Equity-Rich Properties Continue to Outnumber Those Seriously Underwater by Four-to-One Margin; Portion of U.S. Homes Considered Equity-Rich Ticks Up to 27.5 Percent; Seriously Underwater Properties Down to 6 Percent. 15.2 million residential properties in the United States were considered equity-rich, meaning that the combined estimated amount of loans secured by those properties was 50 percent or less of their estimated market value.

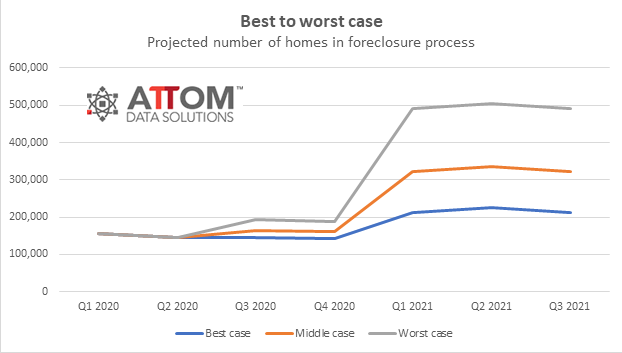

The United States faces a possible foreclosure surge over the coming months that could more than double the number of households threatened with eviction for not paying their mortgages – an offshoot of the worldwide Coronavirus pandemic that has cast a shadow over the nation’s eight-year housing market boom.

Home sellers nationwide realized a gain of $75,971 on the typical sale, up from the $66,500 in the first quarter of 2020 and from $65,250 in the second quarter of last year. The latest figure, based on median purchase and resale prices, marked yet another peak level of raw profits in the United States since the housing market began recovering from the Great Recession in 2012.

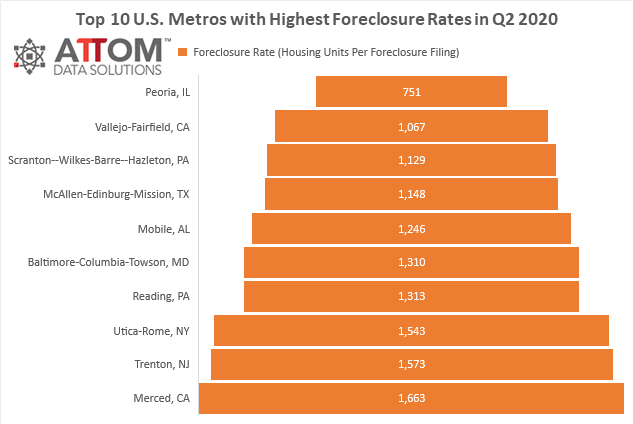

According to ATTOM Data Solutions’ recently released Midyear 2020 U.S. Foreclosure Market Report, U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2020, hit an all-time low with 165,530 filings reported. Nationwide 0.12 percent of all housing units (a foreclosure rate of one in every 824 housing units) had a foreclosure filing in the first half of 2020.

There were a total of 165,530 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2020, down 44 percent from the same time period a year ago and down 54 percent from the same time period two years ago.

The housing-market boom that pushed home prices upward for eight-years throughout the United States sputtered abruptly in May 2020 in large swaths of the country – the first sign that the worldwide Coronavirus pandemic is damaging property values across the nation. New sales figures from ATTOM Data Solutions show that median home prices stayed the same or dropped from April to May of 2020 in 17 states, as well as in half the metropolitan areas with enough transactions to analyze.

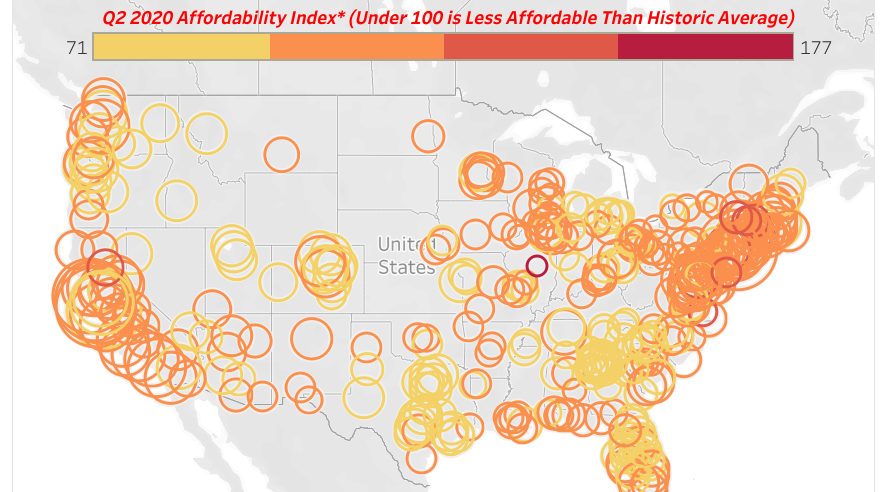

ATTOM Data Solutions, curator of the nation’s premier property database and first property data provider of Data-as-a-Service (DaaS), today released its second-quarter 2020 U.S. Home Affordability Report, showing that median home prices of single family homes and condos in the second quarter of 2020 are more affordable than historical averages in 49 percent of U.S. counties with enough data to analyze, up from 31 percent a year ago.