Source: https://www.millerpulse.com/

The key to any economic recovery in the US is relaxing social distancing. Many businesses such as restaurants, gyms, doctors and hotels can’t operate profitably at 50% or lower capacity. Most restaurants run on razor thin margins, so filling seats and cramming them together is essential for their survival. In this article we examine the year to date recovery of the restaurant industry in the US.

Data provider MillerPulse is a leader in the point of sale data market focused on restaurants. They collect data from restaurants representing over $85 billion in annual sales and can see their weekly sales and traffic. MillerPulse sees data both by region as well as by restaurant type.

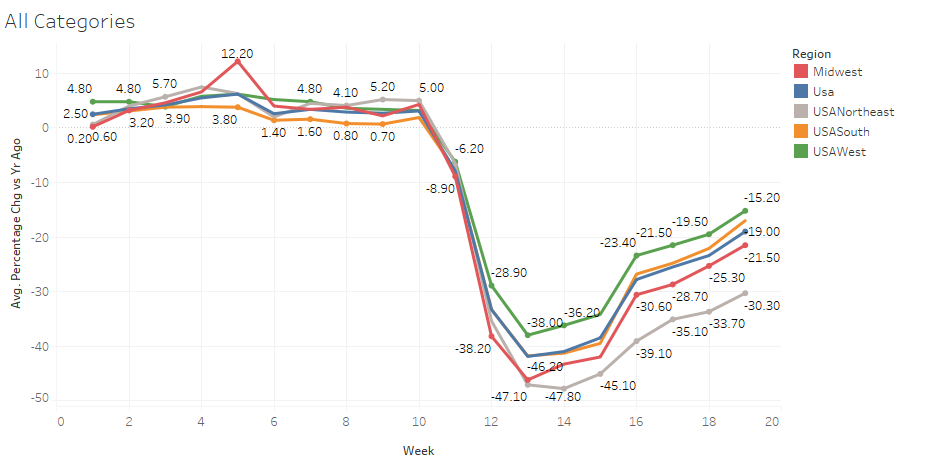

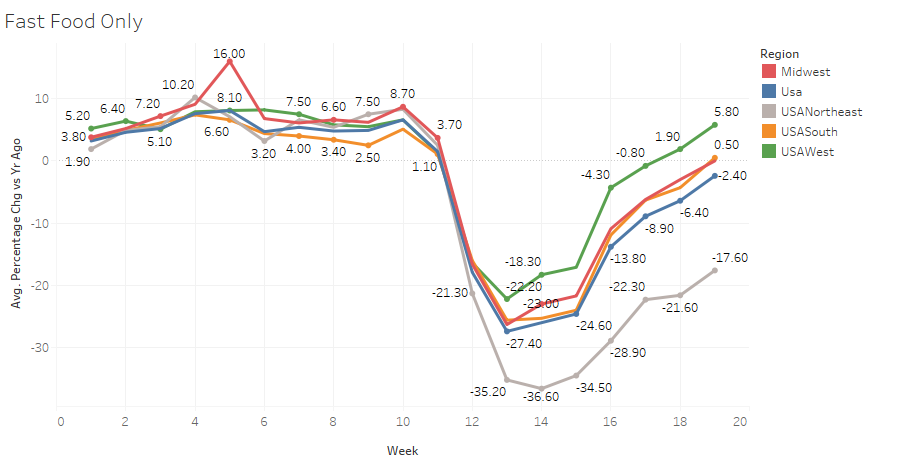

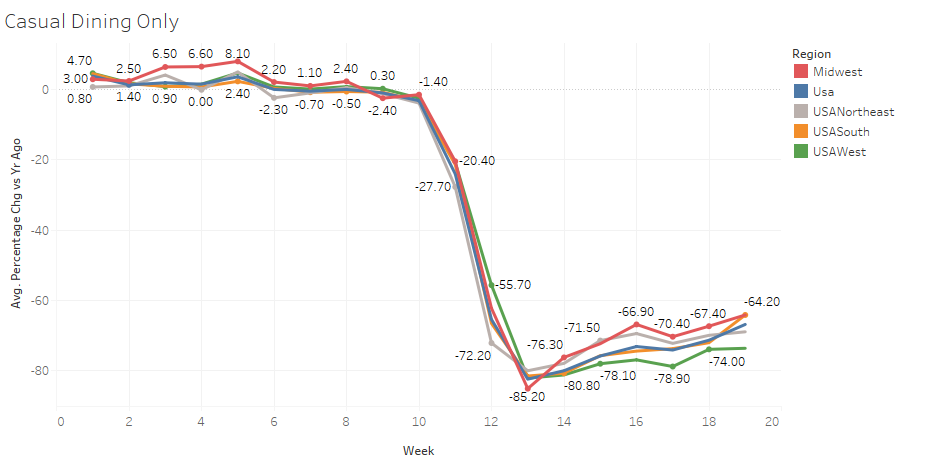

Overall US restaurant sales bottomed in week 13, the week ended March 29th. Overall sales were down 42% year over year. There were a few dynamics at play here. In-restaurant revenue collapsed to 0 for almost all restaurants in the nation. Restaurants with established takeout businesses were able to counter some of this blow. Casual dining restaurants were hit the hardest as people weren’t allowed to dine in establishments in most states and they had the least developed take-out and delivery businesses. Their sales were down 83% year over year. Fast food weathered the storm best at -27% year over year.

The recovery also differed materially by restaurant type. Fast food overall is now barely even down on the year, at -2.4% versus last year nationally. But Larry Miller, Co-Founder of MillerPulse noted that “Fast food sales, while dramatically improved, are still concerning since check rather than traffic is doing the heaving lifting. Traffic is still down an unhealthy -18.5% year over year.”

Casual dining on the other hand has seen an extremely muted recovery to date, recovering to down 67% versus its trough at down 83%.

What this tells us is that Americans are far from being comfortable sitting in a restaurant yet. Despite extremely different views on quarantine across regions, all regions showed the same behavior. Until the consumer feels comfortable again, which may not be until a vaccine is found, the near-term outlook for the economy remains lukewarm at best.

To learn more about the data behind this article and what MillerPulse has to offer, visit https://www.millerpulse.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.