The effects of inflation are omnipresent. The mobile app market isn’t immune to them, and has, in fact, begun to show signs that the economic headwinds facing the business macrocosm are filtering down to the mobile microcosm, affecting publishers and apps of all sizes. Without a clear end in sight, this environment demands that those evaluating opportunities in the mobile ecosystem have a sustainable approach to surface insights around its most resilient aspects. In our State of Mobile Apps During an Economic Downturn report, data.ai reveals how mobile performance data can illuminate a brighter path through these turbulent times for app makers.

A Resilient Ecosystem With Some Standout Markets

Looking at the first half of 2022, the mobile ecosystem faced similar headwinds to the larger economy, although the impact was more muted. Certainly, there’s been no gale force capable of setting the market back significantly or erasing the wins seen post-Q1 2020. Still, a storm continues to build on the horizon.

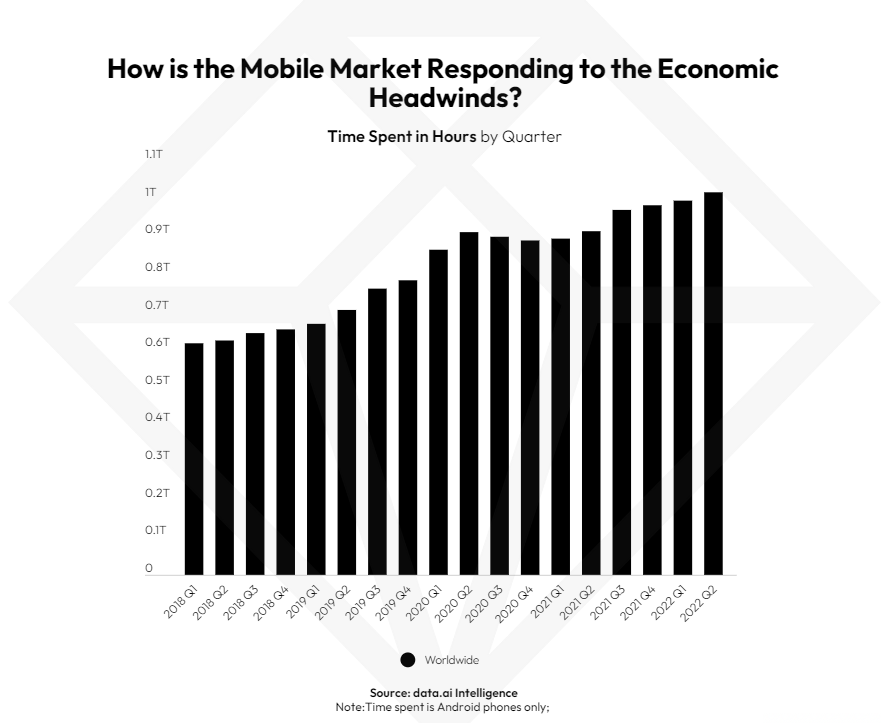

The good news is that a key measure of the market’s overall health, the amount of time spent in apps by consumers, posted double-digit growth in H1 compared to the first half of 2021 — it’s grown 11% year-over-year to reach an all-time high of more than 2 trillion hours on Android phones alone. Downloads have also reached an all-time high of 74.4 billion downloads of apps and games across iOS and Google Play in H1 2022, up 13% YoY. Revenue, conversely, slipped ever-so-slightly in the first half, coming in 3% under the year-ago period.

Dropping down a layer to look at specific countries, our research shows that several markets throughout LATAM and EMEA have performed quite well in terms of year-over-year growth across key metrics crucial to app success. Developing market Brazil, for instance, saw 15% growth in consumer spending on in-app purchases.

Categories Delivering Despite Headwinds

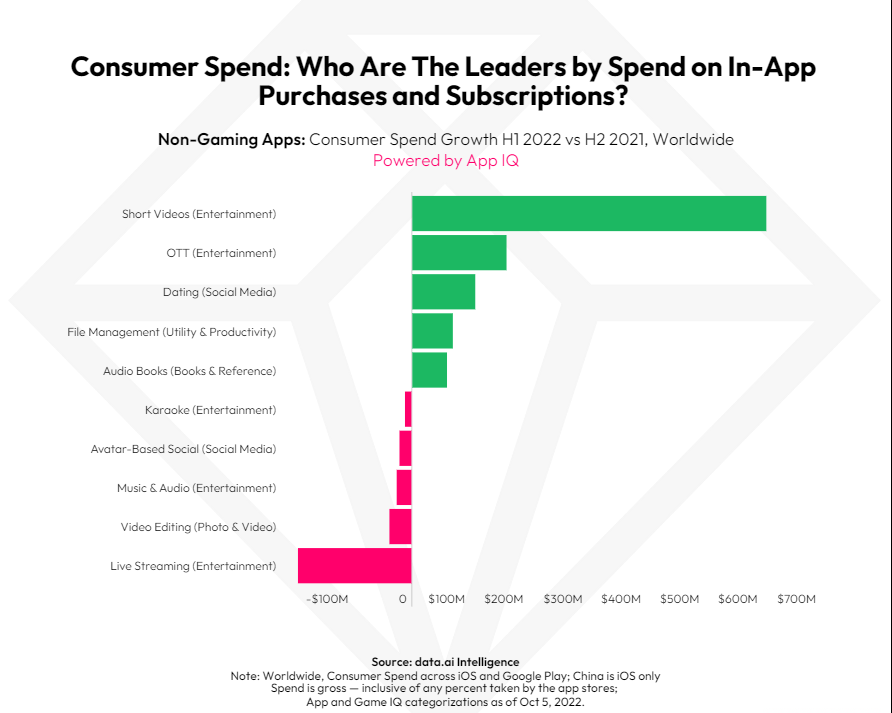

Just as resilient markets have emerged in short order, so have specific categories of apps. Utilizing App IQ and Game IQ, our app taxonomy solutions, our analysis uncovered a trend across both new downloads and spending that favors social interactions and entertainment.

In fact, Media Sharing Networks (Social Media) apps were among raw download growth in H1, adding 152 million installs globally versus the period prior: H2 2021.

As for in-app consumer spend, Short Videos (Entertainment) apps, chief among them TikTok, have emerged as leaders. Close to $606 million more was spent in these apps during the first half than in the six months prior. OTT and Dating (Social Media) apps were also standouts by this measure, as were Audio Books (Books & Reference) apps.

Short Videos and Social Networks apps are among the positive outliers from H1 in terms of growth in total time spent. It should come as no surprise that, on the other end of that spectrum, is Meeting (Business) apps, in other words a cohort including, among others, Zoom, Google Meet and Skype for Business.

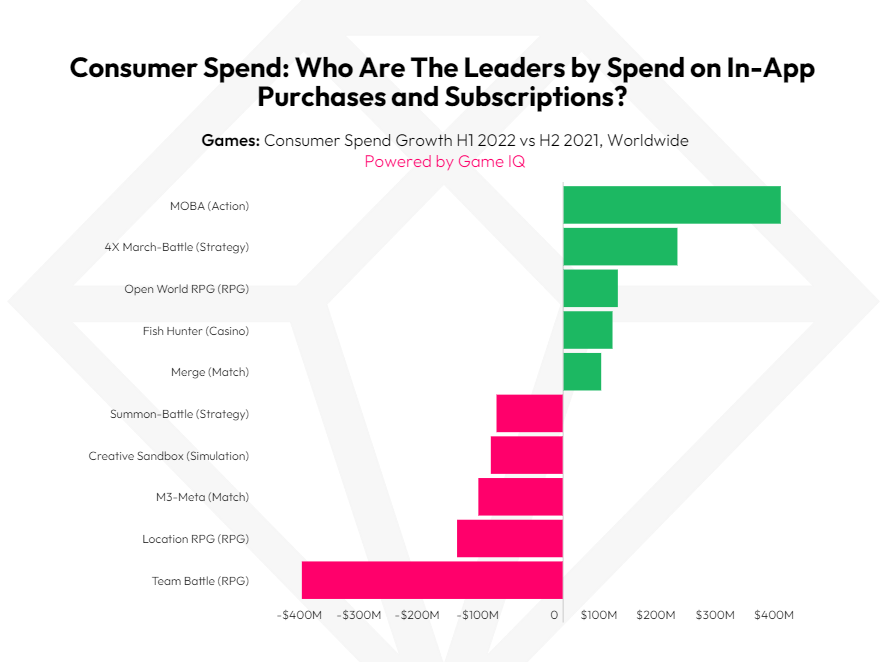

Games Remain Top Performers, But Key Genres Shift

Gaming has continued to be the primary driver of adoption and spending across all markets. First-time download growth in H1 has been focused mainly in Hypercasual titles, particularly Puzzle genre titles led by the likes of 2048 and

Meanwhile, the largest year-over-year growth in spending has occurred in MOBA (Action), a genre exemplified by Tencent’s perennial chart-topper Honor of Kings, along with 4X March-Battle (Strategy) and Open World RPG with its flagship title, Genshin Impact, rewriting the book on successful live service mobile game launches.

At the same time, a significant shift is underway among the types of titles mobile gamers are pouring their minutes and monies into. Total time spent by all users has been increasing rapidly in the Creative Sandbox (Simulation) genre, led by ROBLOX. However, time spent has dropped off precipitously is total time in Battle Royale (Shooting), which mirrors its constriction on console and PC.

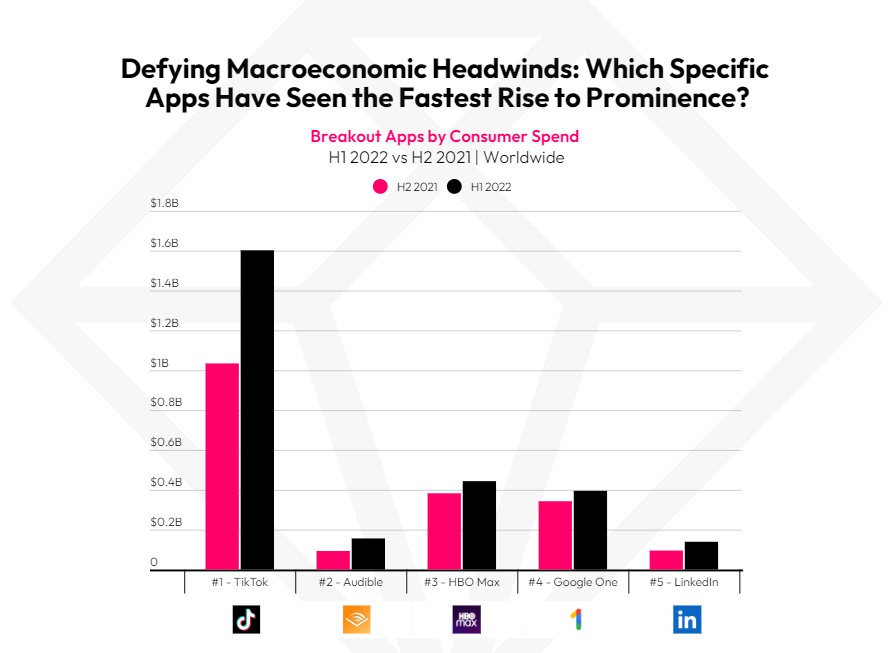

Breakout Apps Accelerate Amid The Slowdown

Among the breakout apps by consumer spend are examples of the Short Videos and OTT genres in TikTok and HBO MAX, respectively. ByteDance’s social platform shows up again in breakout apps by monthly active users (MAU), as does Meta’s Instagram, an app locked in a head-to-head battle against TikTok.

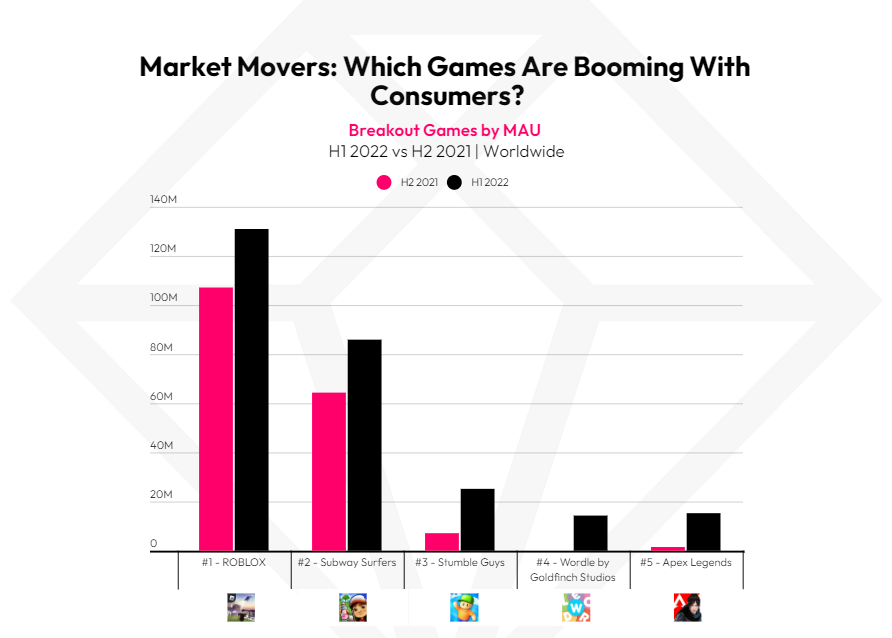

Rising stars among mobile games similarly reflect the larger genre trends. MOBA title Honor of Kings delivered the largest delta between its H1 2021 and H1 2022 consumer spend totals, while the Creative Sandbox genre’s marquee example, ROBLOX, leads in MAU growth.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.