Introduction

Welcome to the Juy 2020 National Apartment List Rent Report. Although shelter-in-place orders continue to loosen across the country, the number of new COVID-19 cases has begun to spike in recent days, signalling that the effects of the pandemic are far from behind us. And despite a surprising drop in the unemployment rate from April to May, a record number of Americans remain out of work, with new unemployment claims continuing to top one million per week. The economic fallout from the pandemic does not appear on track for the quick V-shaped recovery that many had originally hoped for, and this economic weakness is reflected in our rent data. Our national rent index fell by 0.1 percent over the past month, and year-over-year growth now stands at just 0.2 percent.

Rents continue to soften amid COVID-19

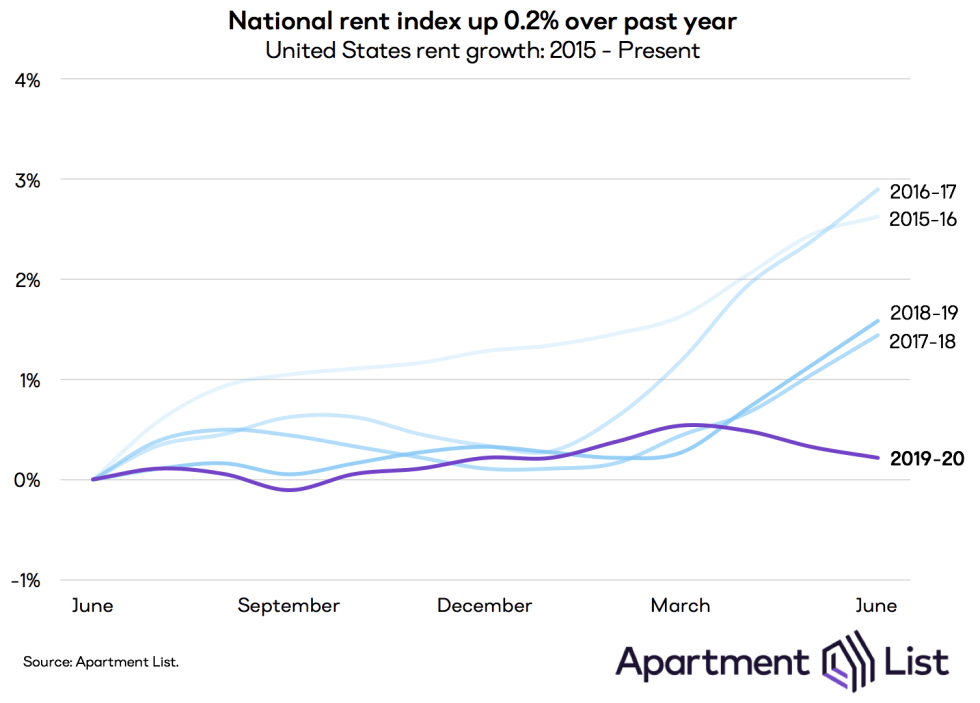

Our national rent index fell by 0.1 percent from May to June, with a cumulative decline of 0.3 percent since March, when the pandemic began. While this dip may seem modest, it is occurring at a time of year when rent growth is normally at its fastest due to seasonality in the market. Rent growth from March to June has ranged from 1.0 percent to 1.7 percent in prior years, going back to 2014, when our rent estimates begin. Over the past twelve months, our national index has increased by just 0.2 percent. This is by far is by far the lowest year-over-year growth rate that we’ve observed in June over any of the past five years, as shown in the chart below. The fact that we’re seeing rents decrease at what is normally the peak season for rental activity is reflective of the financial hardship and shifting preferences being imposed by the pandemic.

The past three months of declining rents signal a softness in the market that can be broadly attributed to two major factors:

The pandemic has dramatically slowed moving activity due to a combination of shelter-in-place orders, eviction moratoriums, and general uncertainty. And even as these restrictions loosen, Americans are wary of moving. In a recent survey, we found that 30 percent of Americans are less likely to move during the remainder of 2020 because of the pandemic, and that these changing plans are most commonly the result of health concerns.

Mounting economic fallout from the pandemic is forcing many Americans to seek out more affordable housing options. Today’s unemployment rate remains at a historic high, and many are struggling to make their monthly housing payments. In the same survey mentioned above, we found that 17 percent of Americans are now more likely to move, and that the need to find more affordable housing is the primary motivation.

Property owners are beginning to respond to these new realities by offering lower prices in order to fill vacancies. The overall decline in our national index is still fairly modest, but this masks significant variation across markets. Prices are responding much more rapidly in the most heavily impacted parts of the country, which we explore below.

Expensive markets and tourism-driven economies show biggest declines

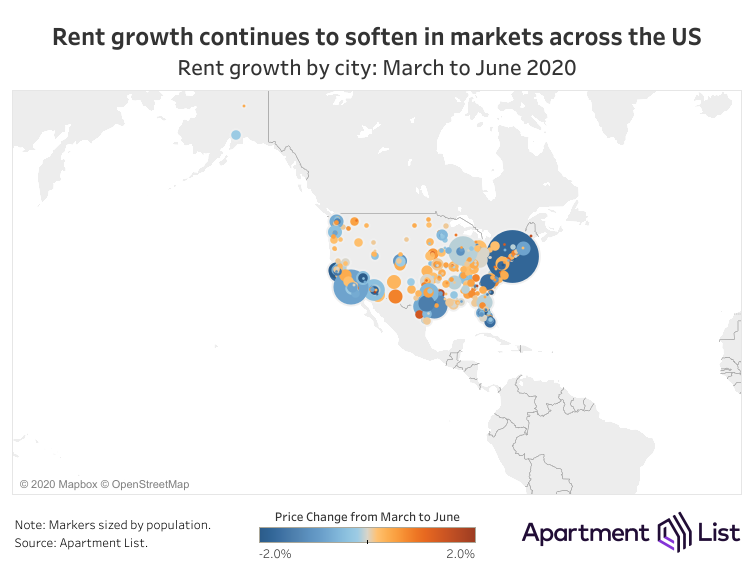

Market-level data give us a clearer picture of which cities are experiencing more dramatic rent declines. Of the 100 largest cities for which we have data, 56 saw rents fall or hold steady over the past three months. And in 88, rents are growing slower now than they were at this time last year.

The cities experiencing the biggest dropoff in rent prices generally fall into two major buckets:

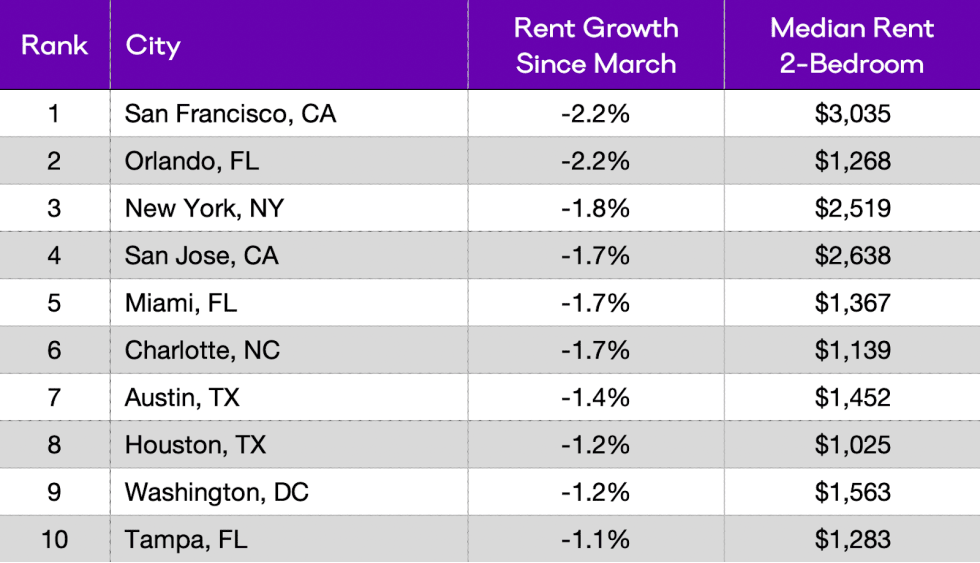

The first group is typified by Orlando (-2.2 percent rent decline) and Miami (-1.7 percent rent decline). As tourism ground to a halt at the onset of the pandemic, we predicted that these cities would be particularly vulnerable because they have the 2nd and 3rd highest shares of workers facing extreme employment risk. Today, with a significant share of households now facing financial hardship, landlords have begun to lower rents in order to attract qualified renters to fill their vacancies. Other cities that we identified as high-risk are also represented in the Top 10 list below. Las Vegas was deemed the most vulnerable city, and while rents there have fallen by a modest 0.4 percent since March, neighboring Henderson, NV has experienced a more significant rent decline of 2.1 percent. Houston and Tampa are also examples of this trend – both markets were among the top 10 in our earlier analysis of labor force risk, and both now rank in the top 10 for biggest price declines.

That said, the city that has seen rents drop fastest over the past three months is one where high-risk workers comprise a relatively small portion of the workforce. Despite having an outsized share of its workforce employed in the tech industry – where the transition to remote work has largely been a smooth one – rents in San Francisco have come down by 2.2 percent over the past month. This seems to be driven by the fact that the median rent in San Francisco is the highest in the country, at $3,035 for a 2-bedroom. Similarly, San Jose and New York City, which have the 2nd and 3rd most expensive rents in the country, also are among the top five for biggest price drops in recent months. As layoffs expand beyond the service industry and into white collar occupations, landlords in these markets appear to be responding to a lack of demand for high-priced rentals.

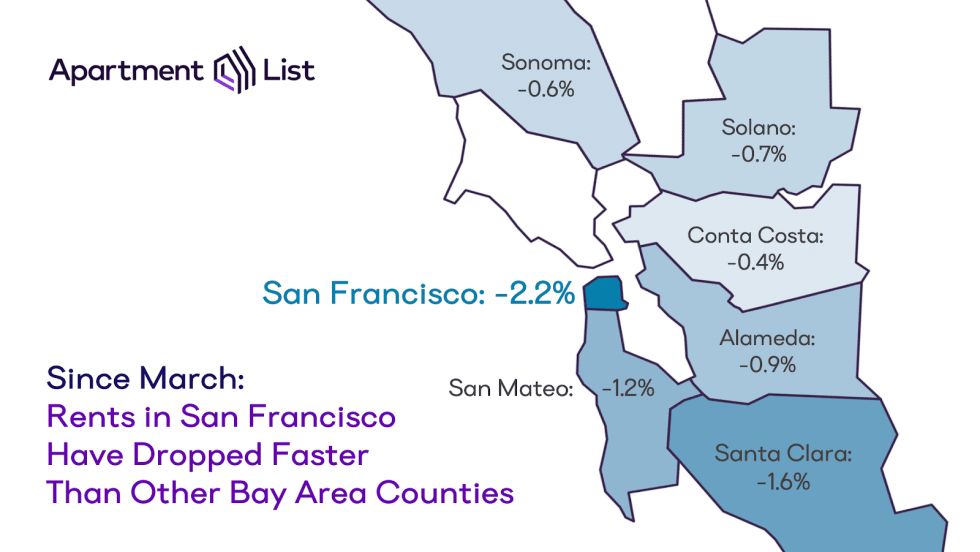

In San Francisco, rents are falling fastest in the core city

Delving a bit deeper into the data for San Francisco specifically, we notice an interesting nuance in rent changes throughout the region as a whole. While the city of San Francisco has seen rents come down by 2.2 percent since March, the surrounding regions have experienced more modest declines.

In the South Bay counties of San Mateo and Santa Clara, where rents also tend to be quite expensive, rents have fallen by 1.2 percent and 1.6 percent, respectively. Meanwhile, the more affordable Alamada, Contra Costa, and Solano counties in the East Bay have been even less affected, with declines of 0.9 percent, 0.4 percent, and 0.7 percent, respectively. On the whole, it seems that the most expensive parts of the Bay Area are seeing rents fall fastest.

This trend might also reflect a growing embrace of remote work among Bay Area tech companies. Notably, Twitter and Facebook have announced permanent changes that will allow for flexible working arrangements beyond the pandemic, which could mark the beginning of a significant long-term shift in the relationship between labor and housing markets. Some Bay Area workers may take advantage of this new flexibility by abandoning downtown in search of more space and greater affordability in the suburbs, while still remaining within a reasonable distance to commute to the city as needed.

Conclusion

Since the start of the COVID-19 pandemic, we have seen shelter-in-place ordinances put a halt to normal moving activity, combined with staggering job losses as huge segments of the economy were put on pause. These unprecedented forces have dampened the demand for rental housing across the country. 30 percent of Americans say that they are less likely to move since the start of the pandemic, while the 17 percent who are more likely to move are being driven primarily by a need to find more affordable housing. While we are not yet seeing significant rent reductions at the national level, rents have declined somewhat rapidly in the most heavily impacted markets.

As far as longer-term impacts, the pandemic’s effect on rent prices will depend heavily on how quickly the economy is able to recover. There are indications that the recovery will be more drawn out than many had initially hoped, making it likely that we’ll see a protracted uptick in downgrade moves as many households facing financial hardship begin looking for more affordable housing. We may also see a significant slowdown in new household formation, as more Americans move in with family or friends to save on housing costs. These trends could mean that competition will remain tight for rental units at the middle and lower ends of the market, while luxury vacancies get harder to fill. As long-term remote work gains traction, we may also be seeing the beginning of a shift away from expensive downtown markets and toward more affordable suburbs.

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.