When the seriousness of the health threat from coronavirus set in, and shelter-in-place orders were put in place across the U.S. in March, the effect on job postings was dramatic. Job postings on Indeed dropped at a rate previously unseen, and by May 1, they were 39% below the trend from the previous year. Not only were businesses hiring less, but they were also letting workers go. As businesses closed or adjusted operations, unemployment skyrocketed and many people were left without work.

In many cities and towns, it felt, for a moment, as though the world stood still. “Nonessential” businesses closed, and those who could, worked from home. Streets were empty as, collectively, people left their homes less often than ever.

But then things started to change. A staggered reopening began. Depending on location, restaurants, gyms and stores opened their doors at varying capacities.

It’s impossible to tell how the different phases of reopening will progress — Texas, for one, recently rolled back its reopening — but businesses closing and reopening certainly has a direct effect on the labor market. Put simply, “No place in the U.S. has been untouched by the COVID-19 economic crisis,” says Jed Kolko, chief economist at Indeed. We sat down with Jed to find out what job postings looked like in different states and cities.

Local job mix matters more than death rate or social distance on job postings

As Jed started to dig into the details of job postings on Indeed, he noticed stark differences in the change in job postings from place to place. In every mid- to large-sized city, job postings dropped by at least 24% compared to last year’s trend after the coronavirus crisis hit — with some areas seeing job postings decrease by as much as 60%.

To identify the causes of the disparities in job posting trends, Jed used a few different factors to classify cities. One of Jed’s hypotheses was that cities hit hardest by the pandemic, as measured by death rate (New York, Boston and Detroit, for example), would have a greater decrease in job postings. He also thought cities with more social distancing — where people moved around less and therefore spent less (San Jose, New York and San Francisco, for example) — would see greater declines in job postings. Both of these things turned out to be true. But they were overshadowed by an even more important factor: local job mix.

Local job mix refers to the variety of jobs across different industries and sectors in a city. Jed looked at job postings in each city, and at which cities generally had a higher proportion of work-from-home occupations.

High work from home metros saw the largest decrease in job postings

We often think of wealthier cities as recession-proof. After all, it was industrial places like the Rust Belt that were hardest hit during the global economic downturn of 2008.

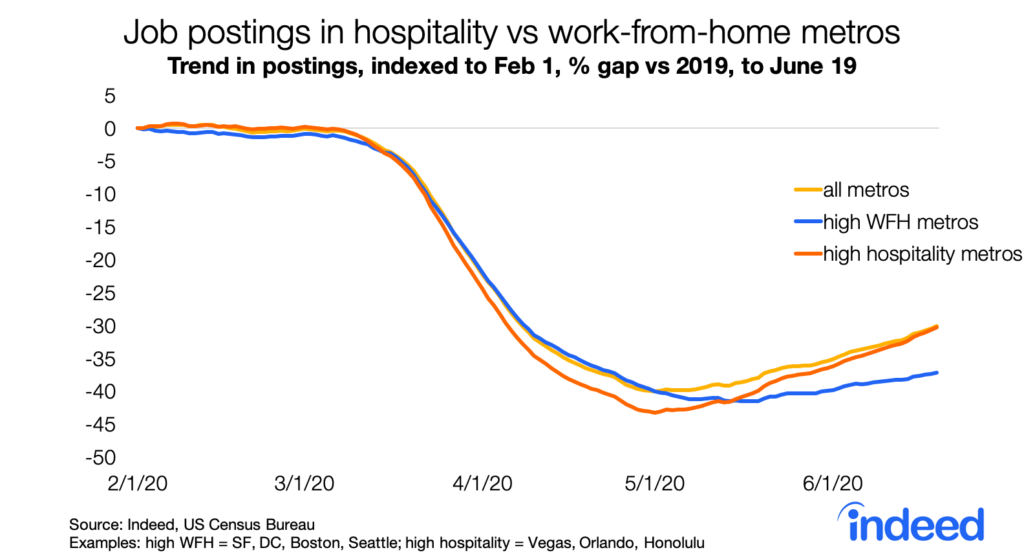

As states put in place rules limiting physical proximity to slow the spread of coronavirus, hospitality and tourism-related industries were hit hardest. No surprise there perhaps, but when Jed looked at job postings in the early stages of reopening, he noticed a counterintuitive phenomenon: Job postings have actually decreased more in rich metros where more people can work from home, than in metros more reliant on tourism.

As Jed says, “It’s a paradox: In places where more people can work from home — like tech hubs and finance centers — job postings have declined more than in tourist destinations such as Las Vegas and Orlando.” How can this be?

There are a few key reasons. First, job postings have declined even in sectors where people can work from home. Tech and finance job postings have fallen more than most other sectors, though not as much as hospitality and tourism, and arts and entertainment postings have.

Second, working from home is correlated with going out less, and spending less in the local economy. So in cities with lots of tourism like Las Vegas, where a smaller proportion of people work from home, more people are out in the community and spending money at local businesses.

Finally, cities with a larger proportion of work from home jobs tend to be wealthier. And the recent reduction in spending by the richest Americans has hurt the economy hard. The decrease in spending by the highest-earning 25% of people has accounted for about half of the decline in overall spending in the U.S. in the last few months.

To sum it up: Job postings for local in-person businesses have decreased the most in high work-from-home metros like New York and San Francisco.

Local economic conditions matter

In a world where media attention is often focused on large, global companies or futuristic practices like permanent work-from-home policies, Jed’s findings support the fact that local economic connections are huge drivers of the labor market. In his words, “local economic conditions matter.”

As we continue to monitor the data, Jed has his eye on the implications of these job posting trends on inequality. If in-person jobs have been hit hardest in the wealthiest cities because workers in high-paying industries are hunkering down at home and spending less, this may mean that it gets even harder for service industry employees to make ends meet in expensive metros. As Jed put it, in those places, “opportunities may be drying up more for people who were already struggling.”

And the picture could change quickly. The surge in new coronavirus cases is leading to more shutdowns, which could affect the labor market. Even though there’s still no difference in job posting trends in the Sunbelt metros where cases jumped in June, we’ll be watching that closely in the coming weeks.

To learn more about the data behind this article and what Indeed has to offer, visit https://www.indeed.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.