In Europe, 40% of respondents said that they purchased more items online, including supplies and groceries, since the pandemic began, according to the latest wave of Comscore’s Global Digital Payments Tracker. In this article, we complement these insights by quantifying the levels of activity across retail categories that have seen a noticeable change between April 27, 2020 to May 31, 2020. This is a period of time when European governments gradually lifted the stay-at-home restrictions, and consumers began to plan for their summer holidays.

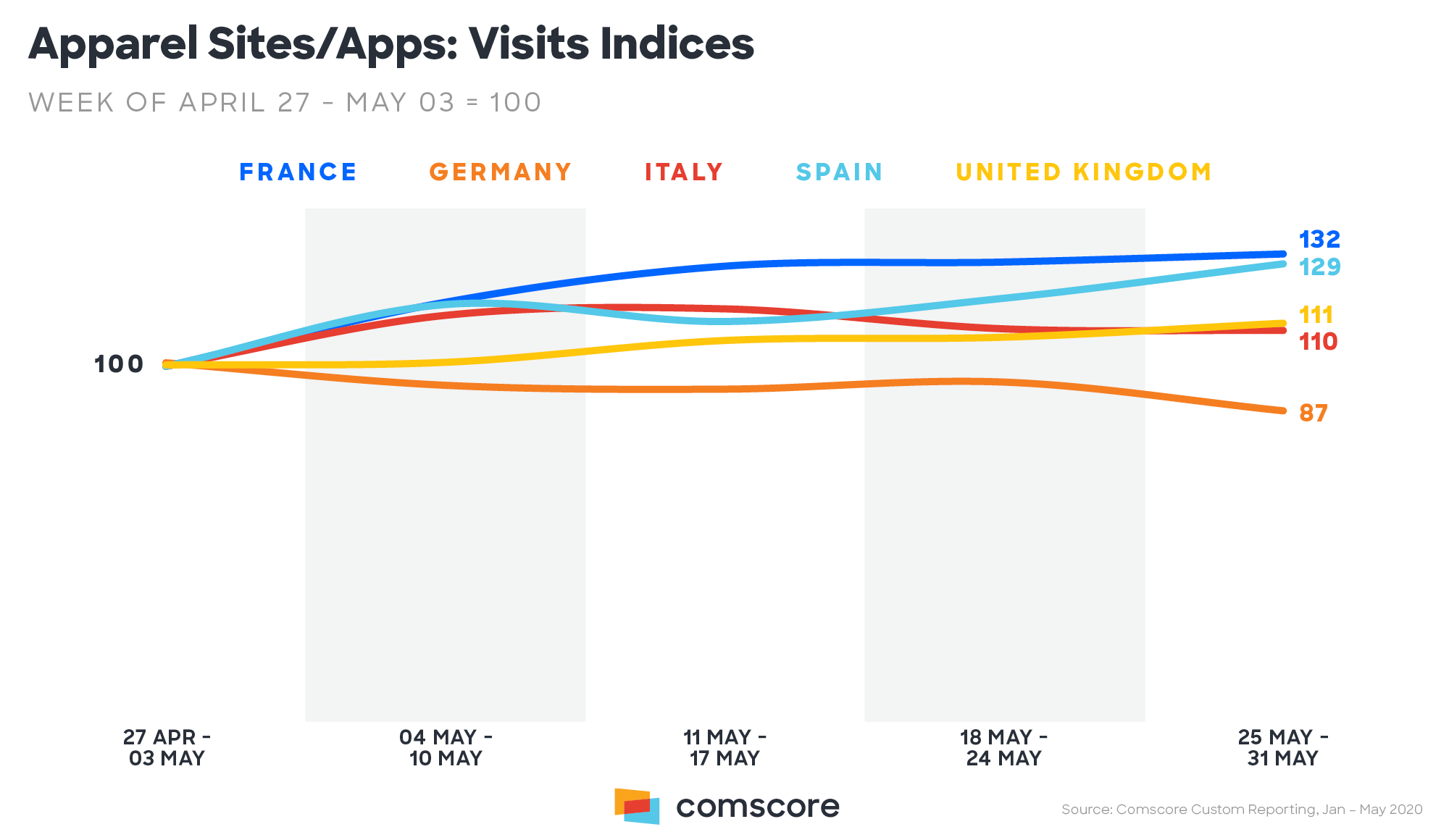

Apparel

Summer is the time when people dust off their summer wardrobes. While this year consumer behaviour has been radically altered off course, there are signs that the appetite for new summer outfits has not been entirely suppressed: weekly data show an increase in visits to online apparel retail sites in nearly all EU5 countries in the period from April 27, 2020 to May 31, 2020. The highest increase was seen in France with a 32% increase in the week of May 25-31, 2020 compared with the week of Apr 27-May 3, 2020. Germany was the only country in the group which had a decrease in visits to these sites, with 13% fewer visitors.

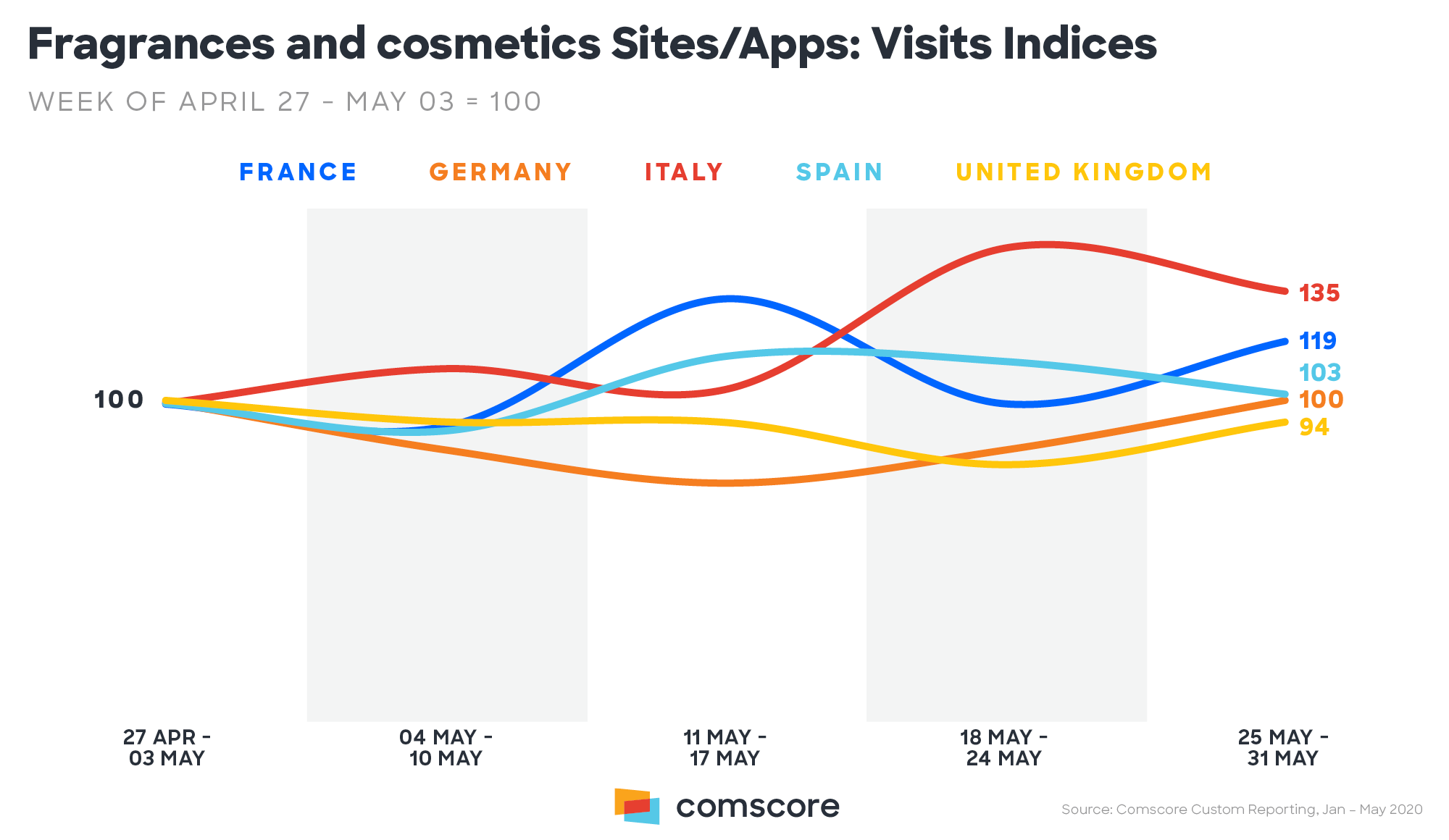

Fragrances & Cosmetics

There is anecdotal evidence that consumers have spent less on personal hygiene and grooming products during the lockdown. However, with the exception of the UK, which lags behind other countries in terms of lifting its stay-at-home restrictions, the Fragrances & Cosmetics category ended the period on a slightly higher note than at the start. Italy had the biggest change, with a 35% increase in visits during this timeframe, followed by France with a 19% increase. The observed volatility stems from the fact that the size of the audience is smaller than in other retail categories such as Apparel, which makes it more sensitive to events such as public holidays which dot the month of May in Europe.

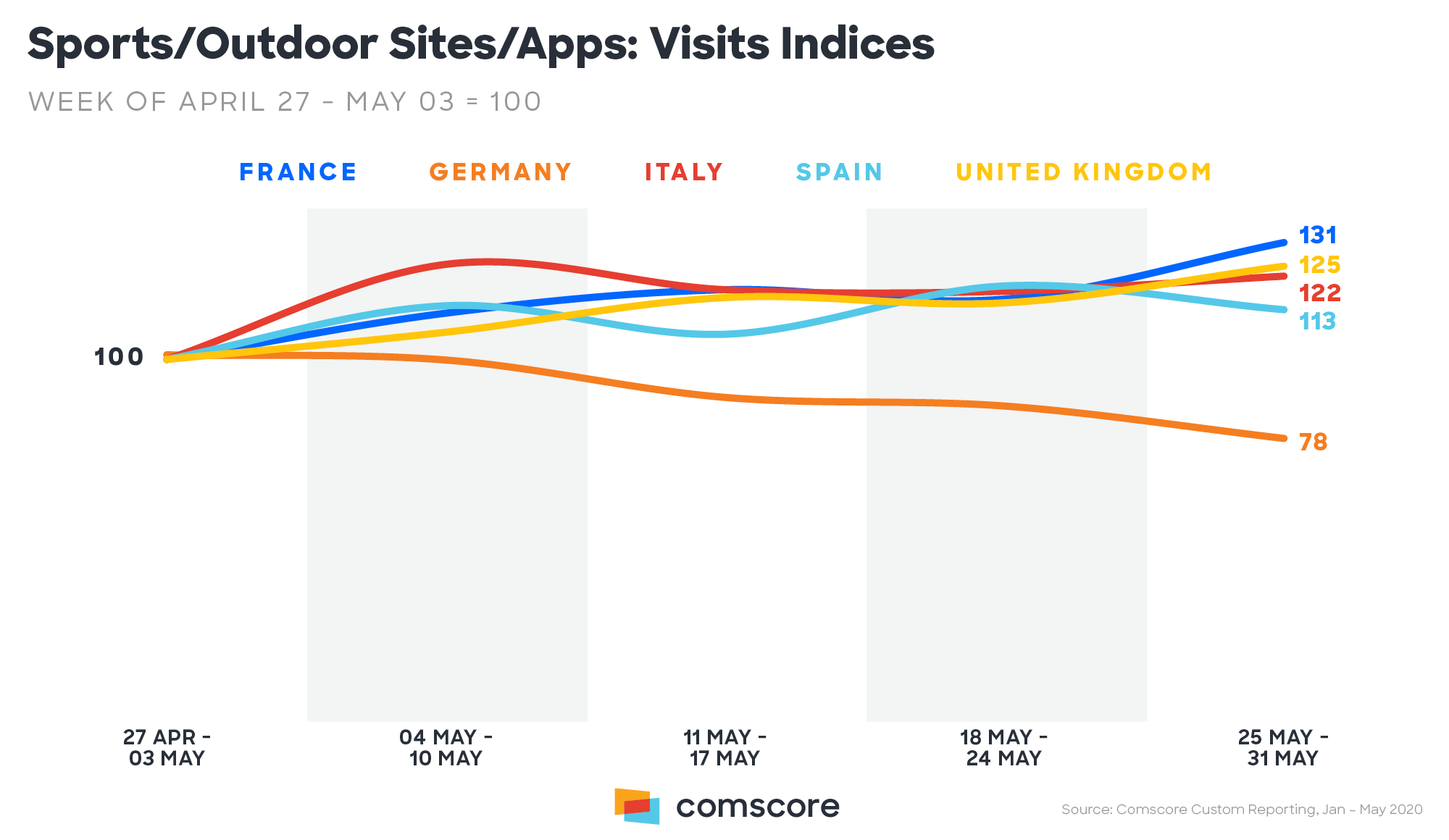

Sports / Outdoor Retail

Since summer is a time when outdoor activity usually picks up, it’s not unusual to see spikes in activity in the Sports/Outdoor category. And, with the noticeable exception of Germany, this is reflected in the data: visits to the Sports/Outdoor retail category increased in all EU5 countries, bar Germany. The pattern observed in Germany reflects the same pattern observed in the Apparel category. The reasons for this are unclear. Germany was among the first EU5 country to gradually lift restrictions, perhaps providing less of an incentive to shop online.

While the increase in retail activity in the past few weeks has been limited to a handful of categories, the increase in visitation could be a promising sign for an eventual return to more normal consumer behaviour. Seasonality is likely to play a large part in this. Long-term, as consumers continue to show more comfort buying items online that they may not have previously purchased through the internet, there is a possibility that the scope of their purchases will expand.

To learn more about the data behind this article and what Comscore has to offer, visit https://www.comscore.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.