Our last analysis of department stores highlighted the foot traffic potential for the space heading into the summer months. Now, with the holiday retail season already heating up, we dove into the visit data for department stores as well as upscale shopping corridors to take a closer look at this past summer’s foot traffic and the momentum being carried into the holiday season.

Mid-Range Department Stores Bounce Back

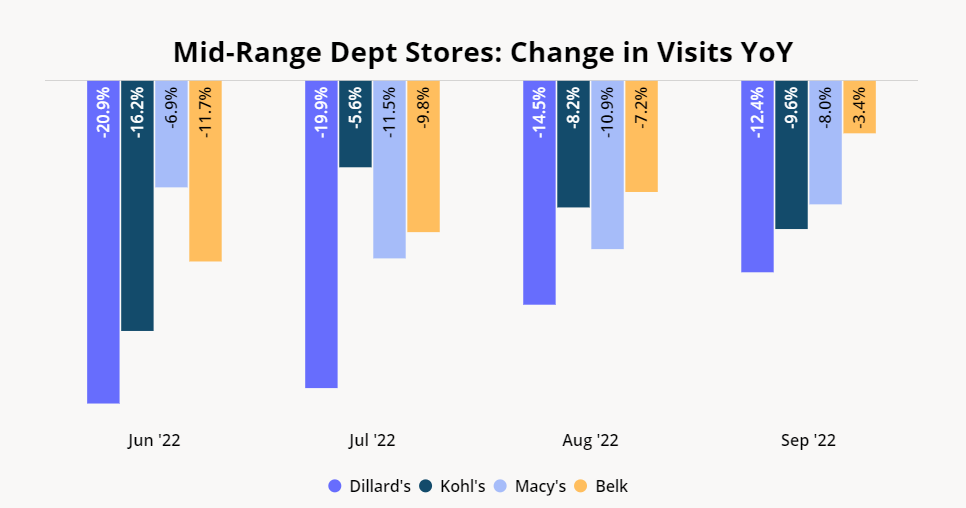

Mid-range department stores Dillard’s, Kohl’s, Macy’s, and Belk saw year-over-year (YoY) visit gaps shrink over the summer months. This is a particularly positive sign for the mid-range retailers considering the comparison to 2021’s strong foot traffic fueled by stimulus payments and the wider retail reopening.

The combination of strong Labor Day visitation trends and early holiday shopping have provided a significant boost for mid-range department stores. And as inflation continues to ease, visit data indicates that discretionary spending is back on track in the department store space. The YoY visit gap to Dillard’s narrowed from 20.9% in June 2022 to just 12.4% in September, while Belk’s YoY visit gap also narrowed from 11.7% to only 3.4% in the same timeframe.

Location analytics indicates that Kohl’s and Macy’s are following a slightly different trajectory. After investing heavily in reinvigorating the brand ahead of early back-to-school shopping, Kohl’s saw its smallest YoY foot traffic gap of the summer in July 2022 (-5.6%) after seeing a 16.2% YoY decline in June.

As Macy’s continued to close full-size locations in 2022, its visit gap widened slightly over the summer before narrowing in September. While the YoY visit gap to Macy’s grew from 6.9% in June to 11.5% and 10.9% in July and August, respectively, the chain’s visit gap narrowed again to 8.0% in September. Macy’s continues to roll out the smaller-format Market by Macy’s which has the potential to build on this upward trend and drive visits during the holiday season.

Summer of Luxury

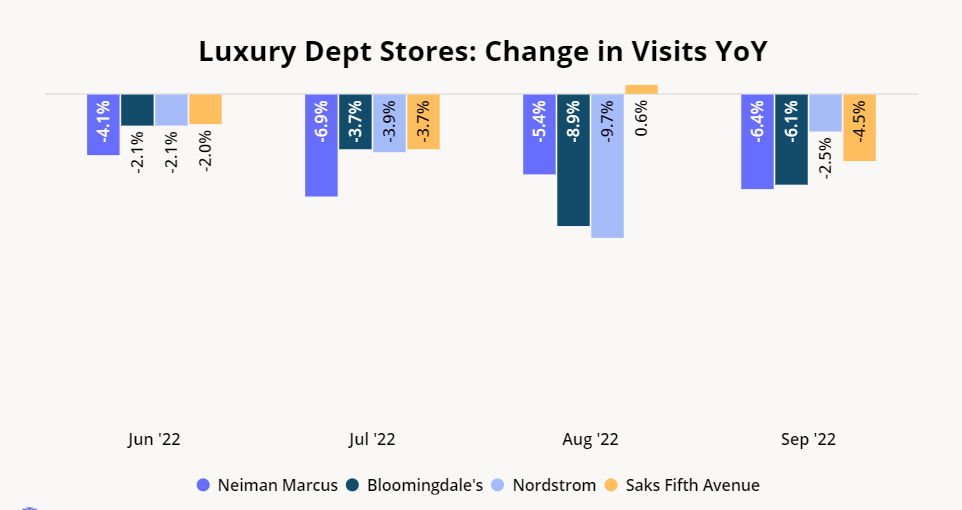

Overall, visit data for the luxury department store chains shows smaller YoY visit gaps than those of their mid-range counterparts – likely because luxury consumers are less affected by inflation. Each luxury department store analyzed had monthly visits in June through September 2022 at near 2021 levels. Notably, YoY visits to Saks Fifth Avenue were positive in August (0.6%) due to a resurgence of weddings and other in-store initiatives.

Still, the summer posed some challenges for high-end department stores. Wider visit gaps in July and August reflect the trend of spending pull-back in the luxury space – perhaps caused by affluent consumers’ summer travel abroad.

Looking ahead to the holiday season, positive trends in the luxury department store space are likely to continue as these brands are a destination for affluent consumers shopping for big-ticket gifts.

The Attraction of Upscale Shopping

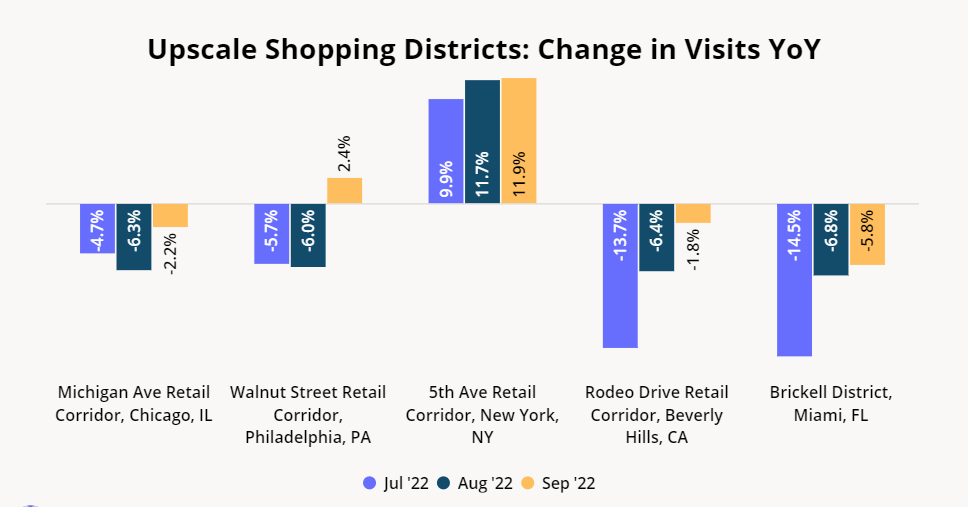

As affluent shoppers flock to their favorite department stores this holiday season, they will likely find them in upscale retail corridors. Analysis of some of the most popular corridors – Michigan Ave in Chicago, Walnut Street in Philadelphia, 5th Ave in New York, Rodeo Drive in Beverly Hills, and Brickell District in Miami – revealed strong visits heading into the holiday season.

One way upscale retail districts attracted shoppers is through investment in experiential initiatives. This summer, Rodeo Drive in Beverly Hills, CA held the BOLD Sumer Red Carpet Experience which gave visitors the opportunity to walk the red carpet and pose for photos with their pets. In September 2022, Philadelphia’s Walnut Street hosted the Rittenhouse Square Fine Arts Show – the oldest outdoor art show in the country – and broke positive for YoY visit growth for the month (2.4%).

Transitioning into the holidays, special events held in upscale retail corridors have the potential to continue to drive visits. The Rockefeller Center Christmas Tree off New York’s 5th Avenue draws over 2.5 million visitors annually, and Michigan Ave in Chicago – also known as the Magnificent Mile – has its own Lights Festival complete with family activities, tree lighting, and a parade.

Special attractions aren’t the only way for upscale retail districts to find foot traffic success this holiday season. Due to the mild winter weather, outdoor culture, and booming foot traffic trends for Miami, the Brickell District is poised to benefit from a geographical advantage that could translate into strong visits over the holidays.

The (Gift)Wrap-Up

After visits to the department store space picked up steam through the summer, the holiday season looks bright for both mid-range and luxury retailers. Similarly, upscale shopping districts saw rising foot traffic trends that suggest a potentially robust end to the year.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.