Sandalwood China E-Commerce Data shows the cumulative sales volume of China online cellphone sales reached 76.49 million from January to October 2022, a 3% y/y decline compared to 2021. E-commerce channel has taken 1/3 of the overall market sales. Compared to the 12% y/y decline of the whole cellphone market (online+offline), e-commerce channel remains resilient.

Taking a closer look at the growth factor of cellphone sales around Double 11. Sales volume of the whole sector during pre-sales (Oct 20 – 30) was 1.6 times regular period (Oct 1-19) while that during Double 11 (Oct 31 – Nov 11) reached 3.7 - exceeded expectations of many.

A deeper dive into brand analysis indicates Apple had the highest growth factor during Double 11 – sales reached 6.2 times regular period. Xiaomi ranked top among Android phones – sales were 4.7 times regular period. Samsung, IQOO, One Plus also performed well (3-4 times regular sales).

Market is concentrated towards leading product lines based on sales performance by price range.

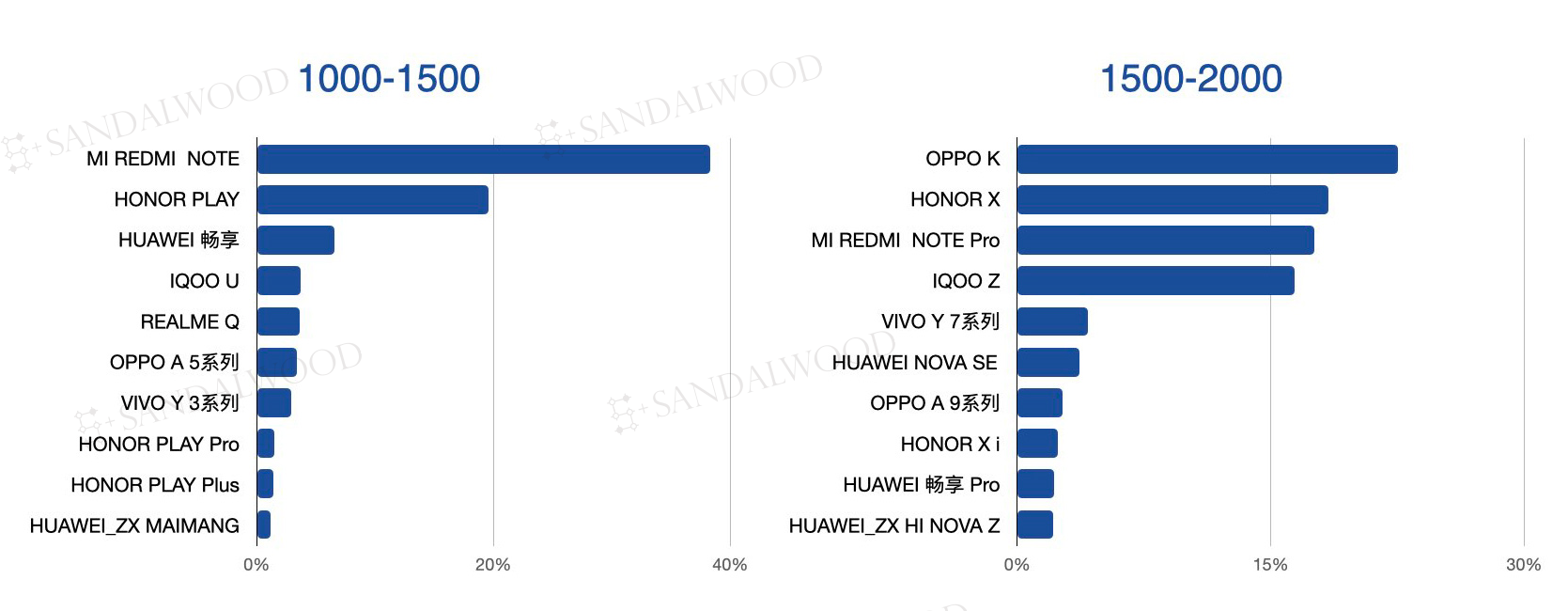

1000-2000 RMB Segment

Sales accounts for approximately 1/3 of the overall e-commerce channel. Redmi Note and Honor Play took the lead and accounted for 60% of the 1000 – 1500 RMB price range. The 1500 – 2000 RMB range is dominated by OPPO K, Honor X, Redmi Note Pro, and IQOO Z, competing head-to-head while accounting for 75% of the segment combined.

E-Commerce Cellphone Sales Product Line Ranking by Price Segment

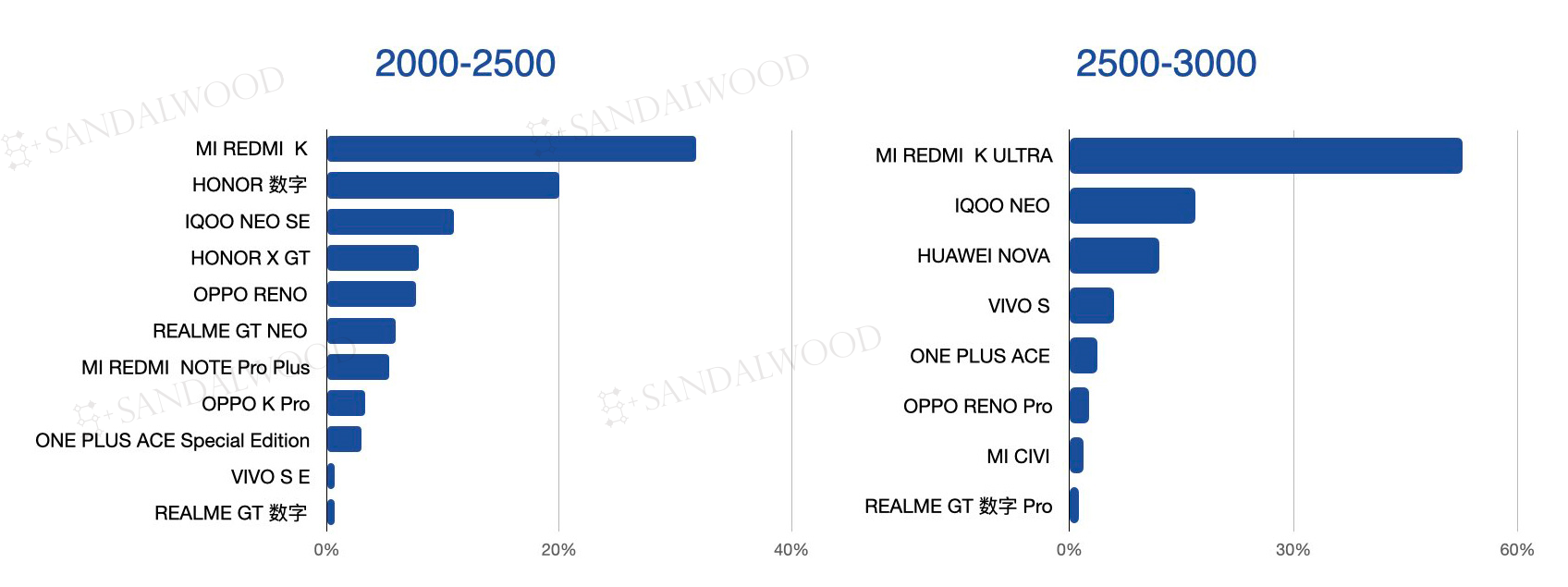

2000-3000 RMB Segment

Redmi dominates. Redmi K series took the lead of 2000-2500 RMB range, followed by Honor Digital. IGOO NEO SE, Honor X GT, Realme GT NEO also performed well. Within the 2500-3000 RMB range, Redmi K Ultra took half of the segment share. IQOO Neo, Huawei Nova also outperformed the others within this range, accounting for 80% of the segment share along with Redmi K Ultra.

3000-4000 RMB Segment

Highly competitive segment. Honor Digital Pro leads followed by Realme GT Digital Special Edition in the 3000-3500 RMB range; IQOO Digital leads in the 3500-4000 RMB range with One Plus ACE pro, Xiaomi Digital, Huawei Nova Pro, Vivo X ranking among the top.

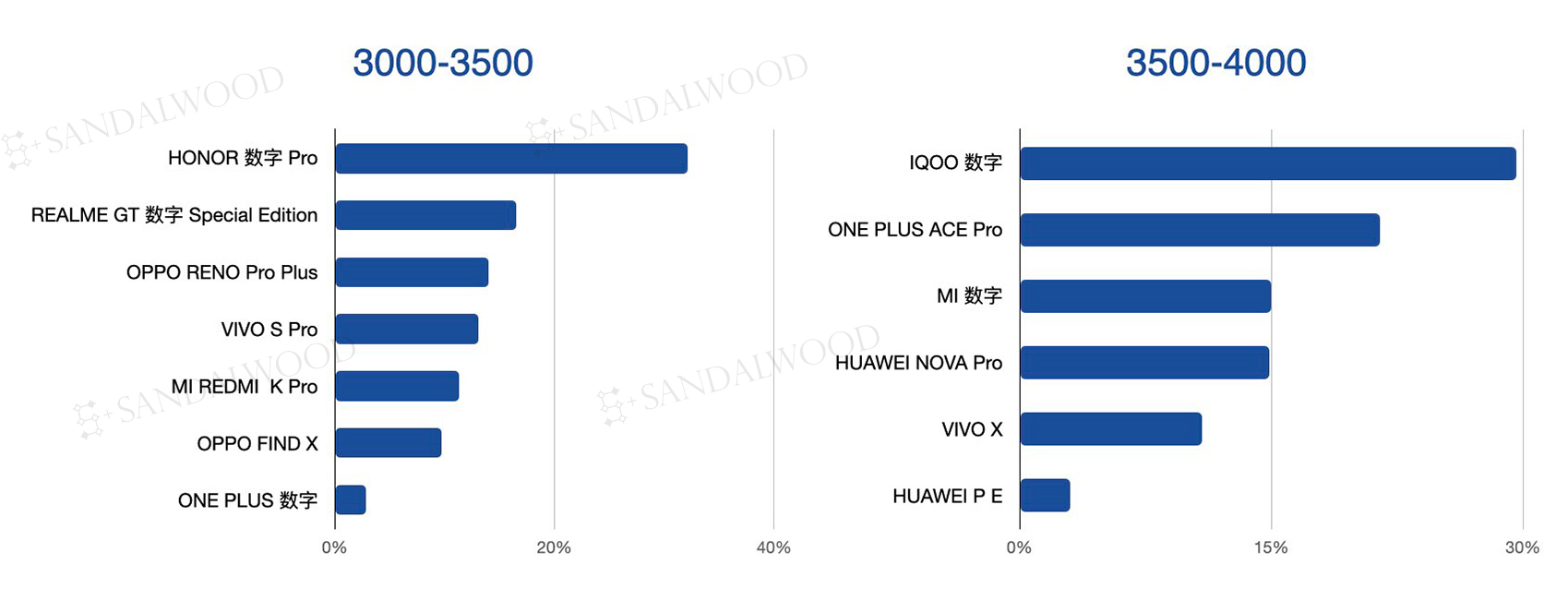

4000-5000 RMB Segment

Android phones dominate. Xiaomi Digital Pro, Huawei P series lead, taking almost half of the segment share combined; One Plus, IQOO Digital rank among the top.

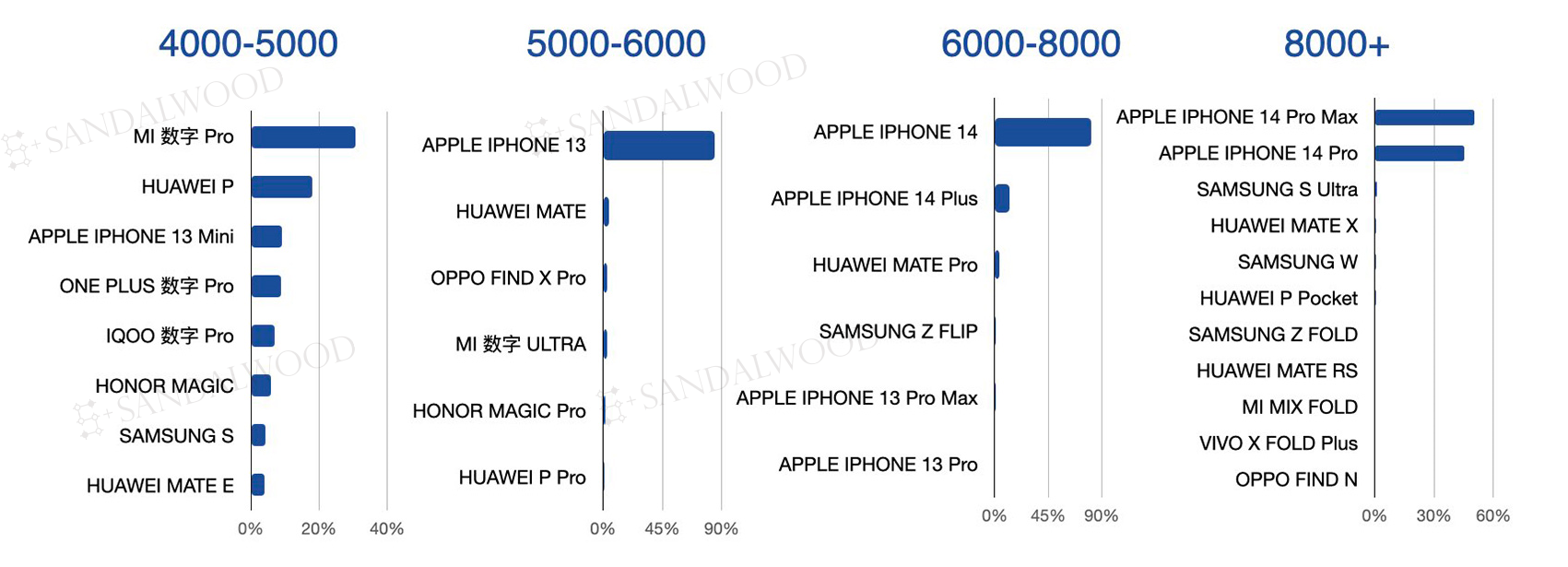

5000+ RMB Segment

So far Apple has taken the lead with iPhone 13 contributing the most in the 5000-6000 RMB range; Huawei Mate dominates among Android phones. OPPO Find X, Xiaomi Digital Ultra, Honor Magic Pro also rank high. For the 6000 – 8000 RMB range, the new iPhone 14 series serves as the main force; Android, on the other hand, is led by Huawei Mate Pro and Samsung Z Flip. iPhone 14 Pro series also dominates the 8000+ RMB range, followed by Samsung and Huawei.

With Double 11 coming to an end, the competitive landscape of 2023 will unfold with new flagship products soon to be launched. Under rising e-commerce market centralization, focusing on leading product lines, grasping the right market, and consolidating the fundamentals will set the path to win.

To learn more about the data behind this article and what Sandalwood has to offer, visit http://www.sandalwoodadvisors.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.