The grocery sector has been among the most interesting to analyze during the pandemic. During the crisis, some brands grew, while others struggled. And even when looking at the visits that did happen, consumer shopping patterns changed significantly.

So as the US begins to reopen, how has the grocery sector been affected?

Grocery’s Pandemic Trend

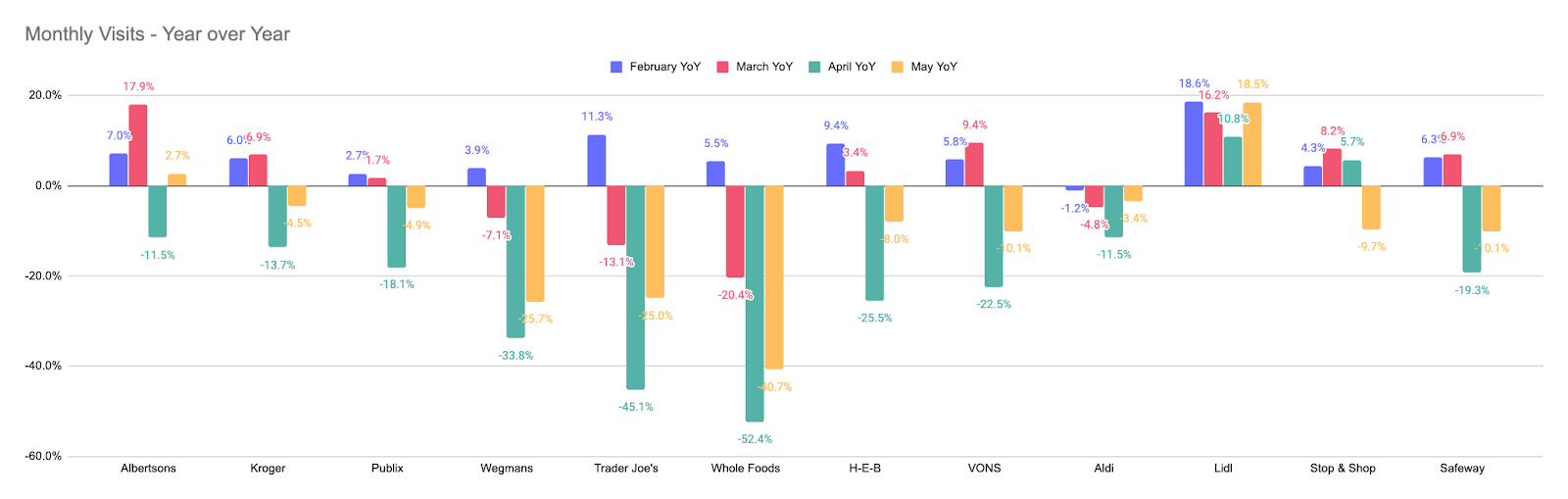

Looking at twelve top grocers from across the country shows a fairly common trend impacting the sector, with a few exceptions. February grocery visits came in at fairly normal levels with a slight year-over-year boost. March continued the trend, though the full monthly lift was limited by state and company restrictions that began to come in during the middle of the month. Then visits dropped off significantly into April, as restrictions came into full force over a longer period of time. Across the twelve brands analyzed, April saw an average decline of 19.7% in visitors year over year.

While the rebound was already beginning to unfold in late April, the recovery certainly found a new pace in May. The average visit decline across the same brands was down just 10.1% year over year, even though many were still seeing significant in-store restrictions and state-level regulations.

Obviously, not all brands have felt the same impact. Albertsons and Lidl were already back to year-over-year growth in May, though the latter was heavily influenced by a significant expansion in locations. Brands like Publix, Kroger, H-E-B, and Aldi were inching closer to normal levels, while Trader Joe’s and Whole Foods were still battling back from larger deficits.

The Recovery is in Full Swing

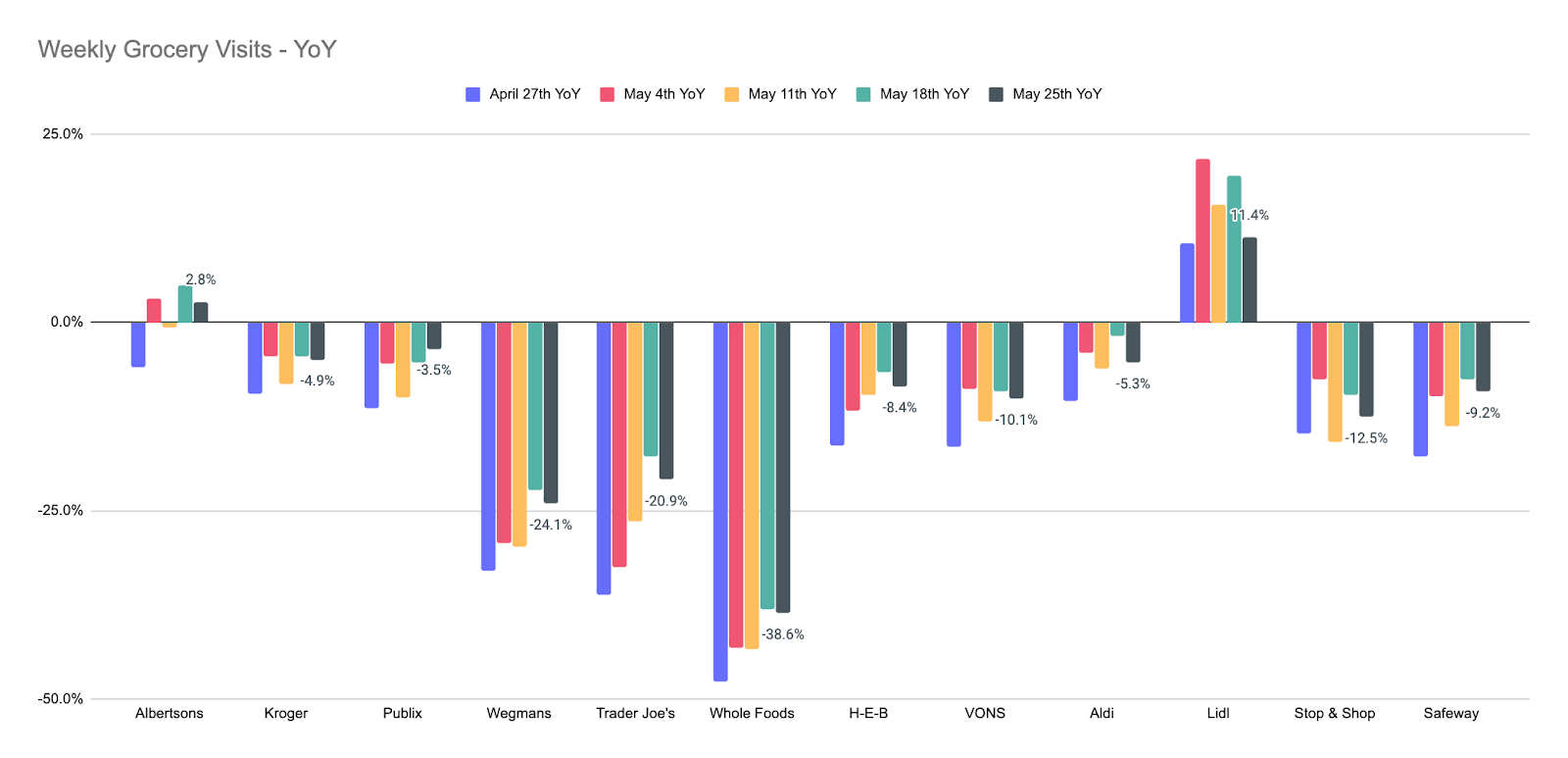

But the positive trend is being felt across the entire sector. Looking at changes in weekly visits year over year shows a clear shift back to ‘normal’ for every brand analyzed. This includes Whole Foods and Trader Joe’s, two brands that have felt the impact more than others for a variety of reasons. The former saw the visit gap from 2019 shrink by nearly 10% since late April, while Trader Joe’s saw an improvement of nearly 16% during this same period.

What Do the Coming Months Hold?

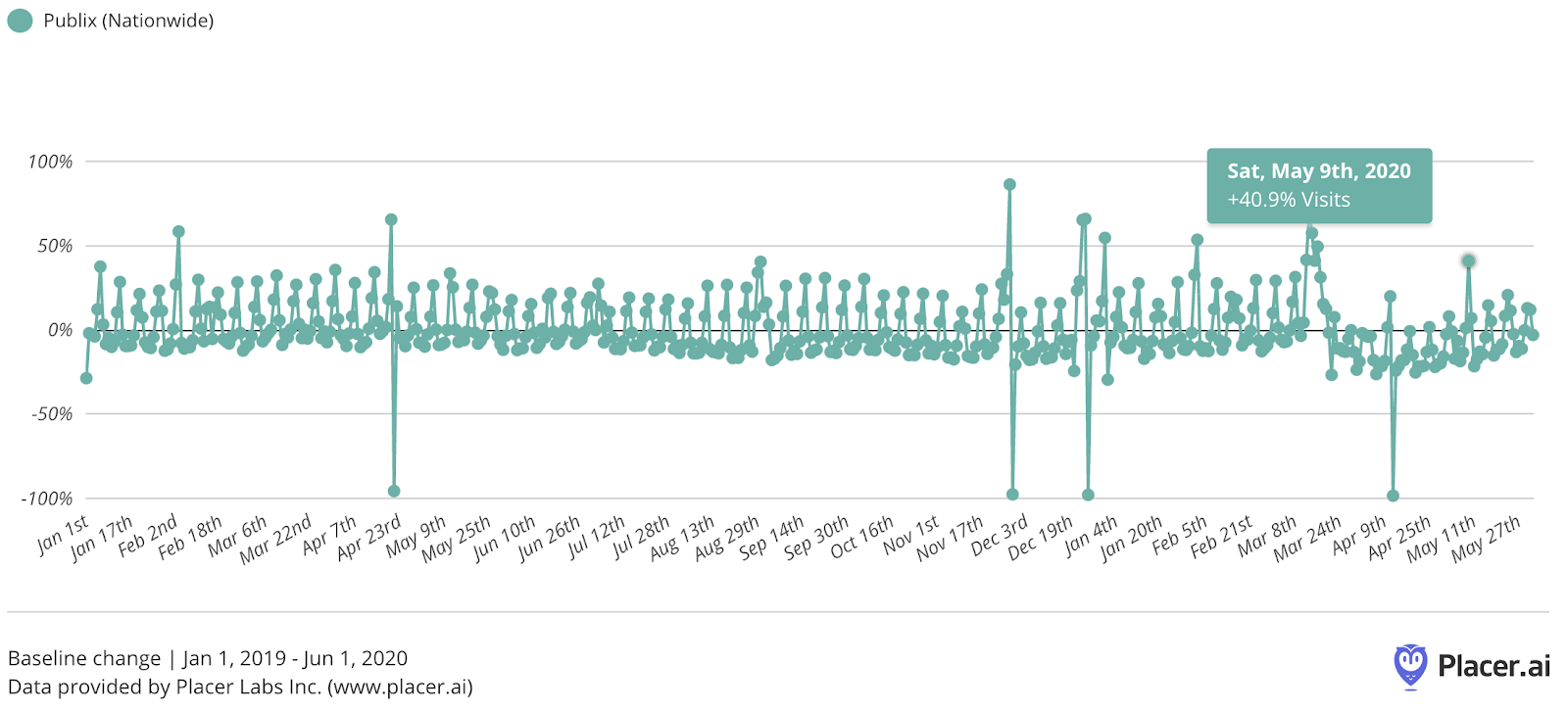

The big questions that remain for the sector are far beyond the control of any of these brands – namely, how quickly will restrictions be removed and can a second surge of the pandemic be avoided. Publix, while benefiting from visit growth in Georgia, is being held back by a slower reopening process in Florida. But even with these challenges, the brand is driving growth. Publix saw a 7.4% increase in nationwide visits on Saturday, May 9th year- over year, though the Saturday before Memorial Day did seeee a decline of nearly 10% year of year.

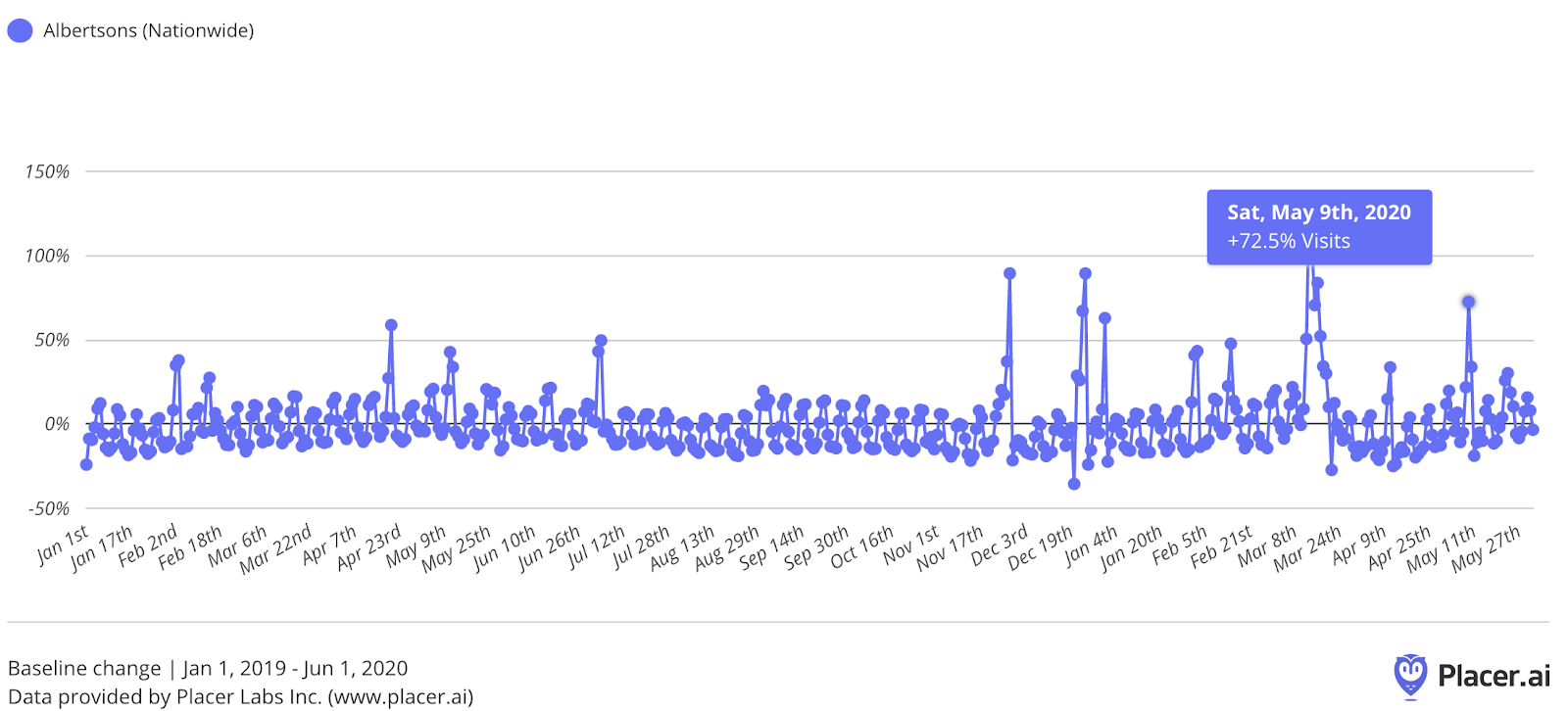

And the same mixed bag held true for one of the strongest pandemic performers, Albertsons. Visits on Saturday, May 9th, were up 29.8% while the Saturday before Memorial Day was down 3.4%.

There are a myriad of reasons why this may be the case. From weather to a potential aversion by some parts of the population to major shopping days, the recovery will certainly not be predictable in its daily result. However, it’s critical to note the significant recovery that these brands are already experiencing. While recent events could hamper this growth, especially for city-oriented brands, the indications of recovery are very promising.

What’s Next?

If the last few months have taught us anything, it’s that there are no guarantees. A surge of cases could dramatically impact the recovery. On the other hand, the growing levels of normalcy and the desire to return to past routines could quickly help overcome lingering pandemic concerns. Additionally, there are brands that are still heavily limited by their geographic focus. As an increasing number of states remove restrictions, brands like Wegmans and Trader Joe’s could see a major uplift in visits while others that have benefited from new trends could theoretically see short term declines.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.