February 2022 was one of the last “typical” retail months, sandwiched between the Omicron surge of December 2021/January 2022 and the high gas prices and rising inflation that characterized most of last year. A year later, we dove into the February 2023 foot traffic data to understand how the major retail categories performed relative to this recent benchmark of normalcy.

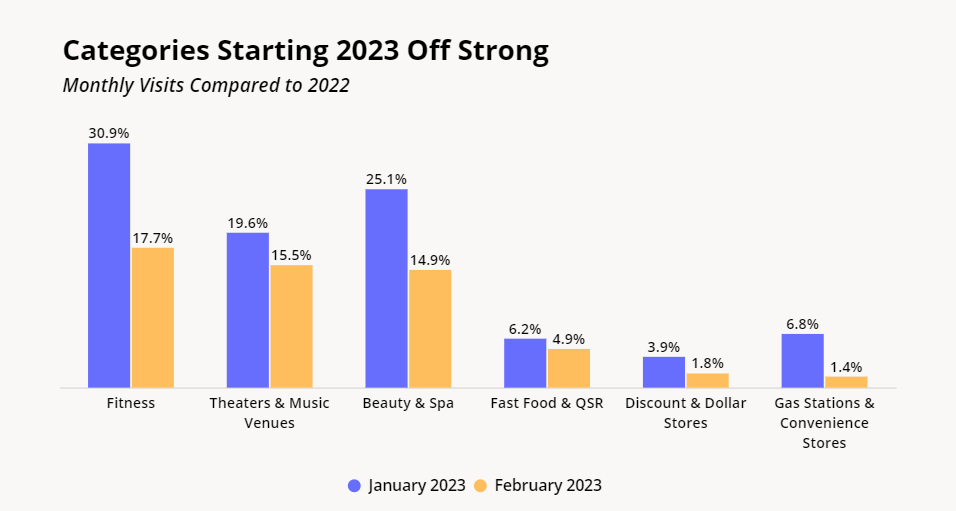

Six Early 2023 Traffic Growth Winners

Fitness and Theaters & Music Venues – among the categories hardest hit by COVID restrictions – saw the largest year-over-year (YoY) visit increase in February 2023, with traffic up 17.7% and 15.5%, respectively, relative to February 2022. Beauty & Spa, which also took a hit in the early days of the pandemic, was one of the strongest retail categories in 2022 and appears poised to continue its winning streak in 2023.

Fast food & QSR has been leading other dining segments in terms of COVID visit rebound, and the category seems well-positioned to continue its recovery in 2023. Budget-conscious consumers looking for ways to trade down are likely still choosing lower priced QSR venues over traditional sit-down restaurants, which may explain the segment’s February 2023 YoY visit increase of 4.9%.

Other categories that started the year off strong are Discount & Dollar Stores – with February visits up 1.8% relative to February 2022 – and Gas Stations & Convenience Stores, with a 1.4% increase in monthly traffic YoY.

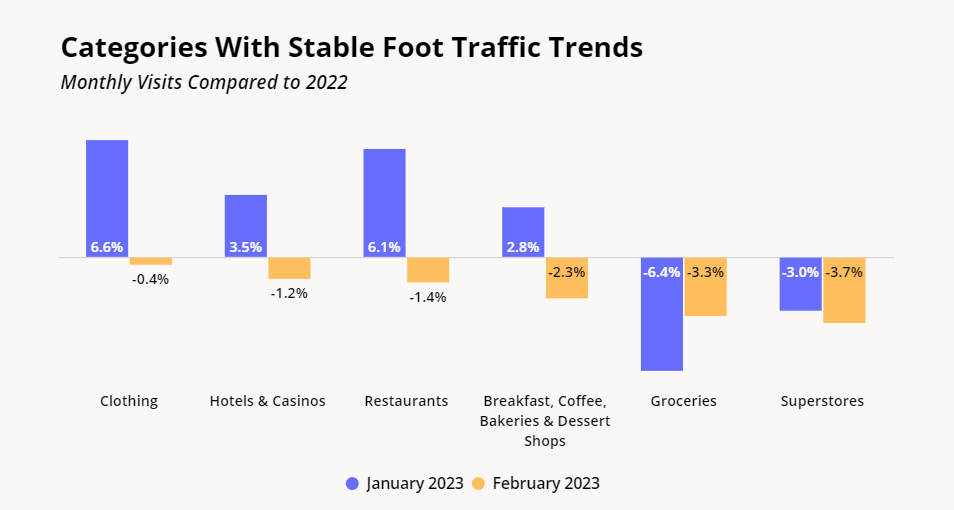

Six Categories Seeing Visits Stabilize in Volatile Environment

Other key categories that did not see visit growth in February still managed to maintain relatively stable YoY visit trends – also an impressive feat given the volatility of the current retail landscape and the difficult comparison to February 2022. Clothing (a category that includes off-price apparel, footwear chains, and specialty clothing brands) saw its visits remain on par with February 2022 levels following a strong January. Hotels & Casinos also experienced a small 1.2% decrease in February 2023 visits relative to February 2022.

Foot traffic to the Restaurant category, which includes fast casual and full-service dining concepts, and to the Breakfast, Coffee, Bakeries, and Dessert Shops category stayed close to 2022 levels as well – February 2023 visits were down just 1.4% and 2.3%, respectively, YoY.

Meanwhile, YoY visits to the Grocery and Superstore sector – two major pandemic winners – dropped in February 2023 for the second straight month. But the strength of these categories over the past couple of years could mean that the recent dips are more a sign of traffic regressing to a pre-COVID norm rather than any real weakness in these segments. For Grocery, the decline in the visit gap between January and February also serves as a further indication of the impact that declines in group size have had on traffic to the category.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.