In an RCA Insights post earlier this month, Jim Costello described how CMBS distress would be just the “tip of the iceberg” for upcoming loan trouble in the U.S. office, industrial and retail sectors, and indicated that investors should build relationships with other lenders to uncover deals. Readers of RCA Insights asked: what about lending in the apartment and hotel sectors?

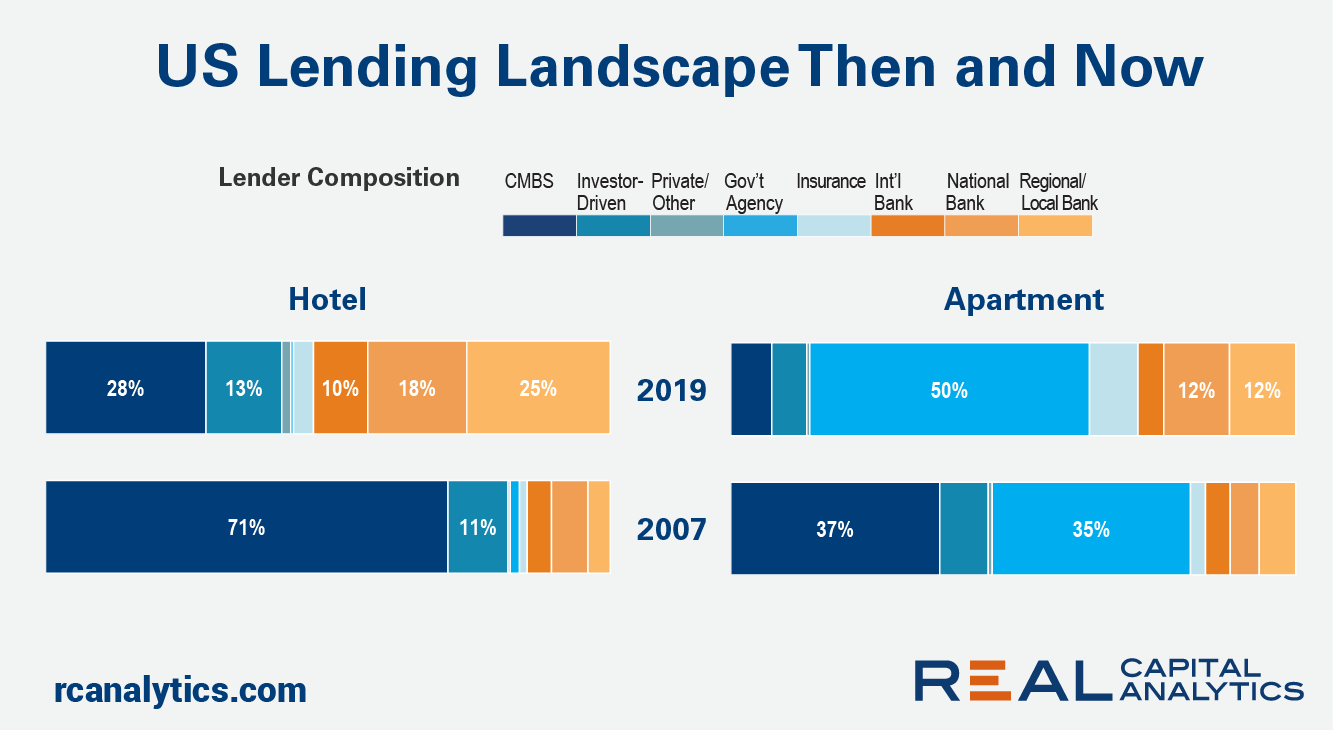

Back in 2007 before the Global Financial Crisis hit, the composition of the commercial real estate debt market for all sectors was dominated by CMBS. Fast-forward to 2019, before Covid-19 shuttered the U.S. economy, and the CMBS share of lending was much reduced.

While CMBS still represented the largest slice of hotel lending in 2019, it was a much smaller piece of the pie. As the CMBS share fell back, other lender groups such as banks and investor-driven lenders filled the gap. For the apartment market, government agencies and the banks gained the most ground, while CMBS dropped to less than a 10% share of the market.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.