Until recently, luxury shopping in the US was typically concentrated in cities such as New York and Los Angeles. But now, a shift is underway as new wealth centers emerge across the country, including Sunbelt states. We took a closer look at some of these markets to see how demographic changes are creating new retail opportunities and understand what may lie ahead for the brick-and-mortar luxury sector.

Luxury Outperforming Traditional Retail

The second half of 2022 saw many apparel retailers struggling. However, the luxury fashion market is displaying resilience in the face of a challenging retail climate. This success is likely driven by the relative imperviousness of high-income shoppers to the broader economic challenges many are experiencing. So while inflation is still having some impact on high-income consumers’ economic sentiment – which may be leading to a larger-than-expected drop in luxury retail foot traffic – high-income shoppers are still fairly insulated from inflationary concerns.

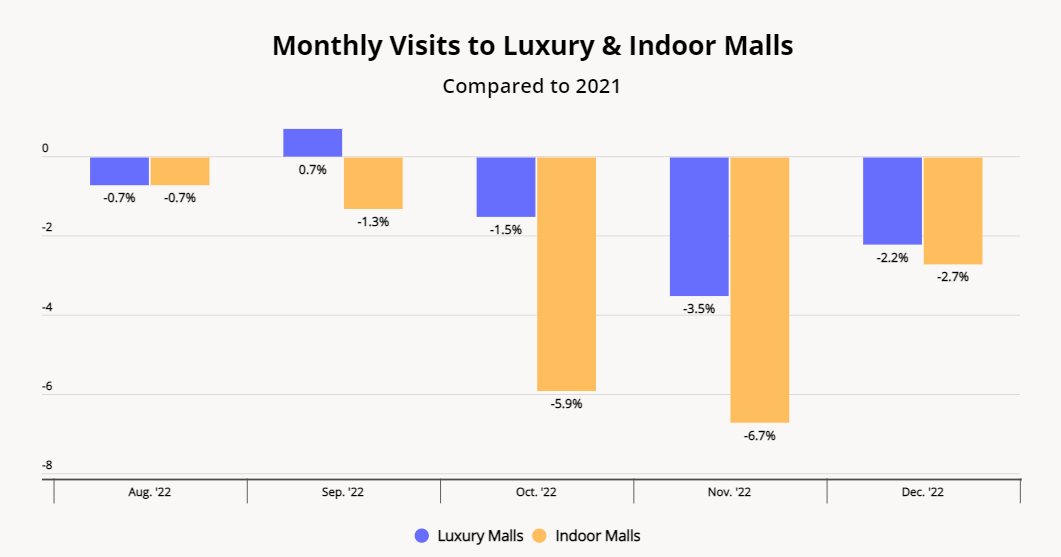

The resilience of luxury retail becomes apparent when looking at visits to luxury shopping malls (or malls and outdoor shopping corridors which consist of mainly high-end tenants) and traditional indoor malls as compared to 2021. Although – for the most part – both luxury and conventional shopping malls did not exceed their 2021 visit levels in H2 2022, luxury malls did outperform their non-luxury counterparts. Compared to regular indoor malls, luxury shopping malls saw year-over-year (YoY) growth of 0.7% in September 2022 and saw smaller visit gaps than their non-luxury counterparts every month of Q4.

Growing Luxury Regions

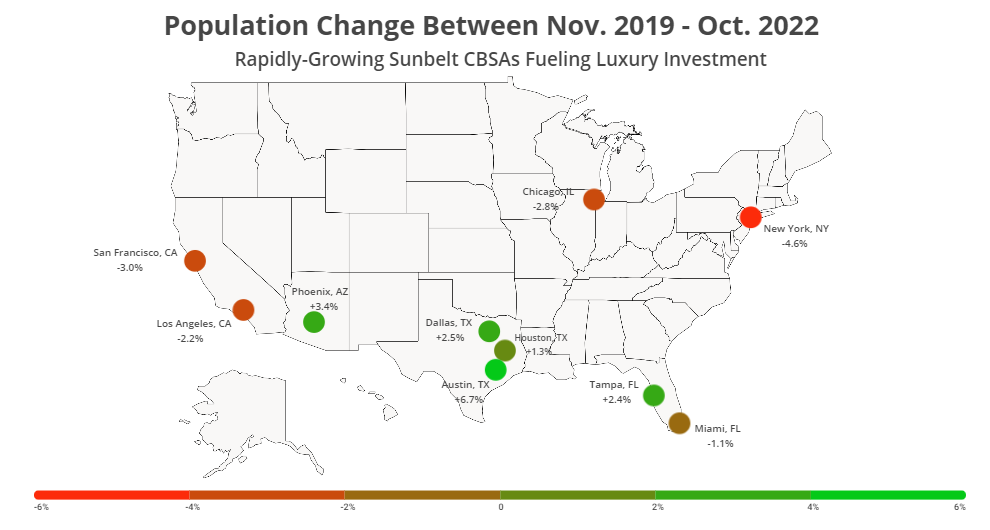

Looking forward to 2023, the category is likely to continue maintaining its edge thanks to the growth of non-coastal domestic markets for luxury goods. The pandemic saw a definitive shift in American migration patterns, with many relocating from wealth capitals such as New York, Los Angeles, and San Francisco to Sunbelt States like Texas, Florida, and Arizona, likely incentivized by lower housing costs and the strength of the hi-tech sectors.

These trends become apparent when comparing the population changes in major and emerging CBSAs (core-based statistical area) between November 2019 and October 2022. New York, San Francisco, Los Angeles, Chicago, and Miami all lost between 1.1% and 4.6% of their populations. Meanwhile, CBSAs like Dallas-Fort Worth, TX, Austin, TX, Tampa, FL, and Phoenix, AZ, all saw significant population growth.

Luxury retailers – many of which were already in these cities in a more limited capacity – are now following the population influx, opening locations and amplifying their presence in these growing cities. Hermès opened a store on Austin’s eccentric South Congress Avenue, and Dallas is becoming a designer fashion destination. Chanel opened a store in Nashville, and Scottsdale’s upscale Fashion Square boasts a wide array of designer brands, including one of the two men’s-only Gucci boutiques in the country.

Incoming Residents HHI and Origins

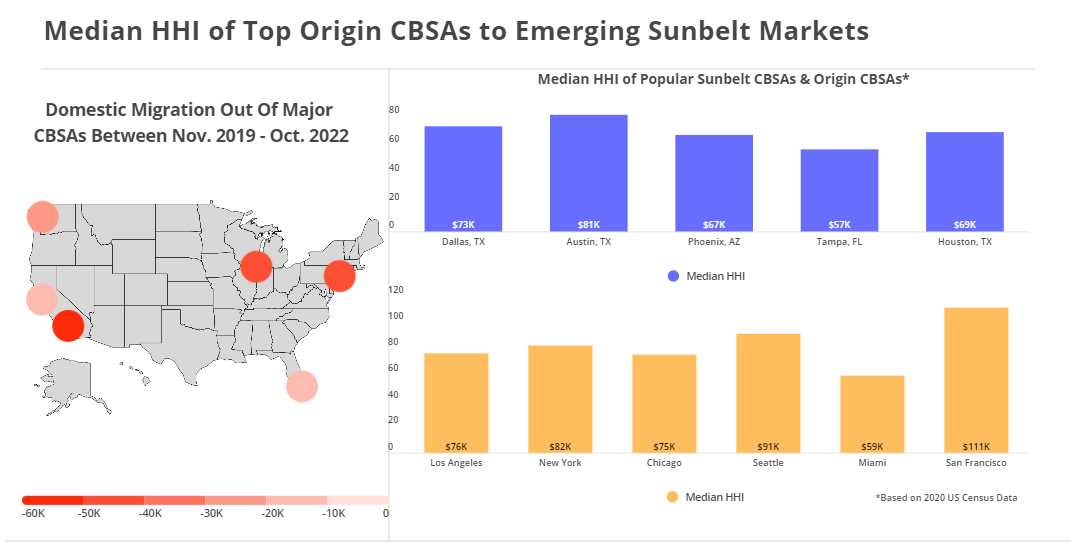

Digging deeper into the migration data suggests that not only are these Sunbelt markets seeing their population grow, but that the incoming population often come from areas with relatively high HHIs. This could mean that these new residents likely have a relatively higher spending power – a major reason so many brands are opening locations in these cities.

Many newcomers to these cities come from major metropolitan areas with higher median household incomes (HHI) than the median HHI in their destination cities. In fact, for the five rapidly growing CBSAs identified, the top migrators to those cities all came from areas where the median HHI was significantly higher than the destination HHI.

Dallas, TX, for example, with its median HHI of $73,000, saw an influx of new residents from Los Angeles ($76,000), New York ($82,000), and Seattle ($91,000). Austin, already on the wealthier side due to its strong tech sector, boasting a median HHI of $81,000/year, saw plenty of newcomers from San Francisco, median HHI of $111,000.

As these cities continue to attract new talent, business investments, and wealthy incomers, the luxury scene should continue to thrive.

Sunbelt Democratization of Wealth

The popularity of remote work and the exploding tech scene across the Sunbelt have allowed people to set down roots in areas that may have once been considered less economically powerful. As these regions continue to grow, and remote work enables high earners to set down roots wherever they want, these cities should continue to see demand for luxury retail continue growing.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.