The first half of 2020 was, in many ways, unprecedented. The COVID-19 pandemic had a profound impact on the economy as a whole, and on multifamily specifically. We’ve covered various aspects of that impact elsewhere on the ALN blog. In this space today, let’s consider how Texas multifamily performed in the first half of the year from a few different perspectives.

All numbers will refer to conventional properties of at least 50 units. For more detailed information about a specific market, be sure to sign up for ALN’s complimentary monthly and quarterly Market Review reports.

Texas Overall

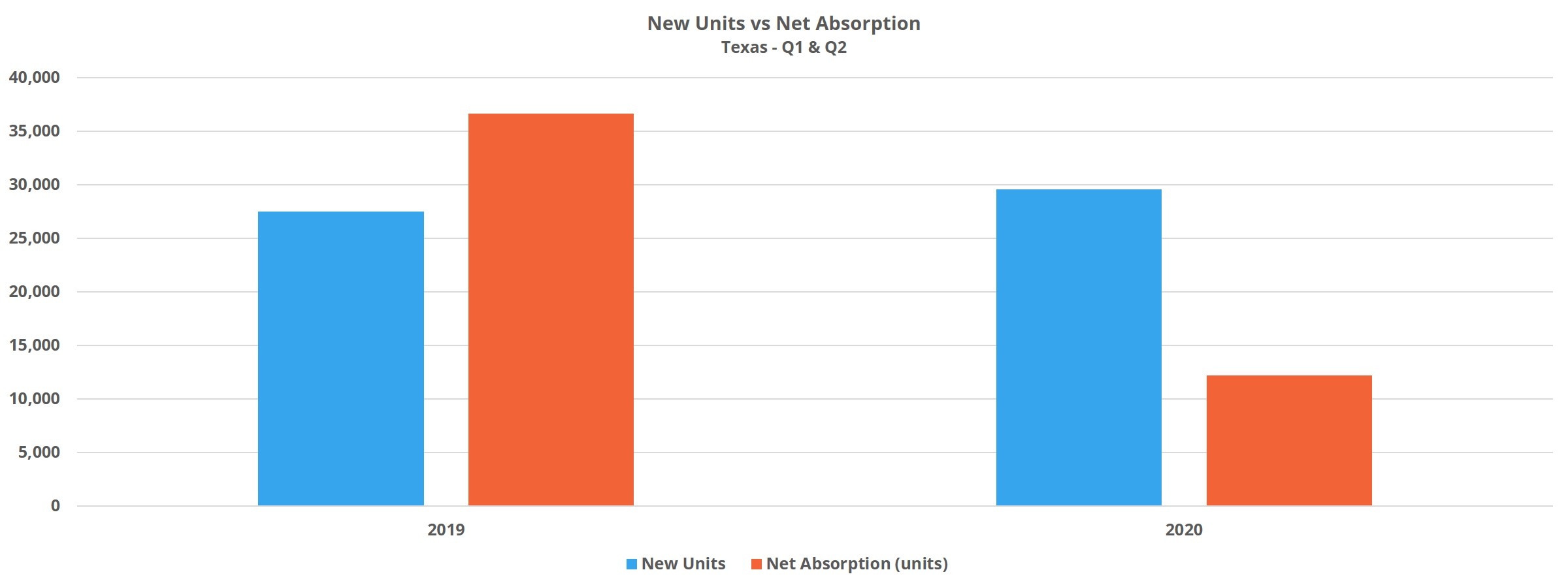

Despite construction delays for part of the year, more new units were delivered in the first six months of 2020 than in the same period in 2019. About 30,000 new units were delivered in total. Demand fell by 67% compared to last year as only about 12,100 units were absorbed. The result was a decline in average occupancy of 0.8% to just below 90%.

The decline in rent growth was even more precipitous. In the first half of last year, average effective rent for Texas conventional properties grew by 2.7%. This year, average rent growth was 0.4%. In addition to operators being less aggressive with rent increases, rent growth was held back by an increased reliance on rent concessions. Typically, we would expect to see rent discounts decline is availability and value between the start of a year and mid-year. This year not only did the availability of concessions increase by 10%, but the average value of the discount rose slightly as well. At the end of June, 31% of conventional Texas properties were offering a new lease concession.

Texas Price Class

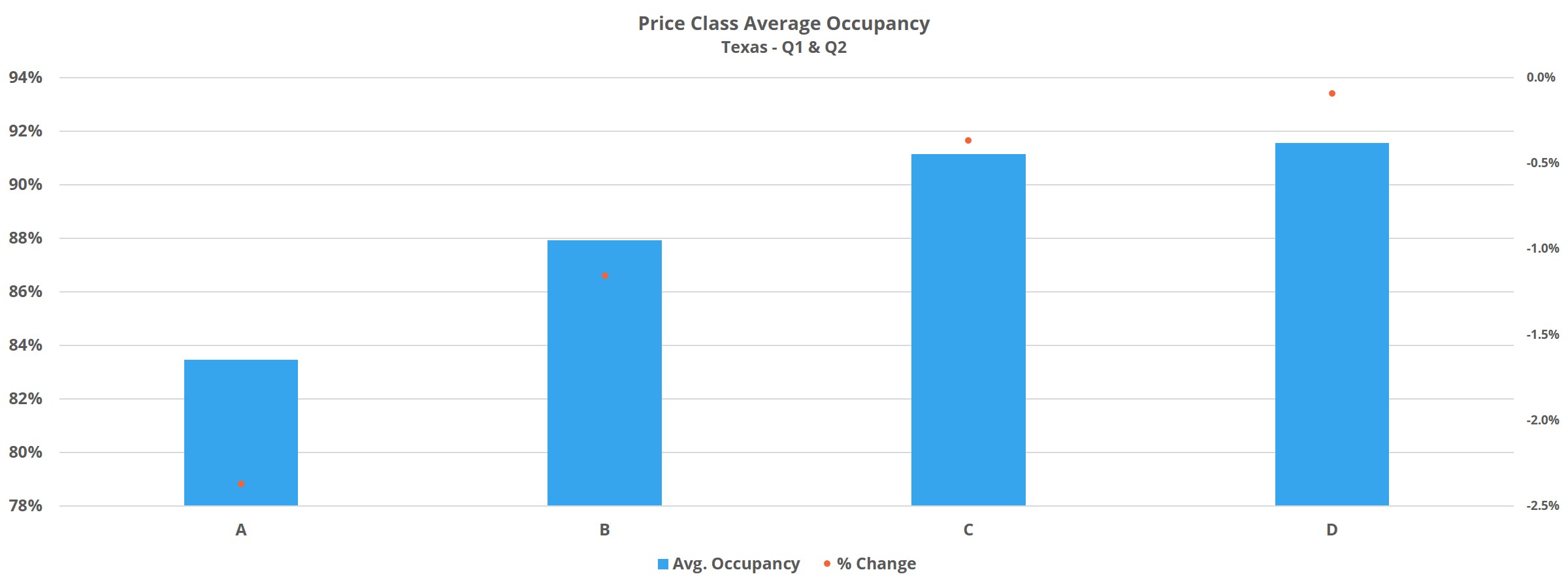

ALN assigns conventional properties to one of four price classes, A through D, based on each property’s percentile rank in its market for average effective rent per square foot. This allows for more apt comparison across markets. For Texas properties, Classes A and B were hardest hit on the average occupancy front. Class A properties suffered an average occupancy decline of 2.4% and Class B properties experienced a 1.2% decline. All four price tiers ended June 2020 with a lower average occupancy than at the end of June 2019, but Class B properties dropped the most – declining by 2% since last June to 88%. Average occupancy in price Classes C and D declined as well in the first six months of the year, but only by 0.4% and 0.1% respectively.

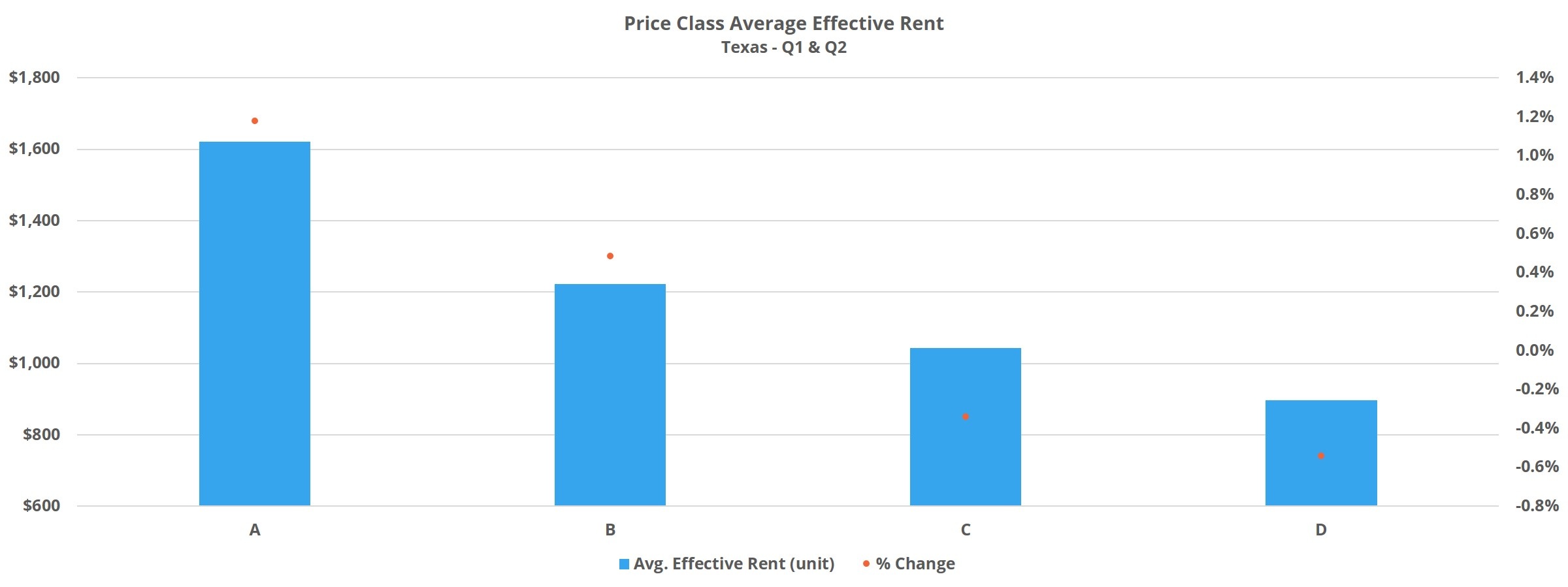

On the rent front, the dynamic was the reverse. The top two tiers managed to eke out some rent gains, though not to the extent of last year, while the lower two tiers defended occupancy at the expense of rent growth. After a 2.5% increase in average occupancy last year, Class A properties gained 1.2% this year. For Class B, a 2.7% 2019 figure was followed by a gain of 0.5% in average occupancy this year. Thanks to double digit increases in the percentage of properties offering a discount, in the lower two price tiers average effective rent declined by 0.4% and 0.6% respectively.

Texas Market Size

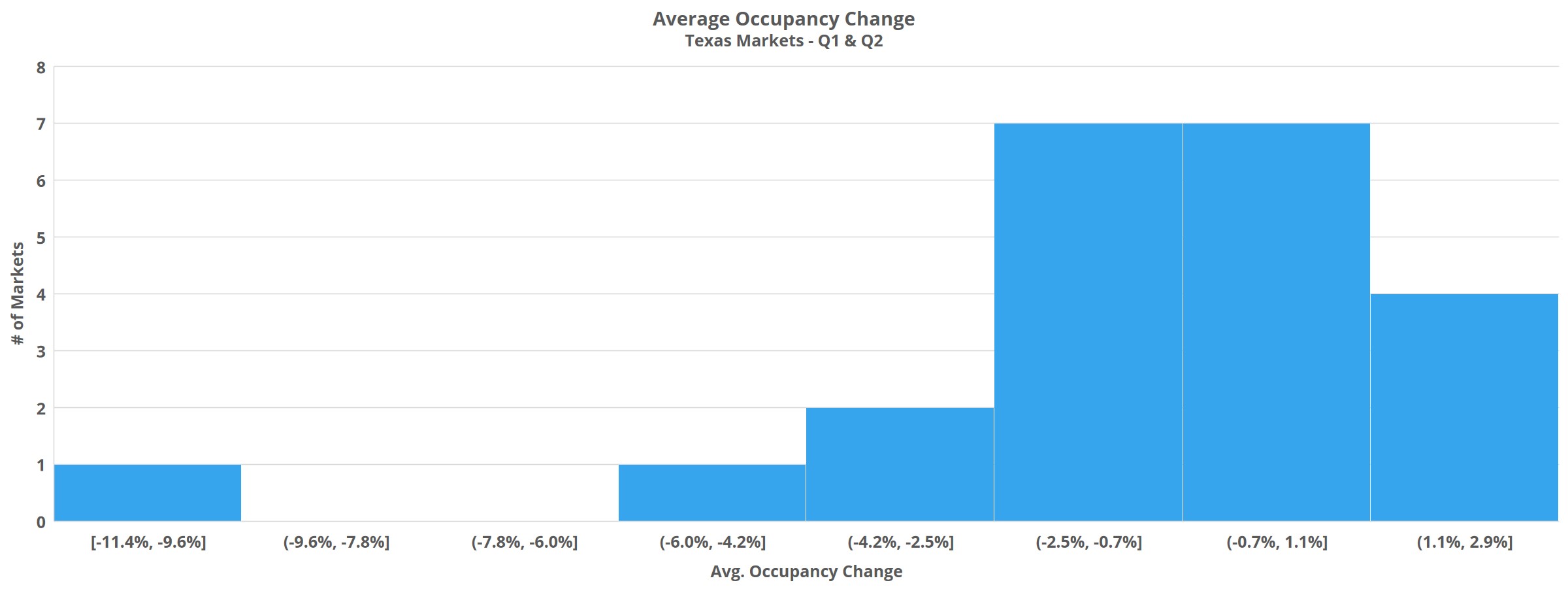

Of the four major Texas markets, all but Dallas – Fort Worth delivered more new units in the first half of this year than during the same time last year. Simultaneously, demand fell in each of the three markets by between 67% and 75% compared to last year. The result was average occupancy losses ranging from 0.9% in Houston to 1.9% in Austin. In DFW, net absorption fell by “only” 45% and the area managed to lose only about 0.2% in average occupancy.

The biggest occupancy losses were in the smaller Texas markets, especially those which rely on energy, healthcare or education for their main sources of employment. In Midland – Odessa, average occupancy declined by 11% as more than 1,800 rented units were shed from January through June. In Victoria, a market where the public-school system and two medical centers crack the top five largest area employers, average occupancy fell by 5%. Lastly, Lufkin suffered a 3.9% decline.

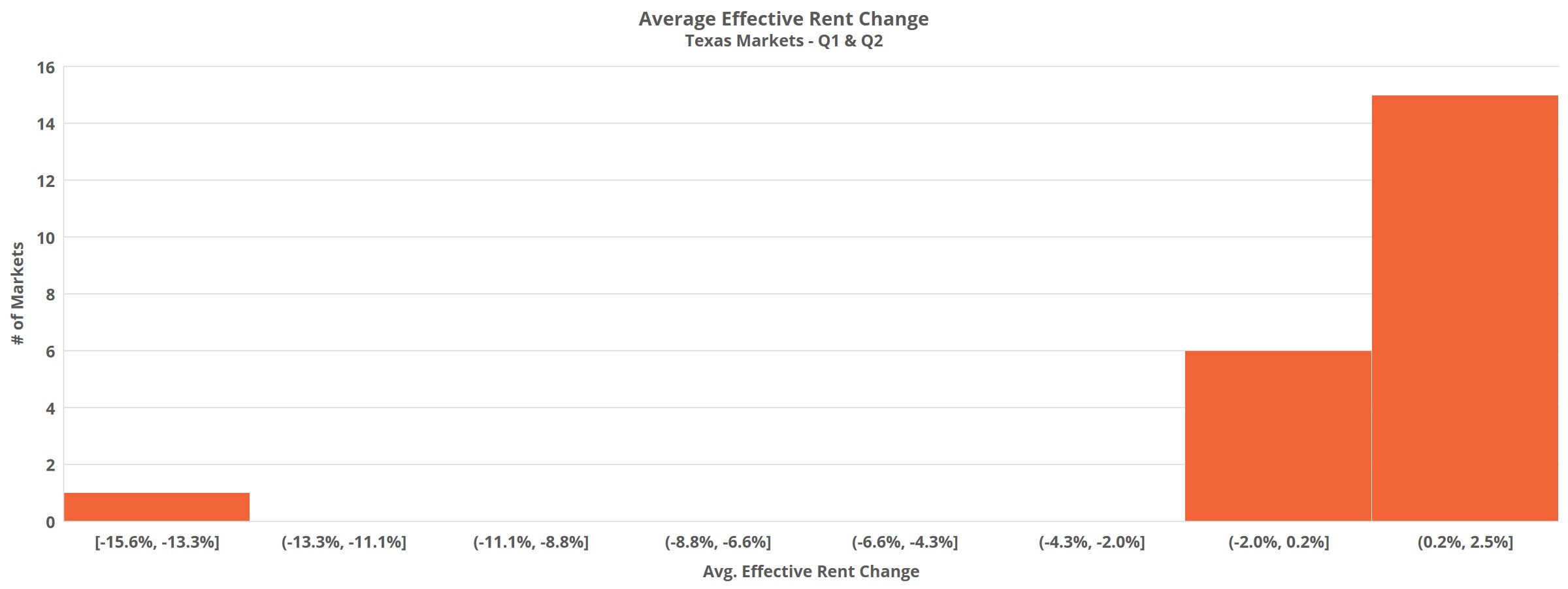

The large markets averaged 0.4% effective rent growth, led by a 0.8% gain in Dallas – Fort Worth. Only Austin lost ground, receding by around 0.3%. These results stand in stark contrast to the same period in 2019 when Houston was the laggard with a 2% gain.

Remove the eye-popping 15% average effective rent loss in Midland – Odessa, and the smaller Texas markets actually gained 0.8% in the first half of the year. Top performers include a 1.7% gain in Abilene, a 1.6% gain in the Waco – Temple – Killeen area and 2.5% in Texarkana.

Takeaways

Unlike in much of the country, new supply for Texas increased in the first half of the year compared to the same period in 2019, but demand fell by two-thirds. Average effective rent growth, while not negative, was a fraction of what it was last year.

The only major market to decrease deliveries compared to 2019 was Dallas – Fort Worth. The market has also been the most resilient of the major markets this year, with DFW net absorption totaling more than the rest of the state combined.

The more expensive properties, price Classes A and B, suffered larger declines in average occupancy, but managed to maintain some level of rent growth. The reverse was true of the lower tier properties where occupancies were steady at the expense of rent growth thanks to increased concession availability.

Only three markets – Austin, Midland – Odessa and Victoria saw losses in both average occupancy and average effective rent.

To learn more about the data behind this article and what ALN Apartment Data has to offer, visit https://alndata.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.