Convenience stores (c-stores), once dismissed as uninspiring places to grab a quick cup of coffee or a sugar-laden snack, are re-inventing themselves as go-to, affordable places to shop, pick up tasty, ready-made meals, and splurge on low-cost treats. In the face of rising prices and shifting post-pandemic work routines – with more people working from home and commuting less often – this positioning has helped the sector sustain remarkable growth despite economic headwinds. While fewer customers may need to snag a donut on the way to the office, more seem to be on the hunt for cheaper ways to treat themselves – and for many budget-conscious consumers, c-stores have become an attractive quick service restaurant (QSR) alternative.

With 2023 upon us, we dove into the data to see how two leading convenience stores – Wawa and 7-Eleven – are adapting to meet consumers’ changing needs.

Wawa: A Rising Star in the C-Store Space

Founded in 1964 as an outlet for milk products from a family-owned dairy plant based in Wawa, Pennsylvania, Wawa – one of our 10 Top Retail Brands to Watch in 2023 – now boasts more than 950 stores across six states, including Pennsylvania, New Jersey, Delaware, Maryland, Virginia and Florida, as well as Washington, D.C.

With a devoted fan-base of regulars who just can’t get enough of Wawa’s welcoming environment and freshly-prepared food offerings, the chain recently ranked #12 on Forbes’ “Halo 100” – a list of the nation’s most beloved brands across industries. Wawa has also been expanding, with plans to grow its fleet to 1800 stores by 2030 and to enter the markets in additional states. Over the past couple of years, the popular c-store has experimented with new drive-thru dining formats and has built out its menu to include hamburgers and other dinner offerings.

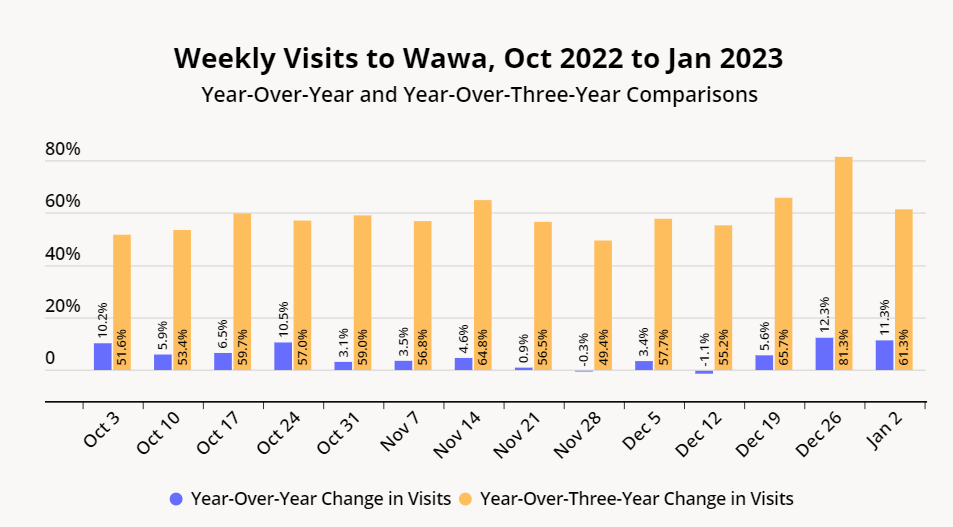

And this pivot to QSR has served the c-store well. Visits to Wawa exploded during Q4 2022, a trend that has continued into the new year. Despite Wawa’s strong 2021 performance, visits to the chain were up year over year (YoY: 2022 vs 2021) almost every week of the quarter. And year-over-three-year (Yo3Y: 2022 vs 2019) foot traffic increased even more, reaching a whopping 81.3% in December 2022. While some of the increase was undoubtedly fueled by the chain’s continued expansion over the past few years, the average number of visits per venue also increased by 41.4% between Q4 2019 and Q4 2022 – indicating that the chain’s expansion is meeting a ready demand.

Thank Heaven for 7-Eleven

With over 9400 stores across 38 states and territories, 7-Eleven is America’s largest convenience store chain. And like Wawa, the Slurpee giant has also been making inroads into the QSR space.

Since 2019, 7-Eleven has opened nine enhanced “Evolution” venues, which offer in-store restaurants, premium products like cigars, craft beers, and wine cellars. The stores, which are customized to meet the needs of local communities, also serve as testing grounds for new products. In 2021, the chain opened its first dining drive-thru, where customers can grab a Slurpee or a Laredo Taco on the go. In addition, the chain has expanded its food offerings in stores across the country. And, of course, 7-Eleven – ranked by YouGov as America’s most popular grocery store for Q3 2022 – continues to fill its role as a prime neighborhood supermarket, where people can pick up milk, eggs, and other staples.

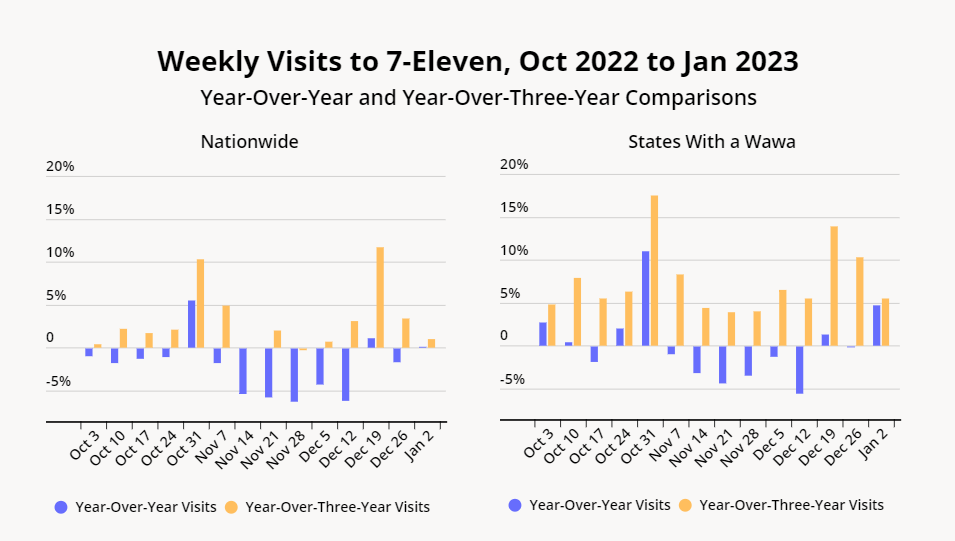

And 7-Eleven has also been on a growth trajectory. The company’s strong 2021 performance makes for a tough YoY comparison, but during most weeks since October 2022, visits to the c-store have outpaced pre-pandemic levels. For a behemoth with such a vast geographical footprint, this overall level of visit growth is remarkable. And when zooming in on the six states which also boast a Wawa, the growth is more impressive still – with Yo3Y visits up between 3.9% and 17.5% throughout the entire period.

Given the scale of 7-Eleven’s growing reach, it should come as no surprise that the company has begun dipping its toes in retail media, debuting its new Gulp Media Network in October 2022, and noting plans to explore in-store media partnerships in the near future.

The Slurpee Effect?

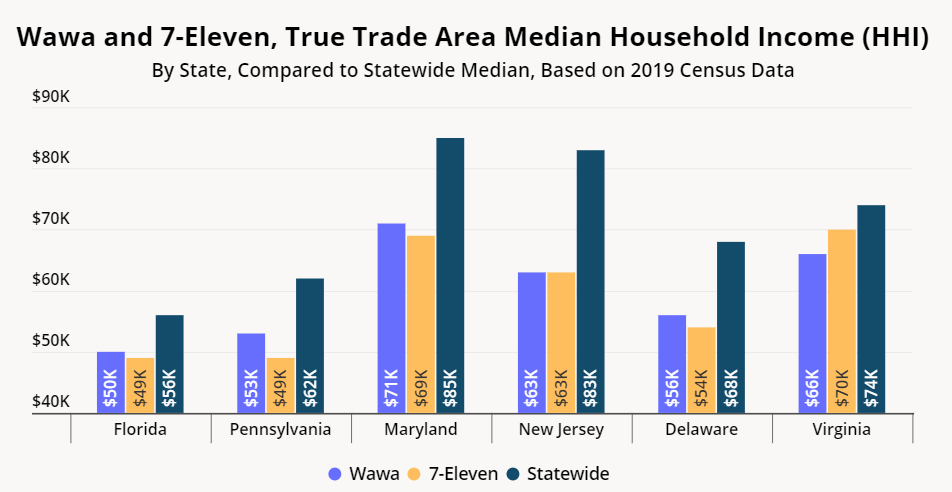

A glance at the demographics served by the two c-store giants may help explain why their positioning as affordable one-stop venues for both grocery items and cheap eats has proven to be so successful. Zooming in on the six states which have both Wawas and 7-Elevens, we compared the median household incomes (HHIs) of the chains’ Q4 2022 true trade areas with statewide baselines. And in all six states, the median HHI of the c-stores’ trade areas was significantly lower than the statewide median – meaning that the two chains’ target audiences tended to be less affluent.

At a time when inflation is leading many consumers to tighten their purse strings and trade down, people with lower incomes may be particularly reluctant to splurge on eating out or even to make big grocery hauls. But even in trying economic times, ready-made food fills an important need for families, regardless of their income. And c-stores – which offer the full panoply of essential grocery items, low-cost prepared food, and treats that make people smile, are especially well-positioned to fulfill that need. As the traditional QSR sector continues to struggle to return to pre-pandemic visit levels, 7-Eleven and Wawa may also be enjoying a “Slurpee effect” – the culinary equivalent of the “lipstick effect,” where money-strapped consumers seek out low-cost discretionary items to splurge on.

An All-Day Affair

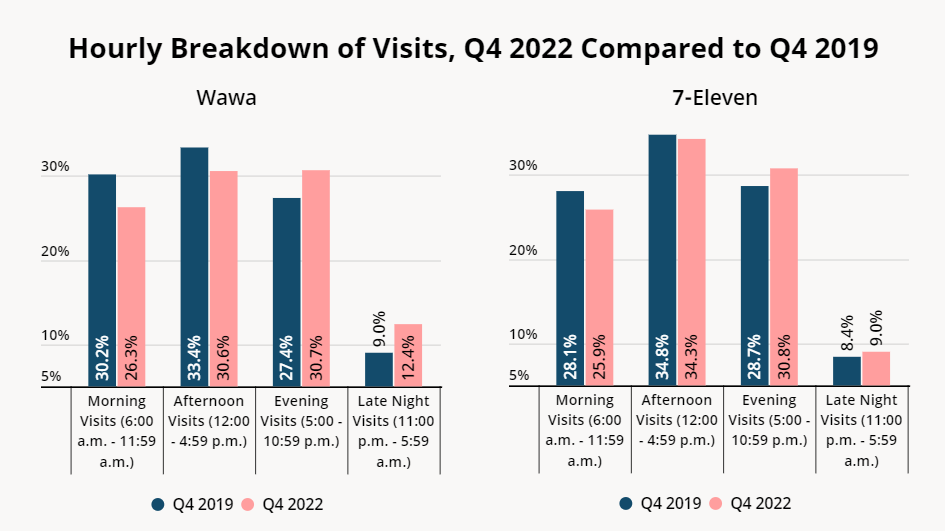

The expanding roles of c-stores like Wawa and 7-Eleven – as one-stop places to shop, eat, and indulge throughout the day – also appears to be reflected in hourly visitation patterns to the two chains.

Before the pandemic, foot traffic to both Wawa and 7-Eleven peaked during the morning and afternoon, as busy commuters made pit stops on their way to the office or looked for a cheap and convenient place to grab lunch during their workday. But while the majority of visits to the two c-store giants still take place early- and mid-day, the past three years have seen a distinct shift towards evening and night time visits. In Q4 2019, 30.2% of Wawa visits took place between 6:00 AM and 11:59 AM, and another 33.4% took place between 12:00 PM - 4:59 PM. But in Q4 2022, these foot traffic shares dropped to 26.3% and 30.6%, respectively. At the same time, the share of evening visits to Wawa increased from 27.4% to 30.7%. A similar, if less marked, trend can be observed for 7-Eleven. As both chains increase their dinner offerings and lean into QSR, this shift may become even more pronounced moving forward.

Key Takeaways

As food prices continue to soar, customers will likely continue to flock to c-stores in search of cheap eats. And Wawa and 7-Eleven, both of which are doing a good job of meeting customers where they are, appear poised to remain ahead of the curve.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.