The amount of equity in mortgaged real estate increased by $590 billion in the first quarter of 2020 from the first quarter of 2019, an annual increase of 6.5%, according to the latest CoreLogic Equity Report. Borrower equity hit a new high in the first quarter of 2020, and borrowers have gained over $6 trillion in equity in the last 10 years.

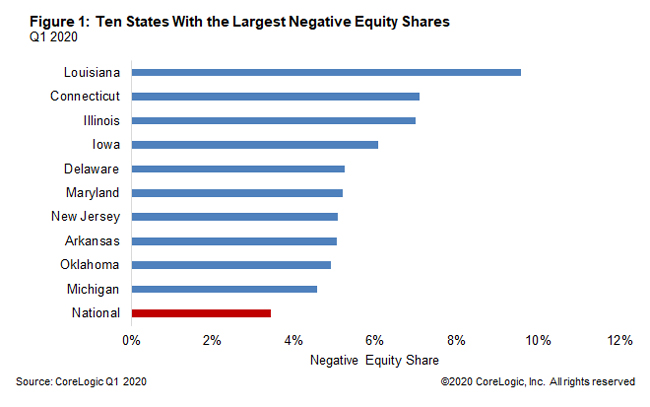

The nationwide negative equity share for the first quarter of 2020 was 3.4% of all homes with a mortgage, the lowest share of homes with negative equity since CoreLogic started tracking it in the third quarter of 2009. The number of underwater properties decreased by 350,000 from the first quarter of 2019 to the first quarter of 2020.

In the latter half of the first quarter of 2020, COVID-19 began to spread across the U.S with the immediate economic impact not fully realized until the end of March. However, the pandemic did not lower borrower equity in the first quarter of 2020 since home prices continued their upward momentum and added to borrower equity through March.

Figure 1 shows the ten states with the largest negative equity share in the first quarter of 2020. Louisiana stands apart with 9.6% of mortgages with negative equity – more than twice the national average. Connecticut (7.1%) and Illinois (7%) rounded out the top three states with the highest negative equity shares. States with high negative equity shares have experienced low home price appreciation.

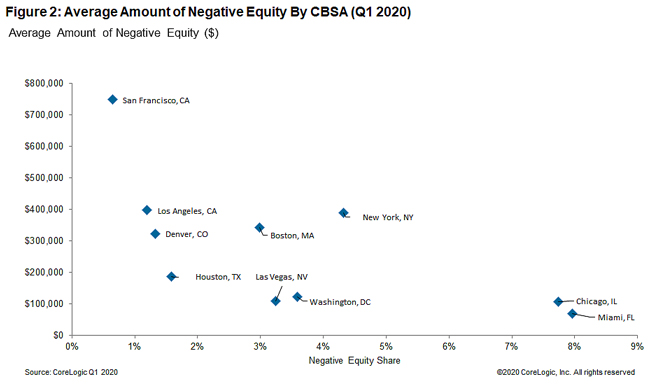

Figure 2 shows the average dollar amount of negative equity and the negative equity share for 10 large metropolitan areas in the first quarter of 2020. The average amount of negative equity is inversely related to the negative equity share. For example, in this group of CBSAs, San Francisco has the largest average amount of negative equity, but the negative equity share is only 0.7%. Miami has the smallest average amount of negative equity, but has a negative equity share of 8%, which is more than double the national rate.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.