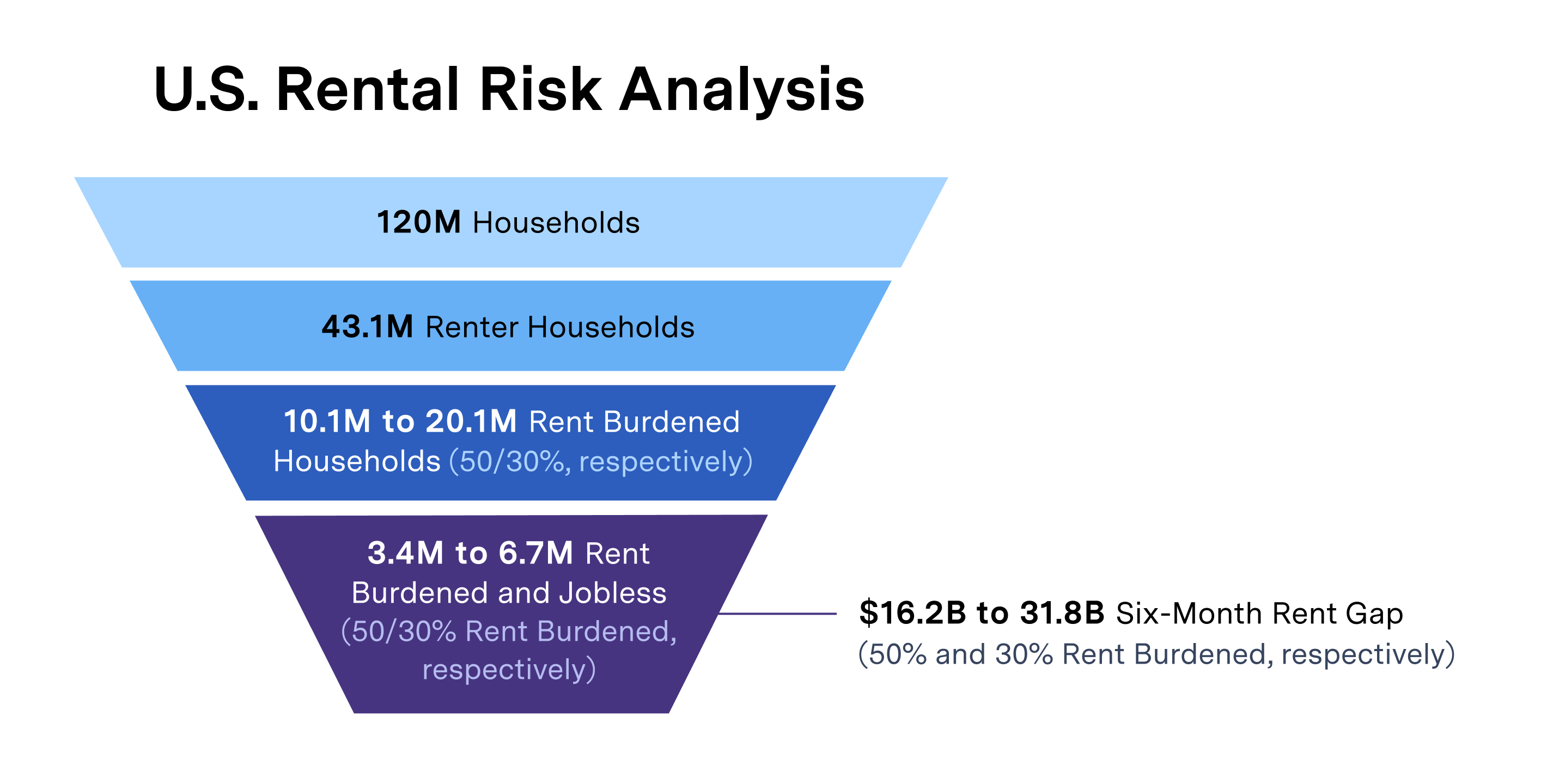

Our analysis found that across the country, rent-burdened households with high rates of COVID-19 related job loss face a rent gap of up to $31.8 billion over 6 months.

As the COVID-19 pandemic continues to batter the U.S. economy with an unprecedented surge in unemployment, many American families are facing a new threat to their livelihood: eviction. This looming reality adds new and urgent questions about the fate of our economy: How many American families will face eviction without additional financial assistance after the federal CARES Act Pandemic Unemployment Assistance (PUA) expires on July 31, and where will these evictions be geographically concentrated?

To help answer these critical questions, we assessed rental risk by analyzing unemployment claims, housing costs, and underlying social vulnerability at the national, state, and local levels, using the UrbanFootprint Recovery Insights Platform.

The results are staggering. Across the country, nearly 7 million households could face eviction without government financial assistance. These are heavily rent-burdened households that have likely experienced job loss as a result of the COVID-19 crisis. This level of displacement would be unparalleled in U.S. history and carries the potential to destabilize communities for years to come.

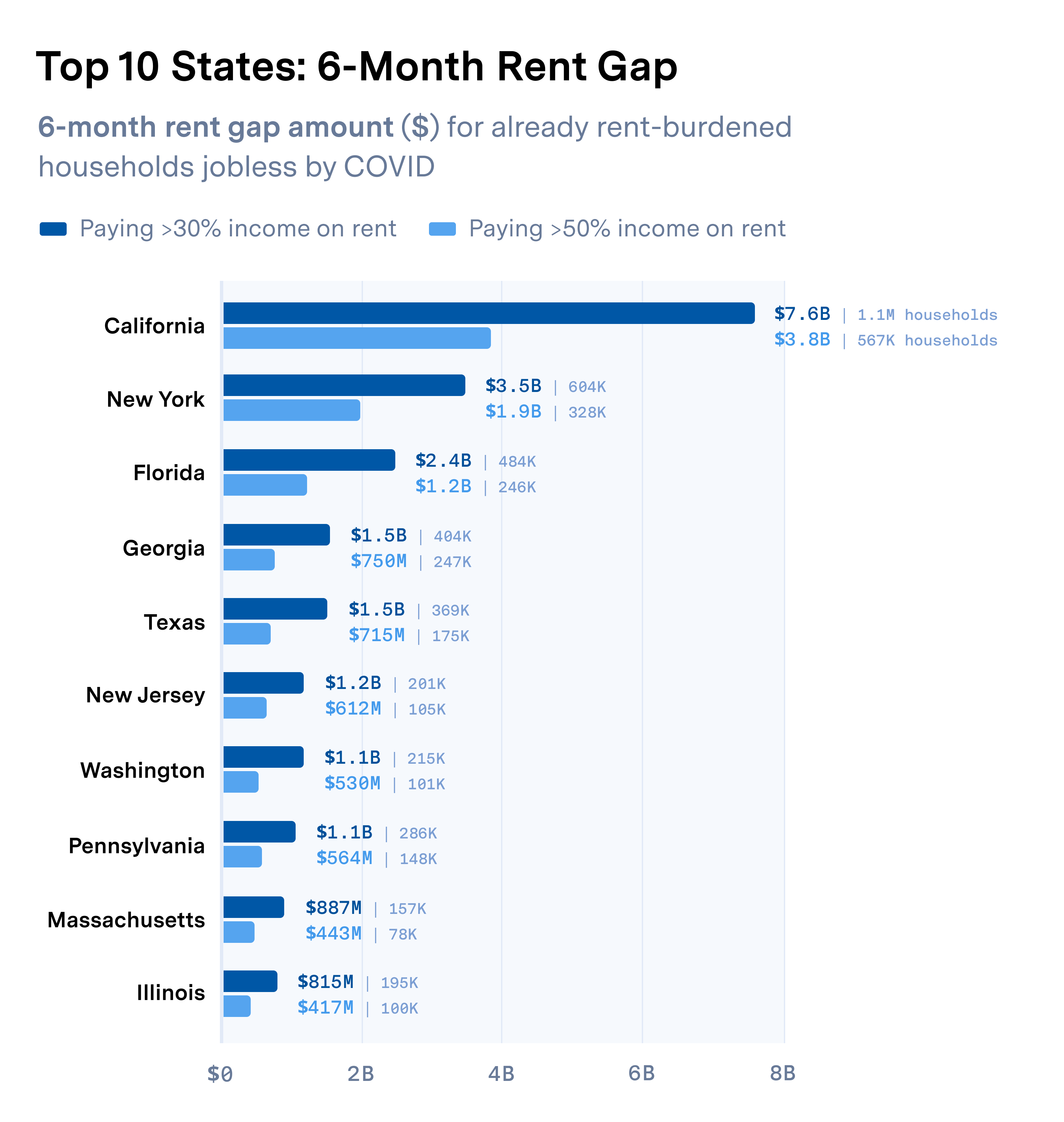

Closing this rent gap will cost between $16.2 and $31.8 billion over six months. This gap, while a pressing issue in every state, is distributed unevenly across the nation’s diverse housing markets and driven by a confluence of job loss and high relative rental housing costs.

Where is COVID-related rental risk concentrated?

Of the 120 million households in the United States, 43.1 million are renters. Even before the crisis, 20.1 million (47%) of these renter households were rent-burdened, and 10.1 million (23%) were severely burdened, defined as those spending 50% or more of their income on monthly rent. A severely rent-burdened household is unlikely to have the ability to save for an economic shock like prolonged job loss or a health problem.

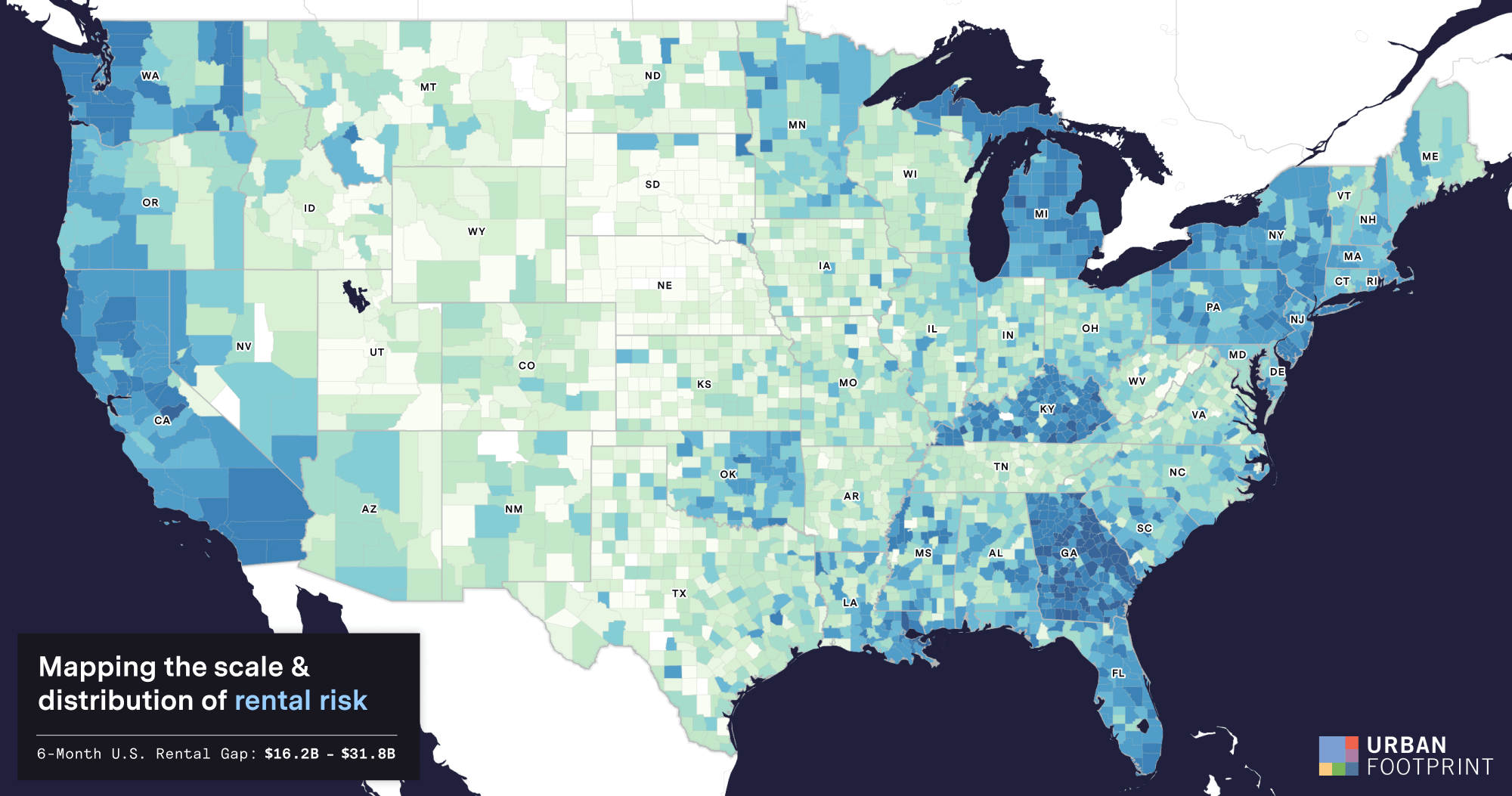

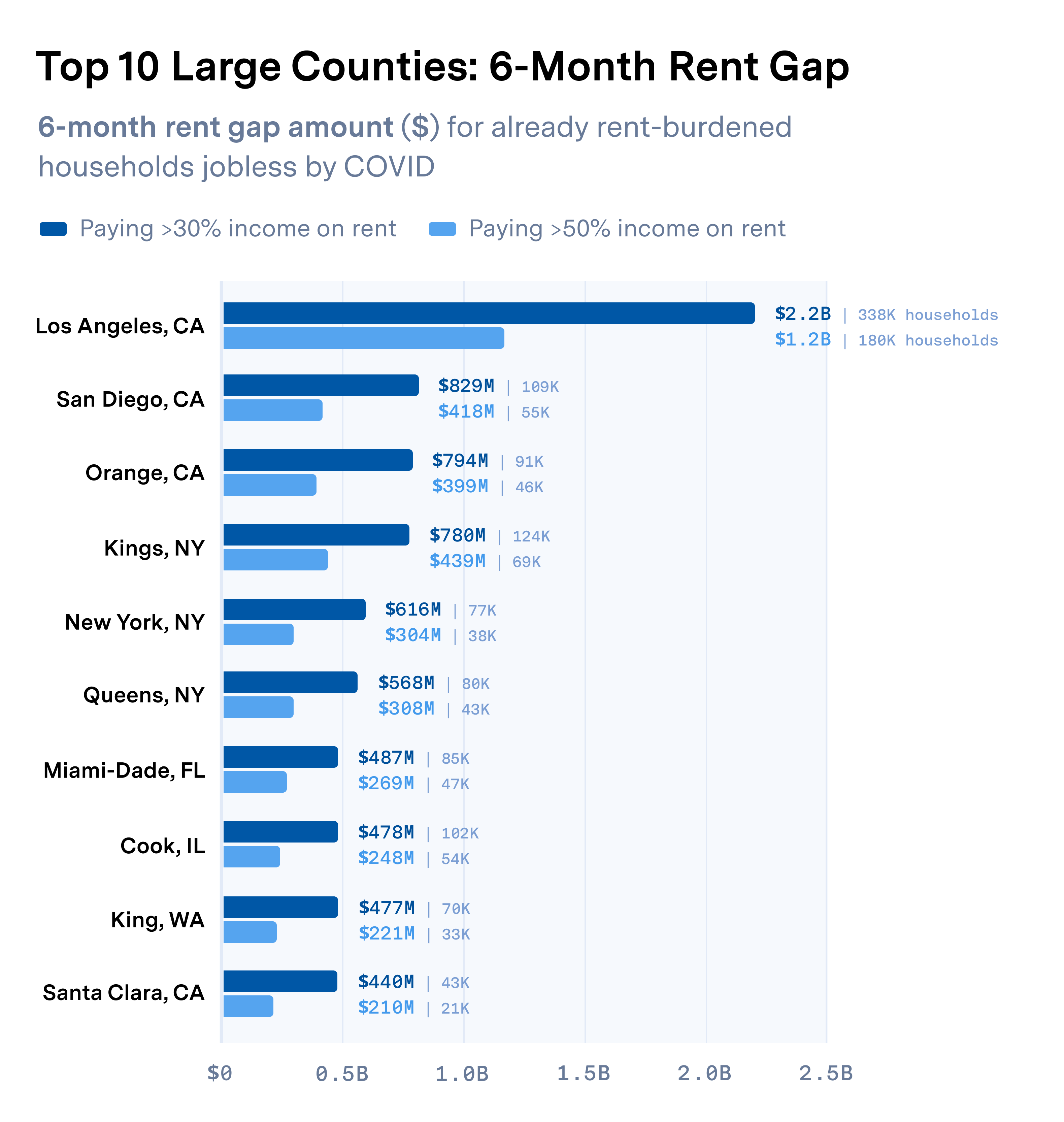

Unemployment has disproportionately impacted rent-burdened households in the US, which are two times more likely than the average renter to experience job loss. Honing in on the 3.4 to 6.7 million rent-burdened households that have experienced job loss as a result of the COVID-19 crisis, we see risk spread across the country. In general, the states and counties with the biggest rent gap tend to have large populations, high housing costs and high income inequality.

Mapping the scale and distribution of rental risk across the United States. Here we see highly rent-burdened households (those spending greater than 50% of income on rent), compounded by COVID-related job loss.

Unemployment and jobless claims spreading across Louisiana since the COVID-19 crisis began.

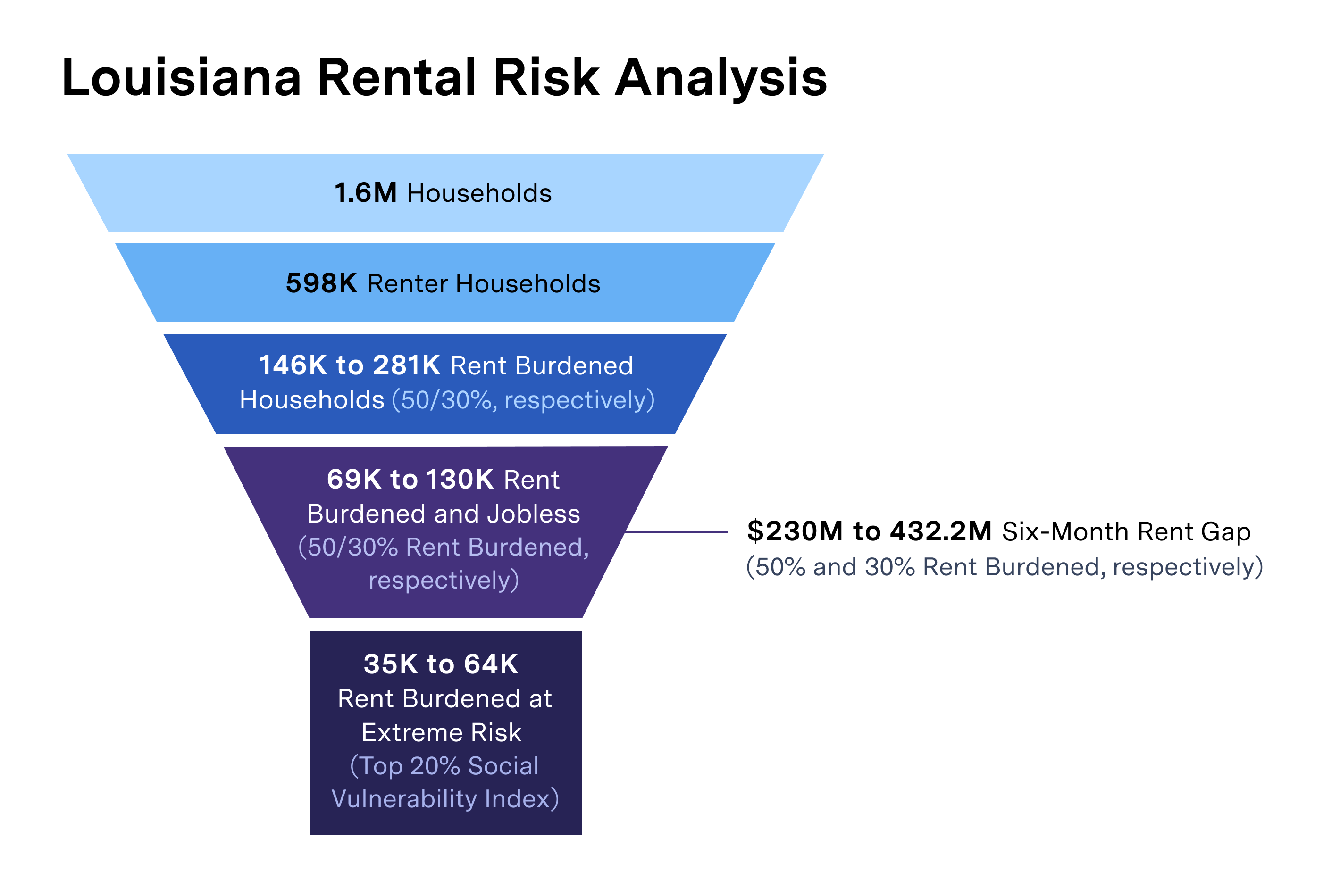

We are actively supporting state agencies and housing stakeholders in Louisiana in unpacking the rental crisis there and designing the most effective interventions. Driven by very high unemployment in the service and hospitality sectors, in Louisiana, a minimum of 69,000 to 130,000 renter households are at risk when local and federal protections and aid expire. These are heavily rent-burdened households that have experienced job loss as a result of the COVID-19 crisis. The six-month rental assistance needed for these renters ranges from $230.0 and $432.2 million.

Which of these households are most vulnerable?

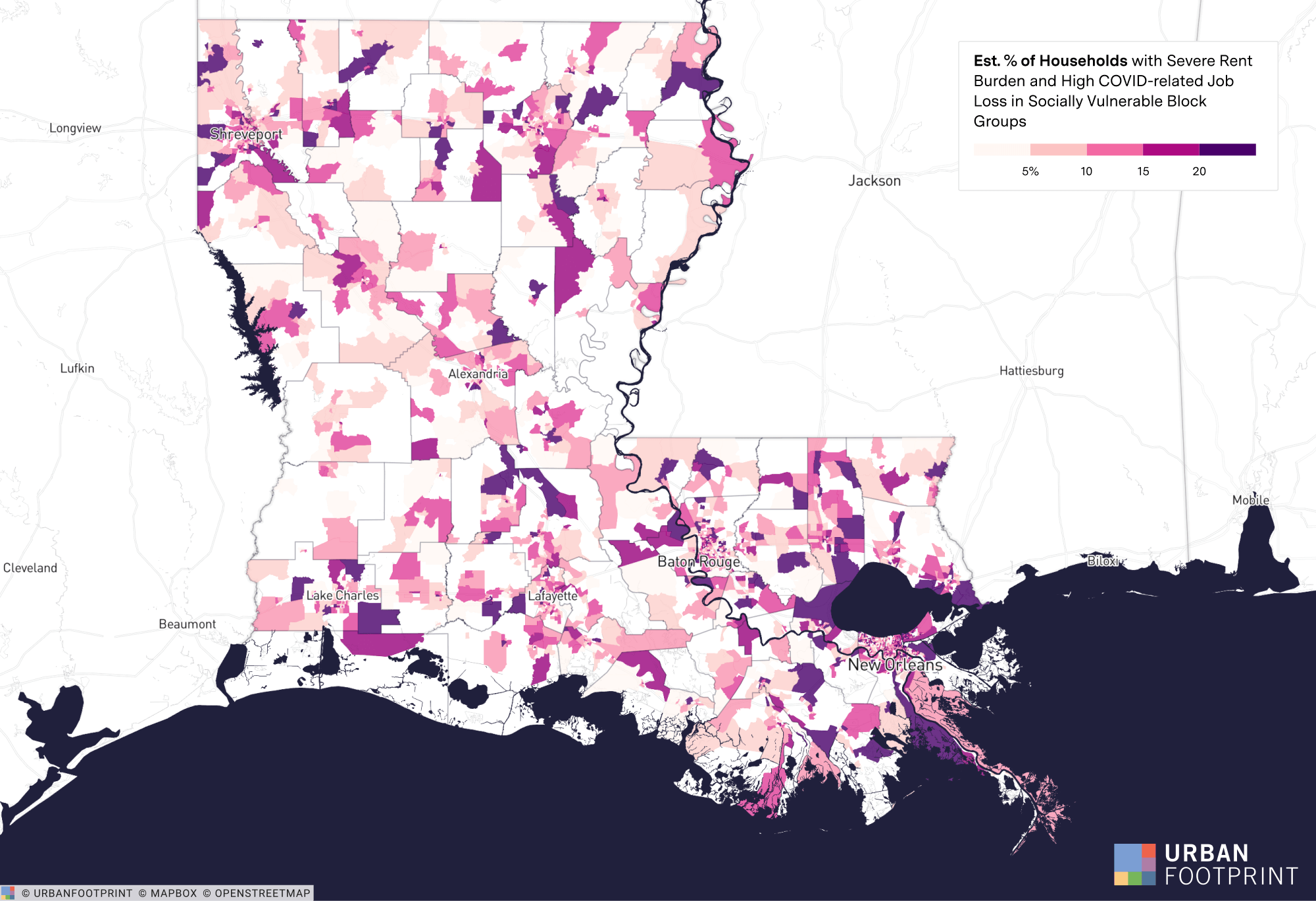

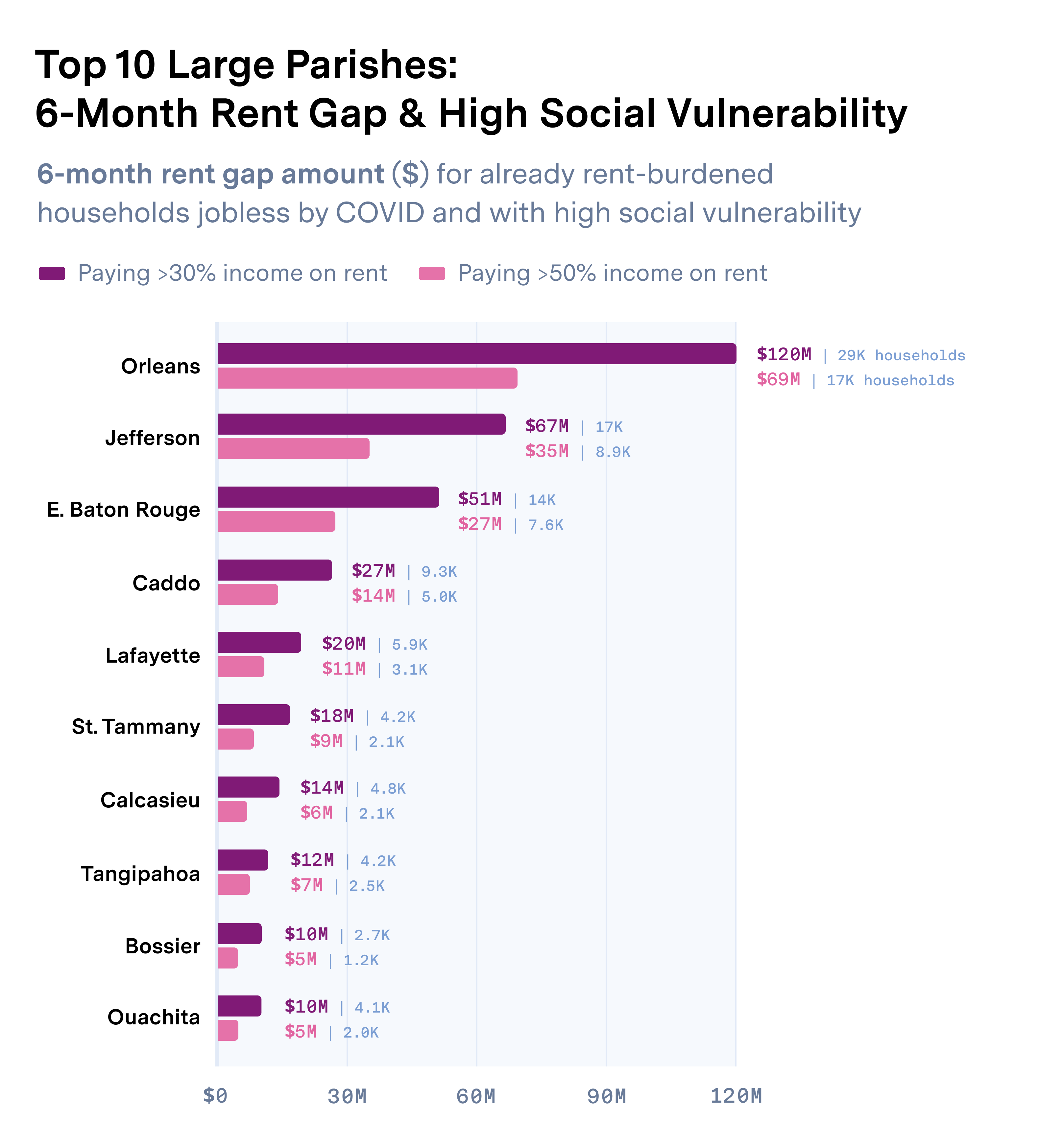

To identify the subset of these households most at risk of eviction, we mapped Louisiana’s most heavily rent-burdened households with COVID-related job loss against our Social Vulnerability Index, a composite index that takes into account poverty, crowded housing, single parent households, and other metrics that indicate a household in this community is unlikely to withstand an economic shock. By this measure, more than 35,000 households are most at risk across the state.

In an environment of limited resources, these are the communities that are most likely to need assistance to avoid eviction and homelessness.

Mapping the scale and concentration of rent-burdened households, COVID-related job loss, and underlying social vulnerability in Louisiana.

Stabilizing Renter Households and Communities

The United States is on the precipice of a COVID-induced housing crisis. Millions of rental households are facing eviction if their income is not restored—via return to employment or additional government assistance. Federal unemployment insurance is set to expire on July 31, and the path back to pre-COVID economic activity and employment levels is unpredictable at best. This leaves the fate of many renters and communities in the balance.

Lawmakers in Washington and in state houses across the nation are considering a range of policy actions to address this issue. These interventions include the $100 billion Emergency Rental Assistance and Rental Market Stabilization Act of 2020, and numerous pieces of legislation at the state level.

We are tracking and evaluating this issue closely and deploying our analysis and software platforms to help agencies understand the scope and distribution of this issue and how specific interventions will impact communities on the ground.

Footnotes

To learn more about the data behind this article and what UrbanFootprint has to offer, visit https://urbanfootprint.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.