Does Valentine’s Day make you nervous? It may, especially if you’re planning a memorable romantic get-together with that special someone that hits all the right notes. It may also make you nervous if you’re a retailer, especially one that specializes in traditional Valentine’s Day gifts like flowers and jewelry.

As a retailer, you’ve only just made it past the December holiday shopping season, and now you’re facing another holiday that poses the same uncertainties: How will inflation and other economic factors affect consumer behavior and my sales this February?

To determine whether retailers are likely to find Valentine’s Day 2023 rosy or thorny, Envestnet® | Yodlee® looked at seasonal spending going back to 2019, before COVID, to discover trends in such romance-relevant sectors as flowers, greeting cards, jewelry, dating services, fine dining, and alcohol. They also looked at spending in these sectors through 2022. And they looked at the average transaction amount for each of these sectors, to track the change in price over the past four years of pulling out all the stops on Valentine’s Day. The resulting report may offer retailers some insight as to how much Cupid-conscious consumers are likely to spend this Valentine’s Day.

Jewelry

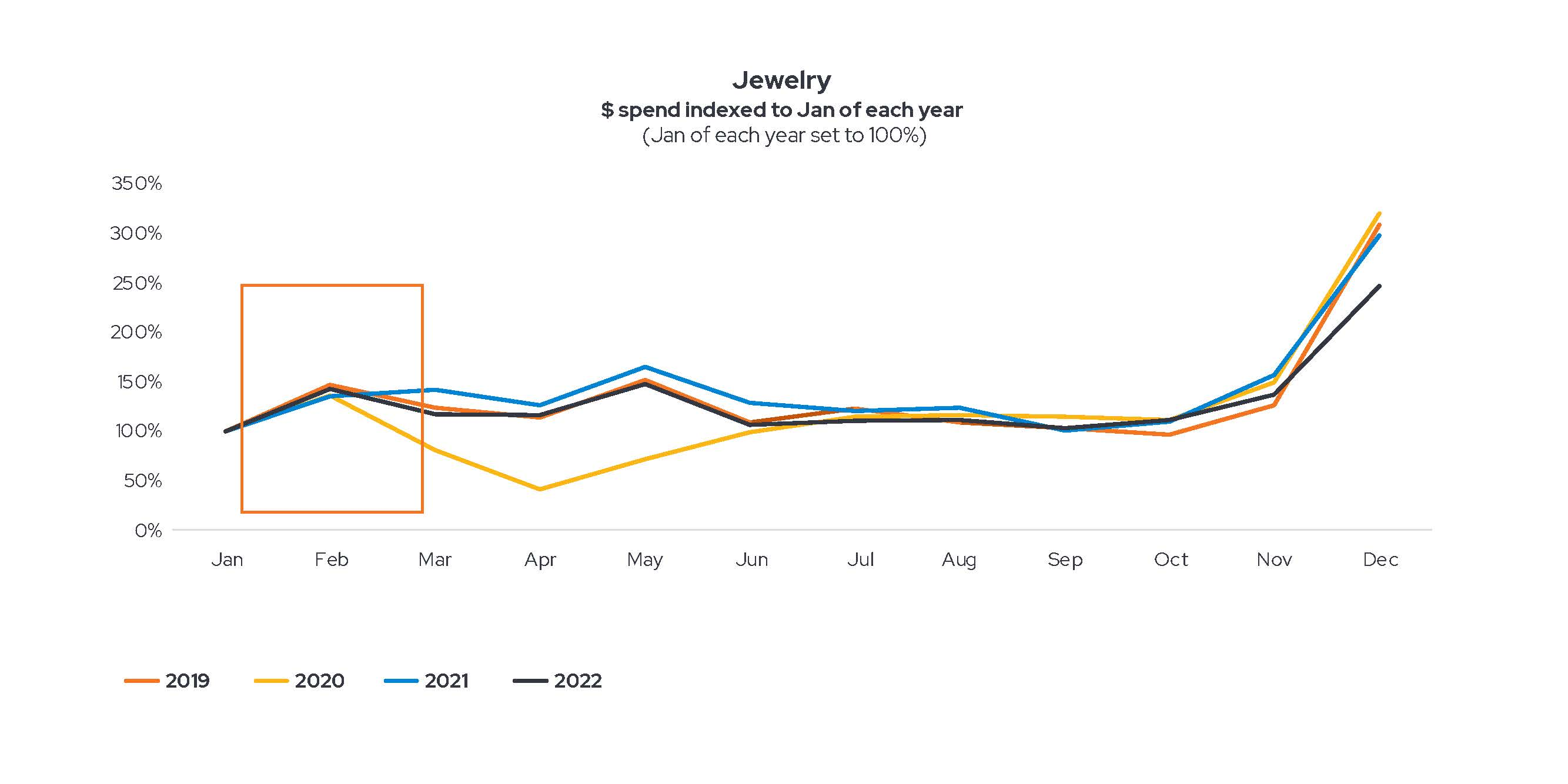

Jewelry spending is seasonal, typically spiking at three times of the year: Valentine’s Day, Mother’s Day, and the December holidays.

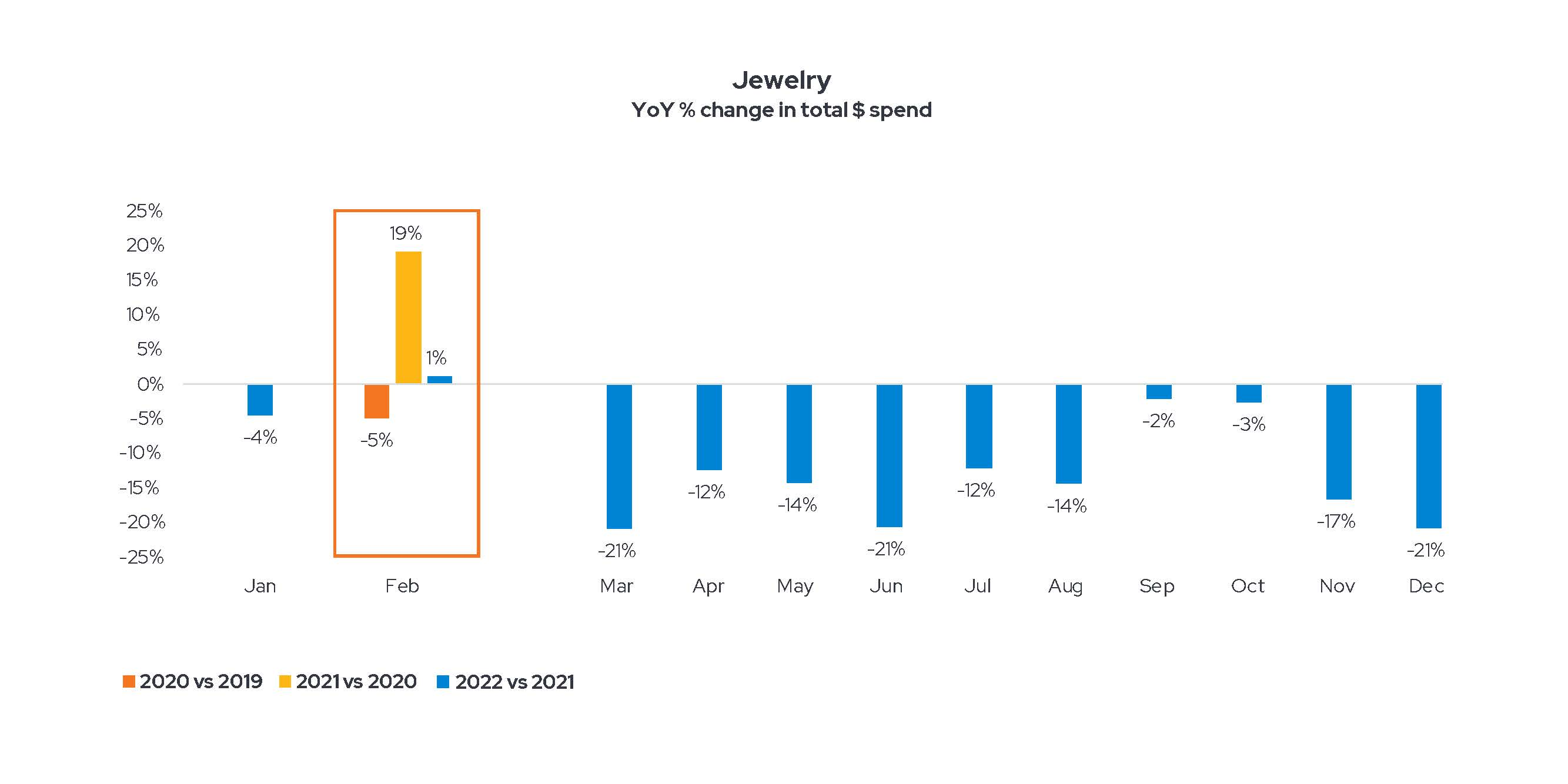

In terms of year-over-year spending, however, sales dropped in February 2020, as COVID began to make its impact felt. Spending jumped the following February as vaccinations began, and as a result, in 2022, it began to level off. For the past year, sales have continued to fall below 2021 levels. Industry insiders say demand has dropped because of inflation and because rising travel costs have cut into discretionary spending on jewelry and other luxury sectors.

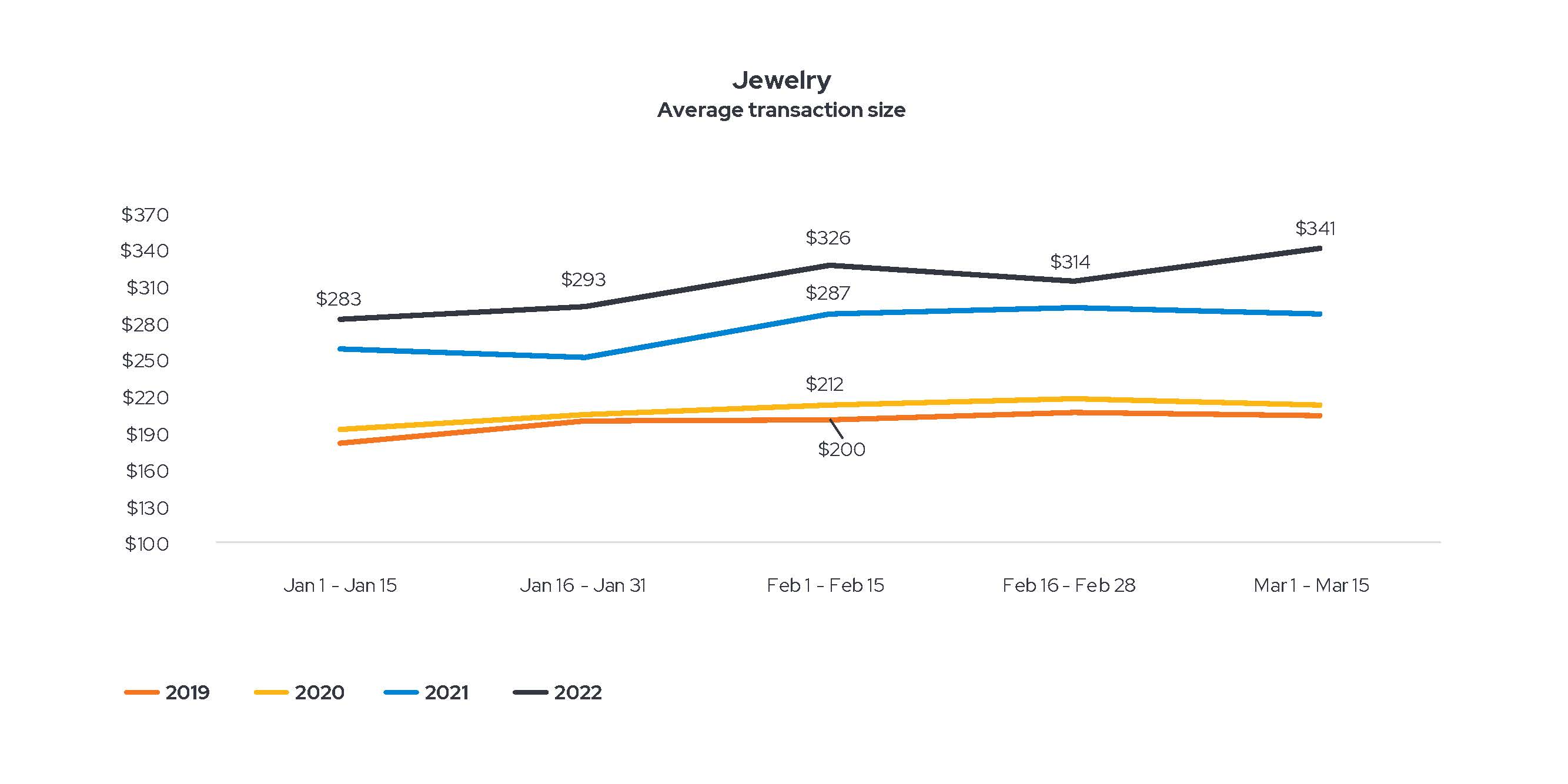

Nonetheless, jewelry consumers are spending more every winter on each transaction.

Given those trends, jewelers may expect to see higher average transaction sizes but not greater overall spending.

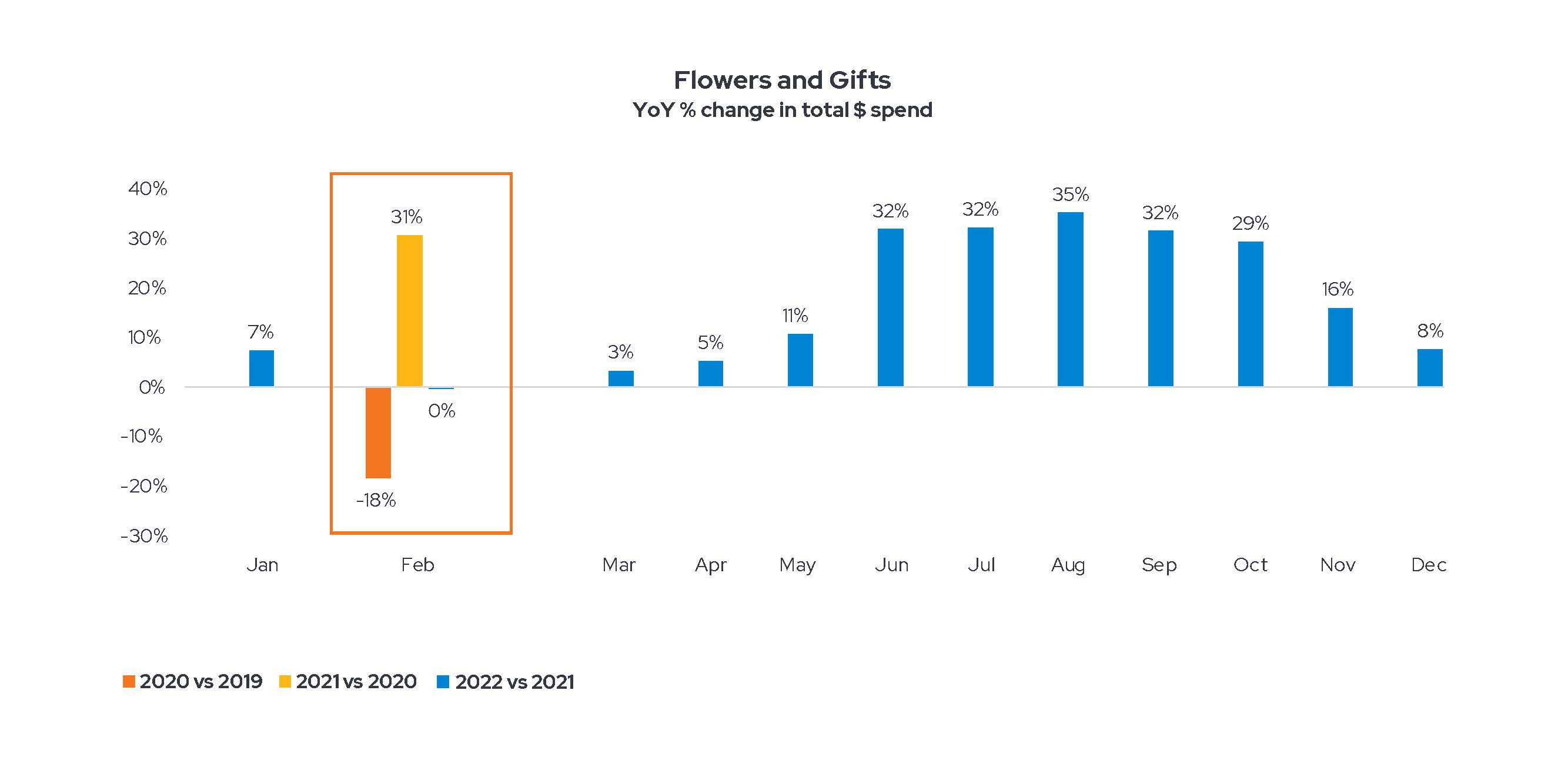

Flowers and Gifts

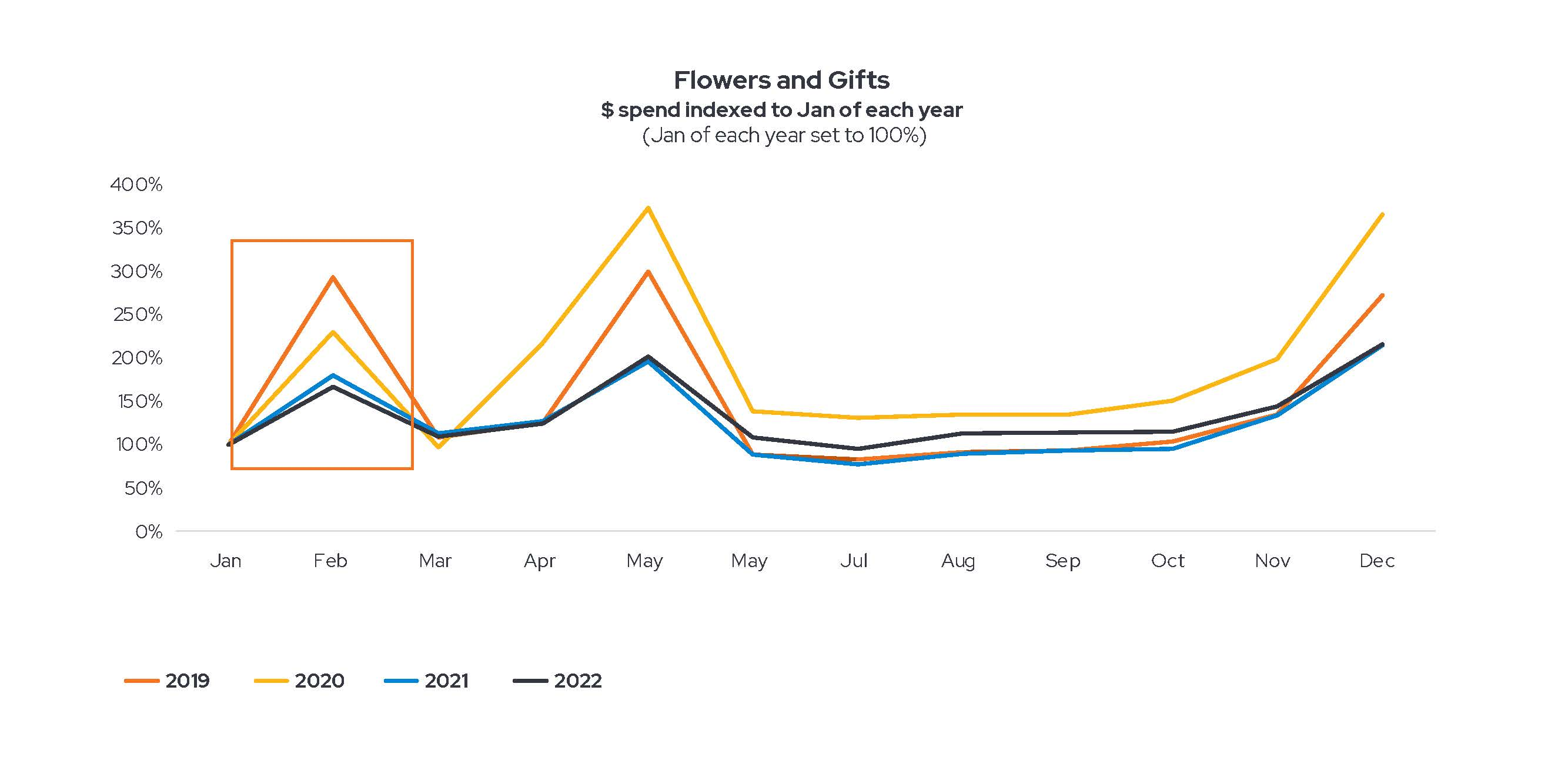

As with jewelry, spending in the flower business tends to spike at the same three times of the year.

And like jewelry, the sector saw a dip in February 2020, a big comeback in February 2021, and a plateau last February.

Unlike jewelry, however, year-over-year spending has been strong for florists throughout 2022, even with rising prices. Given the florist industry’s robust sales, confirmed by Envestnet | Yodlee data, there seems to be a good chance that those proclaiming their love this Valentine’s Day will say it with flowers.

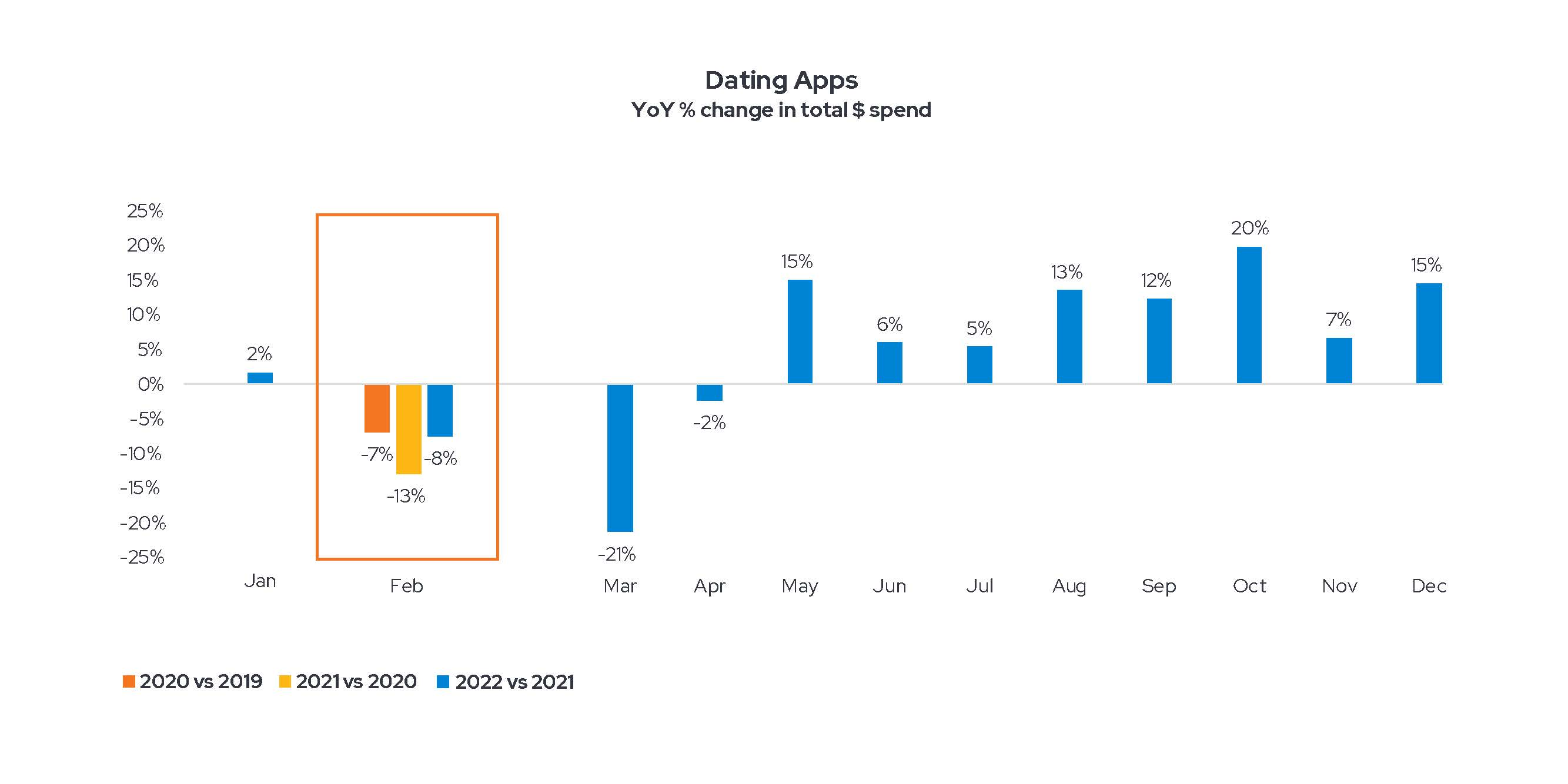

Dating Apps

As you might expect, year-over-year spending on dating apps has been low in recent Februarys, since people weren’t getting out much.

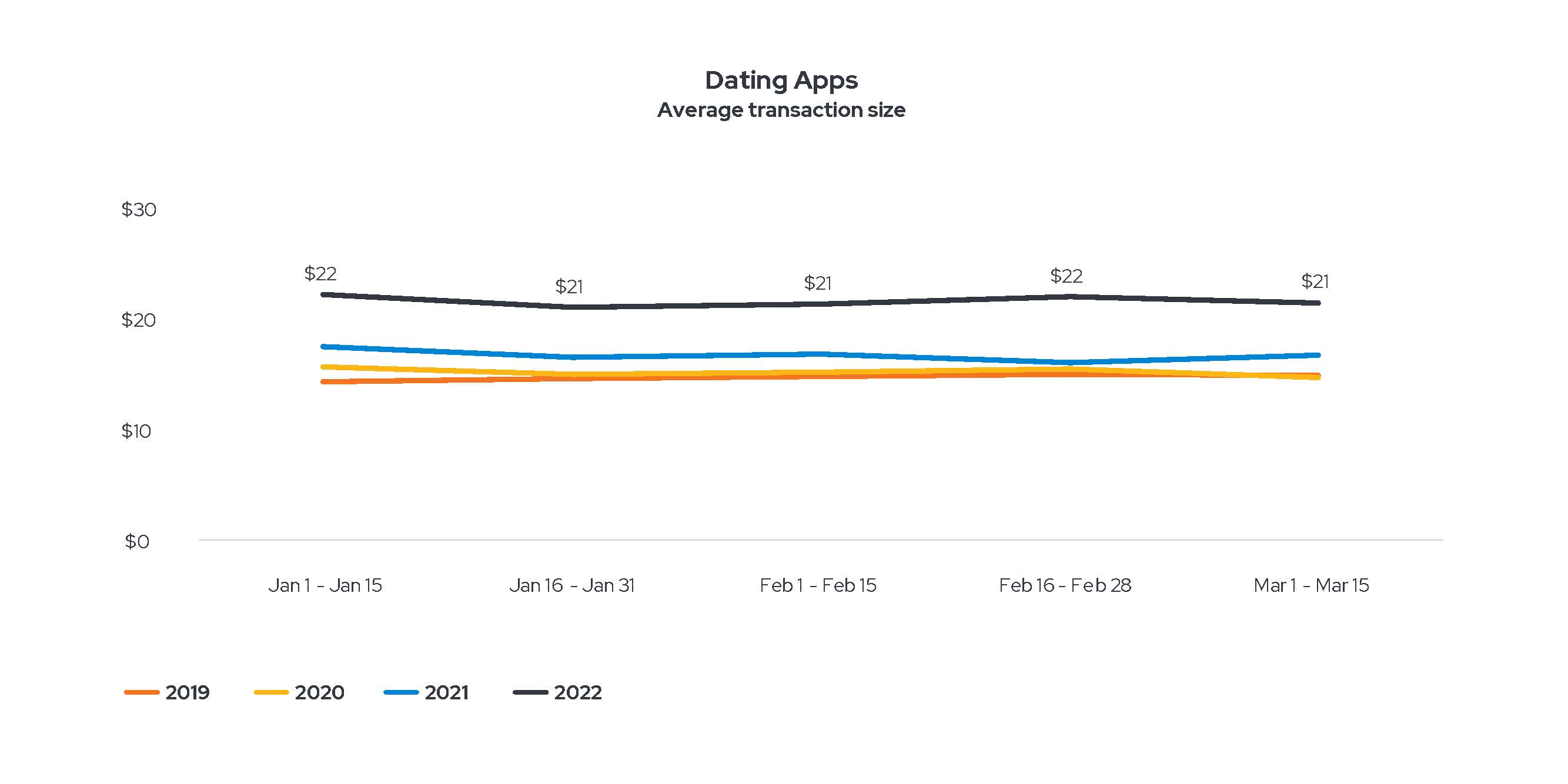

Nonetheless, year-over-year spending on dating apps began to pick up in May and has been strong ever since. 2022 saw spending rise for dating apps Bumble and Hinge, though those revenues came at the expense of market share leader Tinder. But there’s no indication, based on Envestnet | Yodlee data, that single folks spend more money on dating apps during February than at other times.

Envestnet | Yodlee data here seems to align with common sense. If you don’t have a Valentine’s date by February 1st, you’re probably not going to start suddenly swiping right on Groundhog Day just so you’ll have someone to spend the 14th with.

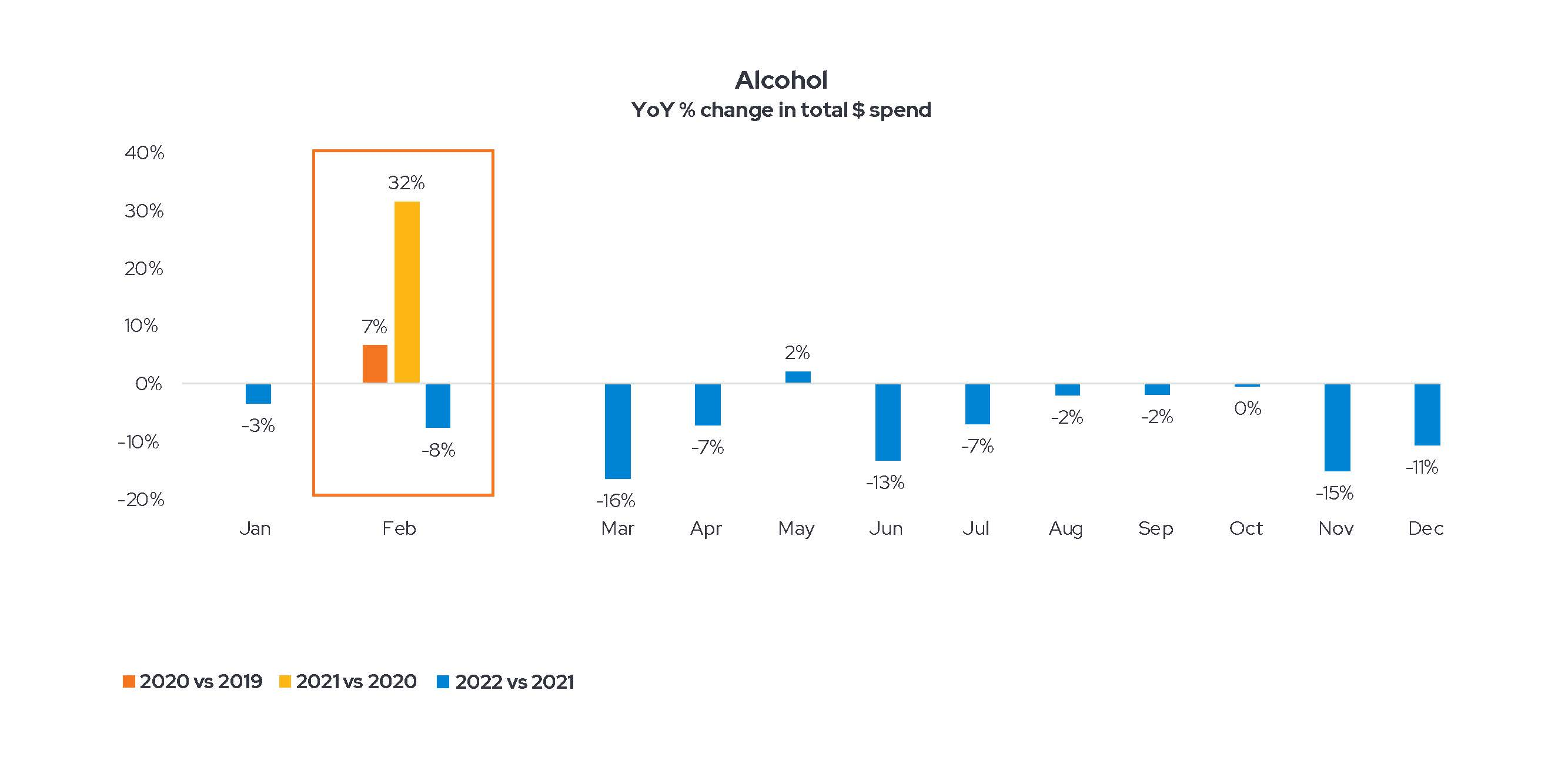

Alcohol

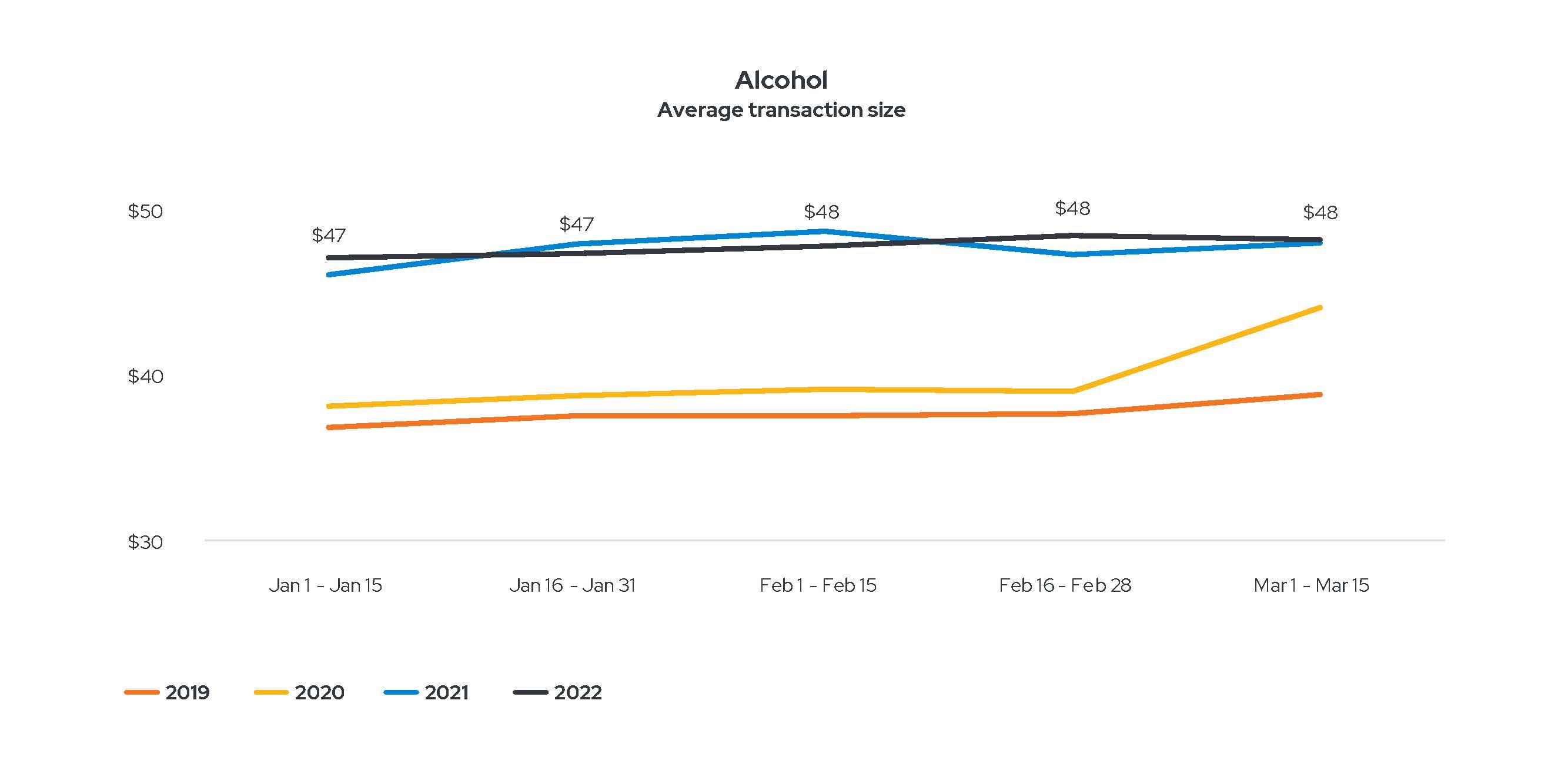

You might expect people to spend more on wine and spirits in February, but they don’t. Based on Envestnet | Yodlee’s analysis, seasonal spending at the liquor store doesn’t really pick up until St. Patrick’s Day a month later. The March celebration is traditionally one of the two biggest days of the year for alcohol purchases, along with Independence Day.

What’s more, year-over-year spending has been weak for the last 13 months. Inflation may be a culprit, with alcohol prices rising since (Envestnet | Yodlee data shows the average transaction size at liquor stores jumped 26% between February 2020 and February 2021) and with consumers having less cash available for discretionary spending.

Whatever the cause, it seems there won’t be much toasting among alcohol retailers this Valentine’s Day.

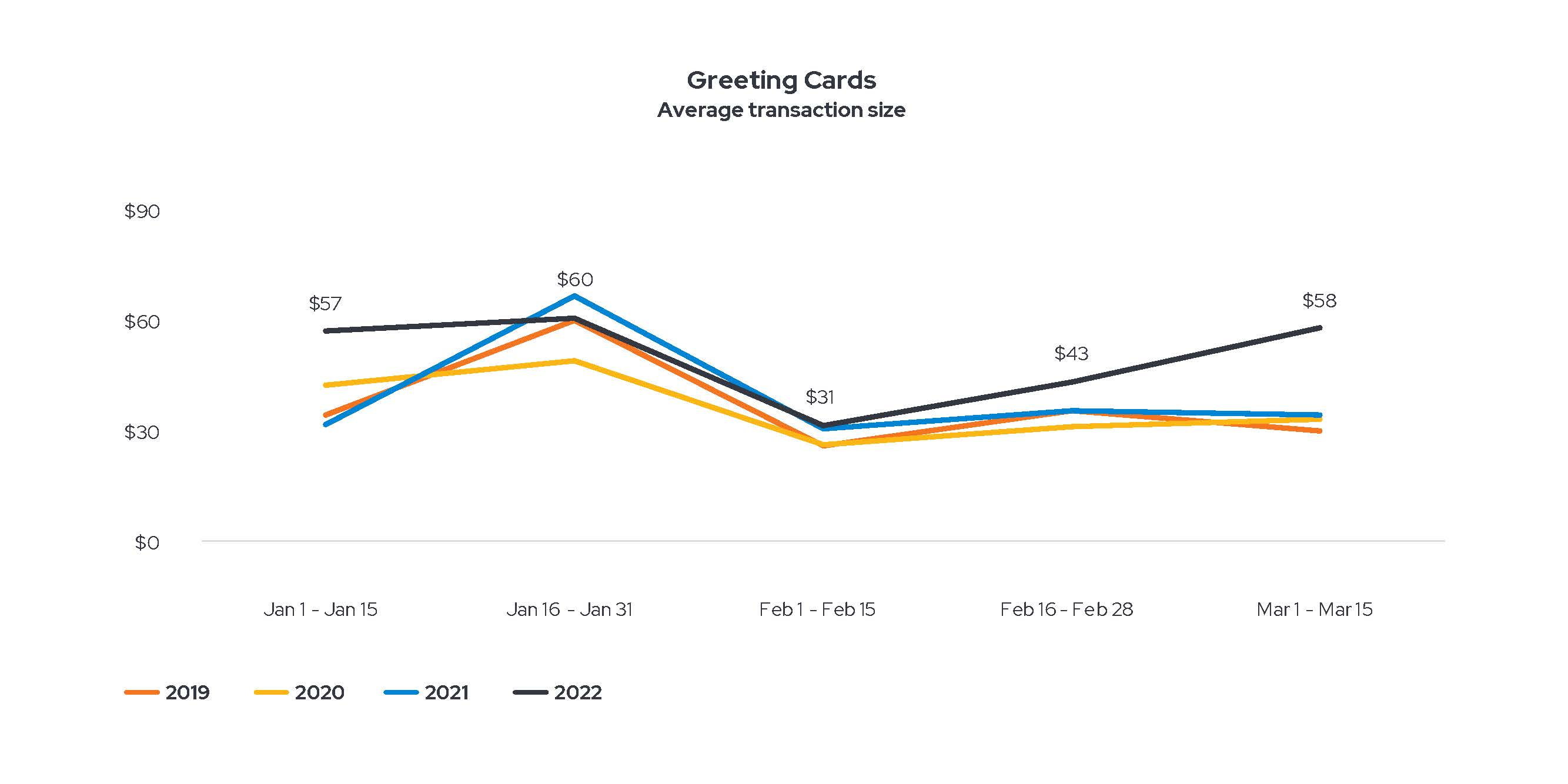

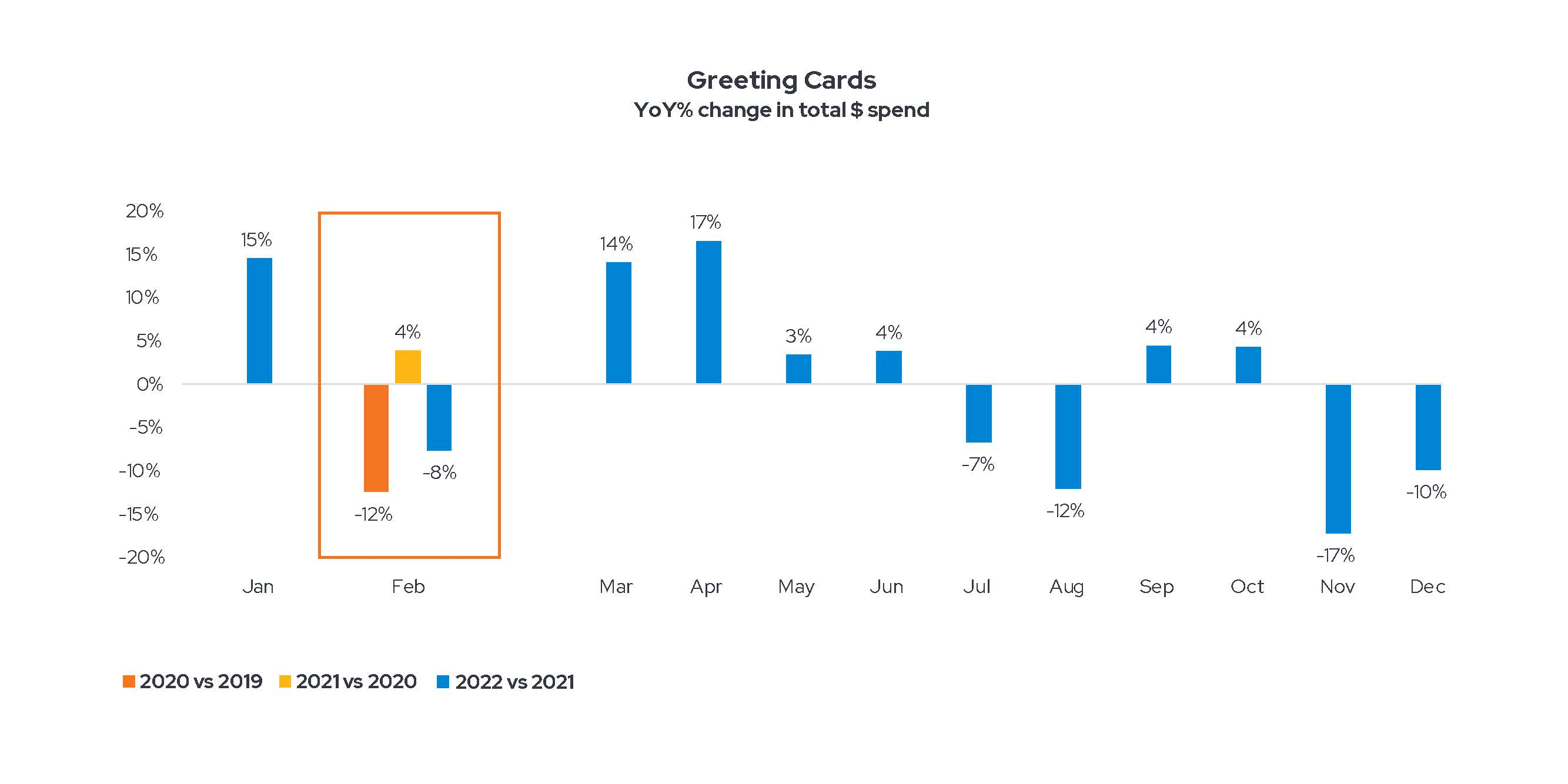

Greeting Cards

People do buy a lot of cards to send their Valentines – they’re on the shopping list of 40% of Valentine’s Day gift-buyers - but they do so in the second half of January. Of course, Valentine’s shoppers may also buy candy (it’s the most popular Valentine’s Day product) and other gifts at greeting card stores, which drives up the average spend on seasonal transactions.

Nevertheless, the fluctuations observed in Envestnet | Yodlee data in year-over-year spending at card stores throughout 2022, especially the lows during the recent winter holiday season, don’t bode well for card retailers this Valentine’s Day.

Fine Dining

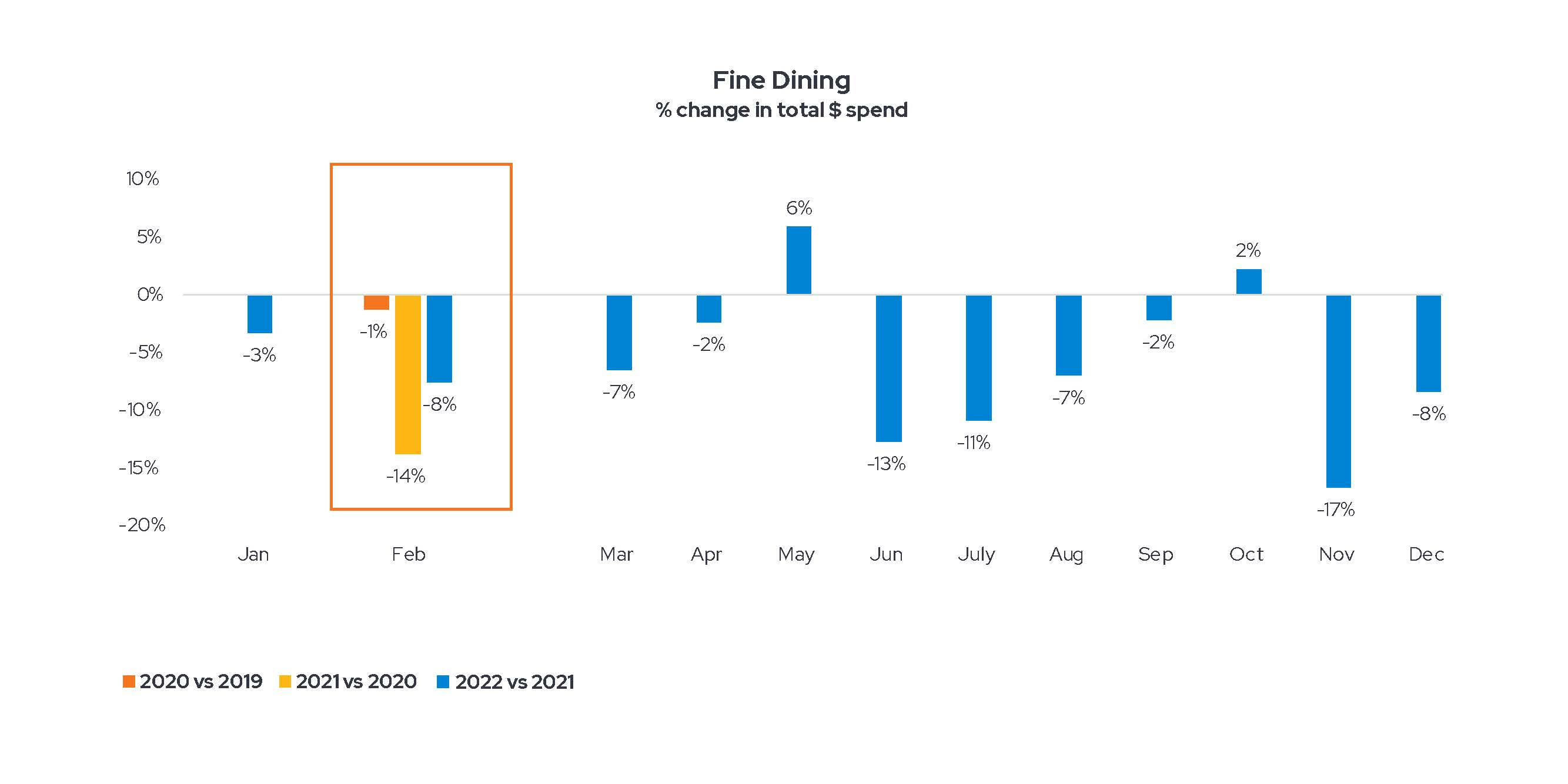

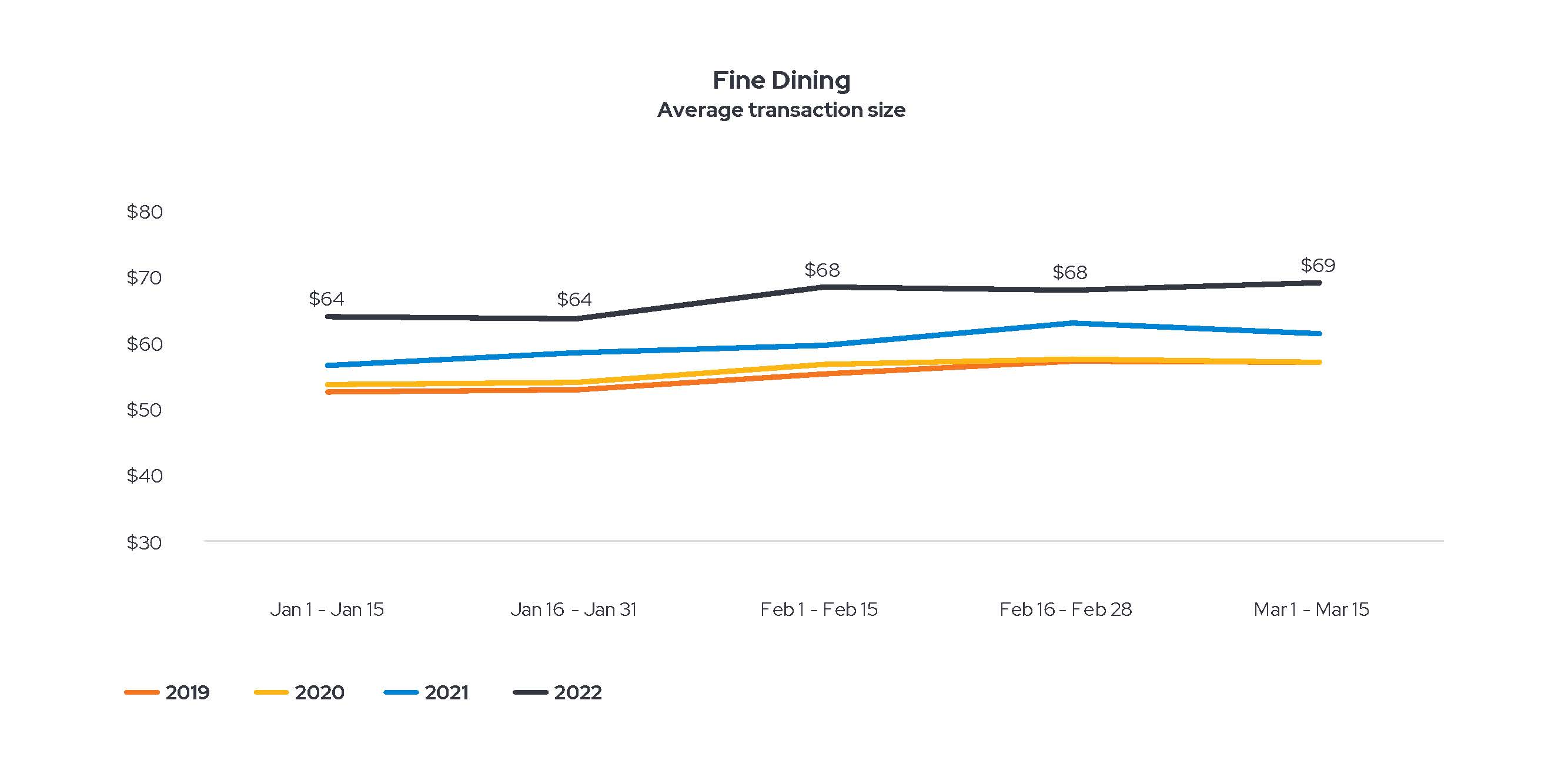

As we noted during the December holidays, restaurants have been hit hard by inflation.

Plus, as Envestnet | Yodlee’s data shows, the sector has seen spending fall every February since before the pandemic. And it probably didn’t help that Valentine’s Day last year fell on a Monday; typically, Mondays and Tuesdays are the slowest night of the week at restaurants. (This year, unfortunately for restaurateurs, it falls on Tuesday.) Even so, as Envestnet | Yodlee data shows, fine dining restaurants do typically see a rise in average transaction size between January and February.

So restaurants hosting romantic dinners this February 14th may not see a larger take at the end of the evening, but each check will likely be bigger than last February.

The Total Cost of Showing your Love

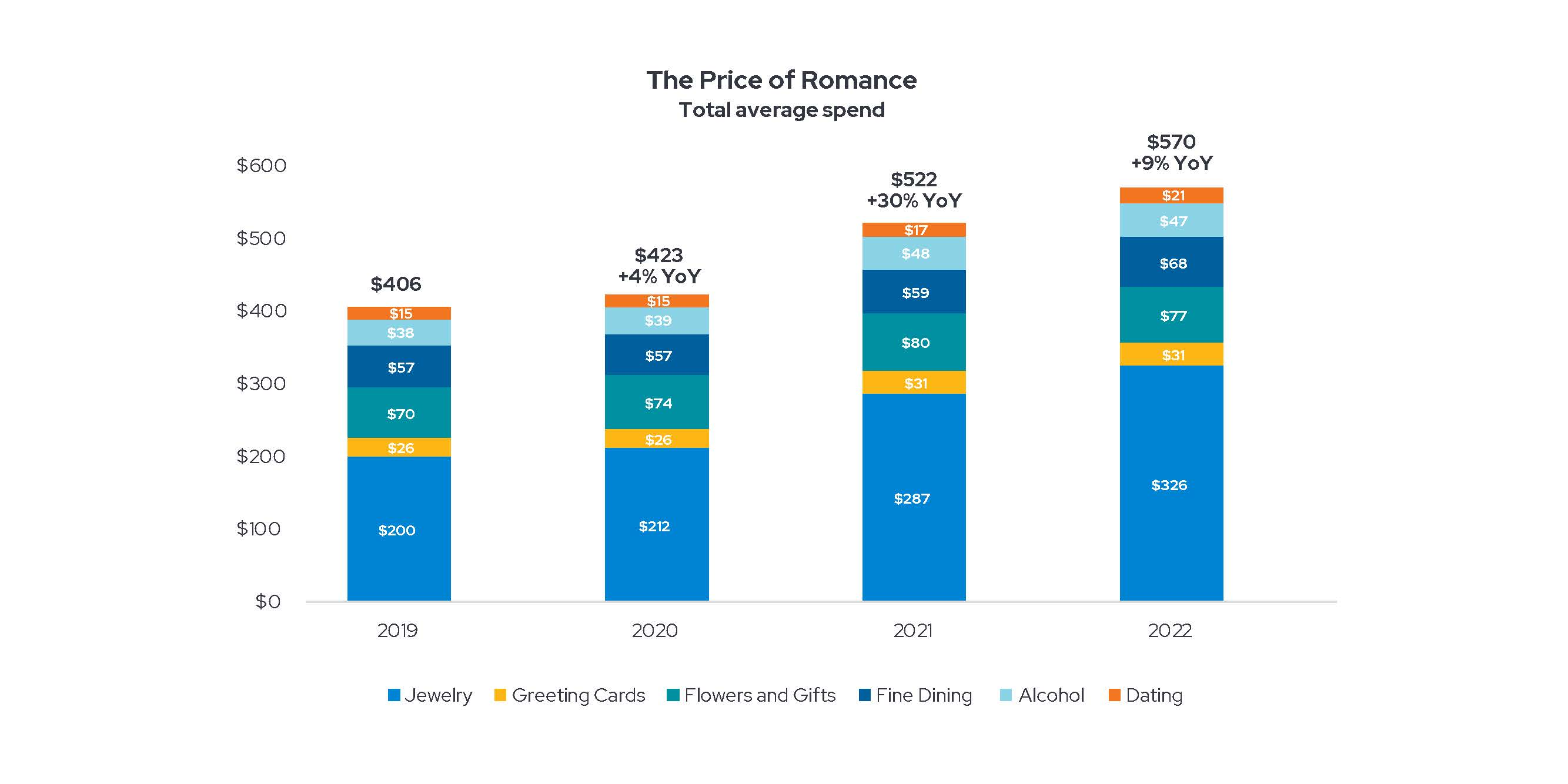

What if you wanted to go all out on Valentine’s Day? What if you spent the average in all six of these sectors – joined a dating app, bought your Valentine a card, flowers, wine, jewelry, and a candlelight dinner? How much would you spend in total? Here’s what it would have cost you each of the last four Valentine’s Days.

The marked rise in recent years, from a total of $406 in 2019 to $570 last year, is mostly attributable to the 63% leap in jewelry spending. If you leave off the gems, the total price seems more stable, from $206 in 2019 to $244 in 2022.

Even that amount may seem to some like a steep sum for one day of romance, even with the one you love. It’s likely that besotted buyers won’t be spending that kind of money on every category this year but will pick and choose. Given observed trends, florists and dating apps seem safe. Jewelers and restaurants may see higher tickets but lower traffic. And liquor stores and greeting card merchants may not find much reason to celebrate.

To learn more about the data behind this article and what Yodlee has to offer, please reach out to Dylan Curtis at Dylan.Curtis@yodlee.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.