Off-price apparel was a notably resilient segment during the pandemic, with the major players even expanding their physical retail presence over the past couple of years. Now that inflation has replaced COVID as the major challenge facing retail, we dove into the data to see how the segment is performing and what might lie ahead in 2023.

Year-Over-Year Improvements

When we last checked in on the off-price segment, there was some concern that a holiday season marked by a wealth of promotions would cut into off-price’s market share. But through a holiday retail landscape characterized by high, if stabilizing inflation and cautious consumer sentiment, off-price seems to have exceeded all expectations.

The space is dominated by four retailers – T.J. Maxx, Marshalls (both owned by parent company TJX Companies), Burlington, and Ross Dress for Less– with rising players like Citi Trends are growing in popularity. All five chains had a strong 2021, with monthly visits consistently exceeding pre-pandemic levels – which makes comparing the 2022 holiday season to the previous year’s holiday season difficult.

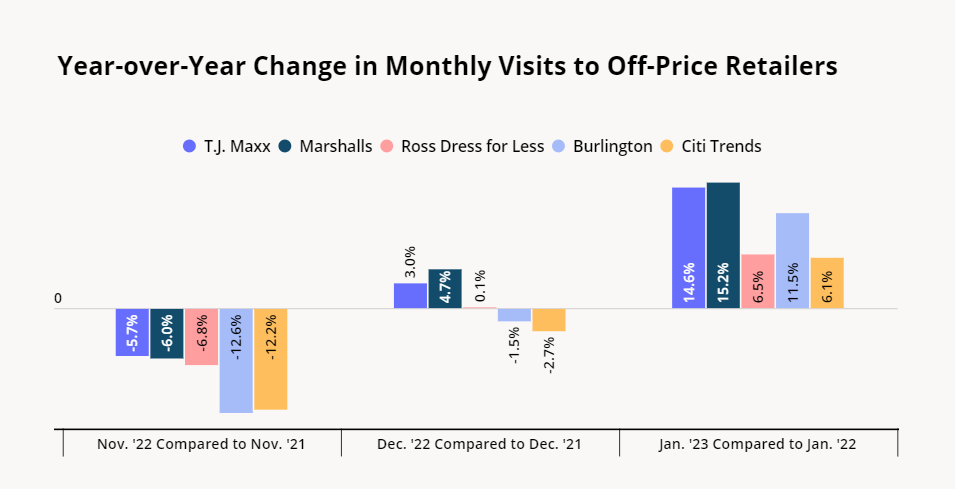

But despite the strong 2021 benchmark, visit data shows that the off-price sector still managed once again to draw in the crowds. Although November 2022 saw the typical visit gaps that characterized much of 2022, that trend shifted in December, just in time for the main holiday rush. During the last month of 2022, foot traffic to T.J. Maxx, Marshalls, and Ross grew by 3.0%, 4.7%, and 0.1% relative to December 2021, respectively, while visit gaps to Burlington and Citi Trends narrowed to 1.5% and 2.7%. This December growth is notable given its comparison to an unusually strong 2021 and the concerns that off-price retail wouldn’t be able to compete with steep sales from other chains.

By January 2023, all chains saw positive year-over-year (YoY) foot traffic growth – T.J. Maxx, Marshalls, Ross, Burlington, and Citi Trends saw growth of 14.6%, 15.2%, 6.5%, 11.5%, and 6.1%, respectively, relative to 2022. And while some of the increase is likely due to a muted Omicron-impacted January 2022, the data is also likely a reflection of off-price apparel’s attraction in times of economic uncertainty and a good omen for the sector’s potential in 2023.

Year-Over-Three-Year Stabilization

And while many off-price chains managed to finish 2022 on a strong note, the sector’s strength becomes even more apparent when comparing off-price visits to pre-pandemic levels. Although the segment did see a slight downturn in visits in November 2022 – likely due to last year’s limited Black Friday performance across retail categories – December visits exceeded 2019 levels for all brands analyzed, with year-over-three-year (Yo3Y) visits up 8.0%, 6.0%, 3.9%, and 6.5% for T.J. Maxx, Marshalls, Ross, and Burlington, respectively. Meanwhile, Citi Trends continued to reap the benefits of its aggressive expansion, with December 2022 visits to the chain 19.3% higher than in December 2019.

The positive Yo3Y visit trend continued in January 2023, with monthly traffic to all chains analyzed up relative to January 2020, as the segment continued proving its resilience and its ability to withstand a range of retail challenges from the pandemic to the ongoing rise in inflation.

Visits and Visitors on The Rise

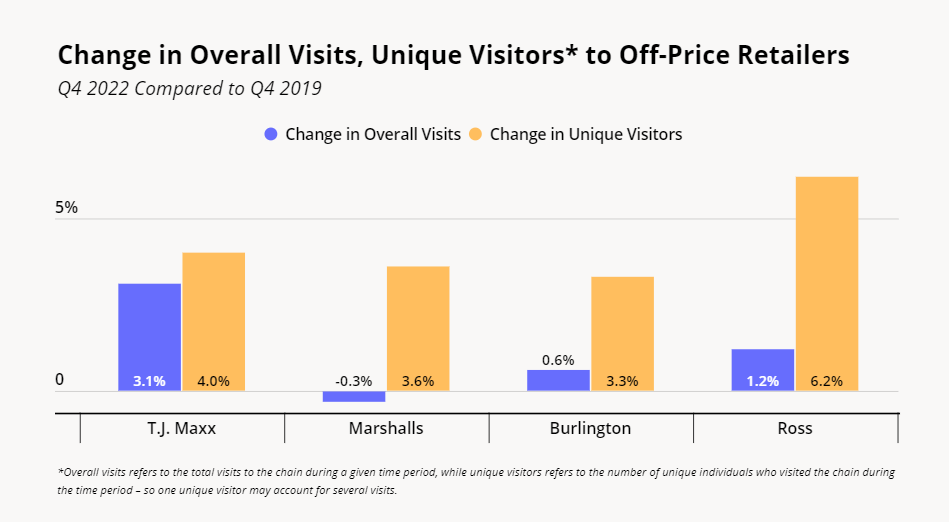

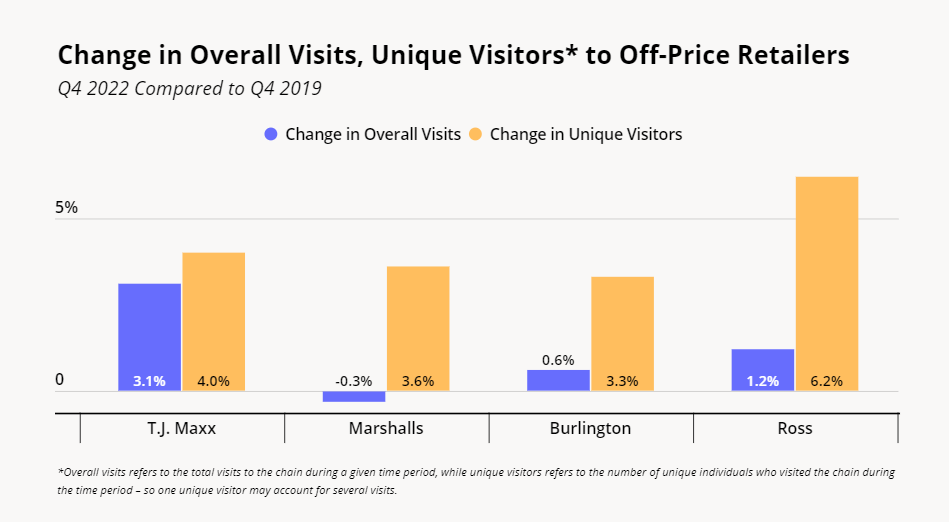

And it’s not just overall off-price traffic that is up – the number of unique visitors to off-price chains has also grown. Between Q4 2022 and Q4 2019 all four leading off-price chains saw a significant increase in unique visitors (how many individuals visited a chain during the quarter, regardless of the number of visits per person) that exceeded the Yo3Y growth in total visits. This indicates that the Yo3Y increase in off-price visits is due to more individuals visiting off-price stores, which means that the off-price sector has successfully widened its appeal in recent years and is reaching a larger number of potential customers.

The increase in unique visitors could be due to inflation-weary consumers’ trading down behavior – and it could also indicate that the chains’ expansions are successfully helping them reach new audiences.

Indeed, it is perhaps this strength that is empowering these chains to double down on their expansion plans. TJX Companies announced plans for a 1.6 million square foot fulfillment center in Texas in 2020, likely hoping to increase its digital fulfillment online shopping capabilities in an increasingly omnichannel world. Meanwhile, Ross opened 40 new stores in the past year, and Citi Trends, keeping in track with their CTx remodel plan, is also well on the way to opening more stores in 2023.

Thriving Despite it All

The positive traffic trends highlight off-price’s promise in the current economic climate. The sector was on the upswing before the pandemic, and despite the obvious challenges posed by lockdowns, the period was hugely successful for the segment. Now, a year after the last COVID surge and as many consumers continue to pull back on spending, off-price is proving it can not only withstand the challenges but thrive despite them.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.