About the Placer.ai Mall Indexes: These Indexes analyze data from more than 100 top-tier indoor malls, 100 open-air lifestyle centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai uses anonymized location information from a panel of 30 million devices and processes the data using industry-leading AI and machine learning capabilities to make estimations about overall visits to specific locations.

Last year (2022) marked a significant opening up of retail as the wider landscape enjoyed the first true post-pandemic period. Yet, the upside of finally moving beyond pandemic-driven limitations was quickly offset by a myriad of economic challenges including inflation and high gas prices.

Analyzing our Mall Indexes over the past year has shown the impressive resilience of top-tier malls across the three sub-segments throughout the year. But with the holiday season now in the rear view, we dove into the 2022 data one last time to understand how malls closed out the year and what it could mean for their potential in 2023.

Holiday Peaks, Challenging Comparisons

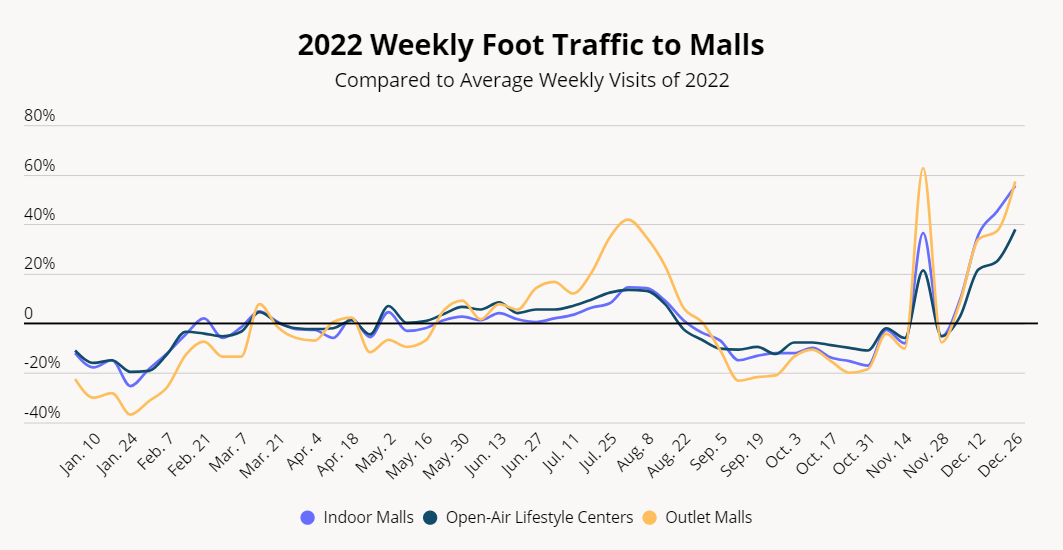

While holiday visits were clearly limited across segments when looking at visits year-over-year (2022 vs 2021) or compared to pre-pandemic, the holiday season peaks were still significant. Visits on the week of Black Friday rose high above the annual average with outlet malls seeing their strongest visit week of the year. Indoor malls and open-air lifestyle centers also saw strong visits that week, though the final week of December actually brought in more overall visits for both segments.

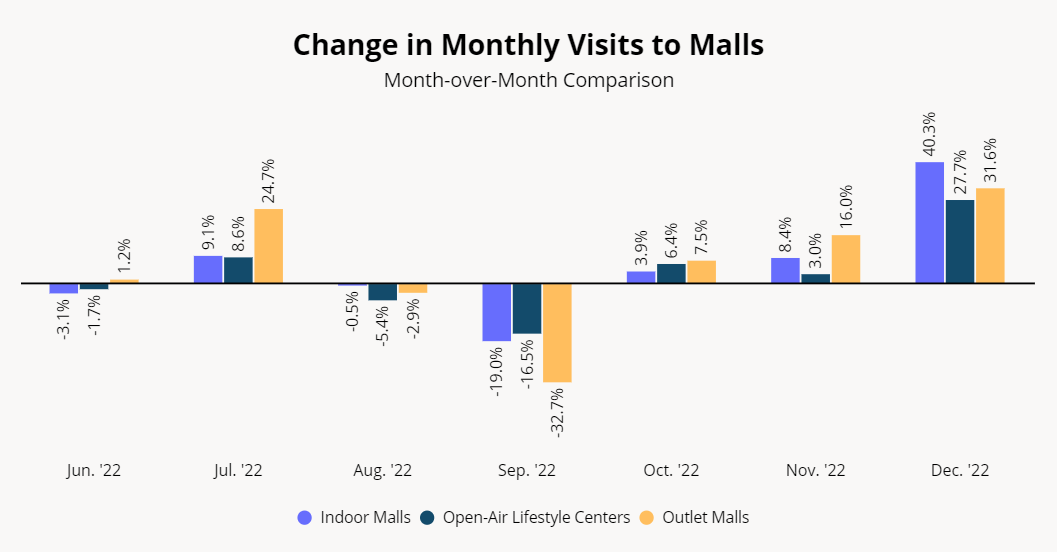

And the impact of these final weeks was indeed significant. Visits in December rose 40.3% for indoor malls compared to November visits while open-air lifestyle centers and outlet malls saw increases of 27.7% and 31.6% respectively month-over-month (MoM).

December’s relative is significant as the month marked the clear visit high points for all three segments – indicating the ongoing importance of the holiday season. Essentially, while the absolute visits declined, the relative importance of the holiday period to mall and retail visits remained hugely important.

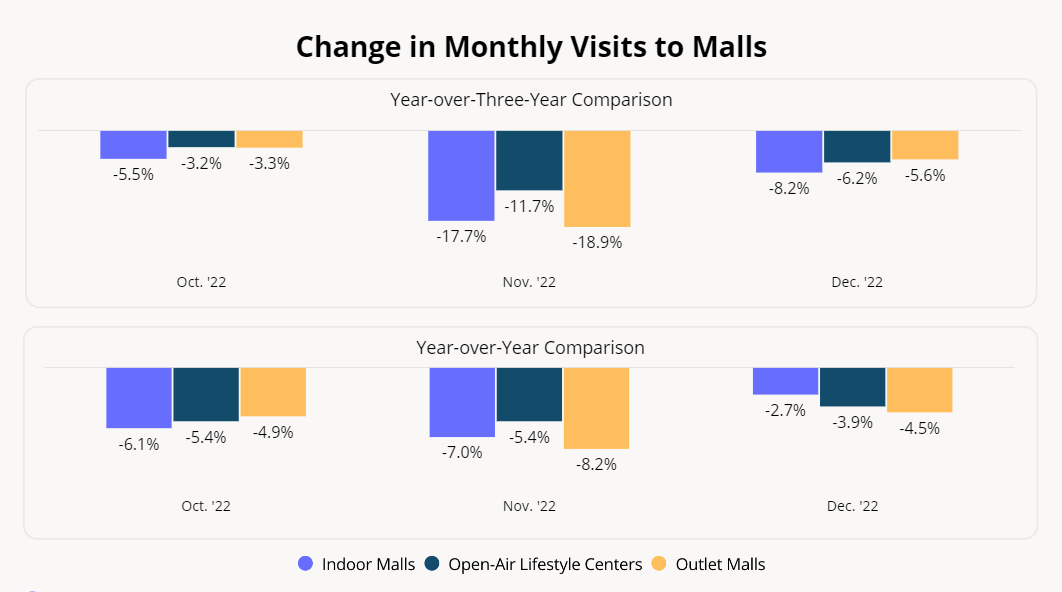

While the relative importance of this period remained, there were still visit declines in December. Visits for indoor malls, open-air lifestyle centers, and outlet malls were down 8.2%, 6.2%, and 5.6%, respectively, compared to pre-pandemic 2019 and down 2.7%, 3.9% and 4.5% YoY.

Yet, the declines – both YoY and compared to 2019 – shrunk in December when compared to November. Compared to 2021, there was a 4.3% decrease in the YoY visit gap for indoor malls between November and December, while open-air lifestyle centers and outlet malls saw their visit gaps shrink by 1.5% and 3.7%, respectively. And this relative improvement looks likely to continue - not to mention the boost considering returns could be higher than normal.

Foundation for a Strong Start to 2023

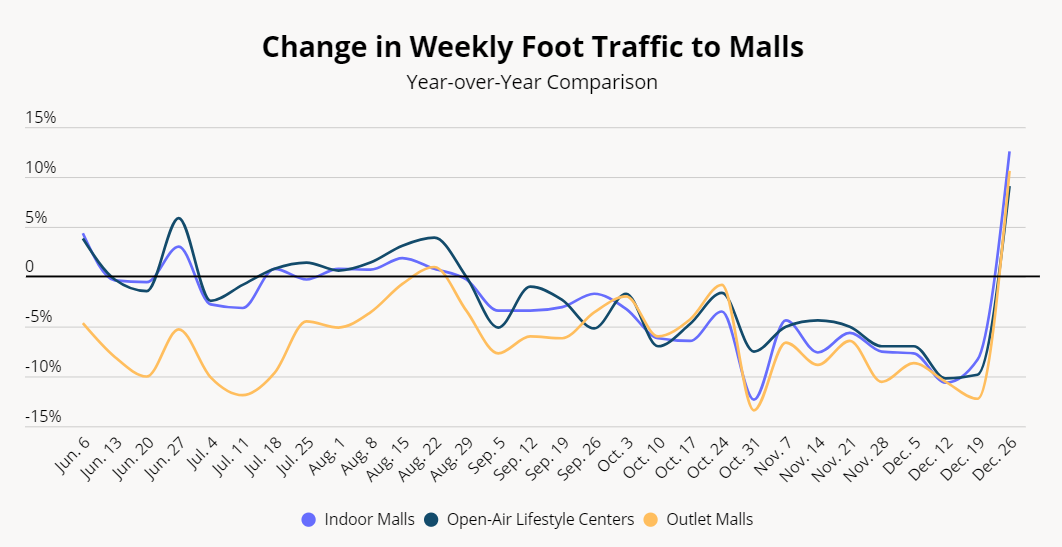

One of the key trends called out in our 2023 Retail Trends Forecast white paper was the potential for very strong YoY results in brick-and-mortar retail in Q1. This was due to the ongoing recovery, the potential for declining economic headwind effects and, most importantly, the comparison to an Omicron-hampered January and February of 2022.

The earliest results from 2023 indicate that this could be even more significant than expected. Visits the week beginning December 25th were up 12.3% YoY for indoor malls and up 9.1% and 10.6% for open-air lifestyle centers and outlet malls, respectively. The aforementioned factors alongside a Christmas week that featured a more extended shopping opportunity – the holiday itself fell on the weekend, meaning days off were on non-holiday days – combined to drive major visit jumps across these segments.

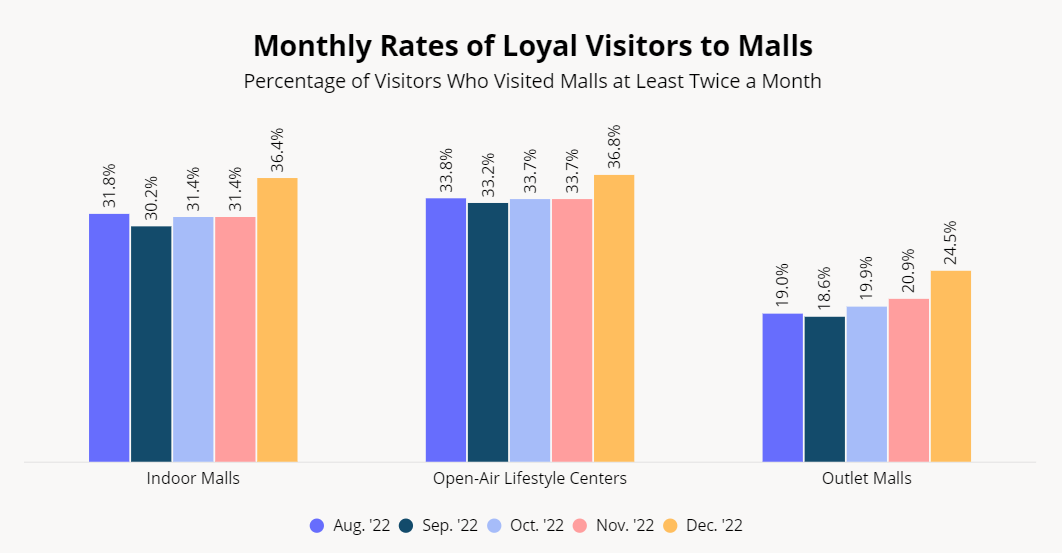

And it wasn’t just the visits, but the increases in repeat visits that grew. The clear effect was that audiences weren’t just shopping again, but were increasing their rate of visits, an incredibly positive sign amid lingering economic challenges.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.