The past few years have been good to the discount and dollar sector. The segment saw heightened visits and store fleet growth in a period marked by a global pandemic and economic uncertainty. Now, we dive into the performance of four major discount chains – Dollar Tree, Dollar General, Family Dollar (owned by Dollar Tree), and Five Below – to see how the upcoming holiday season might affect visits.

Store Fleet Expansion Leading to Continued Growth

The discount and dollar store category includes some of the largest retailers in the country. Dollar General boasts over 18,000 locations and counting. Family Dollar, owned by Dollar Tree, has 8,241 retail locations, while the Dollar Tree brand has 7,890 stores in the U.S. And Five Below, which has begun to pivot to a higher-income segment with its “Five Beyond” concept, currently operates over 1,000 stores with plans to triple its store count by 2030.

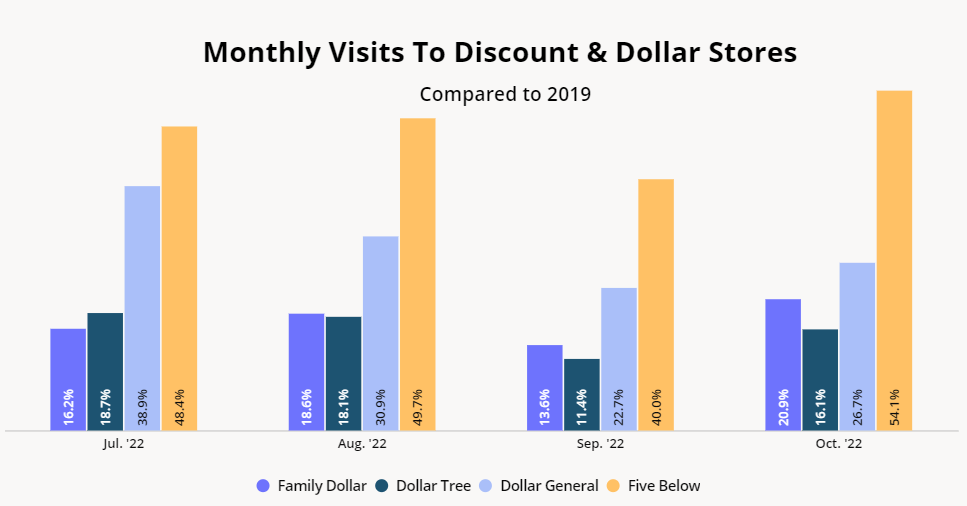

These companies’ impressive foot traffic growth has been boosted by the segment’s recent expansions. The pandemic drove major traffic surges to these essential retailers – and a year-over-three-year (Yo3Y) analysis shows that the growth is having a long-term impact on retail foot traffic to the category. All four brands posted impressive foot traffic gains in the second half of the year, with October growth of 20.9%, 16.1%, 26.7%, and 54.1% for Family Dollar, Dollar Tree, Dollar General, and Five Below, respectively.

Comparison to 2021

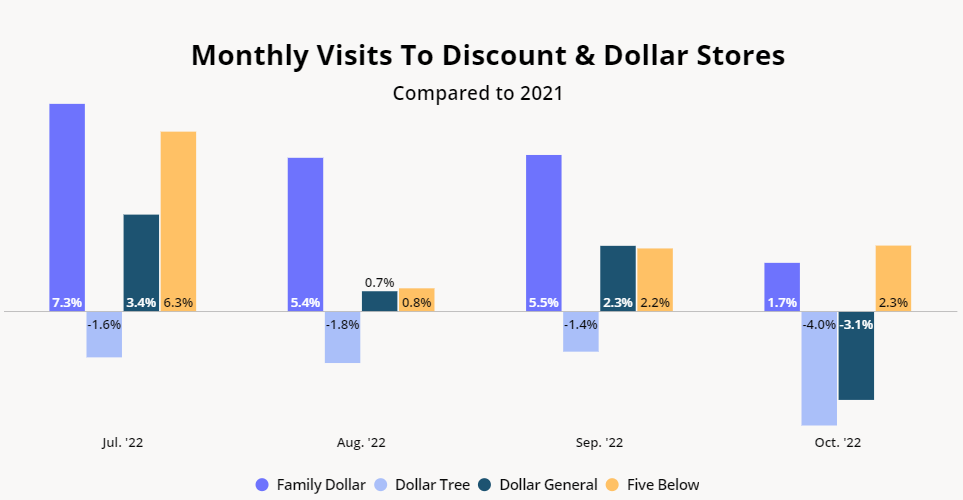

While Yo3Y visits tell the big-picture story, zooming into year-over-year (YoY) visits puts current foot traffic trends into context. And although 2021 was an excellent year for discount and dollar stores, with most chains outperforming 2020’s already strong visit numbers, many of the leading discount & dollar brands succeeded in keeping the momentum going into 2022.

Foot traffic to Family Dollar and Five Below remained above 2021 levels every month, seeing visit growth of 1.7% and 2.3%, respectively, in October 2022. Dollar General saw YoY foot traffic increases almost every month except October, when visits fell just 3.1% relative to October 2021. Meanwhile, Dollar Tree saw slight YoY dips, but this is in comparison to last year’s strong performance, and not a reflection of reduced consumer demand.

And critically, these companies are implementing strategies for continued long-term growth, enabling them to continue thriving in a post-pandemic environment. As inflation continues to strain budgets, higher-income customers are choosing lower-priced shopping options – and discount stores are expanding their retail footprint and offering a more diverse mix of products to keep new customers coming back. Dollar Tree, Dollar General, and Five Below have all been experimenting with higher-priced retail concepts to expand their product selection and consumer base. Dollar Tree, Dollar General, and Family Dollar have also begun testing fresh foods, including produce, in several of their stores. The decision to diversify their offerings moves these brands closer to “one-stop-shop” status and is likely to pay off as inflation pushes value-oriented consumers to seek out lower-cost options.

Discounters Pulling Ahead

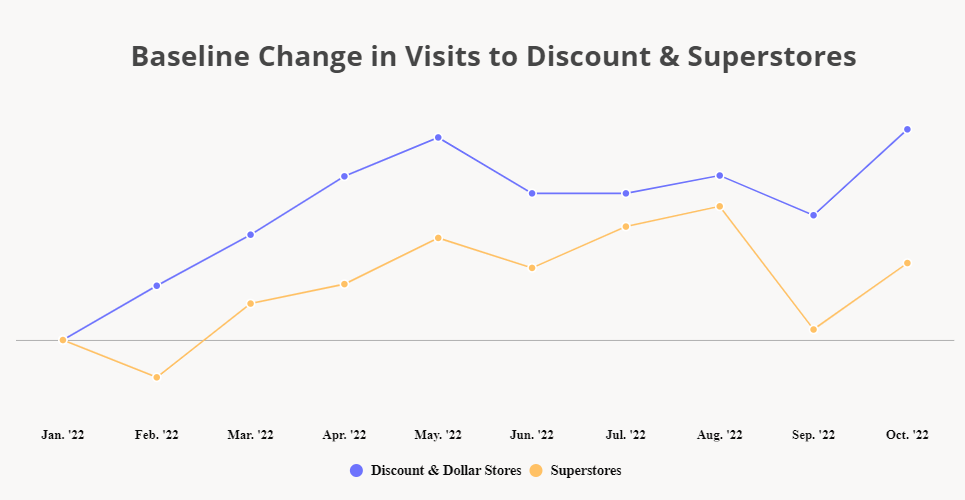

But while discount and dollar stores have been one of the primary beneficiaries of consumers trading down, the category may be facing some heightened competition over the holiday season. Several major superstores such as Target and Walmart have begun slashing prices to offload excess inventory, which may redirect some bargain-hunting consumers away from dollar stores.

Interestingly, however, foot traffic data indicates that there is enough demand to sustain growth in both categories – and that discount and dollar stores’ value proposition remains attractive even in the face of widespread price cuts. An examination of the baseline change in visits to dollar stores and superstores from January 2022 shows that both segments are growing, with discount stores pulling ahead of superstores – despite the steep discounts that are sure to continue into and define this upcoming holiday season. The fact that visits to discount and dollar stores have exceeded visits to superstores such as Target and Walmart highlights just how well-positioned discount stores remain.

Positive Signs Ahead of the Holiday Season

The continued strength of discount and dollar stores in the face of contracted consumer spending bodes well ahead of a holiday season that is sure to be closely watched. Though facing stiff competition from superstores, discount stores should be well-positioned to continue benefiting from consumer trade-down and positive foot traffic growth patterns.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.