With our new Neighborhood Insights tool, Unacast can now drill-down to the Census Block Group (CBG) level of local populations to study human mobility. CBGs are the smallest geographical unit for which the United States Census Bureau publishes data. Typically, CBGs have a population of 600 to 3,000 people.

This new ability to zero-in on much smaller population centers allows us to take recovery analysis to deeper levels. We can also now examine mobility traffic between different groups of people: Residents, Locals, Workers and out-of-town Tourists.

To explore the capabilities of Neighborhood Insights, we decided to examine human mobility recovery in different New York City neighborhoods, looking at private and public locations in NYC’s financial district, public parks and tourist hotspots. What follows is a sampling of the unique insights gained from studying each neighborhood.

White collar Workers leave downtown to area Residents

From a high level, downtown areas have been slow to recover. Visitation remains very low in CBGs with large volumes of office space, while the use of public areas and some parks by Residents and Locals has actually exceeded 2019 visitation levels, even though mobility overall is still down about 50% as of this writing, largely due to out-of-town Workers staying home and Tourists staying away.

New York City’s Financial District and Flatiron neighborhoods have suffered greatly since mid-March and no CBGs in these areas have yet recovered. Visitation from all mobility categories except Residents remain near zero, even as the city cautiously moves towards reopening.

Many of those previously working out of these locations pre-COVID are white collar workers with the ability to work from home. That said, the degree to which these workers or others return will influence how the area recovers. On Wall Street, at least, locals are not enough to do the job.

While visitation from Residents in the FiDi CBGs have remained relatively constant throughout the pandemic it has not significantly contributed to the area’s recovery, indicating that the long-term interruption of Workers to and from the area could be devastating to retailers, restaurateurs, hospitality providers and others in the financial district.

Locals are frequenting public spaces now empty of Tourists

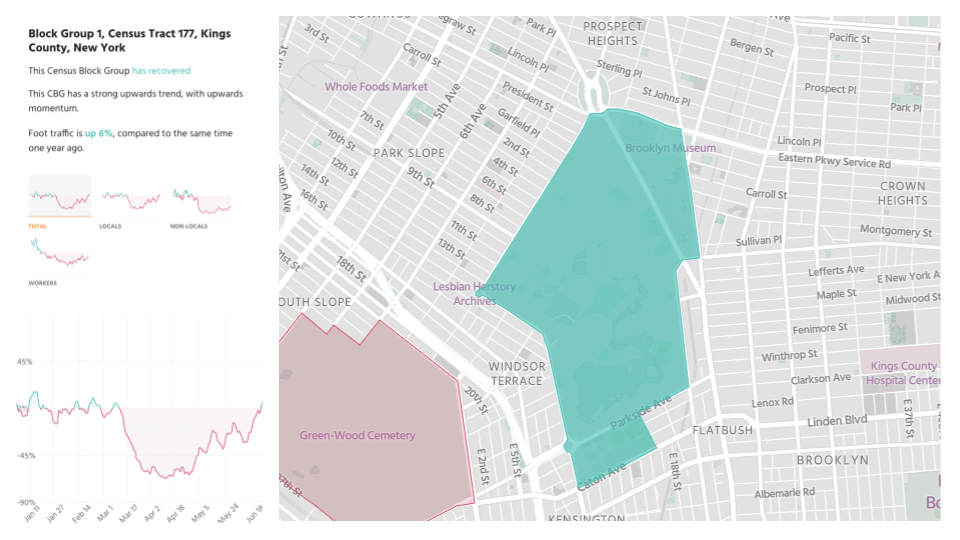

New York’s public parks lead the way in terms of CBGs with the highest rates of human mobility recovery, i.e. Prospect Park in Brooklyn recorded overall visitation in the first week of June that went above 2019 levels for the first time since mid-March.

The story initially seems quite different in Central Park where overall visitation remains weak vs 2019. But with the Neighborhood Insights tool, we can push beyond the macro view to see that the underlying conditions driving the differing mobility rates in each location are quite similar. How so?

Prospect Park is a neighborhood park for the burrow of Brooklyn; not so much a tourist destination or Instagram hotspot. The people using the park are almost all Residents and Locals. They probably used the park last year. They will probably use the park next year. It is their consistent presence in the CBG that is aiding its recovery.

By comparison, Central Park is in the center of Manhattan. In a pre-pandemic world, Central Park was a massive intersection of human traffic, much of it from Tourists taking in the sights and office Workers taking a break or passing through on their commute. The Tourists may not be back for a while and some of the Workers will stay home for good. It is their extended absence from the CBG that is impeding its recovery.

In another interesting data point, visits by Locals to Central Park have shown strong growth in the last few weeks, indicating that more New Yorkers are taking the time and opportunity of shutdown to reacquaint themselves with some areas of the city now almost entirely devoid of commuting Workers and Tourists. Unfortunately, we can detect no similar swell of support from Locals and Residents for other typical tourist destinations.

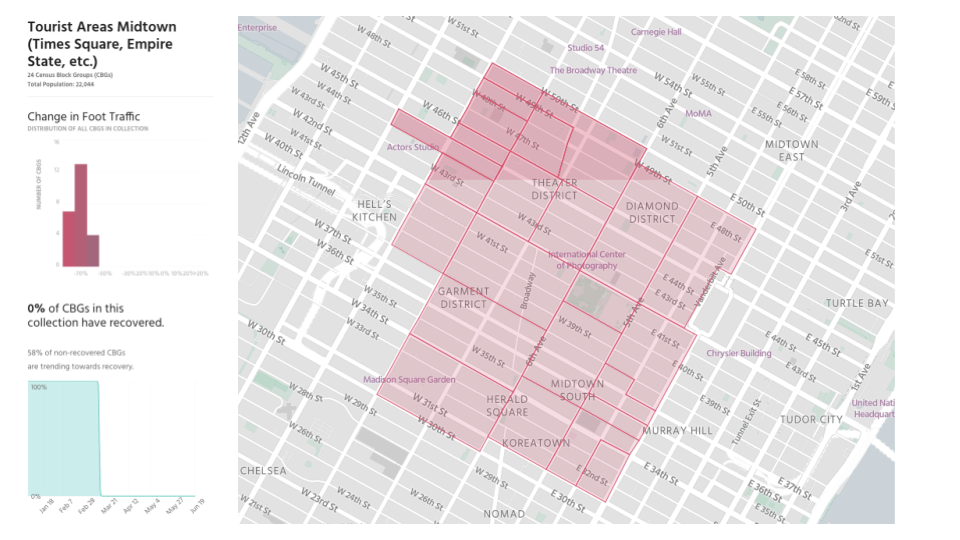

Times Square, the Theater District and SoHo are largely abandoned

Most tourist areas in NYC are almost completely devoid of Tourist traffic, and unlike the city’s parks, Locals and Residents are not rushing-in to fill the void.

The Times Square neighborhood is down 97% of total visitation from last year, driven largely by a pandemic period non-Local visitor count of nearly zero. Likewise the Empire State Building’s neighborhood traffic is down 96% versus 2019. It’s worth noting that low-to-no Worker visitation is also a factor for that building and CBG.

The trendy, retail-heavy SoHo neighborhood in NYC remains deeply under last year’s visitation levels, with out-of-town Tourist traffic remaining near zero and Local traffic only just beginning to pick-up. The economic battering being sustained by retailers and restaurateurs in SoHo are inline with the general findings from our June 2020 deep-dives on the Clothing Retailer and Restaurant industries.

To learn more about the data behind this article and what Unacast has to offer, visit https://www.unacast.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.