Our recent look at digitally native brands highlighted the unique experiences that can be found in retail corridors – outdoor and pedestrian-friendly clusters of stores, restaurants, and entertainment venues. But indoor malls also house a number of different retail, dining, and entertainment options in close proximity – and yet foot traffic data indicates that visitors treat these two types of hubs quite differently. Here, we take a closer look at the foot traffic trends and consumer behavior data for nine major retail corridors to understand what separates these hubs from indoor malls.

Our recent look at digitally native brands highlighted the unique experiences that can be found in retail corridors – outdoor and pedestrian-friendly clusters of stores, restaurants, and entertainment venues. But indoor malls also house a number of different retail, dining, and entertainment options in close proximity – and yet foot traffic data indicates that visitors treat these two types of hubs quite differently. Here, we take a closer look at the foot traffic trends and consumer behavior data for nine major retail corridors to understand what separates these hubs from indoor malls.

Won’t You Stay a While?

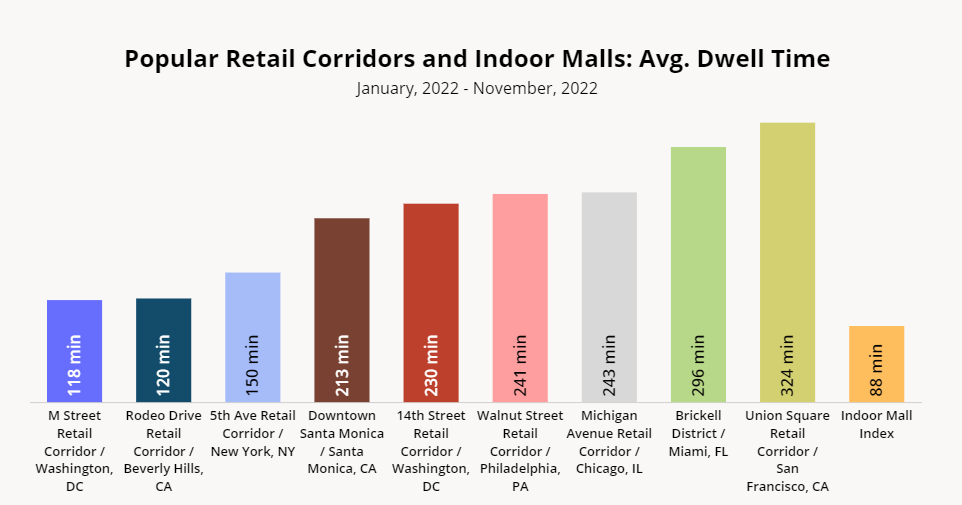

Consumer behavior in retail corridors is characterized by extended dwell times relative to malls. One reason for this is that retail corridors are dining and entertainment hubs. They boast an abundance of full service restaurants that go beyond a typical food court, making retail corridors popular social and leisure destinations.

Retail corridors are also uniquely conducive to lengthy strolls and window shopping down pedestrian-friendly streets. The ability to walk around an open-air environment as opposed to an enclosed mall heightens the sense of exploration found in retail corridors, which significantly boosts dwell times.

Particularly during the holidays, retail corridors offer special events such as light festivals and tree lightings that encourage entertainment-seeking guests to spend more time out and about. Visitors stay longer to view these spectacles which gives brands more exposure to consumers and the opportunity to be discovered by new audiences.

Local Hangouts, Close to Home

Retail corridors occupy relatively expansive outdoor sections of urban areas and include many street level shops and restaurants. Visitors to these downtown areas could be headed for a particular store – or they could simply be looking to get out of the house, browse storefronts, or meet up with friends in a convenient, central location. And because retail corridors don’t always have convenient parking options, they often attract locals looking for recreation close to home.

Indoor malls, on the other hand, have a much higher density of stores – and so they usually attract visitors intent on shopping, discovering new concepts, or trying out new products. And since – unlike retail corridors – malls tend to have abundant parking lots, visitors may be willing to travel further distances to the mall than to retail corridors.

Analysis of nine retail corridors and their True Trade Areas – which measure 70% of foot traffic within 50 miles – revealed that the retail corridors had a smaller true trade area relative to the average true trade area of Placer.ai’s Indoor Mall Index. This indicates that visitors generally travel shorter distances from home to the retail corridors and longer distances from home to malls.

Come Again?

Shopping with a specific purpose – to complete an errand or visit a favorite store – means mall shoppers are likely to be repeat visitors. These consumers are brand loyal and likely have rewards memberships with their preferred retailers and the malls they occupy, which in turn encourages more frequent mall visits.

Retail corridors, on the other hand, appeal to the recreational consumer who visits in their spare time, not necessarily to cross a store off their to-do list, which pushes visit frequency down. All nine of the retail corridors analyzed were less frequently visited than the Indoor Mall Index between January 2022 and November 2022.

Fitting Foot Traffic

Retail corridors and the brands that occupy them are well-positioned for the holiday shopping season as consumers on vacation look for opportunities to not only shop but to socialize, explore, and be entertained as well. Retail corridors and their experiential aspects are likely to attract visitors with these goals in mind.

Malls, on the other hand, seem to attract a more mission-driven consumer who is willing to drive further, and more often, to purchase specific items or visit specific stores. This may explain why malls also see such a significant spike in pre-holiday foot traffic as consumers head to shopping centers to purchase the perfect gift for their friends and family.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.