retail’s Resilience in the Face of Inflation

Inflation has taken center stage over the past few months. With the current price hikes affecting daily spending, shoppers are increasingly considering “trading down” – substituting their regular brands with lower-priced alternatives.

But although consumers are adopting a more value-conscious behavior, foot traffic data indicates that the true state of retail is not as bleak as may be expected. A recent Mastercard report revealed that retail spending grew 11.7% year-over-year (YoY) as of July 2022 – significantly more than July’s 8.5% YoY inflation rate, indicating that the increase in retail spending is not just due to higher consumer prices.

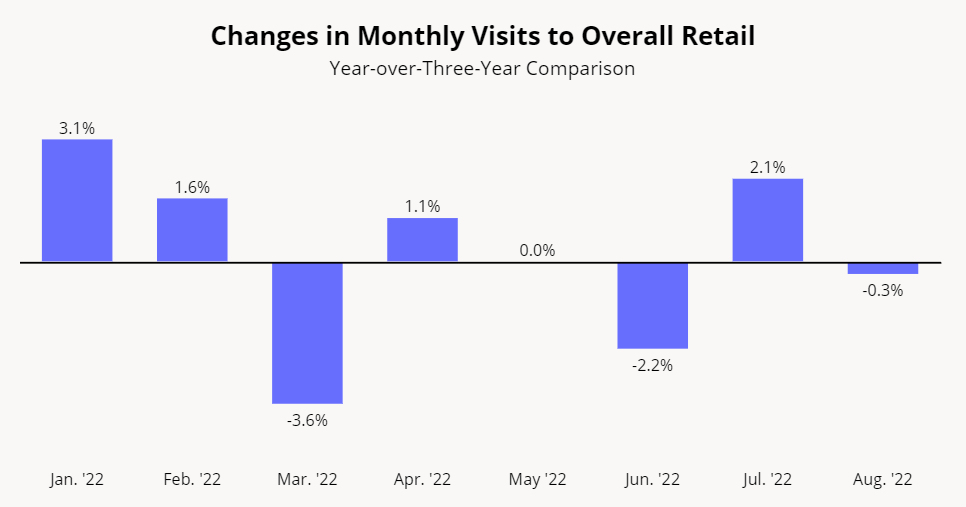

And while year-over-year (YoY) retail visits over the summer were down slightly due to the difficult comparison to a strong 2021 back-to-school season, year-over-three-year (Yo3Y) monthly visits indicate a positive trend. For half the months between January and August 2022, nationwide retail visits were higher than in the equivalent months in 2019, and only two months showed clear Yo3Y declines. So while consumers may be looking to stretch their budgets, the retail sector is still in relatively good health.

Brands Beating Inflation

The past few years have been particularly eventful, and the brick and mortar retail space has felt the impact. Following an impressive post-lockdown comeback in the second half of 2021, Omicron brought visits down again in early 2022. Then, just as the retail space was beginning to rally, the double blow of high gas prices and inflation sent retailers scrambling once more.

But the brick and mortar retail space is now demonstrating its resilience once more. And while some retailers are feeling the crunch, other brands are finding ways to thrive despite the wider economic headwinds. Across the apparel, dining, superstore, fitness, and beauty sectors, companies are finding ways to satisfy consumers’ current value orientation and keep visitors coming back to their brick and mortar locations.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.