According to ATTOM Data Solutions’ recently released Midyear 2020 U.S. Foreclosure Market Report, U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2020, hit an all-time low with 165,530 filings reported. Nationwide 0.12 percent of all housing units (a foreclosure rate of one in every 824 housing units) had a foreclosure filing in the first half of 2020.

ATTOM’s latest foreclosure activity report noted that counter to the national trend, 10 of the 220 metro areas analyzed in the midyear report showed increasing foreclosure activity compared to a year ago. Those areas included Stockton, California (up 161 percent); Chico, California (up 61 percent); McAllen, Texas (up 42 percent); Lake Havasu, Arizona (up 39 percent); and Fort Wayne, Indiana (up 21 percent).

The midyear foreclosure activity analysis reported that the states with the highest foreclosure rates in the first half of 2020 were Delaware (0.28 percent of housing units with a foreclosure filing); New Jersey (0.25 percent); Illinois (0.24 percent); Maryland (0.21 percent); and Connecticut (0.18 percent). Other states with first-half foreclosure rates among the 10 highest nationwide were South Carolina (0.18 percent); Florida (0.17 percent); Ohio (0.16 percent); North Carolina (0.14 percent); and Georgia (0.14 percent).

ATTOM’s midyear foreclosure market report stated that among the 220 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in the first half of 2020 were Peoria, Illinois (0.37 percent of housing units with foreclosure filings); Trenton, New Jersey (0.36 percent); Rockford, Illinois (0.36 percent); Atlantic City, New Jersey (0.32 percent); and Lake Havasu, Arizona (0.30 percent).

The report also noted that other metro areas with foreclosure rates ranking among the top 10 highest in the first half of 2020 were Fayetteville, North Carolina (0.27 percent of housing units with a foreclosure filing); Bakersfield, California (0.27 percent); Columbia, South Carolina (0.25 percent); Chicago, Illinois (0.25 percent); and Cleveland, Ohio (0.25 percent).

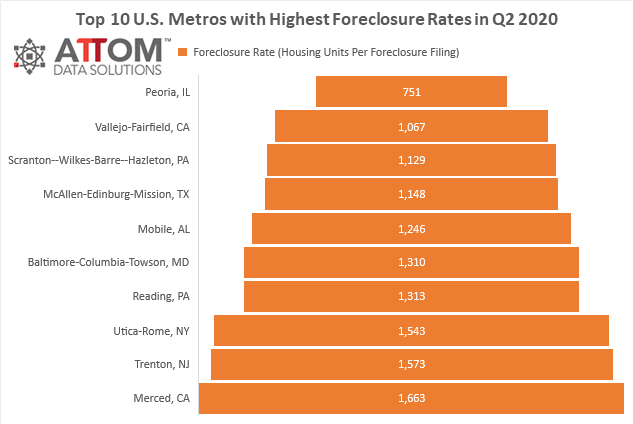

Q2 2020 Foreclosure Activity

ATTOM’s midyear foreclosure market report also featured high-level findings from Q2 2020, including there were a total of 30,656 U.S. properties with foreclosure filings reported during the quarter. That number is down 80 percent from previous quarter, as well as a year ago, to lowest quarterly total since Q1 2006. The report stated that the national foreclosure activity total in Q2 2020 was 89 percent below the pre-recession average of 278,912 per quarter from Q1 2006 to Q3 2007, making Q2 2020 the 15th consecutive quarter with foreclosure activity below the pre-recession average.

Also according to the report, Q2 2020 foreclosure activity was below pre-recession averages 93 percent or 205 out of the 220 metro areas analyzed, including Los Angeles, Chicago, Dallas, Houston, Miami, Atlanta, San Francisco, Riverside-San Bernardino, Phoenix and Detroit.

In this post, we take a look at those metros with a population of 200,000 or more that saw the highest foreclosure rates in Q2 2020. Those areas include: Peoria, IL (with one in every 751 housing units receiving a foreclosure filing); Vallejo-Fairfield, CA (one in every 1,0670; Scranton–Wilkes-Barre–Hazleton, PA (one in every 1,129); McAllen-Edinburg-Mission, TX (one in every 1,148); Mobile, AL (one in every 1,246); Baltimore-Columbia-Towson, MD (one in every 1,310); Reading, PA (one in every 1,313); Utica-Rome, NY (one in every 1,543); Trenton, NJ (one in every 1,573) and Merced, CA (one in every 1,663).

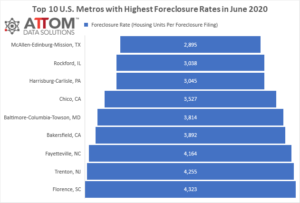

June 2020 Foreclosure Activity

ATTOM’s midyear foreclosure market report also reported on June 2020 foreclosure activity. Among the high-level June 2020 takeaways were nationwide, one in every 14,798 properties had a foreclosure filing. The reported cited the states with the highest foreclosure rates in June 2020 were Maryland (one in every 5,393 housing units with a foreclosure filing); New Mexico (one in every 6,346 housing units); Delaware (one in every 6,798 housing units); New Jersey (one in every 8,800 housing units); and South Carolina (one in every 9,326 housing units).

In this post, we also unveil the top metros, among those with a population of 200,000 or more, with the highest foreclosure rates in June 2020. Those areas include: McAllen-Edinburg-Mission, TX (one in every 2,895 housing units received a foreclosure filing); Rockford, IL (one in every 3,038); Harrisburg-Carlisle, PA (one in every 3,045); Chico, CA (one in every 3,527); Baltimore-Columbia-Towson, MD (one in every 3,814); Bakersfield, CA (one in every 3,892); Fayetteville, NC (one in every 4,164); Trenton, NJ (one in every 4,255); and Florence, SC (one in every 4,323).

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.