Health and wellness remains a booming industry in 2022, as more and more Americans prioritize self-care in the wake of COVID. And while online fitness classes still provide a convenient option for many, premature predictions of the demise of the gym have proven greatly exaggerated: People crave community and human interaction – and they’re willing to leave the house to get it.

A Booming Industry

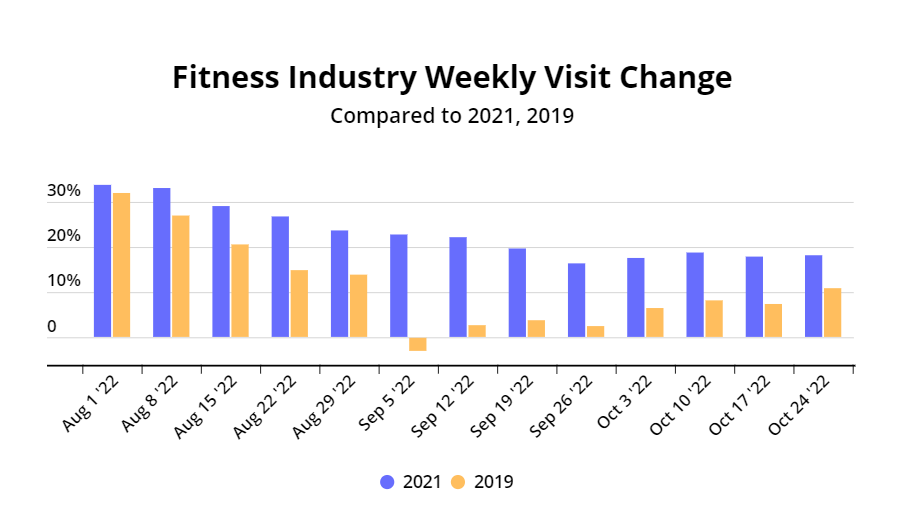

Despite inflation rates hovering above eight percent throughout the summer, a year that started off well for the fitness industry has gotten even better. During the first week of August, offline fitness visits were up 33.7% relative to the equivalent week in 2021, while year-over-three-year (Yo3Y) visit growth reached 31.9%. And although this impressive visit growth slowed somewhat in September, foot traffic generally remained well above its pre-pandemic baseline and appears once again to be on an upswing.

Some of the year-over-year (YoY) increase can be attributed to a slow-down in gym visits during the third wave of the pandemic. The Yo3Y surge, however, reveals an industry that has not just recovered, but is significantly outperforming its pre-COVID numbers.

Health Clubs Thriving Across the Board

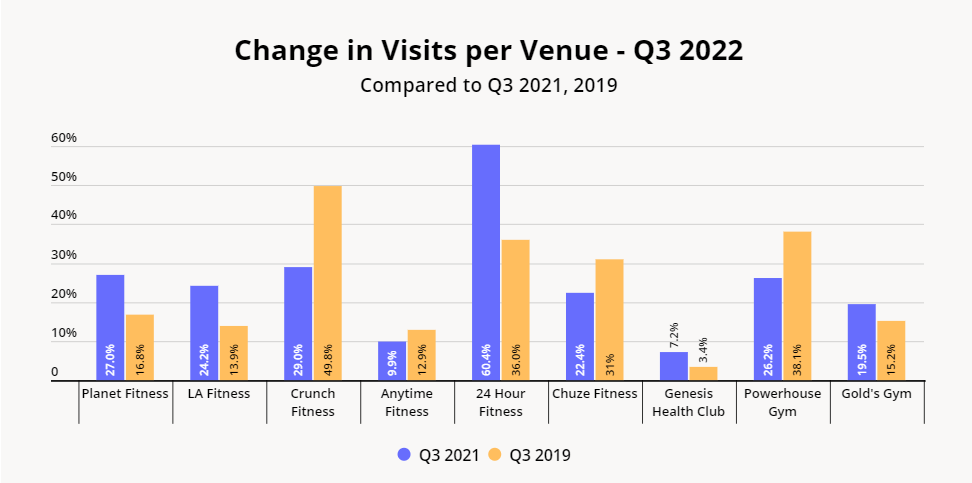

Zooming in on some of the nation’s top gym brands confirms the continued success of the sector. While overall Yo3Y foot traffic was down for some chains in Q3 2022 – due to shrinking fleets in the wake of rebranding and consolidation moves – both YoY and Yo3Y visits per venue were up across the board. Notably, the ambit of chains with increased visits per venue includes not just deeply discounted clubs like Planet Fitness and Crunch Fitness, which offer memberships starting at about $10 a month, but also pricier options like LA Fitness and Powerhouse Gym.

Increased Visit Duration

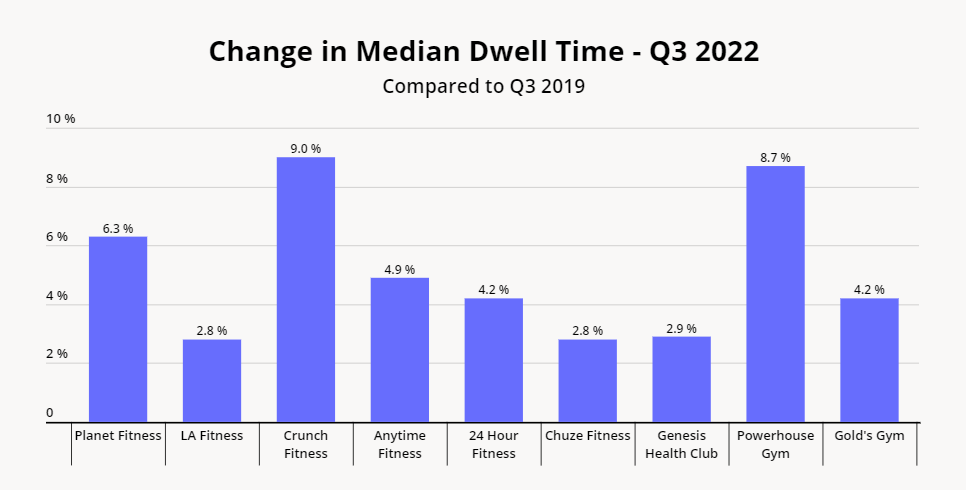

While some of the growth undoubtedly comes from recouped membership rosters, fitness-conscious Americans are also upping their workout frequency. And once people make it to the gym, they tend to stay there longer than they did in 2019. A look at the median dwell times for leading fitness chains shows remarkable growth from 2019 to 2022, ranging from 2.8% at LA Fitness and Chuze Fitness, to 9.0% at Crunch Fitness. This is good news for health clubs, since people who spend more time at the gym are more likely to renew their memberships going forward.

Cheaper, Stronger Brands Snagging More Visit Share

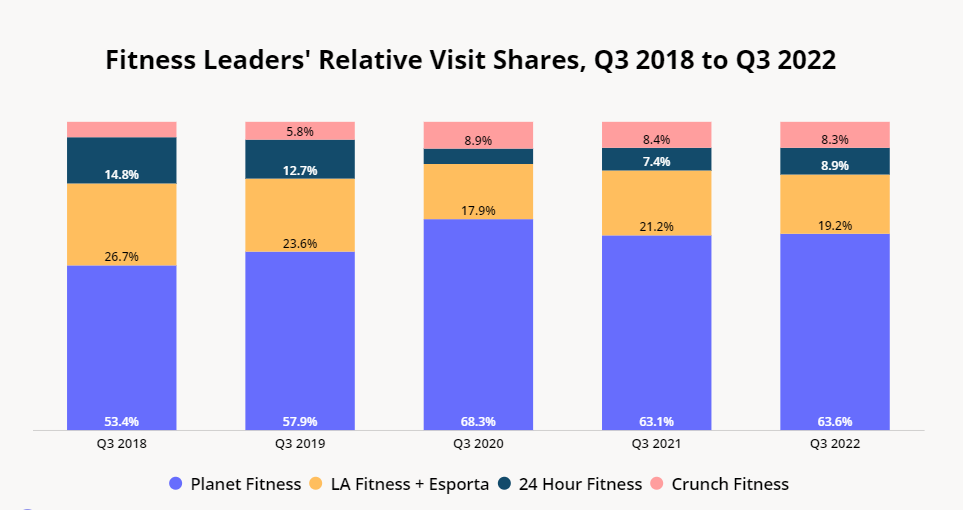

While business is thriving across the sector, comparing the relative foot traffic distribution for four of the nation’s top brands over the past several years shows that the lower-cost gyms are snagging a growing slice of the visitor pie. Planet Fitness, further cementing its position as the nation’s most-visited gym, saw its relative foot visit share jump from 53.4% in Q3 2018 to 63.6% in Q3 2022. Crunch Fitness’ share grew from 5.2% to 8.3% over the same period.

LA Fitness and 24 Hour Fitness, on the other hand, experienced mild declines. LA Fitness, hit particularly hard by COVID closures in places like California, has sought to meet the growing demand for low-cost alternatives by rebranding many of its locations as discount Esporta clubs. While this move has not yet brought the company’s visit share back to where it was in 2018, the needle has begun to move in the right direction. 24 Fitness, which for its part sustained a significant blow when it was forced to file for bankruptcy during the pandemic, is also seeing its share of foot traffic begin to bounce back.

Leaning into Mental Health

The continued industry boom may stem, in part, from steps the clubs have taken to lean in to consumers’ heightened focus on mental health and emotional well-being – particularly among Gen Z adults, who make up a substantial share of gym goers. 24 Hour Fitness partnered with Headspace this October to offer its customers three months of free access to the well-known mindfulness app. Other gyms, like Crunch Fitness, have invested in meditation classes as well as rest and recovery rooms where people can relax and socialize after a tough workout.

At the height of the pandemic, some 70% of fitness consumers reported missing their health clubs as much as their friends and family. As gyms increasingly position themselves as places not just to work out, but to hang out and engage in a broader range of self-care activities, their positive trajectories appear poised to continue.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.