With holiday celebrations around the corner, consumers have plenty of grocery shopping ahead of them. Our recent webinar covered the prevailing visitation trends in the space, including data from Turkey Wednesday. And in order to keep our finger on the pulse, we dove into the most recent visit data for the grocery sector and Publix, one of the leaders in the category.

Grocery’s a Go

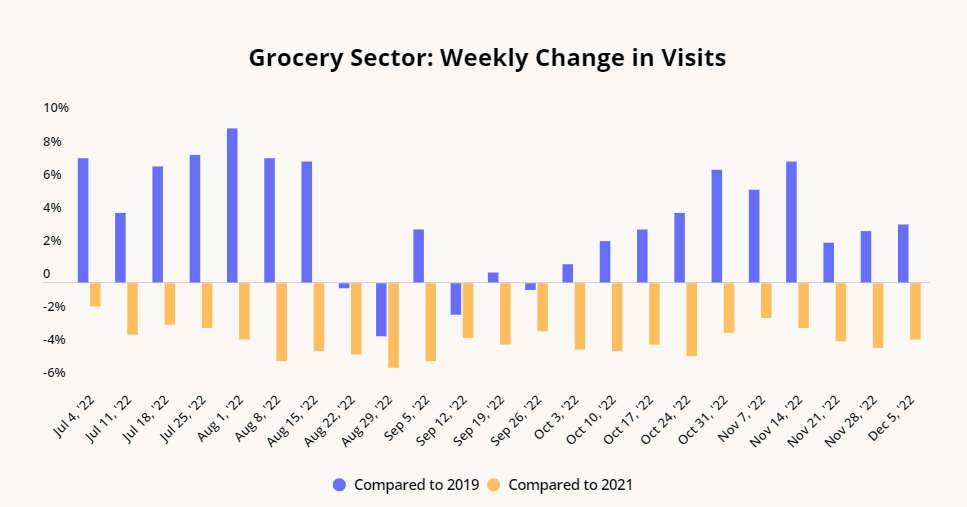

The grocery sector experienced significant foot traffic gains during the pandemic and is sustaining elevated visits as the end of 2022 nears. And despite 2021 being a particularly strong year for grocery visits – creating a difficult year-over-year (YoY) comparison – year-over-three-year (Yo3Y) visits were positive for most weeks between July 4th and December 11th, 2022. The fact that visits are above 2019 levels demonstrates the considerable growth of the grocery space.

Publix’s Busy Fall

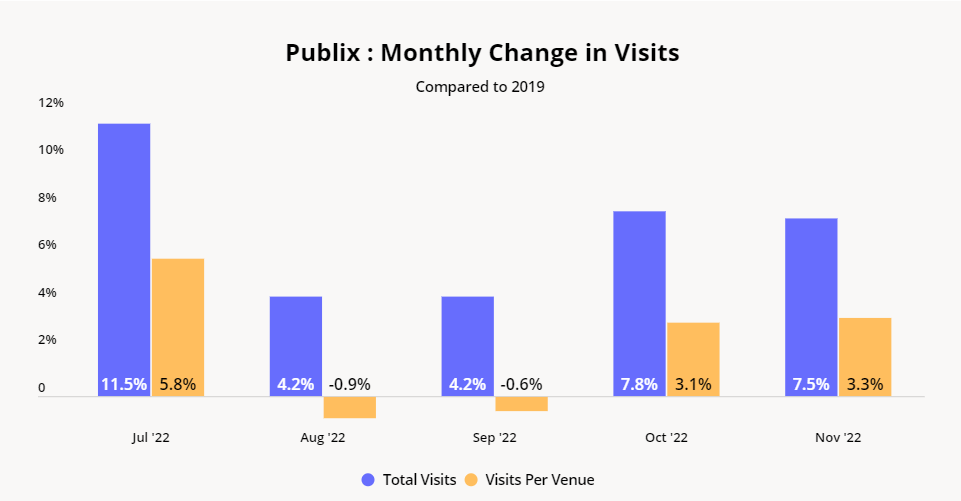

To better understand the current state of grocery, we dove into the visit data of one of the category’s leading companies. Publix boasts over 1,300 locations across the southeast and is the most visited grocer in Florida and the second most visited nationwide. The brand has added approximately 100 stores since 2019, including several new locations in recent months. In both October and November of this year, Publix had multiple weeks in which it unveiled a number of stores, a sign of its rapid expansion.

And in the same months, the visit data confirms that Yo3Y visits, as well as visits per venue increased. This suggests that as Publix adds more stores, each one is attracting additional foot traffic rather than detracting from the visits of nearby stores. In other words, new locations aren’t cannibalizing visits but instead attracting fresh foot traffic to Publix.

Publix TTA Analysis

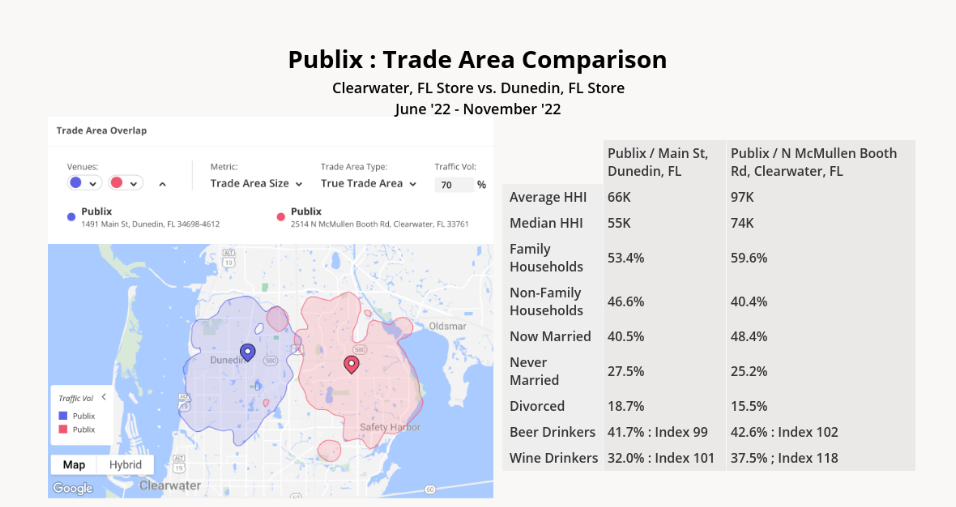

And location intelligence indicates that as the chain continues to expand, there is plenty of untapped demand to drive new foot traffic. To better understand the brand’s expansion strategy, we used True Trade Area (TTA) analysis – in this case, measuring 70% of a property’s foot traffic within 50 miles – to gain insight into visitor demographics and behaviors of two nearby Florida Publix locations.

Despite being less than four miles apart, the two stores – one in Clearwater FL, and another in Dunedin FL – have very little TTA overlap. The Clearwater store’s (12.1 sq mi) and the Dunedin store’s (10.6 sq mi) trade areas have an overlap of only 0.4 square miles – just 3.5% and 4% of the locations’ trade areas, respectively.

The two locations have distinct demographic profiles as well. The Clearwater store’s trade area has an average annual HHI of 97K compared to 66K for the Dunedin location. The Clearwater store’s trade area is also characterized by more married consumers (48.4%) than the Dunedin store’s trade area (40.5%).

And according to the AGS: Behaviors & Attitudes dataset the psychographic profiles of the two Publix branches differ as well. The trade area of the Clearwater, FL store comprises 42.6% Beer Drinkers and 37.5% Wine Drinkers as opposed to 41.7% and 32.0%, respectively, in Dunedin, FL’s trade area. The higher percentage of beer and wine drinkers in Clearwater, FL’s Trade Area could make it an ideal fit for a Publix Pours location, a new cafe-like feature at select Publix stores that serves beer and wine for consumption while customers shop.

The analysis of these two locations demonstrates that even nearby Publix stores don’t necessarily cannibalize visits. Each store attracts a unique visitor and an understanding of True Trade Areas and visitor demographics allows a brand like Publix to recognize demand for two stores and curate its offerings in each.

Grocery in Gear

The final weeks of the year will likely sustain the grocery sector’s positive visit trends as holiday meals mean more trips to the grocery store. Strong foot traffic numbers indicate that the space should carry pandemic gains over into the new year.

As chains like Publix look to match growing visits by growing their fleets, demographic and psychographic analysis has the potential to optimize their expansion strategies.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.