With the announcement of Macy shuttering some additional stores in 2023, we dove into the location intelligence data to understand the rationale behind the brand’s store fleet optimization strategy.

Macy’s Long-Term Rightsizing Bet

Macy’s first announced its Polaris transformation strategy in February 2020 – a month before COVID-19 upended the brick-and-mortar retail landscape. The three-year plan involves closing 125 stores – mostly in malls or in underperforming locations – along with opening smaller, stand-alone venues, revamping the brand’s loyalty program, and ramping up investment in private labels.

This year marks the third and final year of Polaris. As part of its store fleet diversification efforts, the company has already opened several smaller, off-mall locations, dubbed Market by Macy’s, that offer a more curated product selection. The brand also launched a Macy’s Backstage discount concept in more than 300 Macy’s stores nationwide and in nine freestanding locations as of January 2023. And now, Macy’s is also shuttering four mall-based stores in early 2023 in Colorado, California, Maryland, and Hawaii as part of the final stretch of closings.

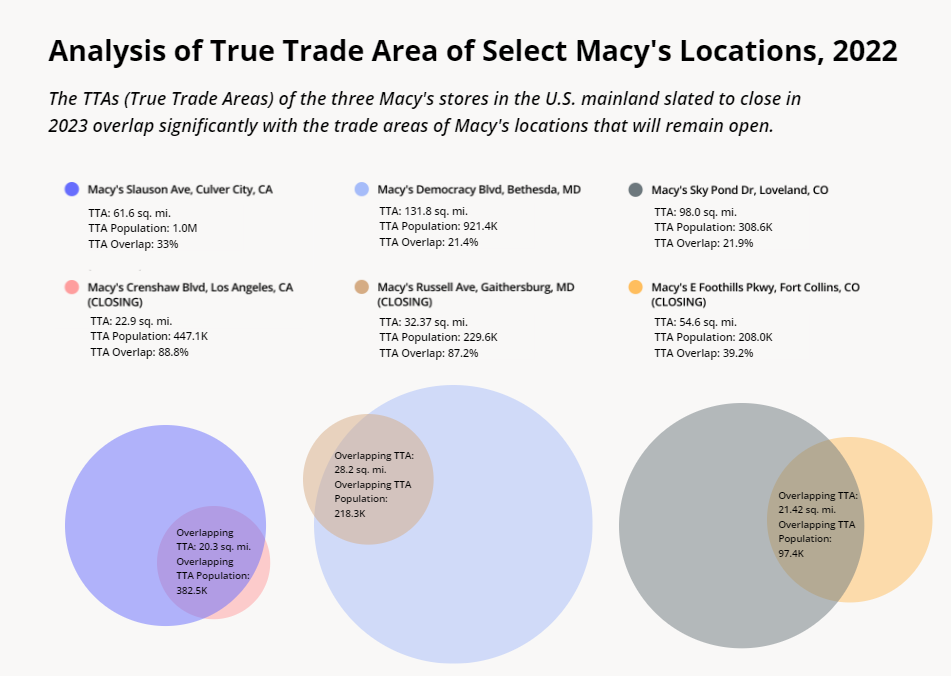

Analyzing foot traffic metrics to some of the Macy’s stores slated for closure this fall sheds some light on the rationale behind the company’s significant rightsizing push. Comparing the True Trade Areas of the three soon-to-be closed mainland U.S. Macy’s stores (excluding Hawaii) reveals that all three locations had significantly smaller trade areas than the nearest Macy’s store that will remain open. And in all three cases, the trade area of the Macy’s store slated for closure also exhibited significant overlap with the trade area of the Macy’s store remaining open.

This data indicates that the Macy’s stores slated for closure attract a relatively small visitor base, and that many of these visitors will continue to have access to the brand’s stores through the nearby Macy’s location that will remain open. So by closing these stores, the company can significantly cut its overhead while still serving many of the shoppers currently served by the closing stores.

Store Fleet Optimization Paying Off

While current closures are carried out as part of its three-year Polaris plan, the brand has been working on reducing its store fleet long before 2020. Already in 2016, the company announced plans to increase e-commerce investment and shutter 100 stores – 15% of the brand’s fleet at the time – with most of the closures taking place in 2017 and continuing in 2018 and 2019. According to Macy’s CEO, Jeffrey Gennette, the company has closed 170 stores since 2016, which means that Macy’s of 2023 is operating a much more streamlined physical footprint than it was a couple years ago.

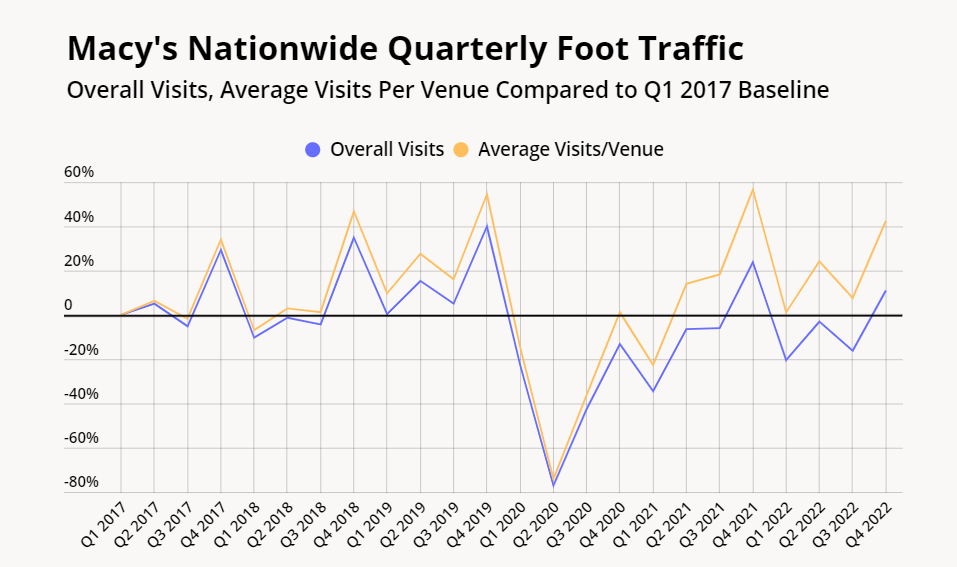

Comparing overall visits to Macy’s nationwide with the average number of visits per venue between Q1 2017 and Q4 2022 reveals the impact of the company’s rightsizing bet. Since Macy’s began closing stores, average visits per venue growth has been outperforming overall visit growth: In Q4 2019 – the last full pre-pandemic quarter – nationwide visits were 39.8% higher than in Q1 2017, while average visits per venue were 54.5% higher in the same period. And since the wider post-COVID retail reopening in Q2 2021, the average visits per venue for the chain have consistently exceeded the Q1 2017 baseline, while overall visits remained lower than the baseline for much of the period.

This indicates that while the store closures have impacted overall visit numbers – after all, fewer stores also mean fewer venues to attract visitors – the rightsizing has also improved the overall efficiency of the chain’s store fleet. The increase in average visits per venue indicates that at least some consumers who used to visit the now-closed venues have continued to patronize the brand by visiting Macy’s stores that stayed open, driving up visits to the remaining Macy’s locations. In other words, location intelligence reveals that Macy’s long-term store optimization has yielded a more economical physical footprint consisting of fewer stores with a wider reach.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.