Tight budgets and a smaller emphasis on extending the holiday shopping season early meant all eyes were on Black Friday 2022 for an indication of what lies ahead for holiday retail. And despite the fact that Black Friday 2021 was limited by rising COVID cases and a concerted effort from retailers to shift focus away from the retail holiday, Black Friday 2022 still fell short for most sectors. Still, the retail holiday continues to attract consumers to brick-and-mortar stores, and comparing Black Friday visits to pre-Thanksgiving foot traffic revealed significant visit spikes almost across the board.

So while the centrality of the day to the retail season continues to diminish, the data does show that Black Friday can still draw consumers to retail outlets even in times of high inflation and economic uncertainty.

Back to Black

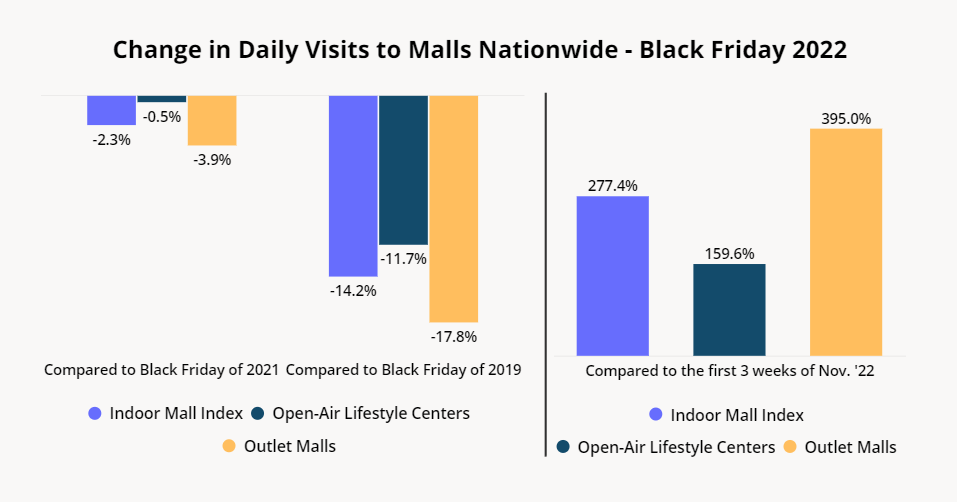

Visit data for malls can serve as an indication of overall retail trends – and mall foot traffic data shows that Black Friday 2022 almost reached Black Friday 2021 levels, but didn’t quite measure up to Black Friday 2019. Nonetheless, Black Friday 2022 did drive a foot traffic surge compared to the previous weeks and months, a strong indication that Black Friday still sparks shopping urgency among consumers.

As budget constraints remain a significant concern this holiday season, many holiday shoppers likely headed to malls in an effort to comparison-shop a combination of retailers under one roof. Visits to indoor malls and open-air lifestyle centers spiked 277.4% and 156.6%, respectively, relative to the daily average over the first three weeks of November. But of the three shopping center types analyzed, the largest visit boost went to outlet malls – with a 395.0% jump in visits relative to the daily average for November 1-21 2022 – as value-oriented shoppers saw them as a prime destination for the steepest discounts.

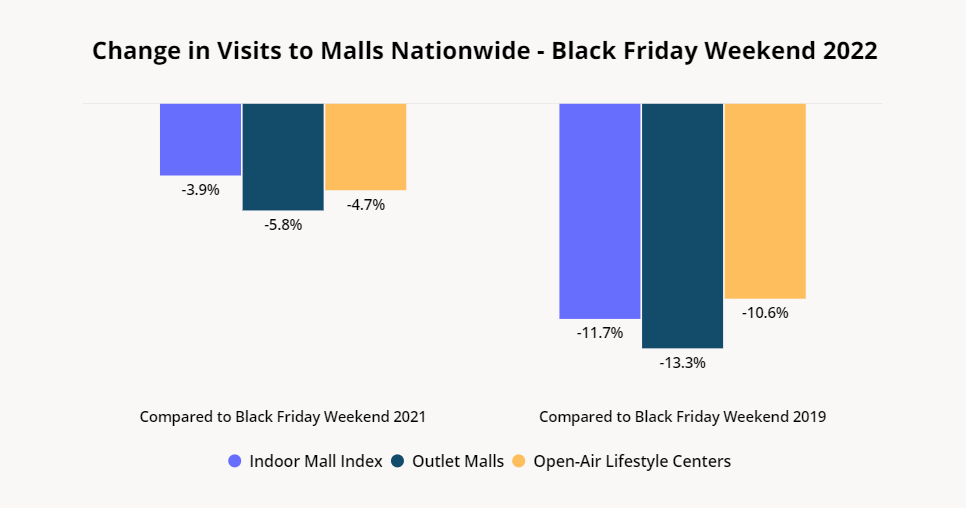

Looking at mall visits over Black Friday weekends as a whole (November 25-27 2022) compared to 2021 and 2019 reveals how consumers’ approach towards Black Friday has shifted in recent years. Year-over-year (YoY) visit gaps grew when comparing the overall weekend performance to Black Friday foot traffic, indicating that more consumers continued shopping on the Saturday and Sunday following Black Friday in 2021, while consumers this year focused more on Black Friday itself. This is consistent with the COVID reality of last year, when some consumers looking to socially distance likely preferred shopping on less-crowded Saturday and Sunday.

The year-over-three-year (Yo3Y) visit gap, on the other hand, narrowed when comparing Black Friday and Black Friday Weekend visits in 2022 with the same period in 2019. This may reflect the fact that more retailers are now offering “Black Friday deals” that extend through the weekend when compared to 2019 – so bargain-hunters had more reason to continue shopping over the long weekend this year than they did in 2019.

Black Friday Across Sectors

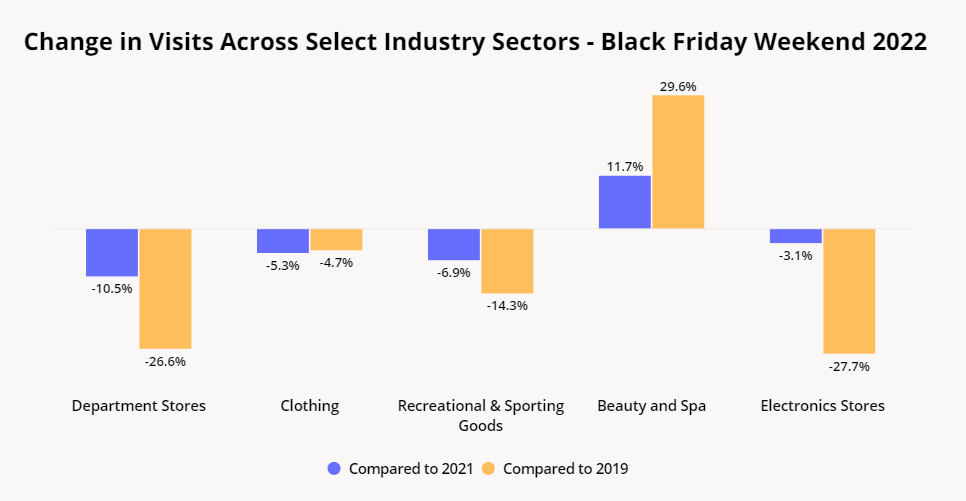

The trend seen in mall foot traffic was reflected in other key retail sectors, with Black Friday weekend visits falling slightly relative to 2021 and falling more significantly relative to Black Friday 2019. Department stores, many of which closed locations in recent years, saw visits fall 10.5% and 26.6% YoY and Yo3Y, respectively. Recreational and sporting goods and electronics retailers also saw foot traffic declines as consumers continue cutting back on discretionary spending in the face of inflation. Clothing, which includes off-price, athletic wear, and other specialty retailers saw only minor dips of 5.3% and 4.7% YoY and Yo3Y, respectively.

But one notable exception to this pattern – the beauty and self care sector – saw visits increase 11.7% YoY and 29.6% Yo3Y. The category’s success may be due to the lipstick effect, as beauty and self care retailers and retail services give consumers an opportunity to pamper themselves without too steep a price tag.

Electronics: Getting a Black Friday Charge

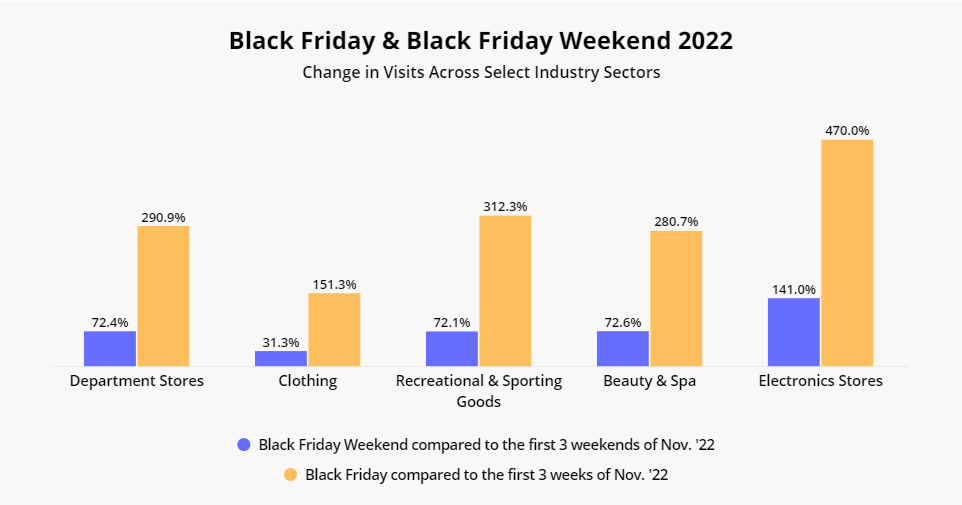

But even as Black Friday may be losing some steam when compared to previous years, the day still attracts significant numbers of consumers to brick-and-mortar retail outlets. Analysis of several industry sectors showed increased Black Friday foot traffic across the board, including many of the categories that saw YoY and Yo3Y dips.

Specifically, black Friday visits to electronics stores jumped 141% relative to daily visits November 1-21 2022, and Black Friday weekend visits jumped 470.0% relative to the first three weekends of November – indicating that shoppers are willing to wait for Black Friday to get the best prices on big-ticket items. So while in some respects Black Friday as a singular event may be losing some of its centrality, the data indicates that electronics is a category that highly motivated consumers on Black Friday 2022.

Black Friday Takeaways

Black Friday 2022 drove a surge in seasonal foot traffic across multiple sectors – even if for most the day itself didn’t perform as well as previous years. The fact that the retail holiday still excites and motivates consumers indicates that the holiday shopping season is off to a positive start.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.