The restaurant industry has been heavily impacted by the global COVID-19 pandemic. Stay-at-home orders and the closure of large swaths of the economy in many U.S. states have limited human mobility for weeks and in some cases months.

To remain competitive, or just afloat, many restaurant operators have pivoted to offer delivery, or curbside pick-up options, and it’s been working pretty well. That said, with many states now lifting COVID-19 restrictions a nice meal at a local restaurant is something many of us may seek out.

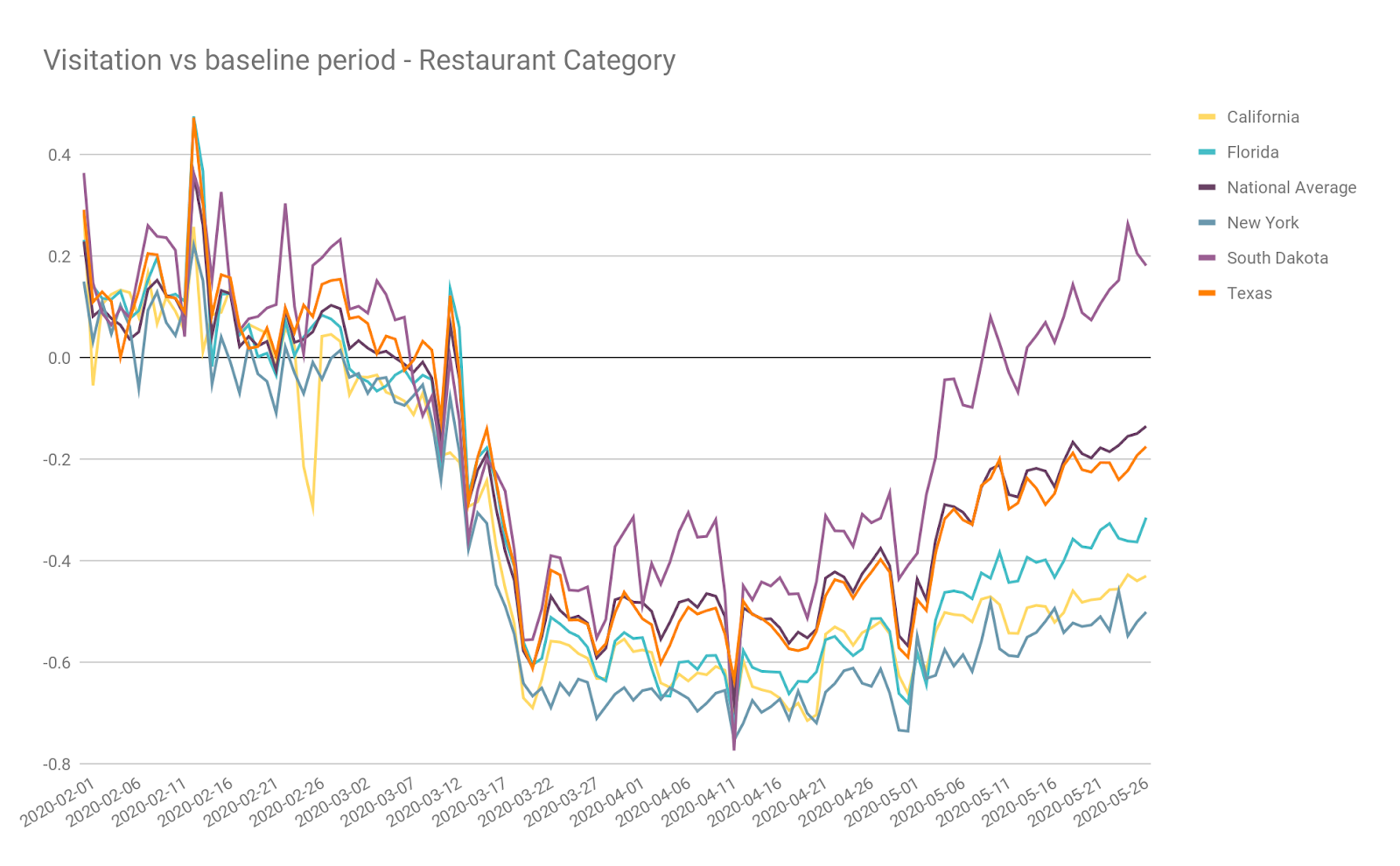

With that in mind, we were curious to see how current visitation levels to restaurants differ across America, state-by-state. To do that, we examined human mobility patterns in five states from different parts of the country and with different approaches to shutdown and reopening. Here’s some of what we learned.

Nationwide visits have climbed to 85% of 2019 levels

Over the last few weeks, nationwide restaurant visitation levels have climbed back -15% versus 2019. That’s a strong recovery versus other sectors, such as Luxury Hotels, which sits at about -75% as a sector. But mean restaurant visitation numbers do not tell the whole story.

Nearly all states have seen some growth in visitation in the last week, but Individual state’s visitation levels vary greatly and for many different reasons. In South Dakota, where formal stay-at-home orders were never in place, restaurant visitation levels are currently sitting at 17% above 2019 rates.

While this is a very promising data point, it is neither indicative of the mean, nor reflective of the norm, as most states have had formal shutdown orders that have limited restaurant visitation rates over the preceding weeks or months.

Southeastern states are rebounding

It’s worth noting that South Carolina and Tennessee - among the first states to issue shutdown orders and also to start reopening - are among the national leaders in restaurant visitation recovery rate.

In South Carolina, where restaurant visitation was down more than 70% in the second week of April 2020, the market has rebounded to within 5% of 2019 levels in the last 50 days. Nearby, Tennessee restaurant visitation has fought back to within 10% of previous levels in the same time.

In a similar vein but from a different part of the country, having just entered its reopening phase in mid-May, Texas’s visitation levels have rebounded quickly, pulling to within 20% of 2019 rates in just under three weeks – a sign that appetite for recovery is strong in the Lone Star state.

Beach yes, burger no

Surprisingly, Florida, which has seen a spike in beach visits recently, has not experienced a similar recovery in the restaurant sector, where visitation levels are still down 30% compared to 2019. That’s compared to a -20% mobility reduction in the state overall. In other words, people in Florida are moving around more, they just aren’t going back to restaurants as much as they did pre-COVID-19.

California is in a similar stance. The state declared both a stay-at-home order and a shutdown order on March 20th – nearly two weeks before several other states. The reopening plan began on May 8th, with public space such as beaches among the first to reopen. Yet at the end of May, restaurant visitation levels were -46% versus 2019 levels. That’s compared to an overall reduction of human mobility in the California Republic of just -19% in the same period.

The implication is that while human mobility in public spaces is returning to normal, people don’t yet feel comfortable going to enclosed restaurants. It remains to be seen if this is a long term trend.

The industry has come far but customers are staying closer to home

Zoom-out from the restaurant industry specifically, and we can see that broader human mobility patterns in each state has direct bearing on restaurant visitation levels.

Back in South Dakota, where shutdown never really happened, overall human mobility levels are back to within 4% of 2019 rates, meaning that on average people are traveling about 96% of the same distance they used to in order to visit a restaurant, or a store, for example. Compare that to California and Florida, where shutdown came early and people lived with it for eight weeks and counting.

In California, mobility is only back to within 19% of normal levels. Florida is back to within 20%. Both states are much larger, more densely populated, and more reliant on tourism and travel to fuel their restaurant industry than South Dakota. So, in each case, the lower relative rate of mobility is a factor in total visitation recovery.

To go

When you examine the underlying data, each state, city and brand has its own tale of recovery to tell that is unique and contextual. We look forward to sharing more of these insights with you.

To learn more about the data behind this article and what Unacast has to offer, visit https://www.unacast.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.